- Home

- »

- Biotechnology

- »

-

U.S. Multiomics Market Size & Share, Industry Report, 2033GVR Report cover

![U.S. Multiomics Market Size, Share & Trends Report]()

U.S. Multiomics Market (2025 - 2033) Size, Share & Trends Analysis Report By Product & Service (Instruments, Consumables), By Type (Single-cell, Bulk), By Platform, By Application, By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-282-8

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Multiomics Market Summary

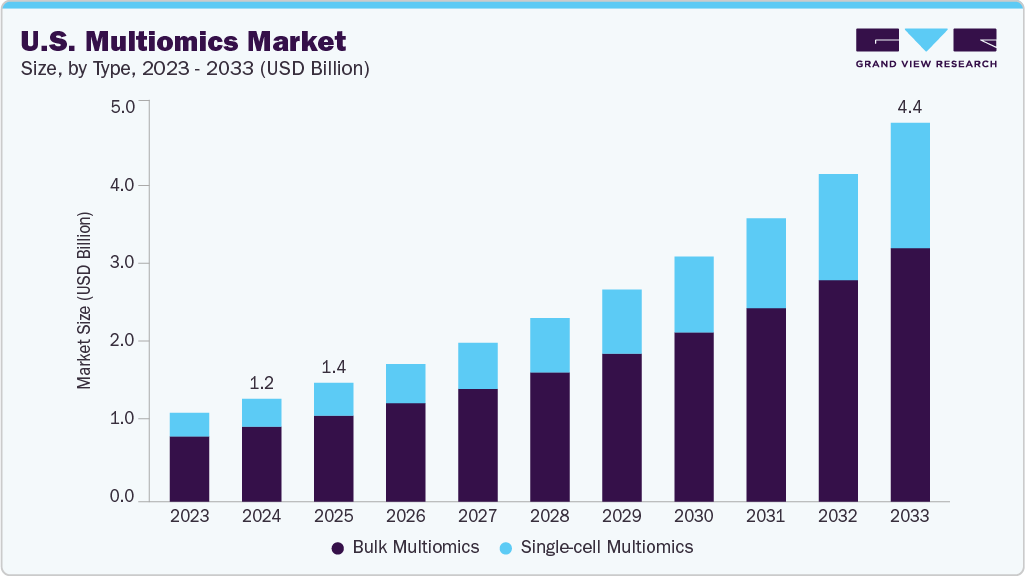

The U.S. multiomics market size was estimated at USD 1.18 billion in 2024 and is projected to reach USD 4.36 billion by 2033, growing at a CAGR of 15.58% from 2025 to 2033. This significant growth is driven by increasing demand for personalized medicine, the integration of artificial intelligence and machine learning in biological data interpretation, and the growing need for comprehensive disease profiling. Moreover, rising investments in research and development by both the government and private sectors and expanding applications in drug discovery, diagnostics, and precision healthcare are expected to propel market growth further over the forecast period.

Technological Innovations

The rapid pace of technological innovation across omics platforms and analytical tools is the key driver in the U.S. multiomics industry. Breakthroughs in high-throughput sequencing technologies, such as next-generation sequencing (NGS), have dramatically increased the speed and depth of genomic and transcriptomic data generation while reducing the cost per sample. Similarly, advancements in mass spectrometry, chromatography, and imaging technologies have significantly improved the resolution and sensitivity of proteomics and metabolomics studies. These innovations enable researchers to obtain a more detailed and accurate view of complex biological processes, essential for applications in disease research, drug discovery, and precision diagnostics.

Single-cell Multiomics Technology Landscape

Category

Technologies

Separation Methods

Feature

Genome-transcriptome

G&T-seq

Flow cytometry; bead-based separation

Medium cell throughput; automation

DR-seq

Cell picking by pipette; preamplification and tagging of DNA and RNA followed by splitting

Low cell throughput

Transcriptome-DNA methylome

scM&T-seq

Flow cytometry; bead-based separation followed by bisulfite treatment

Medium cell throughput; automation

scMT-seq

Micropipetting for isolation of single nuclei

Low cell throughput; partial automation

Transcriptome-chromatin accessibility

sci-CAR

Combinatorial indexing; lysate splitting followed by library preparation

High cell throughput

SNARE-seq

Microfluidic channels; open chromatin tagmentation followed by dual-omics capture

High cell throughput

Transcriptome-proteome

PEA/STA

Microfluidic channels; reverse transcription of PEA probe and RNA followed by targeted amplification

Medium cell throughput; automation

PLAYR

Flow or mass cytometry; detection of amplified product of PLAYR probe pair and antibody staining

High cell throughput

Source: Wiley Online Library, Primary Research, Grand View Research

The evolution of powerful computational tools, cloud-based platforms, and AI-driven analytics has revolutionized how multiomics data is processed, integrated, and interpreted. These technologies allow for the seamless analysis of large-scale, multi-layered datasets, reducing bottlenecks in data handling and accelerating insights. As a result, multiomics workflows are becoming more automated, scalable, and cost-effective, making them increasingly accessible to large pharmaceutical companies and smaller biotech firms, academic institutions, and clinical laboratories. The convergence of these technological advancements is not only expanding the application of multiomics across new disease areas. Still, it is also helping to democratize access to multiomics research, thereby accelerating the market’s growth in the U.S.

Advancements in Precision Medicine

One of the key drivers fueling the growth of the U.S. multiomics market is the increasing emphasis on precision medicine. As healthcare continues shifting from a one-size-fits-all model toward personalized, patient-centric approaches, multiomics technologies play a critical role. By integrating data from genomics, transcriptomics, proteomics, and metabolomics, multiomics enables a more comprehensive understanding of disease mechanisms at the molecular level. This allows for improved disease classification, early diagnosis, risk stratification, and the development of targeted therapies. In clinical areas such as oncology, neurology, and rare diseases, multiomics provides valuable insights that inform treatment decisions, reduce trial-and-error prescribing, and ultimately improve patient outcomes.

The growing adoption of precision medicine in the U.S., supported by strong federal initiatives, private investment, and the presence of leading academic research centers, continues to drive demand for advanced multiomics platforms. Pharmaceutical and biotechnology companies increasingly leverage multiomics to accelerate drug discovery and development, identify novel biomarkers, and improve clinical trial design. Simultaneously, advancements in bioinformatics, machine learning, and data integration tools are enhancing the utility of multiomics data, making it more actionable and accessible across healthcare and research settings. As precision medicine becomes a standard of care, the demand for high-resolution, multi-layered biological insights will remain a central force in shaping the future trajectory of the U.S. multiomics industry.

Market Concentration & Characteristics

The U.S. multiomics market demonstrates a high degree of innovation, driven by integrating various omics layers such as genomics, proteomics, transcriptomics, and metabolomics to provide a comprehensive understanding of biological systems. Adopting advanced technologies like artificial intelligence, machine learning, single-cell and spatial analysis, and cloud-based platforms has significantly enhanced data analysis and interpretation. Innovations in functional genomics, including CRISPR-based tools, are further accelerating drug discovery and biomarker identification. Moreover, the growing translation of multiomics into clinical applications, particularly in oncology and precision medicine, highlights its transformative potential in reshaping healthcare and research.

The U.S. multiomics industry is experiencing robust mergers and acquisitions (M&A) activity, driven by companies aiming to expand their technological capabilities and service offerings. For instance, in October 2024, Vizgen and Ultivue merged in Cambridge, Massachusetts, combining single-cell spatial genomics and multiplex proteomic profiling technologies to advance spatial multi-omics research and clinical diagnostics. These moves aim to integrate complementary multiomics platforms, accelerate innovation, and strengthen positions in diagnostics, drug discovery, and precision medicine.

Regulations play a crucial role in shaping the U.S. multiomics market by establishing standards that ensure the safety, accuracy, and ethical use of multiomics data. Regulatory bodies like the FDA oversee the approval and monitoring of multiomics-based diagnostic tools and therapies, ensuring they meet stringent quality and efficacy criteria. Privacy laws such as HIPAA and the Genetic Information Nondiscrimination Act (GINA) protect sensitive genetic and health data, which is vital given the extensive personal information involved in multiomics analyses. While these regulations can introduce compliance challenges and slow product development timelines, they also build trust among patients, clinicians, and researchers by safeguarding data security and promoting responsible innovation. Overall, a balanced regulatory environment helps drive the adoption of multiomics technologies while maintaining high patient safety and data integrity standards.

The U.S. market for multiomics is witnessing dynamic product expansion as companies develop more integrated and sophisticated platforms that combine multiple omics technologies such as genomics, proteomics, and metabolomics. This expansion is driven by the growing need for comprehensive biological data to improve disease understanding and personalized treatment strategies. Firms increasingly invest in advanced bioinformatics tools and AI-powered solutions to enhance data analysis capabilities. Moreover, collaborations and partnerships among technology providers enable the development of novel assays and multi-layered testing kits, broadening the scope of applications across research, clinical diagnostics, and drug development. These ongoing innovations are helping to accelerate the adoption of multiomics approaches and meet the rising demand for precision healthcare solutions.

Product & Service Insights

The product segment accounted for the largest revenue share of the U.S. multiomics market in 2024. Growing developments and increasing product launches are expected to drive segment growth. Moreover, research shows the efficiency of genomics in predicting and identifying novel compounds, contributing to drug development and synthetic biology. For instance, in March 2023, Mission Bio joined the NSF's Cell Manufacturing Technologies initiative in the U.S., deploying its Tapestri single-cell multi‑omics platform to streamline analytical assays and cell‑therapy manufacturing.

The service segment is expected to grow at the fastest CAGR over the forecast period. This segment is experiencing substantial growth, meeting the demand for specialized expertise and comprehensive solutions. These services encompass experimental design, sample preparation, data generation, and in-depth bioinformatics analysis, essential for assisting researchers and organizations in navigating multi-omics workflows for accurate results.

Type Insights

The bulk multiomics segment dominated the U.S. multiomics industry in 2024. This approach is crucial for providing a comprehensive understanding of the pathogenesis of disorders and diverse phenotypes at the individual level. Its dominance can be attributed to several advantages. These include a straightforward experimental process and cost-effective dissection of large-scale samples.

The single-cell multiomics segment is anticipated to grow at the fastest CAGR throughout the forecast period. This rapid expansion is driven by increasing demand for high-resolution cellular analysis, growing precision medicine and oncology research applications, and continuous advancements in single-cell sequencing technologies. As researchers seek deeper insights into cellular heterogeneity and disease mechanisms, adopting single-cell multiomics is expected to accelerate significantly across academic, clinical, and pharmaceutical settings.

Platform Insights

The genomics segment held the largest market share of 39.83% in 2024. This strong position can be attributed to the widespread adoption of next-generation sequencing (NGS) technologies, increased investment in genomic research, and the growing demand for personalized medicine. Integrating genomics with other omics technologies, such as transcriptomics and proteomics, further enhances its value in clinical and research settings, driving continued growth within this segment. For instance, in February 2025, Dante Genomics expanded into the United States with Dante Omics AI, aiming to revolutionize precision healthcare through advanced multi-omics data integration and artificial intelligence technologies.

The metabolomics segment is expected to witness the fastest CAGR through the forecast period, driven by increasing demand for comprehensive biomarker discovery, advancements in analytical technologies such as mass spectrometry and nuclear magnetic resonance (NMR), and growing interest in personalized medicine. Metabolomics offers unique insights into metabolic profiles and cellular processes, making it a critical tool for understanding disease mechanisms, drug response, and therapeutic efficacy. Moreover, its expanding applications in oncology, neurology, and nutrition science further accelerate market adoption.

Application Insights

The oncology segment held the largest market share of 41.69% in 2024 and is expected to grow with the fastest CAGR over the forecast period. This growth is primarily driven by the rising incidence of cancer, increasing investments in precision oncology, and the growing adoption of multiomics approaches for cancer diagnosis, prognosis, and treatment. Multiomics technologies such as genomics, transcriptomics, proteomics, and metabolomics enable a more comprehensive understanding of tumor biology, facilitating the development of personalized therapies and improving clinical outcomes. Moreover, ongoing research initiatives, clinical trials, and strategic partnerships between biopharmaceutical companies and academic institutions further accelerate the integration of multiomics in oncology, reinforcing its dominant position in the market.

The neurology segment is expected to witness a significant CAGR over the forecast period, driven by the rising prevalence of neurodegenerative disorders such as Alzheimer's disease, Parkinson's disease, and multiple sclerosis. According to the World Health Organization (WHO), as of 2024, neurological conditions affect more than one-third of the global population, making them the leading cause of illness and disability worldwide. This growing disease burden has created an urgent need for early diagnosis, improved disease characterization, and more effective, personalized treatment strategies. As a result, multiomics approaches are increasingly being adopted in neurological research and clinical practice, further supporting the market growth in the U.S. multiomics industry.

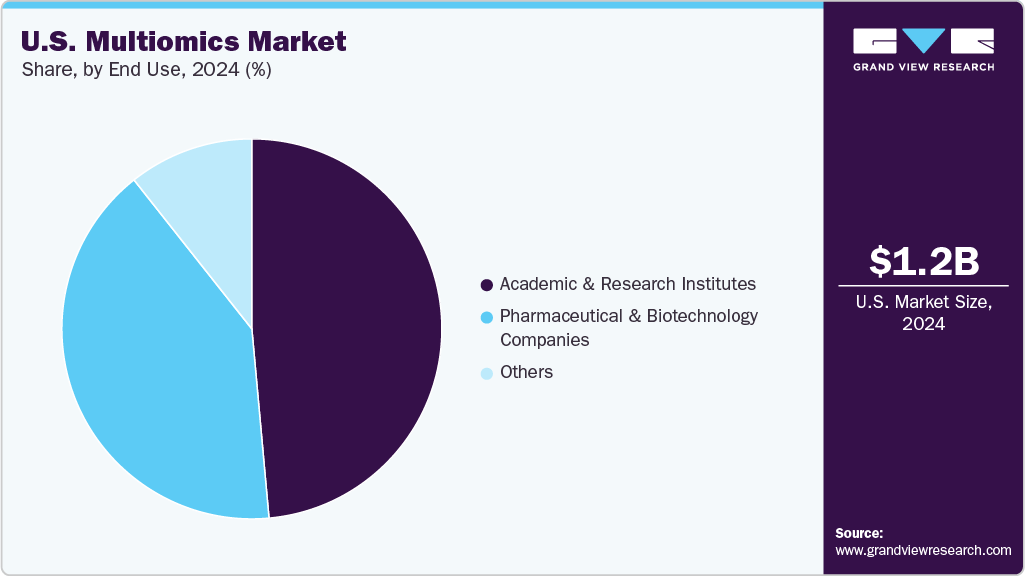

End Use Insights

The academic and research institutes segment led the market with the largest share of 48.56% in 2024, driven by increasing investments in multiomics studies and the continuous advancement of omics technologies. For instance, in September 2023, NIH awarded $50.3 million in the U.S. to create the Multiomics for Health and Disease Consortium, advancing multi-omic research on diverse populations to improve disease understanding. Such substantial funding and focused efforts by academic institutions underscore their pivotal role in driving innovation and growth within the U.S. multiomics industry.

The pharmaceutical & biotechnology companies segment is expected to witness the fastest CAGR from 2025 to 2033, due to the increasing adoption of multiomics technologies for drug discovery, development, and precision medicine. These companies are leveraging integrative multiomics approaches to identify novel biomarkers, understand disease mechanisms at a molecular level, and develop targeted therapies with improved efficacy and safety profiles. The rising focus on personalized treatment strategies and the need to reduce drug development timelines are fueling this segment's rapid growth.

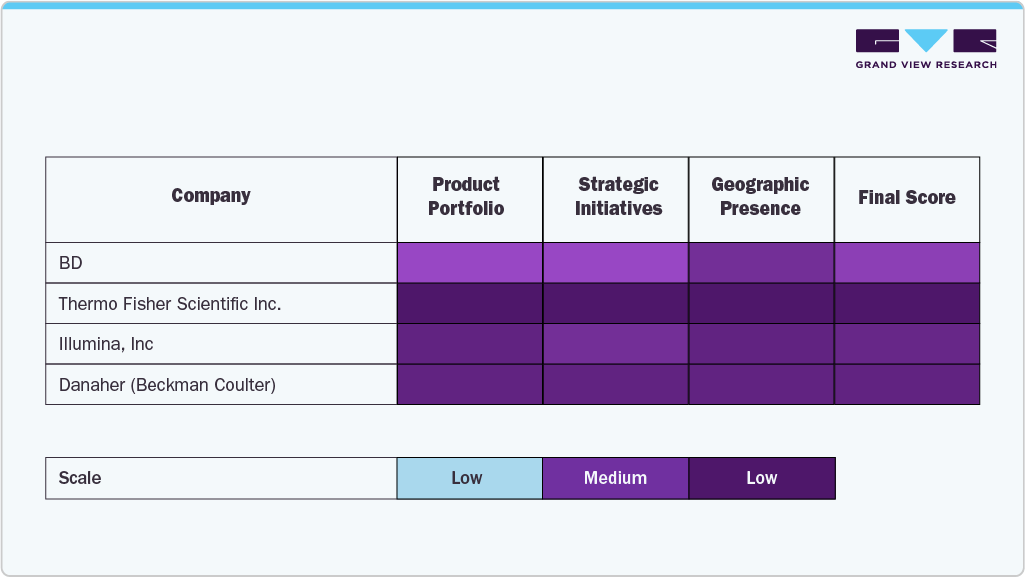

Key U.S. Multiomics Company Insights

The U.S. multiomics industry is characterized by several well-established players that dominate through robust product portfolios, strategic partnerships, and sustained investments in research and development. Leading companies such as Thermo Fisher Scientific, Illumina, Danaher (Beckman Coulter), QIAGEN, and Agilent Technologies have secured significant market share by offering advanced multiomics platforms, comprehensive analytical solutions, and extensive global distribution networks.

Other key players, including BD, PerkinElmer, Shimadzu Corporation, Bruker, and BGI Genomics, are expanding their footprint by introducing innovative technologies and customized multiomics services tailored to the evolving needs of academic research institutions, pharmaceutical and biotechnology companies, and clinical diagnostics providers. These organizations focus on integrating genomics, proteomics, metabolomics, and transcriptomics to deliver deeper biological insights and accelerate translational research.

Leading firms continue to shape the U.S. multiomics industry by combining cutting-edge technological capabilities with broad service offerings and strategic growth initiatives such as mergers, acquisitions, and collaborative ventures. Their leadership is anchored in addressing the growing demand for high-throughput, precise multiomics analyses critical for advancing precision medicine, biomarker discovery, drug development, and personalized healthcare solutions. As the demand for integrated omics data increases, market dynamics will be increasingly influenced by data accessibility, analytical accuracy, cost-effectiveness, and compliance with ethical and regulatory standards.

The U.S. multiomics market is witnessing a dynamic convergence of established expertise and emerging innovations. Breakthroughs in multiomics integration, enhanced data analytics, automation technologies, and strategic alliances are intensifying competition. Companies that successfully merge scientific innovation with customer-centric approaches are poised to drive sustained growth and value in this rapidly evolving and high-potential sector.

Key U.S. Multiomics Companies:

- BD

- Thermo Fisher Scientific, Inc.

- Illumina, Inc.

- Danaher (Beckman Coulter)

- PerkinElmer, Inc

- Shimadzu Corporation

- Bruker

- QIAGEN

- Agilent Technologies, Inc.

- BGI Genomics

Recent Developments

-

In May 2025, Illumina launched DRAGEN v4.4, enhancing clinical oncology and multiomics research. The update introduced preconfigured hematologic and solid tumor workflow applications, improved structural variant calling accuracy by 30%, and supported new multiomics assays, including Single Cell 3'RNA and Protein Prep.

-

In June 2024, Thermo Fisher Scientific launched the Stellar mass spectrometer at the ASMS conference in Anaheim, California. Designed for translational omics research, it offers 10× sensitivity improvements, enabling the analysis of five times more analytes. The system integrates with the Vanquish Neo UHPLC system and supports the Ardia software platform for streamlined workflows.

U.S. Multiomics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.37 billion

Revenue forecast in 2033

USD 4.36 billion

Growth rate

CAGR of 15.58% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product & service, type, platform, application, and end-use

Key companies profiled

BD; Thermo Fisher Scientific Inc.; Illumina, Inc.; Danaher (Beckman Coulter); PerkinElmer Inc.; Shimadzu Corporation; Bruker; QIAGEN; Agilent Technologies, Inc.; BGI Genomics

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

U.S. Multiomics Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. multiomics market report based on product & service, type, platform, application, and end use:

-

Product & Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Products

-

Instruments

-

Consumables

-

Software

-

-

Services

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Single-cell Multiomics

-

Bulk Multiomics

-

-

Platform Outlook (Revenue, USD Million, 2021 - 2033)

-

Genomics

-

Transcriptomics

-

Proteomics

-

Metabolomics

-

Integrated Omics Platforms

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Cell Biology

-

Oncology

-

Neurology

-

Immunology

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Academic and Research Institutes

-

Pharmaceutical & Biotechnology Companies

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. multiomics market size was estimated at USD 1.18 billion in 2024.

b. The U.S. multiomics market is expected to grow at a compound annual growth rate of 15.58% from 2025 to 2033 to reach USD 4.36 billion by 2033.

b. Based on platform, the genomics segment dominated the market with a share of 39.83% in 2024. This is attributed to the continuous advancements in genome editing technology.

b. Some key players operating in the U.S. multiomics market include BD; Thermo Fisher Scientific, Inc.; Illumina, Inc; Danaher (Beckman Coulter); PerkinElmer, Inc; Shimadzu Corporation; Bruker; QIAGEN; Agilent Technologies, Inc.; BGI Genomics

b. The increasing demand for single cell multiomics and technological advancements in omics and rising momentum of proteomics, genomics, transcriptomics, & metabolomics is expected to boost the U.S. multiomics market growth in the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.