- Home

- »

- Food Safety & Processing

- »

-

Seafood Processing Equipment Market Size Report, 2025GVR Report cover

![Seafood Processing Equipment Market Size, Share & Trends Report]()

Seafood Processing Equipment Market Size, Share & Trends Analysis Report by Product (Frozen, Smoked, Canned, Dried), By Equipment (Slaughtering, Gutting, Scaling, Filleting), And Segment Forecasts, 2018 - 2025

- Report ID: GVR-2-68038-601-1

- Number of Report Pages: 105

- Format: PDF, Horizon Databook

- Historical Range: 2014 - 2016

- Forecast Period: 2018 - 2025

- Industry: Consumer Goods

Industry Insights

The global seafood processing equipment market size was valued at USD 1.95 billion in 2017. It is anticipated to grow at a CAGR of 3.2% over the forecast period. Strict government regulations regarding food and associated industries are anticipated to increase consumer inclination towards seafood. Rising income, population, urbanization, and health awareness are expected to further propel the market growth.

The demand for tasty and healthy processed food is witnessing exponential increase every year, with a rising population and an increased need to fulfill its food requirements. This exerts pressure on the food processing industry. This factor is anticipated to favor the market for seafood processing equipment. Rising health awareness in Europe and North America coupled with developing regions including Asia Pacific is forecasted to further boost the growth over the forecast period.

The Global Aquaculture Alliance (GAA) manages the Best Aquaculture Practices (BAP) certification standards for the seafood processing industries, hatcheries, farms, and feed mills. The overall regulatory framework enforces manufacturers to opt for standardized equipment and is expected to continue over the next eight years.

In recent years, the demand for seafood has witnessed substantial growth. The increase in consumption of protein is owing to rising consumer awareness regarding the benefits of high nutritional food. The seafood industry has witnessed favorable market conditions and trading scenarios along with a hike in fish production. The rise in aquaculture is also anticipated to give traction to the market.

The market for seafood processing equipment is ruled by certifications, regulations, and standards set by various governments. Meeting the food standards and safety guidelines are the primary target for the value chain participants.

Equipment Insights

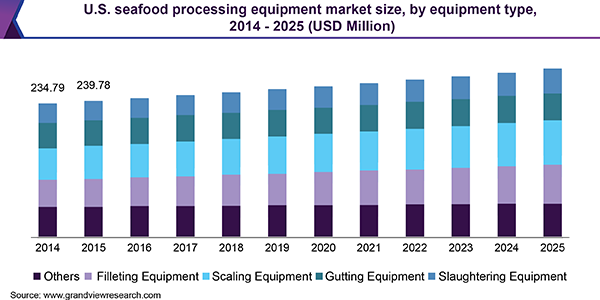

Technological advancements in terms of operations and software, facilitate manufacturers to offer a range of functions in a single unit. Scaling equipment emerged dominant with a market share of over 22.07% in terms of value in 2017. It is expected to witness the fastest CAGR of 3.8% over the forecast period. Recent advancements in the machine and equipment sector are expected to revolutionize the market in the near future.

The global seafood processing equipment market constantly requires efficient and effective solutions for different complex manufacturing operations. Gutting equipment, being one of the basic and important processing equipment in seafood processing, is anticipated to grow considerably in the near future. Various equipment facilitate the desired food quality and standard of processed food.

Product Insights

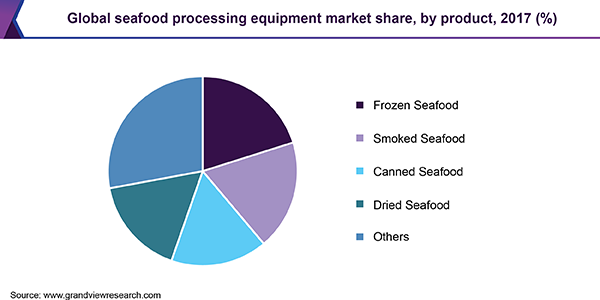

Frozen seafood emerged dominant with a market share of over 20.23% in terms of value in 2017. The canned seafood segment, on the other hand, is expected to register the fastest CAGR of 3.6% over the forecast period.

Smoked seafood was the second-largest contributor in terms of value with a market share of 18.44% in 2017, owing to the dynamic food preferences of customers. This is one of the prominent product segments as consumers' taste preference keeps evolving with time and is dynamic in nature.

Regional Insights

Asia Pacific is expected to lead the global market over the forecast period. In terms of revenue, Asia Pacific contributed to 42.13% share in 2017 and is expected to expand at a CAGR of 4.7% during the forecast period.

The economic performance of China with large-scale investments in technology and research favor the regional growth. China is expected to undertake massive changes in its food and beverage industry scenario, to overcome the challenges such as economic disparity and increasing urbanization among others.

Europe was the second largest region, in terms of revenue, with 27.04% market share in 2017. High demand for high-quality systems from several major industries is anticipated to bode well for regional growth over the forecast period. North America accounted for 16.10% of the global market in 2017.

Seafood Processing Equipment Market Share Insights

Numerous manufacturers are shifting their focus toward developing countries and units that can function with advanced technology. Global multinational companies dominate the industry and are majorly concentrated in North America and Europe. The top manufacturers occupy the majority of the global market, with North America and Asia Pacific accounting for substantial market shares. The pricing and other strategic initiatives depend on the top players.

Manufacturers focus majorly on the development of industrial processes and operations backed up with technological advancements to consolidate their market position. They invest hugely in research and development facilities and introduce innovative designs along with enhanced capacities to boost the product adoption. Polar Systems Ltd., GEA Group Aktiengesellschaft, Uni-Food Technic A/S, BAADER Group., Arenco AB, Marel, and SEAC AB are some of the key market players.

Recent Developments

-

In February 2023, Marel, a multinational food processing company launched filleting machine MS 2750. It is anticipated to deliver the highest yield processor and trout weighing between 1.5-10 kgs.

-

In April 2021, GEA Group Aktiengesellschaft, launched the latest version of its SKIN thermoforming packaging technology- PowerPak SKIN 50. This provides processors of fish, and high-end products such as top-quality seafood, with high-capacity packing of products of up to 100mm high that protrude up to 50mm above the level of the packing tray.

-

In January 2021, SEAC AB, a Swedish fish-processing manufacturer was acquired by BAADER Group.The SEAC technology is a perfect fit for BAADER to further extend its overall product portfolio amongst small fish species.

Report Scope

Attribute

Details

The base year for estimation

2017

Actual/Historical data

2014 - 2016

Forecast period

2018 - 2025

Market representation

Revenue in USD Million, and CAGR from 2018 to 2025

Regional scope

North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa

Country scope

The U.S., Canada, The U.K., Germany, Italy, Russia, Turkey, China, India, Japan, South Korea, Australia, Brazil, South Africa.

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

15% free customization scope (equivalent to 5 analyst working days)

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels, and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the global seafood processing equipment market report on the basis of equipment type, product, and region.

-

Equipment Type Outlook (Revenue, USD Million, 2014 - 2025)

-

Slaughtering

-

Gutting

-

Scaling

-

Filleting

-

Others

-

-

Products Outlook (Revenue, USD Million, 2014 - 2025)

-

Frozen

-

Smoked

-

Canned

-

Dried

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2014 - 2025)

-

North America

-

The U.S.

-

Canada

-

-

Europe

-

Germany

-

Russia

-

The U.K.

-

Turkey

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."