- Home

- »

- Communications Infrastructure

- »

-

Social Commerce Market Size & Share, Industry Report 2033GVR Report cover

![Social Commerce Market Size, Share & Trends Report]()

Social Commerce Market (2025 - 2033) Size, Share & Trends Analysis By Business Model (B2B, B2C, C2C), By Product Type (Personal & Beauty Care, Apparel, Accessories, Home Products), By Platform/Sales Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-318-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Social Commerce Market Summary

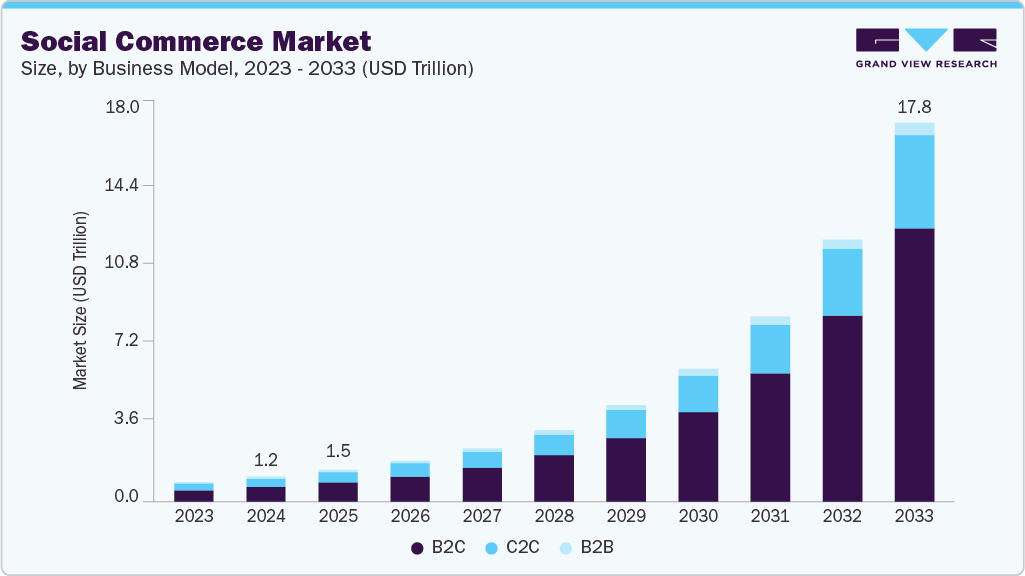

The global social commerce market size was estimated at USD 1.16 trillion in 2024 and is projected to reach USD 17.83 trillion by 2033, growing at a CAGR of 36.4% from 2025 to 2033 owing to the increasing global penetration of social media platforms. These platforms have evolved from mere networking tools into powerful sales channels with integrated shopping functionalities.

Key Market Trends & Insights

- Asia Pacific social commerce dominated the global market with the largest revenue share of 71.6% in 2024.

- The social commerce industry in U.S. is expected to grow significantly over the forecast period.

- By business model, B2C led the market and held the largest revenue share of 58.8% in 2024.

- By product type, the personal & beauty care segment held the dominant position in the market and accounted for the largest revenue share in 2024.

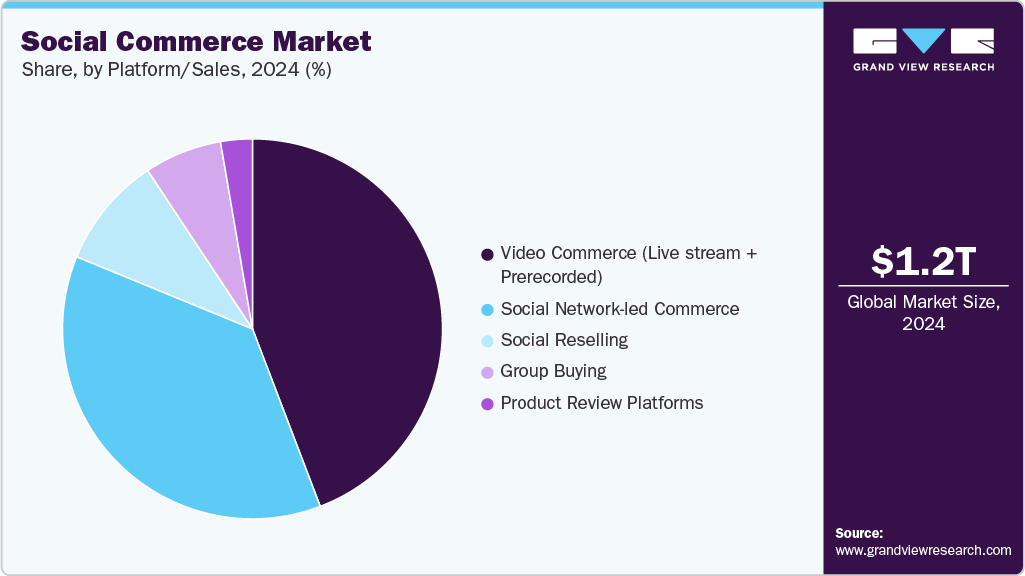

- By platform/sales channel, the social network-led commerce segment is expected to grow at the fastest CAGR from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 1.16 Trillion

- 2033 Projected Market Size: USD 17.83 Trillion

- CAGR (2025-2033): 36.4%

- Asia Pacific: Largest market in 2024

The growing user base, particularly among Millennials and Gen Z, who prefer interactive and real-time shopping experiences, provides a large and engaged audience for brands. Social media platforms’ algorithms personalize content based on user behavior, making product discovery seamless and intuitive, further boosting reach.Social media companies are rapidly enhancing their platforms with features such as shoppable posts, live-stream shopping, in-app checkout, and AI-driven product recommendations. These innovations eliminate friction from the buyer journey by reducing the number of steps from discovery to purchase. For example, TikTok Shop and Instagram Checkout enable users to complete purchases without leaving the app, increasing conversion rates and reducing cart abandonment. These features also support impulse buying and capitalize on user engagement within the platform.

The global shift toward mobile-first internet usage is fueling social commerce industry growth. Consumers, especially in emerging markets, rely heavily on smartphones for internet access and retail interactions. The integration of seamless digital payment options such as Apple Pay, Google Pay, UPI (India), and local e-wallets enhances transaction security and convenience, encouraging consumers to shop through social platforms. Combined with mobile-optimized interfaces, this trend supports the rapid expansion of social commerce in both mature and developing markets. According to the GSMA Association’s State of Mobile Internet Connectivity 2024 report, around 4.6 billion individuals, equivalent to 57% of the global population, can access mobile internet using their devices.

Business Model Insights

The B2C segment dominated the market and accounted for the revenue share of 58.8% in 2024, driven by the increasing preference for direct brand-to-consumer interactions, enabling greater control over customer experience and brand messaging. Consumers are showing a rising appetite for personalized, story-driven content that B2C brands can deliver effectively via social platforms, enhancing engagement and loyalty. In addition, the integration of end-to-end shopping features within social media, such as product tagging, live demonstrations, and instant customer service, allows B2C brands to streamline the path to purchase and reduce dependency on third-party retailers.

The C2C segment is anticipated to grow at the highest CAGR during the forecast period due to the proliferation of peer-to-peer marketplaces and consumer-driven resale culture, particularly in categories such as fashion, electronics, and collectibles. Social media platforms enables individuals to act as both buyers and sellers, leveraging their personal networks for trust-based transactions. The growing popularity of second-hand and sustainable shopping, especially among environmentally conscious consumers, further fuels this segment. Moreover, low entry barriers, minimal infrastructure needs, and integrated payment and shipping solutions provided by platforms make it easier for individuals to monetize personal goods and services, accelerating C2C activity in both mature and emerging markets.

Product Type Insights

The personal & beauty care segment dominated the market and accounted for the largest revenue share in 2024, driven by highly visual and demonstrable nature of beauty products, which aligns with the content formats popular on platforms such as Instagram, TikTok, and YouTube. Consumers are heavily influenced by beauty tutorials, product reviews, and transformation videos shared by influencers and everyday users, which build trust and drive purchase intent. The segment also benefits from frequent product launches, seasonal campaigns, and limited-edition drops that create urgency and encourage impulse buying.

The apparel segment is expected to grow at a significant CAGR during the forecast period due to the demand for trend-driven, affordable fashion and the ability of social platforms to facilitate real-time style inspiration through influencer collaborations, posts, and virtual styling. Fast fashion brands and independent designers leverage these platforms to showcase dynamic look books, limited drops, and style challenges that resonate particularly with Gen Z and Millennials. Features such as shoppable videos, AR-based virtual try-ons, and user-generated content allow consumers to visualize fit and style in relatable contexts, reducing hesitation in online purchases.

Platform/Sales Channel Insights

The video commerce (live stream + prerecorded) segment dominated the market and accounted for the largest revenue share in 2024 as it combines entertainment with instant purchasing, creating an immersive and interactive shopping experience. Live streaming enables real-time engagement between sellers and viewers, fostering trust and immediacy, while prerecorded videos offer on-demand accessibility for product showcases and tutorials. The format allows for richer storytelling, detailed product demonstrations, and direct audience interaction through comments and polls, enhancing transparency and product understanding.

The social network-led commerce segment is expected to grow at a significant CAGR over the forecast period due to seamless integration of shopping experiences within users’ existing social interactions on platforms. These platforms leverage deep behavioral data and social graphs to offer hyper-targeted product placements that align with users’ interests, increasing discovery and purchase likelihood. The community-driven nature of social networks encourages peer influence, where user reviews, shared purchases, and group buying behaviors significantly boost trust and conversion.

Regional Insights

North America social commerce held a significant share in the global market in 2024 driven by the high digital maturity of consumers, widespread mobile payment adoption, and the early integration of e-commerce functionalities by social platforms. A strong culture of influencer marketing and high engagement across platforms such as Instagram, TikTok, and Snapchat also supports product discovery and purchase. Moreover, the rise of direct-to-consumer (D2C) brands leveraging social-first strategies and the increasing investment in immersive video-based commerce are further accelerating adoption in this region.

U.S. Social Commerce Market Trends

The social commerce market in the U.S. is expected to grow significantly at a CAGR of 32.4% from 2025 to 2033, due to high average online spending per user and the early adoption of AI and machine learning tools that power personalized shopping experiences. The presence of tech-forward retail brands experimenting with AR/VR and live commerce, along with a growing preference for experiential and story-driven content among younger demographics, boosts the appeal of social shopping.

Europe Social Commerce Market Trends

The social commerce market in Europe is anticipated to register considerable growth from 2025 to 2033 due to rising cross-border shopping behaviors and multilingual content strategies that cater to diverse audiences. The increasing use of private messaging apps like WhatsApp and Messenger for business communication and order processing is also streamlining the buying process.

The UK social commerce market is expected to grow rapidly in the coming years. Local platforms and e-tailers are investing in native shopping features within social apps, while consumers show a strong preference for discovering and buying from small and independent brands through social channels. Moreover, regulatory clarity around digital advertising and e-commerce in the UK enables brands to invest in social commerce campaigns.

The Germany social commerce market held a substantial market share in 2024 due to a digitally-savvy yet privacy-conscious population that values secure, platform-native purchasing experiences. The growing popularity of structured product reviews, detailed demos, and educational content on social media contributes to informed buying decisions.

Asia Pacific Social Commerce Industry Trends

Asia Pacific dominated the global market with the largest revenue share of 71.6% in 2024, due to the mobile-first nature of digital consumers, high population density, and deep smartphone penetration. A cultural inclination toward community-based shopping, gamified commerce, and live-stream interactions further enhances platform stickiness and user engagement. Government initiatives supporting digital economies, especially in Southeast Asia, and the rapid scaling of logistics and payment ecosystems make this region a hotbed for social commerce innovation and growth.

The Japan social commerce market is expected to grow rapidly in the coming years, supported by the fusion of anime, lifestyle content, and e-commerce within platforms such as LINE and Instagram. Consumers appreciate visually appealing, quality-focused content, and prefer detailed product information, which social platforms can provide through video and carousel formats. The rise of local creators and KOLs (Key Opinion Leaders) who promote niche and premium products has also helped brands tap into aspirational consumer segments.

The China social commerce market held a substantial market share in 2024, due to platforms like WeChat, Xiaohongshu (Little Red Book), and Douyin pioneering integrated ecosystems that blend content, community, and commerce seamlessly. The apps, combined with frictionless payment systems such as Alipay and WeChat Pay, supports instant purchases within content feeds. The culture of live-streaming, flash sales, and group buying creates urgency and encourages impulse buying, while AI-driven personalization and social gamification enhance user retention and monetization.

Key Social Commerce Company Insights

Key players operating in the social commerce industry are Meta Platforms, Inc. (Facebook), TikTok (Douyin), Taobao, WeChat (Weixin), Pinduoduo Inc., and Pinterest, Inc. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In May 2025, Pinterest, Inc. launched a new feature that labels AI-generated or modified images to help users more easily identify this type of content. When viewing an image Pin in close-up, users will now see an “AI modified” tag displayed in the bottom left corner. This labeling system relies not only on analyzing image metadata but also on advanced classifiers developed by Pinterest to automatically detect generative AI content, even when clear indicators are absent.

-

In November 2023, Meta Platforms, Inc. (Facebook) introduced a new feature that allows Facebook and Instagram users to link their accounts with Amazon, creating a more streamlined shopping experience. This integration enables users to browse and purchase products directly from Amazon ads within the apps, completing their transactions without leaving Facebook or Instagram.

Key Social Commerce Companies:

The following are the leading companies in the social commerce market. These companies collectively hold the largest market share and dictate industry trends.

- Etsy, Inc.

- Fashnear Technologies Private Limited (Meesho)

- Meta Platforms, Inc. (Facebook)

- Pinduoduo Inc.

- Pinterest, Inc.

- Poshmark

- Roposo

- Snap, Inc.

- Taobao

- TikTok (Douyin)

- Trell Shop

- Twitter, Inc.

- WeChat (Weixin)

- Xiaohongshu

- Yunji Sharing Technology Co., Ltd.

Social Commerce Market Report Scope

Report Attribute

Details

Market size in 2025

USD 1.48 trillion

Revenue forecast in 2033

USD 17.83 trillion

Growth rate

CAGR of 36.4% from 2025 to 2033

Base year of estimation

2024

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion/trillion and CAGR from 2025 to 2033

Report enterprise size

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Business model, product type, platform/sales channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

Etsy, Inc.; Fashnear Technologies Private Limited (Meesho); Meta Platforms, Inc. (Facebook); Pinduoduo Inc.; Pinterest, Inc.; Poshmark; Roposo

Snap, Inc.; Taobao; TikTok (Douyin); Trell Shop; Twitter, Inc.; WeChat (Weixin); Xiaohongshu; Yunji Sharing Technology Co., Ltd.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Social Commerce Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the social commerce market report based on business model, product type, platform/sales channel, and region:

-

Business Model Outlook (Revenue, USD Billion, 2021 - 2033)

-

B2C

-

B2B

-

C2C

-

-

Product Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Personal & Beauty Care

-

Apparel

-

Accessories

-

Home Products

-

Health Supplements

-

Food & Beverage

-

Others

-

-

Platform/Sales Channel Outlook (Revenue, USD Billion, 2021 - 2033)

-

Video Commerce (Live stream + Prerecorded)

-

Social Network-led Commerce

-

Social Reselling

-

Group Buying

-

Product review platforms

-

-

Social Commerce Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global social commerce market size was estimated at USD 1.16 trillion in 2024 and is expected to reach USD 1.48 trillion in 2025.

b. The global social commerce market is expected to grow at a compound annual growth rate of 36.4% from 2025 to 2033 to reach USD 17.83 trillion by 2033.

b. Asia Pacific region dominated the global social commerce market with a share of 71.6% in 2024. This is attributed to the mobile-first nature of digital consumers, high population density, and deep smartphone penetration. A cultural inclination toward community-based shopping, gamified commerce, and live-stream interactions further enhances platform stickiness and user engagement.

b. Some key players operating in the social commerce market include Etsy, Inc., Fashnear Technologies Private Limited (Meesho), Meta Platforms, Inc. (Facebook), Pinduoduo Inc., Pinterest, Inc., Poshmark, Roposo, Snap, Inc., Taobao, TikTok (Douyin), Trell Shop, Twitter, Inc., WeChat (Weixin), Xiaohongshu, Yunji Sharing Technology Co., Ltd.

b. Key factors driving the social commerce market growth include the increasing global penetration of social media platforms. These platforms have evolved from mere networking tools into powerful sales channels with integrated shopping functionalities.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.