- Home

- »

- Alcohol & Tobacco

- »

-

Still Wine Market Size, Share & Growth, Industry Report 2028GVR Report cover

![Still Wine Market Size, Share & Trends Report]()

Still Wine Market (2022 - 2028) Size, Share & Trends Analysis Report By Type (White Wine, Red Wine), By Distribution Channel (Liquor Stores, Internet Retailing), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-942-9

- Number of Report Pages: 83

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2028

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

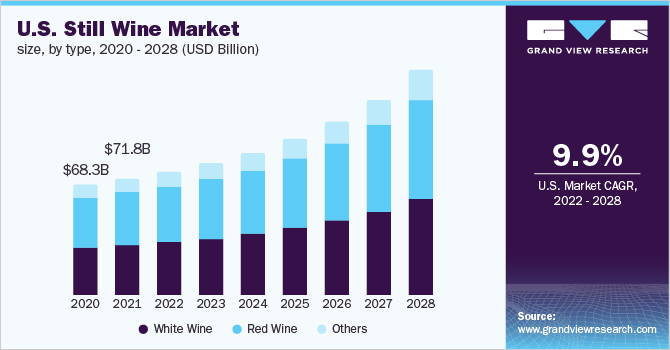

The global still wine market size was valued at USD 279.32 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 10.1% from 2022 to 2028. The market growth can be credited to the consumption of premium still wines. Additionally, the increasing number of wineries in the domestic and international industry owing to the rising number of wine consumers is expected to fuel the market growth. Factors such as traveling and rising disposable income are leading to the adoption of global lifestyles and cultures, therefore leading to the appreciation and consumption of good wines. Thus, these factors are expected to drive the market for still wine. In addition, changing the preference of alcohol consumers from hard liquor to mild or low alcoholic beverages such as wine, beer, and seltzers is a prime factor boosting the market growth.

The growing investment by key players to launch new products is further anticipated to boost the industry sales. However, a gradual shift of wine consumers towards non-alcoholic beverages owing to the introduction of innovative beverages may hamper the growth of the market. Owing to the COVID-19 pandemic, the industry demand has been steady. As a result of the lockdowns, the production and supply chain of raw materials required for the manufacturing of wines were deeply affected, thus hampering the market growth.

During the COVID-19 pandemic, online sales channels have witnessed strong growth due to a variety of applications and stay-at-home regulations. According to the International Organization of Vine and Wine (OIV), online wine sales spiked during the pandemic in 2020. The growth in internet sales can be ascribed to many countries and states reducing their buying and shipping regulations. It was mostly driven by the social distancing and drinking at the home trend. Fueled by unique pandemic circumstances, digital platform innovation ushered in a new era of convenient and user-friendly online purchasing. Consumer inclination towards online sales channels to buy still wine has turned out to be a key trend transforming the global market.

Type Insights

The red wine segment captured the largest revenue share of over 50.0% in 2021. Red wine is consumed on a large scale globally as it is rich in antioxidants and powerful plant compounds. In addition, numerous Vitro studies have shown multiple benefits such as improvement in healthy lifestyles of consumers after daily consumption of red wine at a limited amount. Thus, all factors are anticipated to boost the segment growth over the coming years.

The white wine segment is expected to witness lucrative growth over the forecast period owing to its heart-related health benefits. White wine is also consumed on a large scale in the U.S. The rising demand for white wine in developed countries is likely to boost the growth of this segment in the coming years. The others segment is expected to register the highest growth rate over the forecast period owing to the growing product demand as it has a smooth flavor and taste. Increasing consumption of the product among millennials is also driving the market.

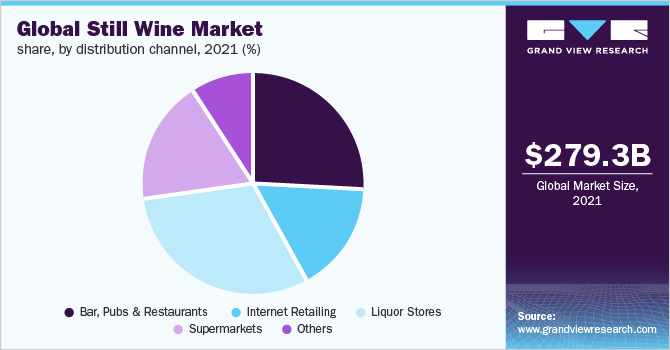

Distribution Channel Insights

The liquor stores segment held the largest revenue share of more than 30.0% in 2021 due to its increasing retail sales of liquor over the counter. Moreover, liquor stores offer a variety of products at a low price compared to bars, pubs, and other sale channels, thus have augmented the popularity of retail counters globally. For instance, as per Dimensional Insight, a software company based in the U.S., 36.8% of consumers preferred local liquor stores to purchase wine and spirits owing to localization and recommendations provided by the local stores.

Internet retailing is expected to exhibit the fastest CAGR of 10.9% from 2022 to 2028 owing to its benefits such as on-time home delivery, suitable shopping experience, and varied schemes. This mode of distribution channel has gained popularity over the past few years. According to a report by Wine Intelligence, there is an increasing focus on the delivery speeds and expansion of alcohol delivery apps. 8Wines has been selling wines through its site since 2015 and it has helped in normalizing the practice of purchasing wine through online mode during the pandemic.

Regional Insights

North America held the largest revenue share of over 30.0% in 2021 as the majority of still wine is consumed in this region. The U.S. is the leader in the consumption of wine. Still, wine is largely consumed as a table wine in North America. Furthermore, the growing demand for premium still wines is estimated to fuel the growth of the market in this region.

Asia Pacific is expected to register the highest CAGR of 10.9% from 2022 to 2028. This can be attributed to the growing demand for red wine in China. Red wine is consumed on a large scale in China as a tradition as the red color is considered lucky. Furthermore, there has been significant growth in the consumption of still wines in countries such as Australia and Japan.

Key Companies & Market Share Insights

Key players are focusing on R&D and launching new products to meet the increasing demand for still wine. Furthermore, key players are focusing on the acquisition of plants rather than investing in new production plants to increase their market share and their presence in the market. For instance, in April 2021, Freixenet extended its inventory of still wines to draw demand from its new consumers. Some prominent players in the global still wine market include:

-

Diageo

-

Pernod-Ricard

-

Constellation

-

EandJ Gallo Winery

-

Treasury Wine Estates (TWE)

-

Castel

-

Trinchero Family

-

Changyu Group

-

Casella Wines

-

Kendall-Jackson Vineyard Estates

-

The Wine Group

-

Dynasty

-

Accolade Wines

-

Concha y Toro

Still Wine Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 297.68 billion

Revenue forecast in 2028

USD 546.86 billion

Growth Rate

CAGR of 10.1% from 2022 to 2028

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2028

Quantitative units

Revenue in USD million/billion and CAGR from 2022 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Italy; Spain; France; China; Australia; Argentina; South Africa

Key companies profiled

Diageo; Pernod-Ricard; Constellation; EandJ Gallo Winery; Treasury Wine Estates (TWE); Castel; Trinchero Family; Changyu Group; Casella Wines; Kendall-Jackson Vineyard Estates; The Wine Group; Dynasty; Accolade Wines; Concha y Toro

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2028. For the purpose of this study, Grand View Research has segmented the global still wine market report on the basis of type, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2028)

-

White Wine

-

Red Wine

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2028)

-

Bar, Pubs & Restaurants

-

Internet Retailing

-

Liquor Stores

-

Supermarkets

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2028)

-

North America

-

U.S.

-

-

Europe

-

Italy

-

Spain

-

France

-

-

Asia Pacific

-

China

-

Australia

-

-

Central & South America

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the still wine market include Diageo, Pernod-Ricard, Constellation, EandJ Gallo Winery, Treasury Wine Estates (TWE), Castel, Trinchero Family, Changyu Group, Casella Wines, Kendall-Jackson Vineyard Estates, The Wine Group, Dynasty, Accolade Wines, and Concha y Toro.

b. Key factors that are driving the market growth include behavioral shift among consumers from hard liquor to milder products such as wine, beer, and seltzers, along with growing trend of domestic and international travel resulting in higher appreciation of wines from across different parts of the world.

b. The global still wine market size was estimated at USD 279.32 billion in 2021 and is expected to reach USD 297.68 billion in 2022.

b. The global still wine market is expected to grow at a compound annual growth rate of 10.1% from 2022 to 2028 to reach USD 546.86 billion by 2028.

b. North America dominated the still wine market with a share of 34.1% in 2021. This is attributable to the changing consumer lifestyles and the growing demand for premium wines, including still wines, in the region.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.