- Home

- »

- Homecare & Decor

- »

-

Soap Dispenser Market Size, Share & Growth Report, 2030GVR Report cover

![Soap Dispenser Market Size, Share & Trends Report]()

Soap Dispenser Market Size, Share & Trends Analysis Report By Product (Automatic, Manual), By Application (Residential, Commercial), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-629-5

- Number of Report Pages: 83

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Report Overview

The global soap dispenser market size was valued at USD 1.40 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 8.3% from 2023 to 2030. The rapid growth of the bathroom fittings industry is offering lucrative opportunities for soap dispenser manufacturers. In addition, the rising demand for multi-functional soap dispensers that are aesthetically appealing and complement other plumbing fixtures are boosting the market. However, the current outbreak of COVID-19 across the globe has significantly stepped-up awareness among people regarding self-hygiene and maintaining a clean environment. The highly contagious virus is easily transmitted through touch, from one infected object or person to another. And as a result, frequently washing hands with soap has been identified as a critical preventive measure by healthcare organizations around the world. This has had a positive impact on the growth of the soap dispensers market and the trend is likely to continue in the months to come.

Rapid expansion in the commercial construction sector has also paved the way for plumbing fixtures, including soap dispensers. The hospitality sector in particular, which includes hotels, resorts, and hospitals, is enhancing the need for soap dispensers in these segments. According to a report released by Lodging Econometrics (LE), through the third quarter of 2021, the U.S. opened 665 new hotels with 85,306 rooms and another 221 hotels with 23,026 rooms opened by the end of the year, totaling 886 hotels with 108,332 rooms for 2021.

Moreover, expanding the product portfolio of manufacturers in the industry is also likely to have a positive impact on the market. Manufacturers have been experimenting with a variety of materials and designs to offer consumers the customized soap dispensers. Improving lifestyles and rising disposable incomes are giving rise to construction of more luxurious bathrooms that aim to give a more spa-like experience. This drives the demand for designer bathroom fittings.

Furthermore, with the advent of smart and connected technology, companies are also offering smart soap dispensers and this trend has been gaining much traction among consumers. For instance, Kohler Co. offers an automatic 16-ounce soap dispenser. This refillable dispenser can be installed in predrilled sink holes and can work in tandem with contemporary-style faucets. The product is available in various finishes such as Polished Chrome, Vibrant Polished Nickel, Brushed Chrome, and Vibrant Stainless.

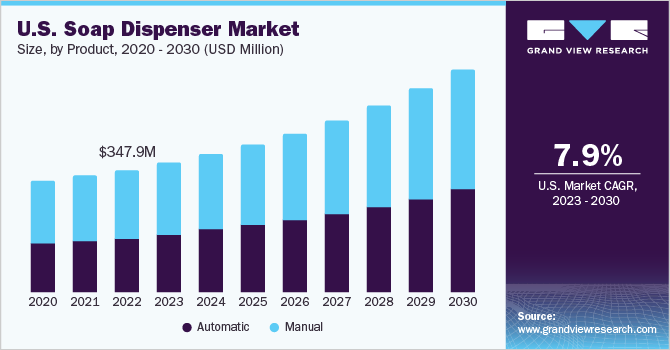

Product Insights

In terms of revenue, manual soap dispensers dominated the market with a share of 56.95% in 2022. This is attributed to a high adoption rate in residential, restaurants, pubs, public places, and several other commercial places. The middle-class groups favor manual soap dispensers over automatic ones since they are more affordable. In addition, new and innovative features including operational variations, such as push-up, foot-operated, and surgical type, in manual soap dispensers are attracting a large number of users for basic hygiene practices.

Automatic soap dispenser is projected to register a CAGR of 9.0% from 2023 to 2030. The rising demand among consumers for hand-free soap dispensers in the market is estimated to boost segment growth over the forecast period. Companies in the market are increasingly focusing on product launches in order to gain a higher market share. For instance, in April 2022, Euronics introduced the NERO soap dispenser for washroom spaces. The range includes Euronics automatic soap dispenser, a touchless device that ensures minimal cross-contamination between repeated uses.

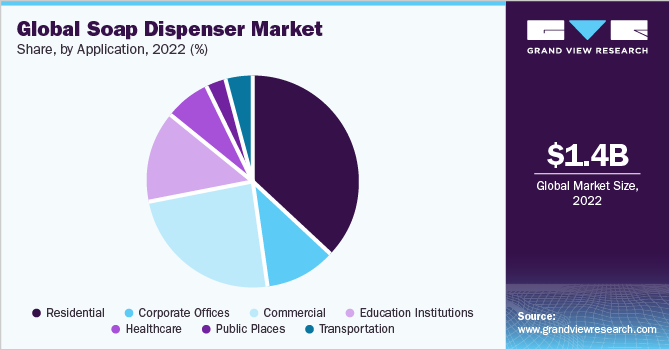

Application Insights

In terms of revenue, residential dominated the market with a share of 37.11% in 2022. An increase in housing ownership rates across various regions, coupled with rising awareness regarding health and hygiene, is expected to drive the demand for soap dispensers in the coming years. According to Apartment List's Homeownership report published in 2021, the millennials homeownership rate rose around 7.9% between 2017 and 2020 (from 40% to 47.9%), and is anticipated to gain much more representation in the housing market as this trend advances.

The commercial is estimated to expand at a CAGR of 8.5% over the forecast period. The growth of this segment is due to rapid expansion of the commercial sector, particularly the hospitality sector, which is driving the demand for bathroom fittings including soap dispenser. Moreover, growth in the travel & tourism industry has propelled the establishment of hotels, restaurants, and shopping and/or entertainment malls. This has had a positive impact on the demand for soap dispensers in restrooms in these areas.

Regional Insights

North America dominated the retail cooler market with a share of 31.81% in 2022. Higher consumer spending in commercial places such as malls, restaurants, and movie theaters has resulted in the growing demand for well-equipped restrooms, thereby driving the demand for soap dispensers. For instance, according to the data published by United States Department of Agriculture (USDA), in August 2021, the number of quick-service restaurants operating in the U.S. grew from 183,543 in 2020 to 189.402 in 2021.

Asia Pacific is expected to witness the fastest CAGR of 9.3% from 2023 to 2030. Recently, other countries in the region, particularly Bangladesh and Vietnam, have gradually tallied their growth with China and India, translating into greater than ever urban housing demand in the region. This scenario is boosting the application of soap dispensers across the residential as well as commercial spaces as a mark of necessity as well as luxury product.

Key Companies & Market Share Insights

The market is characterized by the presence of a few established players and new entrants. Many big players are increasing their focus towards growing trend of the soap dispenser. Players in the market are diversifying the product offering in order to maintain market share.

-

For instance, in March 2020, Bobrick Washroom Equipment, Inc. introduced Bobrick DesignCHAT, an online tool developed to assist designers and architects who may face new challenges as they work remotely. This communication tool enables design professionals to easily reach the Bobrick Architectural Products team, who provides required support and assistance. This tool aims to ease the communication between designers and architects, which would help the company to build a seamless product.

-

For instance, in February 2020, Bradley Corporation introduced a new line of matching Verge soap dispensers and faucets. These complete sets offer cohesive and striking designs which enhance the aesthetics of Verge washbasins and work seamlessly with any basin They incorporate advanced sensing technology for reliability and durability and are available in four styles and six finishes.

Some of the key players operating in soap dispenser market include:

-

Toto Ltd.

-

Kohler Co.

-

ASI American Specialties, Inc.

-

Umbra

-

simplehuman

-

Lovair

-

Bobrick Washroom Equipment, Inc.

-

Bradley Corporation

-

Georgia-Pacific LLC

-

GOJO Industries, Inc.

-

Frost Products Ltd.

-

Dudley Industries Ltd.

-

Stern Engineering Ltd.

-

Duravit AG

-

Sloan Valve Company

Soap Dispenser Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.49 billion

Revenue forecast in 2030

USD 2.64 billion

Growth rate

CAGR of 8.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

August 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; India; Australia; Spain; Japan; Brazil; South Africa

Key companies profiled

Toto Ltd.; Kohler Co.; ASI American Specialties, Inc.; Umbra; simplehuman; Lovair; Bobrick Washroom Equipment, Inc.; Bradley Corporation; Georgia-Pacific LLC; GOJO Industries, Inc.; Frost Products Ltd.; Dudley Industries Ltd.; Stern Engineering Ltd.; Duravit AG; Sloan Valve Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

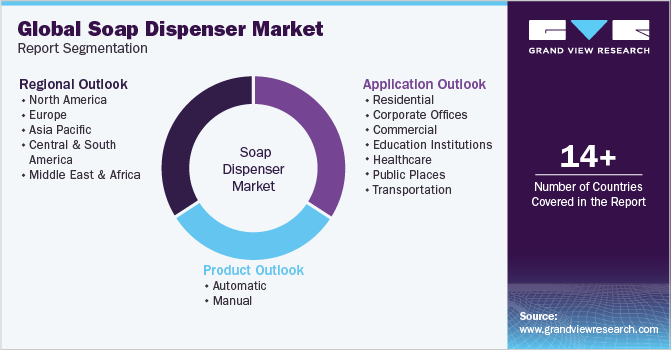

Global Soap Dispenser Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global soap dispenser market report on the basis of product, application, and region:

-

Product Outlook (USD Million, 2017 - 2030)

-

Automatic

-

Manual

-

-

Application Outlook (USD Million, 2017 - 2030)

-

Residential

-

Corporate Offices

-

Commercial

-

Education Institutions

-

Healthcare

-

Public Places

-

Transportation

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Spain

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global soap dispenser market size was estimated at USD 1.40 billion in 2022 and is expected to reach USD 1.49 billion in 2023.

b. The global soap dispenser market is expected to grow at a compound annual growth rate of 8.3% from 2023 to 2030 to reach USD 2.64 billion by 2030.

b. North America dominated the soap dispenser market with a share of 31.8% in 2022. This is attributable to the rising number of commercial construction in the region, likely increasing the application of soap dispensers in commercial spaces.

b. Some key players operating in the soap dispenser market include Toto Ltd.; Kohler Co.; simplehuman; Bradley Corporation; and GOJO Industries, Inc.

b. Key factors that are driving the soap dispenser market growth include rising concerns about hygiene among consumers across the globe and the growing purchasing power of middle-class income groups.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."