- Home

- »

- Next Generation Technologies

- »

-

Robo Advisory Market Size, Share & Growth Report, 2030GVR Report cover

![Robo Advisory Market Size, Share & Trends Report]()

Robo Advisory Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Pure Robo Advisor, Hybrid Robo Advisor), By Provider (Fintech Robo Advisor, Bank), By Service Type, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-969-8

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Robo Advisory Market Summary

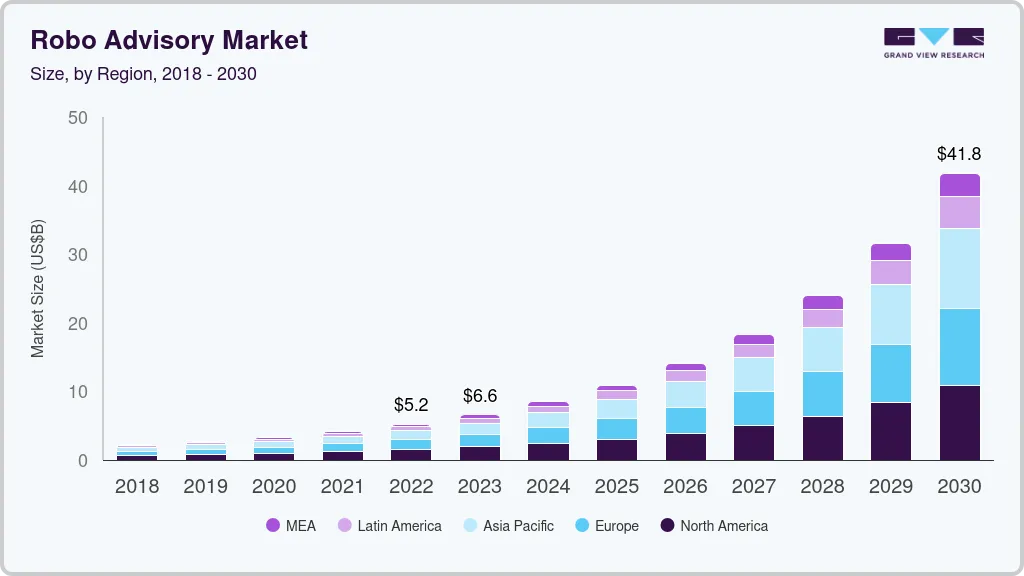

The global robo advisory market size was estimated at USD 6.61 billion in 2023 and is projected to reach USD 41.83 billion by 2030, growing at a compound annual growth rate (CAGR) of 30.5% from 2024 to 2030. Robo advisory platforms provide automated wealth management services accessible via online or mobile platforms. They offer complex financial information and guidance in a simplified manner, easily understandable even without a financial background.

Key Market Trends & Insights

- North America dominated the market and accounted for a 28.9% share in 2023.

- Asia Pacific is anticipated to witness the fastest growth in the market.

- Based on type, hybrid robo advisors led the market and accounted for 63.8% of the global revenue in 2023.

- In terms of provider, the fintech robo advisors segment accounted for the largest market revenue share in 2023.

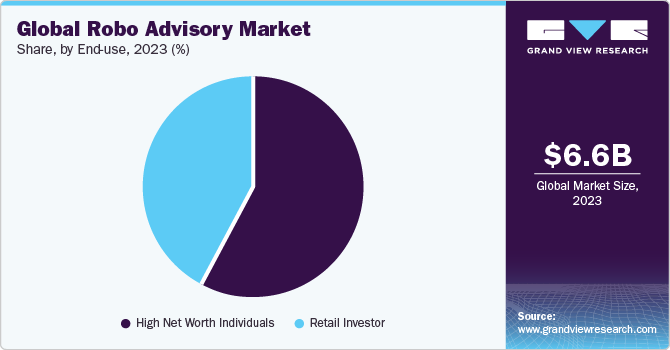

- Based on end-use, the high net worth individuals (HNWIs) segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 6.61 billion

- 2030 Projected Market Size: USD 41.83 billion

- CAGR (2024-2030): 30.5%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

The increasing integration of digital technology in the financial services sector and the trend of consumers moving toward robo advisors instead of traditional investment services are key drivers propelling the growth of the market. The growth of the market is also attributed to the benefits provided by the service, including accessibility, cost-effectiveness, and convenience. Robo advisors cater to individuals seeking financial guidance. In comparison to traditional financial advisors, they offer advice at low fees and with minimum account balances, making investing more economical. There are many companies in the market that does not charge fees. For instance, The Charles Schwab Corporation’s robo advisordoes not charge any advisory fee or commission. Clients only need to pay the operating expenses for the ETFs on their portfolios, including the Schwab ETFs.

The global financial sector has experienced rapid growth due to the rising utilization of digital technology. The integration of Artificial Intelligence (AI) into investment procedures has facilitated automated investing. Retail investors are embracing robo advisors because of their ease of access and cost-effectiveness. Generation x and Millennial generations have not been well catered to by wealth managers due to the high fees they charge and require a high minimum balance. With the robo advisors, retail investors have access to the same services at a lower cost, which is driving the growth of the market.

Numerous robo advisor solution providers are focusing on launching new solutions to help customers with better financial advice. For instance, in July 2022, The Vanguard Group, Inc. announced the launch of Vanguard Personal Advisor, specifically targeted at participants of employer-sponsored retirement plans. With this new launch, the company helped participants resolve the increasing issues faced by them in complex financial situations, which negatively impacted their efforts of retirement savings. Such initiatives are expected to improve the growth of the market during the forecast period.

Despite various benefits of robo advisory solutions, there are some challenges that could hamper the growth of the market. As robo advisors collect and handle critical consumer data such as income security codes, bank account details, Personal Account Numbers (PANs), and assets, it carries a more significant security threat. Robo advisory platforms contain vast amounts of data that could potentially be accessed by cyber attackers for unauthorized access to consumer accounts. Insufficient testing of algorithms, deficiencies in institutional compliance programs, and inadequate record-keeping practices can heighten the risk of data breaches and theft. Thus, security risks and data privacy concerns is major factor that could hinder the growth of the market.

Market Concentration & Characteristics

The market growth stage is high, and the pace of the market growth is accelerating. The market can be characterized by a high degree of innovation with rapidly evolving technological advances. Advances in robo advisory technology are shaping the financial advisor’s back office. Due to these advances, there is rapid automation of business processes, which is driven by the large data resources owned by the advisors.

The market is also characterized by a high level of partnerships and collaborations activities by the leading players. Market players are adopting these strategies to expand their robo advisory offerings and enhance their production processes. This has helped businesses to develop efficient solutions and expand their sales across different geographies.

Robo-advisors possess an equivalent legal status to human advisors, necessitating SEC registration and compliance with securities laws and regulations similar to those governing traditional broker-dealers. The Financial Industry Regulatory Authority (FINRA) is an independent NGO that implements rules that regularize registered broker-dealers and brokers, including online financial advisors. The FINRA regulates and provides resources to help protect investors' interests.

There are no direct substitutes to the robo advisory services. Although human financial advisors can be considered an indirect substitute, they cost more and involve a factor of human error, which can be eliminated using robo advisors. These factors make the service substitutes low in the market.

End-use concentration is high in the robo advisory industry. End users in the market include high-net-worth individuals and retail investors. Robo advisory solutions provide improved accessibility and investors can access these services online without physically visiting an office.

Type Insights

Hybrid robo advisors led the market and accounted for 63.8% of the global revenue in 2023. The demand for hybrid robo advisors is growing as they combine the efficiency and stability of robotic algorithms with the human factor of a personal financial advisor, which is anticipated to drive the segment growth. In addition, hybrid robo advisors provide additional peace of mind by providing customers with access to a live person-to-person interaction to discuss their investments.

For instance, in February 2023, Scotiabank launched a hybrid robo-advisor platform, named Scotia Smart Investor, to provide customers more control over their investments. The company launched the platform via Advice+, a tool that combines personalized advice and AI-powered recommendations in real-time.

Pure robo advisors is expected to grow at a significant CAGR during the forecast period. The growing consumer preference for robo advisory globally is expected to drive the demand for pure robo advisors, contributing significantly to the segment growth. In addition, pure robo advisors offer security features, engaging customer service, extensive education, and low consultation fees. Such factors have led to an upsurge in using pure robo advisors.

Provider Insights

The fintech robo advisors segment accounted for the largest market revenue share in 2023. Fintechs all over the world relies on both automation and personalization-based advisory. In addition, fintech firms rapidly deploy robo advisors by adopting advanced technologies such as advanced analytics and quantitative finance. This deployment will provide accurate and reliable advisory services to retail investors, preventing them from making poor investment decisions.

The banks segment is expected to register the fastest CAGR during the forecast period. Banks are constantly attempting to digitalize their offerings and improve the customer experience. Small banks, in particular, are opting for digitalized services for opening a bank account, fueling the demand for chat-based robo advisory. Such enhancements are being implemented across banking sectors to gain leverage and enhance competitive position in the market, which are expected to drive segment growth.

Service Type Insights

Direct plan-based/goal-based the market in 2023. Investors value the features such as solid goal planning, portfolio management, security features, and attentive customer service in a robo-advisor. Users can run scenarios on effective goal planning and be prompted to take actions that will increase their chances of success by using goal-based robo-advisors, which provide risk profiling and goal-based suggestions. The development of new goal-setting platforms that include a variety of goal-setting alternatives, free digital financial planning tools, and powerful progress trackers integrated across the platform is anticipated to accelerate the segment's growth.

Comprehensive wealth advisory is expected to register the fastest CAGR during the forecast period. These advisers provide complete wealth management services by compiling their clients' financial net worth and comprehending their risk tolerance. In addition to fund-based portfolio recommendations, they provide financial planning, portfolio management services, and financial consulting for wealth and estate planning. This, together with the expansion of financial advising services available for the less wealthy population, is anticipated to fuel segment growth.

End-use Insights

The high net worth individuals (HNWIs) segment accounted for the largest market revenue share in 2023. The growing demand for HNWIs by private equity managers to safeguard their investments is anticipated to drive the segment growth. Moreover, HNWIs frequently seek the advice of investment advisors to manage their wealth properly. In addition, the U.S. has accounted for the most HNWIs, with over 7.4 million people, per World Wealth Report 2022.

The retail investor segment is expected to register the fastest CAGR during the forecast period. The rapid growth of financial inclusion due to pandemics is among the significant factors expected to drive the segment's growth. The rapid increase in trading account creation reflects the sustained surge in the prevalence of retail investors during the lockdowns. For instance, in February 2021, a Financial Industry Regulatory Authority (FINRA) survey reported that 38% of retail investors were involved in creating more than one investment account.

Regional Insights

North America dominated the market and accounted for a 28.9% share in 2023. The presence of several prominent players, such as Betterment LLC., the Vanguard Group, Inc., and others, is expected to boost the growth of the U.S. market. For instance, in July 2023, Plentina Inc., the US-based fintech company announced its planning to pilot a novel robo-advisory service named, ‘Plentina Wealth’ developed for underserved diasporas to build wealth. Such initiatives are expected to contribute to the regional market growth.

Asia Pacific is anticipated to witness the fastest growth in the market. The rise in regional market growth can be attributed to consumers' increasing awareness of the advantages associated with utilizing automated financial support for savings and investments. Numerous companies in the Asia Pacific region are actively pushing for the adoption of robo advisory, which is anticipated to fuel regional growth. For instance, in July 2022, TradeSmart, a prominent online discount brokerage firm in India, announced its collaboration with Modern Algos to introduce AI-driven advisory services. This platform utilizes AI to deliver a streamlined order management system and utilizes advanced algorithms to offer tailored advice aligned with users' age, investment preferences, and future goals.

Key Robo Advisory Company Insights

Some of the key players operating in the market include The Charles Schwab Corporation, The Vanguard Group, Inc., Wealthfront Corporation, Betterment LLC, and Fincite Gmbh.

-

The Charles Schwab Corporation., is an investment management company that specializes in management solutions and provides these solutions to customers according to their financial goals. The company provides its robo advisory services through its advisor services portfolio, and its other investment products include stocks, mutual funds, annuities, and bonds.

-

The Vanguard Group, Inc. is an investment management company that offers its services through Vanguard Digital Advisor, Vanguard Personal Advisor, Vanguard Institutional Investor Services, Vanguard Personal Advisor Services, and Vanguard Institutional Advisory Services. The company offers its services through Vanguard Digital Advisor robo advisor which provides financial advice and offers Exchange Traded Funds (ETFs) portfolios.

Ellevest, Inc., Ginmon Vermögensverwaltung GmbH, Wealthify Limited, SoFi Technologies, Inc., and SigFig Wealth Management, LLC are some of the emerging market participants in the robo advisory market.

-

SigFig Wealth Management, LLC was established in 2006 and it offers financial services through its products including SigFig Discover, and SigFig Digital Wealth. The company offers its robo advisory solutions through its SigFig Digital Wealth product which is a hybrid advice platform and helps offer remote advice on any device to clients.

-

Ginmon Vermögensverwaltung GmbH is an investment management company that enables its clients to build their wealth professionally. The company offers its clients a digital investment based on leading capital market research and robo advisor technology.

Key Robo Advisory Companies:

The following are the leading companies in the robo advisory market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these robo advisory companies are analyzed to map the supply network.

- Betterment LLC

- Fincite Gmbh

- Wealthfront Corporation

- The Vanguard Group, Inc.

- The Charles Schwab Corporation

- Ellevest, Inc.

- Ginmon Vermögensverwaltung GmbH

- Wealthify Limited

- SoFi Technologies, Inc.

- SigFig Wealth Management, LLC

Recent Developments

-

In November 2023, WealthKernel, a wealthtech company offering digital investment services, announced a collaboration with Bambu, a provider of digital wealth technology. This collaboration introduces Bambu GO, a ready-to-use robo advisor technology specifically designed for financial institutions.

-

In June 2023, Revolut, a global neobank and financial technology company introduced a robo advisor in the U.S. to automate customer investment portfolios, simplifying the investment process. The company's robo advisor enable users to invest in one of five portfolios aligned with their risk tolerance, which undergo monthly rebalancing.

-

In May 2022, HDFC Securities introduced HDFC Money, an investment platform leveraging robo-advisory services. This platform would provide access to mutual fund schemes and various financial products without requiring a demat account.

-

In February 2022, Betterment LLC announced the acquisition of Makara, an innovative manager of cryptocurrency portfolios. With this acquisition, Betterment LLC’s customers were able to invest in diversified crypto portfolios, in addition to their existing investments.

Robo Advisory Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 8.47 billion

Revenue forecast in 2030

USD 41.83 billion

Growth rate

CAGR of 30.5% from 2024 to 2030

Base year of estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Report updated

February 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, trends

Segments covered

Type, provider, service type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia (KSA); South Africa; UAE

Key companies profiled

Betterment LLC; Fincite Gmbh; Wealthfront Corporation; The Vanguard Group, Inc.; The Charles Schwab Corporation; Ellevest, Inc.; Ginmon Vermögensverwaltung GmbH; Wealthify Limited; SoFi Technologies, Inc.; SigFig Wealth Management, LLC

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Robo Advisory Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global robo advisory market report based on type, provider, service type, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Pure Robo Advisors

-

Hybrid Robo Advisors

-

-

Provider Outlook (Revenue, USD Million, 2017 - 2030)

-

Fintech Robo Advisors

-

Banks

-

Traditional Wealth Managers

-

Others

-

-

Service Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Direct Plan-based/Goal-based

-

Comprehensive Wealth Advisory

-

-

End User Outlook (Revenue, USD Million, 2017 - 2030)

-

Retail Investor

-

High Net Worth Individuals

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global robo advisory market size was estimated at USD 6.61 billion in 2023 and is expected to reach USD 8.47 billion in 2024.

b. The global robo advisory market is expected to grow at a compound annual growth rate of 30.5% from 2024 to 2030 to reach USD 41.83 billion by 2030.

b. North America dominated the robo advisory market with a share of 28.9% in 2023. The region's growth can be ascribed to the presence of several prominent players, such as Betterment., the Vanguard Group, Inc., and others.

b. Some key players operating in the robo advisory market include Betterment, Fincite GmbH, Wealthfront Corporation, The Vanguard Group, Inc., Charles Schwab & Co., Inc., Ellevest, Ginmon Vermögensverwaltung GmbH, Wealthify Limited, Social Finance, Inc., and SigFig Wealth Management.

b. Key factors that are driving the market growth include increasing digitalization across the globe and rising technological advancements.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.