- Home

- »

- Medical Devices

- »

-

Robotic Nurse Assistant Market Size & Growth Report, 2030GVR Report cover

![Robotic Nurse Assistant Market Size, Share & Trends Report]()

Robotic Nurse Assistant Market Size, Share & Trends Analysis Report By Product Type (Independence Support Robots, Daily Care & Transportation Robots), By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-962-3

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The global robotic nurse assistant market size was valued at USD 1.0 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 14.8% from 2023 to 2030. The growing population of older adults across the globe is encouraging the demand for robotic nurse assistants for various assistive day-to-day functions. As per a report by the WHO, by the year 2030, 1 in every 6 people will be aged 60 and above. The population of elderly people is going to double from 2020 to 2050 and is expected to reach 4.1 billion. Similarly, the number of people aged 80 and above is going to triple from 2020 to 2030 and is expected to reach 426 million by 2050. Furthermore, increasing investment in R&D to produce technologically advanced robots for healthcare facilities is expected to bolster the demand for robotic nurses in the coming years.

A rise in funding and grants for the development of technologically advanced nurse assisting robots, which can efficiently perform the day-to-day chores of a nurse, is another factor responsible for the growing demand for robotic nurses. For instance, in April 2022, Diligent, a nurse assisting robot firm, raised more than USD 30 million in their series B funding. The funding will help the company to increase its scalability and navigate its supply chain issues as it continues to deploy its nurse assisting robot, Moxi.

The robotic nurses are used for various activities like supporting disabled, critically ill patients, and older people in performing their day-to-day tasks, interacting with patients, monitoring patients, and collecting information about patients. These robots are overcoming the shortfall of healthcare workers in regions where the proportion of nurses and patients is not equal. According to the Health, Labor, and Welfare Ministry, there will be a shortfall of around 377,000 healthcare workers in Japan by 2026. In Japan, one-third of the population is aged 65 or above; therefore, since 2015, the government is providing subsidies for the purchase of robots by healthcare facilities. The country is majorly investing in projects to enhance robotic nurse assistants to detect and predict health-related changes among individuals. The “Robot Plan” aims to increase the adoption of robots for giving care from 60% to 80%. This is, in turn, driving the market.

At present, robotics-based nurse assistance is among the most researched area that specifically focuses on patient aid. Over the last decade, the role of robotics in the healthcare sector has increased significantly owing to the requirement to improve the quality and safety of care while controlling expenses. In order to address such requirements, multi-purpose intelligent nurse aid is required that will provide assistance to patients and accomplish teleoperation tasks with an easy-to-use graphical user interface.

There is a growing demand for robotic nurse assistants globally; however, their higher prices are impeding the growth of the market. Furthermore, a large amount of variable cost is required for maintenance, training the staff, and reconstructing the work process. Besides, safety and security concerns related to these robots are restraining the growth of the market. However, constant innovation of affordable technologies, along with an increasing number of production volumes due to the growing popularity of robotic nurse assistants, is expected to bring down the cost of production of such robots.

The COVID-19 pandemic had a positive impact on the market as the percentage of hospitalization increased significantly, which led to the rise in the demand for robotic nurse assistants for patients. The robots also helped in maintaining social distance while taking care of the COVID-19 infected patients, which further boosted the market growth in that period.

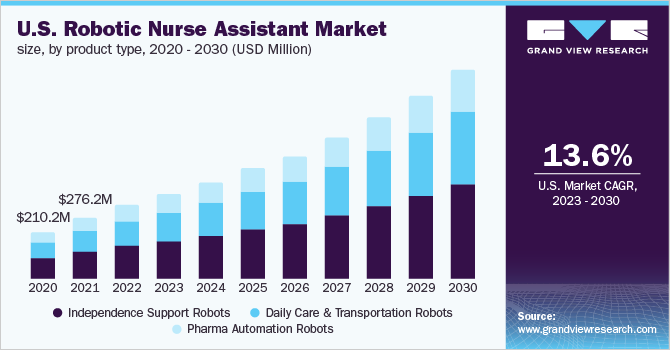

Product Type Insights

In 2022, independence support robots dominated the market with a revenue share of over 43.1%. The growing number of disabled people and a rising percentage of elder people dealing with chronic diseases are boosting the market growth, as these robots are highly useful in taking care of such patients. In addition, these robots are able to do human tasks more efficiently and accurately in a lesser time frame. This is positively supporting the market growth.

The daily care and transportation robots are anticipated to register the fastest growth rate of 25.7%. These robots autonomously process the workflow of hospitals, thereby enhancing the quality and productivity of the healthcare sector. Besides, the growing requirement for nurse assisting robots to help healthcare workers in executing their daily tasks more proficiently is a key factor driving this segment.

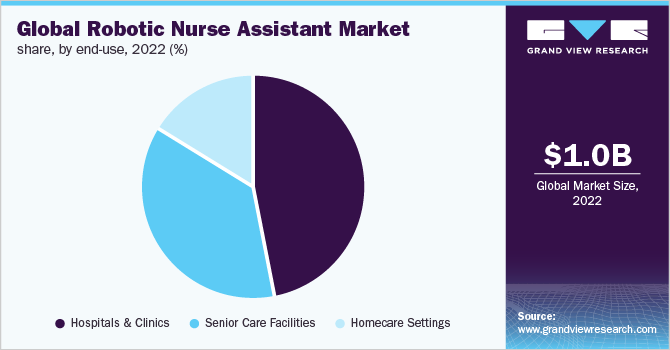

End-use Insights

In 2022, the hospitals and clinics segment emerged as the dominant segment with a revenue share of over 47.1% and is expected to grow at a lucrative rate during the forecast period. The increasing adoption of medical robots, including nurse assistant robots, in hospitals and clinics due to the shortfall of nurses in various countries, coupled with growing healthcare expenditure and adoption of advanced technology in the healthcare sector, is projected to boost the market growth.

The senior care facilities are anticipated to register the fastest growth rate of 15.3% during the projection period owing to the growing geriatric population across the world. Moreover, older people are more prone to chronic diseases and thus they require personalized care, which fuels the market growth. According to a report released by the Union Ministry of Family and Health Welfare in January 2020, two in every three senior citizens suffer from some kind of chronic condition. Furthermore, the growing strategic initiatives by the players to launch new products at an affordable range further fuel the market growth.

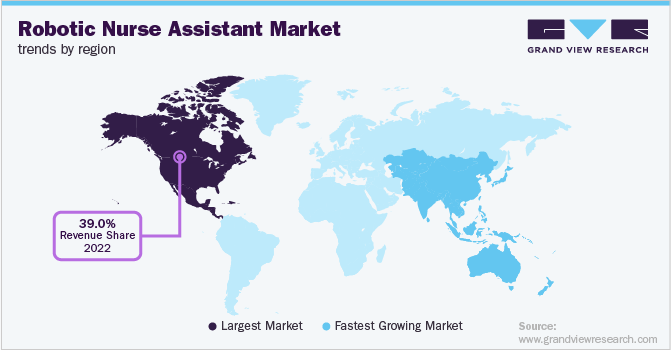

Regional Insights

North America dominated the market in 2022 with a revenue share of over 39.0% and is expected to grow at a lucrative rate during the forecast period. Some of the major factors contributing to the revenue growth of North America are the presence of world-class healthcare facilities, the high purchasing power of hospitals to invest in these systems, better collaborations with insurance companies, and an increasing number of patients opting for superior healthcare services. In addition, the growing need to maintain a ratio of nurses to the patient population further boosts the demand for robot-based assistants within the region.

Asia Pacific is anticipated to register the fastest growth rate of 16.3% during the forecast period due to the presence of a large population of older adults. Furthermore, the continuous growth of the healthcare sector within the region, along with the growing investment in R&D of robotics systems, supports the market growth. The introduction of AI, IoT, and machine learning, coupled with the growing penetration of 5G network within the region, is opening new opportunities for the market to launch new products.

Key Companies & Market Share Insights

Strategic initiatives including collaborations, mergers & acquisitions, partnerships, and product launches are being undertaken by market players to increase their market share. In addition, the adoption of robotic nurse assistants by hospitals and healthcare facilities boosts the market growth. For instance, in 2021, a robotic nurse assistant named Moxi, provided by Diligent Robotics, was utilized for tasks such as delivering lab samples and fetching medications in Texas. Some prominent players in the global robotic nurse assistant market include:

-

Hstar Technologies

-

Diligent Robotics

-

Toyota Motor Corporation

-

RIKEN-SRK

-

SoftBank Robotics

-

Panasonic

-

Fraunhofer IPA

-

Aethon

Robotic Nurse Assistant Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.1 billion

Revenue forecast in 2030

USD 2.9 billion

Growth rate

CAGR of 14.8% from 2022 to 2030

Base year for estimation

2022

Historical data

2016 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; Spain; France; Italy; Russia; Japan; China; India; South Korea; Singapore; Australia; Mexico; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Hstar Technologies; Diligent Robotics; Toyota Motor Corporation; RIKEN-SRK; SoftBank Robotics; Panasonic; Fraunhofer IPA; Aethon

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

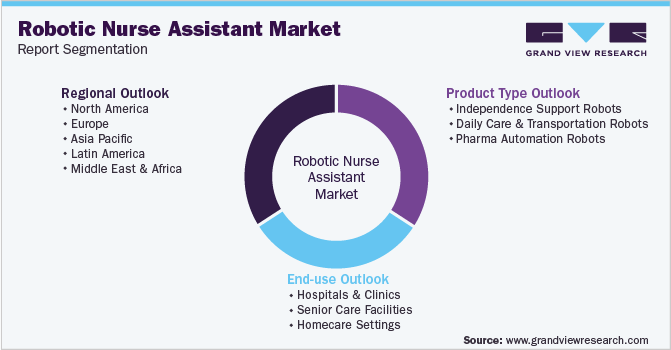

Global Robotic Nurse Assistant Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2030. For the purpose of this study, Grand View Research, Inc. has segmented the global robotic nurse assistant market report on the basis of product type, end-use, and region:

-

Product Type Outlook (Revenue, USD Million, 2016 - 2030)

-

Independence Support Robots

-

Daily Care & Transportation Robots

-

Pharma Automation Robots

-

-

End-use Outlook (Revenue, USD Million, 2016 - 2030)

-

Hospitals & Clinics

-

Senior Care Facilities

-

Homecare Settings

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

Spain

-

France

-

Italy

-

Russia

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Singapore

-

Australia

-

-

Latin America

-

Mexico

-

Brazil

-

Argentina

-

-

MEA

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global robotic nurse assistant market size was estimated at USD 1.0 billion in 2022 and is expected to reach USD 1.1 billion in 2023.

b. The global robotic nurse assistant market is expected to grow at a compound annual growth rate of 14.8% from 2023 to 2030 to reach USD 2.9 billion by 2030.

b. Independence support robots dominated the robotic nurse assistant market with a share of 43.1% in 2022. This is attributable to the growing elderly and disabled population requiring continuous nursing assistance.

b. Some key players operating in the robotic nurse assistant market include Hstar Technologies; Diligent Robotics; Toyota Motor Corporation, RIKEN-SRK; SoftBank Robotics; Panasonic; Fraunhofer IPA; and Aethon.

b. Key factors that are driving the robotic nurse assistant market growth include increasing technological innovations and rising funding and grants for the development of nurse assisting robots that can effectively perform day to day tasks of a nurse.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."