- Home

- »

- Next Generation Technologies

- »

-

Structured Cabling Market Size, Share, Industry Report, 2033GVR Report cover

![Structured Cabling Market Size, Share & Trends Report]()

Structured Cabling Market (2025 - 2033) Size, Share & Trends Analysis Report By Product Type (Copper Cables, Fiber Optic Cables), By Application (LAN, Data Center), By Vertical (Government, Industrial), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-134-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Structured Cabling Market Summary

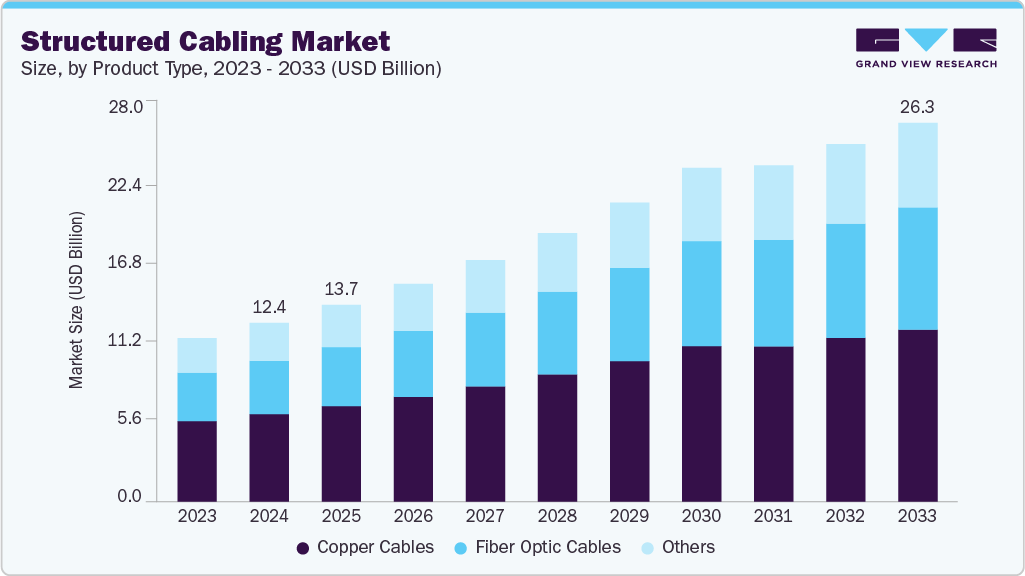

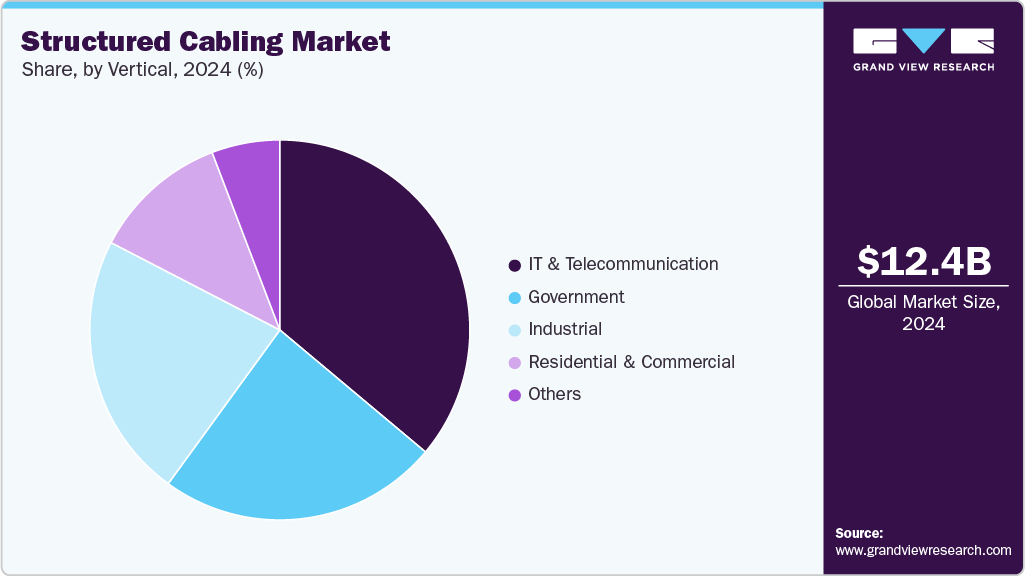

The global structured cabling market size was estimated at USD 12,412.1 million in 2024 and is projected to reach USD 26,300.3 million by 2033, growing at a CAGR of 8.5% from 2025 to 2033. The market comprises a range of cables and hardware components that form the backbone of telecommunication infrastructure.

Key Market Trends & Insights

- North America structured cabling dominated the global market with the largest revenue share of 34.2% in 2024.

- The structured cabling market in U.S. led the North America market and held the largest revenue share in 2024.

- By Product Type, Copper Cables the market and held the largest revenue share of 48.9% in 2024.

- By Application, the LAN segment held the dominant position in the market and accounted for the largest revenue share of 80.8% in 2024.

- By Vertical, the IT & Telecommunication segment is expected to grow at the fastest CAGR of 9.7% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 12,412.1 Million

- 2033 Projected Market Size: USD 26,300.3 Million

- CAGR (2025-2033): 8.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest market in 2024

This infrastructure enables the transmission of voice, video, and data signals across networks. A reliable connection depends on various connecting devices and cabling systems that ensure seamless communication. Structured cabling systems are essential for building efficient and scalable network environments. These systems support consistent performance and ease of management across enterprise communication setups. Structured cabling providers are moving toward offering complete, end-to-end service integration. Local companies are bundling global cabling hardware with advisory, deployment, and ongoing support services. This approach improves efficiency and simplifies infrastructure management for end users. It also enables faster implementation and greater alignment with client needs. The trend is driving demand for flexible, full-suite cabling solutions that combine global quality with localized service delivery. For instance, in November 2024, TechAccess, a service- and solutions-oriented company in Dubai, partnered with Siemon to deliver advanced structured cabling and IT infrastructure solutions across South Africa. This partnership enables TechAccess to offer Siemon’s high-performance passive network technologies for data centers and smart buildings in the region.

The structured cabling market is undergoing a notable shift toward high-speed transmission systems, particularly Cat 6A, Cat 7, and fiber-optic solutions. This change is driven by the explosive growth in data consumption, driven by cloud computing, AI applications, and high-definition video streaming. These advanced cabling systems support greater bandwidth, reduced interference, and improved data integrity, making them ideal for large-scale enterprise networks and hyperscale data centers. As organizations scale their IT infrastructure to accommodate more devices and real-time analytics, older cabling standards are being phased out. The need for future-ready, high-performance connectivity probably to drive this trend forward.

Smart buildings are increasingly dependent on structured cabling systems to support interconnected devices, sensors, and automated systems. The widespread use of IoT technologies in lighting, security, HVAC, and energy management increases the demand for cabling capable of continuous, low-latency data transfer. Structured cabling offers a centralized, scalable, and reliable network foundation to power intelligent building functions. It enables simplified device integration, remote monitoring, and efficient space utilization. This trend is particularly strong in commercial real estate, healthcare, and educational institutions. As urban development moves toward sustainability and digital management, demand for structured cabling in smart buildings is likely to grow.

Product Type Insights

The copper cables segment dominates the structured cabling market in 2024, accounting for a 48.9% share, due to their cost-effectiveness and ease of installation. They are widely used in commercial buildings and legacy systems where short-distance data transmission is sufficient. Their proven reliability and low maintenance needs continue to make them a preferred choice for many network deployments. The market benefits from mature manufacturing processes and the wide availability of compatible hardware. Despite increasing demand for higher bandwidth, copper still meets the requirements of many enterprise networks. This continued relevance supports its dominant share across multiple structured cabling applications.

Fiber optic cables are experiencing rapid growth in the structured cabling market due to their superior bandwidth and transmission speeds. They are increasingly deployed in data centers, large campuses, and environments demanding high-speed, long-distance communication. The rise of cloud computing, AI workloads, and 5G infrastructure is fueling demand for fiber-based solutions. As organizations future-proof their networks, fiber’s scalability and low latency are becoming more attractive. Improvements in installation techniques and declining costs are also contributing to greater adoption. The growth trajectory indicates fiber optics is likely to capture a larger market share in the coming years.

Application Insights

Local Area Networks (LAN) dominate the structured cabling market in 2024 due to their widespread use in office buildings, schools, and enterprise campuses. LAN installations rely heavily on copper cabling, which remains cost-effective and efficient for short-distance connectivity. The market benefits from standardized designs and high demand for reliable internal data transfer. As organizations continue to upgrade their networks, LAN infrastructure sees consistent investment. Integration with IP-based services like VoIP and security systems also reinforces its importance. The segment maintains a strong presence due to its essential role in day-to-day business operations.

The data center application segment is witnessing strong growth in the structured cabling market due to increasing global demand for cloud computing and hyperscale infrastructure. Fiber optic cabling is being deployed extensively to support high-speed data transmission and scalability. Rising investments in colocation and edge data centers are accelerating adoption. Operators are prioritizing low-latency, high-density cabling to meet performance and efficiency requirements. Structured cabling ensures manageability and uptime in complex environments. As digital transformation continues, data centers are becoming a major growth area for advanced cabling solutions.

Vertical Insights

The IT and telecommunication sector dominated structured cabling market in 2024. Increasing adoption of cloud services and 5G deployments is driving infrastructure upgrades. High-bandwidth cabling solutions are essential for supporting modern digital services. Telecom operators are expanding backbone networks and data centers, fueling demand. IT firms are upgrading to support real-time analytics and automation. The sector’s dynamic and technology-driven nature continues to generate consistent market expansion. This ongoing digital transformation is pushing enterprises to invest in scalable and future-ready structured cabling systems.

The industrial sector is witnessing growing demand for structured cabling systems. Rising automation and Industry 4.0 adoption are driving the need for high-speed, reliable communication networks. Manufacturing facilities require robust cabling to connect sensors, machines, and control systems. Structured cabling ensures minimal downtime and improved operational efficiency. Harsh industrial environments are prompting investment in durable cabling solutions. The push for smart factories is accelerating structured cabling deployments across industrial setups.

Regional Insights

North America structured cabling market dominated the global industry in 2024, accounting for a 34.2% share, due to high adoption of advanced IT infrastructure. The region’s strong presence of data centers and tech companies boosted demand. Enterprises continue investing in high-speed networks to support digital transformation. Government initiatives in smart cities also contributed to infrastructure upgrades. The mature market environment supports consistent cabling deployments across sectors.

U.S. Structured Cabling Market Trends

In 2024, the U.S. accounted for the largest share of the structured cabling market. This was driven by sustained investment in hyperscale data centers and cloud infrastructure. Enterprises are upgrading networks to support hybrid work and AI-enabled operations. Government and education sectors are also contributing to demand through digital transformation initiatives.

Europe Structured Cabling Market Trends

Europe maintained a strong presence in the structured cabling market, with demand rooted in smart city initiatives and data localization regulations. Germany, the UK, and France are major contributors due to their industrial base and evolving digital policies. The region is adopting fiber-optic systems to meet higher bandwidth needs. Efforts to improve energy efficiency in buildings are also driving new cabling installations.

Asia Pacific Structured Cabling Market Trends

Asia Pacific is emerging as the fastest-growing region in the structured cabling market. Rapid digitization across manufacturing, education, and logistics sectors is fueling demand. Countries such as China and India are expanding fiber infrastructure to support 5G and cloud services. Increasing adoption of IoT and automation in Southeast Asia is driving new network requirements. Government investments in smart infrastructure are reinforcing cabling deployments.

Key Structured Cabling Company Insights

Some of the key companies in the Structured Cabling industry include ABB Ltd, Belden Inc., Corning Incorporated, Furukawa Electric Co., Ltd., Legrand SA, TE Connectivity Ltd., and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

ABB Ltd has been advancing its structured cabling offerings through integrated electrical and data systems. The company focuses on smart building solutions, enabling efficient data transmission across enterprise environments. ABB is expanding its product portfolio with modular cabling infrastructure for seamless scalability. Emphasis is being placed on high-speed connectivity and energy-efficient designs. Strategic projects across industrial automation and commercial buildings continue to drive its market presence.

-

Corning Incorporated is innovating in high-performance fiber-optic cabling systems tailored for data centers and hyperscale environments. The company is investing in solutions that support AI workloads, 5G infrastructure, and edge computing. Corning's EDGE™ and EDGE8® solutions offer modularity and fast deployment. Its focus on low-loss, high-density fiber technology enhances network capacity. The firm is also partnering with service providers to accelerate digital infrastructure rollouts.

Key Structured Cabling Companies:

The following are the leading companies in the structured cabling market. These companies collectively hold the largest market share and dictate industry trends.

- ABB Ltd

- Belden Inc.

- CommScope Holding Company, Inc.

- Corning Incorporated

- Furukawa Electric Co., Ltd.

- Legrand SA

- Nexans

- Schneider Electric

- Siemens AG

- TE Connectivity Ltd.

Recent Developments

-

In June 2025, CommScope Holding Company, Inc. launched its FiberREACH and CableGuide 360 solutions to address growing structured cabling needs. These offerings deliver high-power PoE and enhanced cable management for faster, denser, and more reliable enterprise network deployments.

-

In November 2024, Nexans partnered with BIMobject, a global digital content platform in Sweden, to integrate its products into Building Information Modeling (BIM), enabling early-stage inclusion in construction design. This partnership supports Nexans’ strategy to drive digital transformation in cabling and enhance efficiency, safety, and sustainability in building projects.

-

In January 2024, CommScope launched SYSTIMAX 2.0, introducing innovations such as GigaSPEED XL5 for multi-gigabit copper connectivity and VisiPORT for real-time port monitoring. These upgrades aim to future-proof structured cabling by enhancing performance, agility, and intelligent infrastructure management.

Structured Cabling Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 13,660.9 million

Revenue forecast in 2033

USD 26,300.3 million

Growth rate

CAGR of 8.5% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive sector, growth factors, and trends

Segment scope

Product type , application, vertical, region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; KSA; UAE; South Africa

Key companies profiled

ABB Ltd; Belden Inc.; CommScope Holding Company Inc.; Corning Incorporated; Furukawa Electric Co. Ltd.; Legrand SA; Nexans; Schneider Electric; Siemens AG; TE Connectivity Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Structured Cabling Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global structured cabling market in terms of product type, application, vertical, and region.

-

Product Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Copper Cables

-

Fiber Optic Cables

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

LAN

-

Data Center

-

-

Vertical Outlook (Revenue, USD Million, 2021 - 2033)

-

Government

-

Industrial

-

IT & Telecommunication

-

Residential & Commercial

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global structured cabling market size was estimated at USD 12,412.1 million in 2024 and is expected to reach USD 13,660.9 million in 2025.

b. The global structured cabling market is expected to grow at a compound annual growth rate of 8.5% from 2025 to 2033 to reach USD 26,300.3 million by 2033.

b. North America dominated the structured cabling market with a share of 34.2% in 2024. This is attributable to the strong presence of data centers and widespread adoption of high-speed connectivity infrastructure across the region.

b. Some key players operating in the structured cabling market include ABB; Belden Inc.; CommScope Holding Company, Inc.; Corning Incorporated; Furukawa Electric Co., Ltd.; Legrand SA; Nexans; Schneider Electric; and Siemon.

b. Key factors that are driving the structured cabling market growth include increased emphasis on cost and time management, growing IoT data, the need for automation of businesses, and increasing competition.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.