- Home

- »

- Next Generation Technologies

- »

-

Smart Fleet Management Market Size & Share Report, 2025GVR Report cover

![Smart Fleet Management Market Report]()

Smart Fleet Management Market Analysis By Transportation (Automotive, Rolling Stock, Marine), By Hardware (Tracking, Remote Diagnostics, ADAS, Optimization), By Connectivity (Short Range, Long Range, Cloud), And Segment Forecasts, 2018 - 2025

- Report ID: GVR-2-68038-286-0

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2014 - 2015

- Forecast Period: 2017 - 2025

- Industry: Technology

Report Overview

The global smart fleet management market size was valued at USD 291.1 billion in 2016 and is expected to expand at a CAGR of 7.7% over the forecast period. The need to achieve higher operational efficiencies and enhance vehicular safety is the primary factor driving the growth of the market. In addition, the integration of connected car technologies within vehicles has enabled a variety of solutions that can help enhance fleet operations.

Various government regulations and initiatives aimed at creating a more reliable and secure transportation network are favoring the development of intelligent transport systems. Various government agencies have also been promoting the use of connected vehicle technologies to reduce energy consumption, curtail carbon emissions, and avoid road congestion. Smart fleet management solutions can help fleet operators to obtain information in real time and make informed decisions that can save costs and enhance operational efficiency.

Connected vehicle technology can offer numerous features and benefits such as tracking, monitoring, and enhanced safety and security. However, implementing the technology calls for a robust network infrastructure to ensure seamless connectivity and transfer of information in real time. The lack of adequate network infrastructure, especially in developing economies such as India and Mexico, is one of the major challenges that can restrict the growth of the smart fleet management market. Moreover, concerns about cyber-attacks and data loss might equally diminish growth prospects for the market.

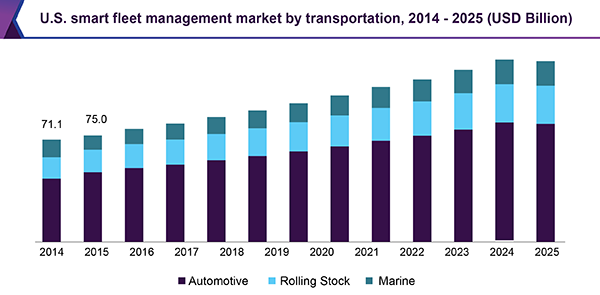

Transportation Insights

The automotive segment held the largest market share in 2016 and is expected to register the fastest growth over the forecast period. Connected vehicle technologies can enable remote monitoring and management of various operations such as fuel management, remote diagnostics, vehicle idle time, route optimization, and predictive maintenance. These solutions can enable fleet operators to optimize their fleet operations and reduce business risks. Such operational benefits, coupled with continued government regulations and initiatives for vehicular and road safety, are likely to drive the segment.

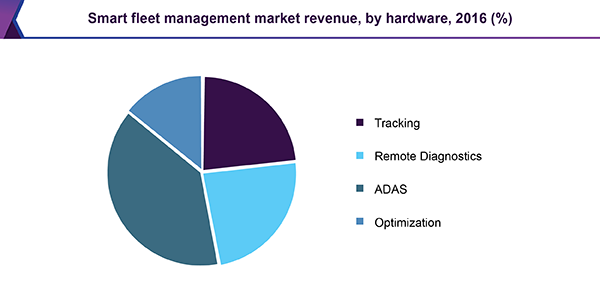

Hardware Insights

When compared to hardware, the Advanced Driver Assistance Systems (ADAS) segment is expected to demonstrate the highest growth rate in the market for smart fleet management. While several governments are continuously issuing regulatory mandates for vehicular safety, the adoption of autonomous vehicle technologies is also growing. This serves as the primary factor driving the ADAS segment.

ADAS incorporates various components such as sensors, radars, LiDAR, and image processing units, which enhance safety and help avoid collisions. They also offer adaptive features such as cruise control, automated lighting, automated brakes, GPS navigation, and integration with smart devices to deliver alerts, all of which can enhance the driving experience.

Fleet operators are also investing in fleet management solutions that can enable predictive maintenance and fleet optimization by tracking and managing diagnostic data remotely. Commercial fleets are subjected to extreme wear and tear, requiring regular maintenance for optimum performance. Remote diagnostics allows fleet operators to analyze vehicular data and predict component failures so that vehicle downtime can be reduced in case of a failure. Tracking and remote diagnostics can empower fleet operators with proactive capabilities that can reduce vehicle downtime and save costs.

Connectivity Insights

The short-range communication segment dominated the market for smart fleet management and is expected to continue doing so over the forecast period. Short-range communication technology allows vehicle-to-vehicle and vehicle-to-infrastructure communication, which can be used to share a myriad of information pertaining to traffic, position, routing, mapping, and navigation, among others. ADAS can use this data to enhance vehicular safety by triggering safeguard measures and avoiding collisions. As various governments continue toissue regulatory mandates to incorporate such technologies in vehicular systems, the market would continue to grow.

Cloud connectivity enables small and medium-sized fleet operators to adopt smart fleet management solutions without having to invest in infrastructure. Cloud-hosted smart fleet solutions can offer operators the ease to scale as per requirement and ensure lower cost of ownership while enabling them to optimize operations. Cloud solutions also offer enhanced security features that can safeguard business-critical data collected from various sources. Thus, cloud connectivity is expected to expand at the highest CAGR over the forecast period.

Key Companies & Market Share Insights

Prominent players operating in the market for smart fleet management include Cisco Systems, Inc.; Continental AG; IBM Corporation; Siemens AG; Robert Bosch GmbH; Tech Mahindra; Sierra Wireless; and Zonar Systems, Inc.

These players are focused on collaborating with various stakeholders and innovating new products. Companies are aggressively investing in research and development to further develop advanced and better autonomous vehicles, ADAS, IoT devices, and sensors, among others. Companies are also embarking upon mergers and acquisitions to expand their footprint in the market and enhance their product portfolio. For instance, Continental AG acquired Zonar Systems, Inc., a provider of fleet management solutions, to expand its presence in U.S. as well as to expand its mobility services portfolio.

Recent Development

-

In April 2023, Continental and HERE announced a partnership with IVECO to provide fuel saving and safety functions in commercial vehicles. Continental and HERE together planned to deliver data aggregation, vehicle positioning, speed limit information, and geospatial content for ADAS.

-

In February 2023, Cisco announced a partnership with Mercedes-Benz to develop mobile office work innovation in Mercedes-Benz E-Class vehicles. This partnership aimed to help people get work done securely, comfortably, and safely in their vehicles.

-

In October 2022, Siemens announced a strategic partnership with Volta Trucks to deliver and scale eMobility-charging infrastructure. The partnership aimed to simplify the transition to fleet electrification by providing turnkey solutions.

Smart Fleet Management Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 387.7 billion

Revenue forecast in 2025

USD 565.1 billion

Growth Rate

CAGR of 7.7% from 2017 to 2025

Base year for estimation

2016

Historical data

2014 - 2015

Forecast period

2017 - 2025

Quantitative units

Revenue in USD billion and CAGR from 2017 to 2025

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Transportation, hardware, connectivity, region

Regional scope

North America; Europe; Asia Pacific; and Rest of the World (RoW)

Country scope

U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; and Mexico.

Key companies profiled

Cisco Systems, Inc.; Continental AG; IBM Corporation; Siemens AG; Robert Bosch GmbH; Tech Mahindra; Sierra Wireless; and Zonar Systems, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels and analyzes industry trends in each of the sub-segments from 2014 to 2025. For this study, Grand View Research has segmented the global smart fleet management market report on the basis of transportation, hardware, connectivity, and region:

-

Transportation Outlook (Revenue, USD Billion, 2014 - 2025)

-

Automotive

-

Rolling Stock

-

Marine

-

-

Hardware Outlook (Revenue, USD Billion, 2014 - 2025)

-

Tracking

-

Remote Diagnostics

-

ADAS

-

Optimization

-

-

Connectivity Outlook (Revenue, USD Billion, 2014 - 2025)

-

Short Range Communication

-

Long Range Communication

-

Cloud

-

-

Regional Outlook (Revenue, USD Billion, 2014 - 2025)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Rest of World (RoW)

-

Brazil

-

Mexico

-

Others

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."