UV Tapes Market Summary

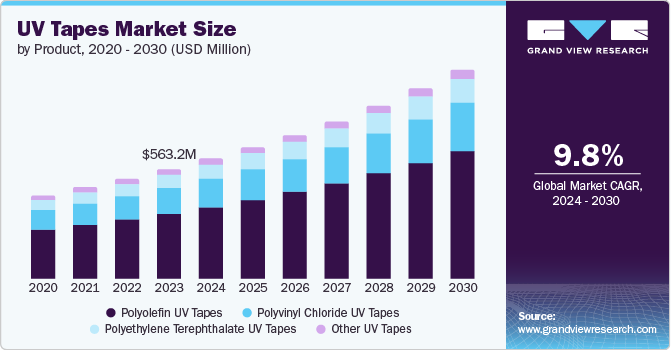

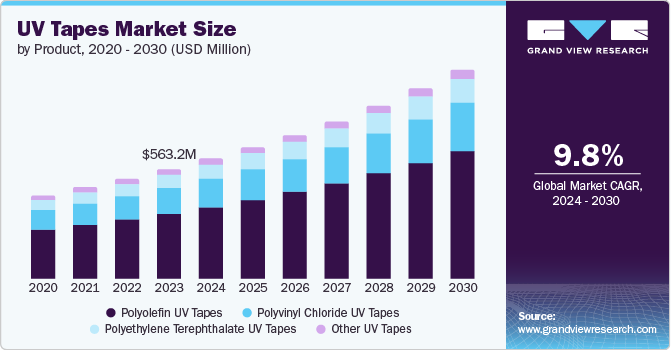

The global UV tapes market size was estimated at USD 563.2 million in 2023 and is projected to reach USD 1.07 billion by 2030, growing at a CAGR of 9.8% from 2024 to 2030. UV tapes are a part of pressure sensitive adhesive (PSA) tapes and are characterized by strong adhesion properties.

Key Market Trends & Insights

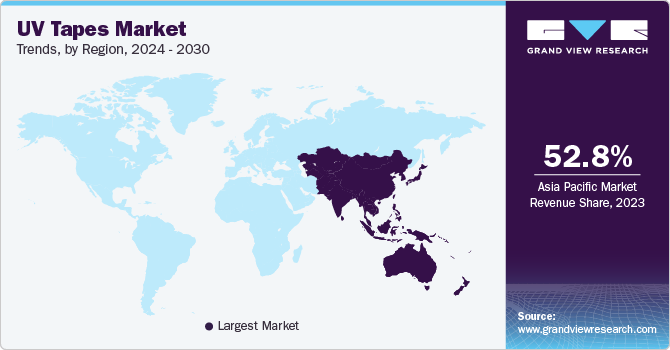

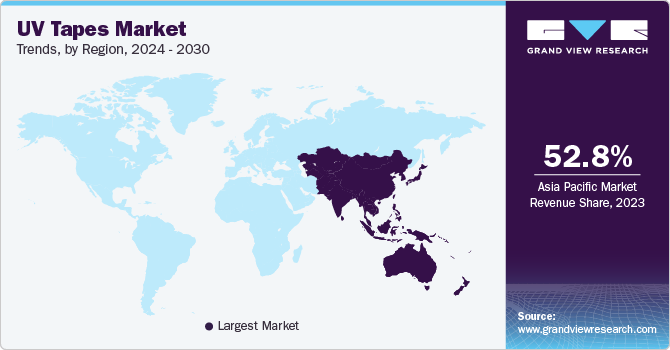

- The Asia Pacific dominated the market in 2023 and the market is expected to grow in the coming years.

- The U.S. UV tapes market held a dominant position in 2023.

- Based on product, the polyolefin UV tapes segment accounted for the largest market revenue share of 59.5% in 2023.

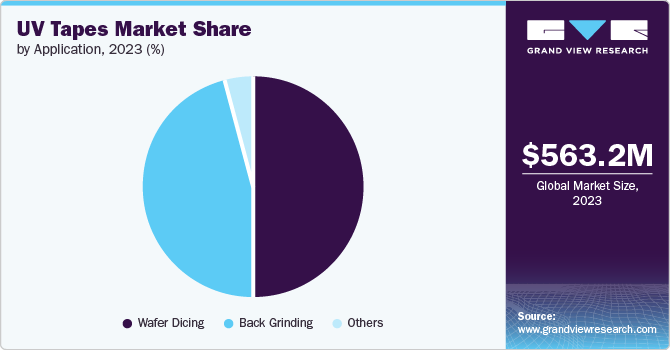

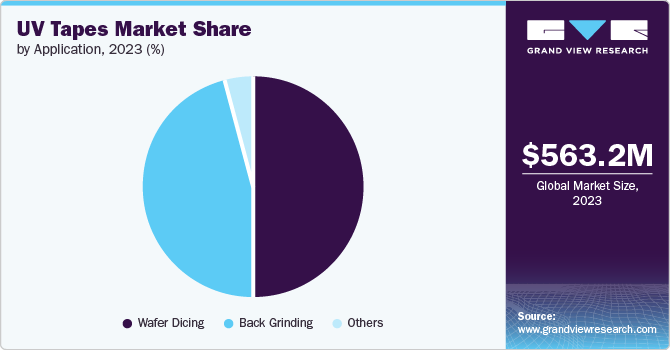

- Based on application, the Wafer dicing segment accounted for the largest market revenue share of 49.7% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 563.2 Million

- 2030 Projected Market Size: USD 1.07 Billion

- CAGR (2024-2030): 9.8%

- Asia Pacific: Largest market in 2023

These are used in the electronics industry for wafer dicing, back grinding, PCB grinding, and glass dicing applications. Growing electronics and semiconductor industries are expected to drive the market over the forecast period.

The ever-increasing demand for semiconductor goods worldwide is a major driver for UV tapes. As the demand for electronics such as smartphones, laptops, and tablets continue to surge, the need for UV tapes is expected to correspondingly rise. UV tapes, particularly polyolefin tapes, are known for their strong adhesion properties even under extreme conditions of heat and pressure. This characteristic makes them highly desirable for various applications in the electronics industry, further propelling market growth.

The diverse applications of UV tapes, such as wafer dicing and back grinding processes, cater to the evolving needs of the electronics industry. As the demand for smaller electronic components such as ICs and microchips increases, so does the requirement for high-performance UV tapes. The expansion of distribution channels for UV tapes is also contributing to market growth.

Product Insights

Polyolefin UV tapes accounted for the largest market revenue share of 59.5% in 2023. This is due to their excellent properties such as high tensile strength, resistance to chemicals and UV light, flexibility, and durability. Even under extreme conditions, they maintain a strong bond, making them ideal for delicate tasks such as wafer dicing and grinding in semiconductor manufacturing.

Polyvinyl chloride (PVC) UV tapes are expected to grow at a CAGR of 9.3% during the forecast period. The growth is due to their versatility, cost-effectiveness, ease of use, and excellent adhesive properties. The increasing adoption of PVC UV tapes in the electrical and electronics industry is fuelling their demand as they provide insulation against moisture and chemicals.

Application Insights

Wafer dicing accounted for the largest market revenue share of 49.7% in 2023. The semiconductor industry’s continuous growth and technological advancements have led to the miniaturization of electronic devices, requiring more precise and efficient wafer dicing processes. UV tapes provide excellent adhesion properties, which are crucial for holding the wafers securely during the dicing process, ensuring accurate cuts without damaging the delicate semiconductor materials.

Back grinding is projected to grow at a CAGR of 9.6% over the forecast period. With the growing trend towards thinner and more compact electronic devices, there is an increasing need for precise back grinding techniques enabled by high-performance UV tapes. Moreover, the shift towards 3D packaging technologies and advanced substrates necessitates the use of UV tapes with superior heat resistance and dimensional stability, further fueling their demand in back grinding applications.

Regional Insights

The North America UV tapes market is anticipated to grow at a CAGR of 9.6% during the forecast period. The market in this region is projected to grow in line with the growing electronics industry and awareness regarding the advantages of UV tapes such as high heat resistance. Besides, the fact that they can be recycled, is also expected to play a key role in the growth in this region.

U.S. UV Tapes Market Trends

The U.S. UV tapes market held a dominant position in 2023 due to the robust expansion of industries such as electronics and automotive that heavily rely on UV-curable adhesives and tapes for various applications.

Europe UV Tapes Market Trends

The Europe UV tapes market was identified as a lucrative region in 2023. The Germany UV tapes market held a substantial market share in 2023. Country's automated production lines necessitate the use of reliable and efficient UV tapes for tasks such as wafer dicing and back grinding.

Asia Pacific UV Tapes Market Trends

Asia Pacific dominated the market in 2023 and the market is expected to grow in the coming years.Some of the major electronics players including Panasonic, Samsung, Sony, LG, and Hitachi are based in this region. Growing demand for semiconductors and components such as ICs and display units have driven the industry in this region.

Key UV Tapes Company Insights

Some key companies in UV tapes market include Mitsui Chemicals, Denka Company Limited, Pantech Tape Co., Ltd., ULTRON SYSTEMS, INC., NIPPON PULSE MOTOR Co., Ltd. and others.

-

Nitto Denko Corporation provides various materials and parts for automotive applications, including adhesive tapes, surface protective films, and automotive materials. Also, packaging materials such as adhesive tapes and films for various industries.

Key UV Tapes Companies:

The following are the leading companies in the UV tapes market. These companies collectively hold the largest market share and dictate industry trends.

- FURUKAWA ELECTRIC CO., LTD.

- Nitto Denko Corporation

- Mitsui Chemicals

- LINTEC Corporation.

- Sumitomo Bakelite Co., Ltd.

- Denka Company Limited

- Pantech Tape Co., Ltd.

- ULTRON SYSTEMS, INC.

- NEPTCO, Inc.

- NIPPON PULSE MOTOR Co., Ltd.

UV Tapes Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 617.4 million

|

|

Revenue forecast in 2030

|

USD 1.07 billion

|

|

Growth Rate

|

CAGR of 9.8% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Report updated

|

September 2024

|

|

Quantitative units

|

Volume in Million Square Meters, Revenue in USD billion and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

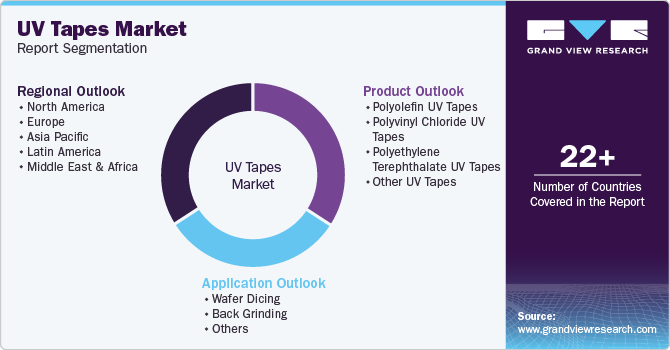

Segments covered

|

Product, Application, and Region

|

|

Regional scope

|

North America, Europe, Asia Pacific, Latin America, MEA

|

|

Country scope

|

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, Japan, India, South Korea, Argentina, Brazil, Saudi Arabia

|

|

Key companies profiled

|

FURUKAWA ELECTRIC CO., LTD., Nitto Denko Corporation, Mitsui Chemicals, LINTEC Corporation., Sumitomo Bakelite Co., Ltd., Denka Company Limited, Pantech Tape Co., Ltd., ULTRON SYSTEMS, INC., NEPTCO, Inc, NIPPON PULSE MOTOR Co., Ltd.

|

|

Customization scope

|

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

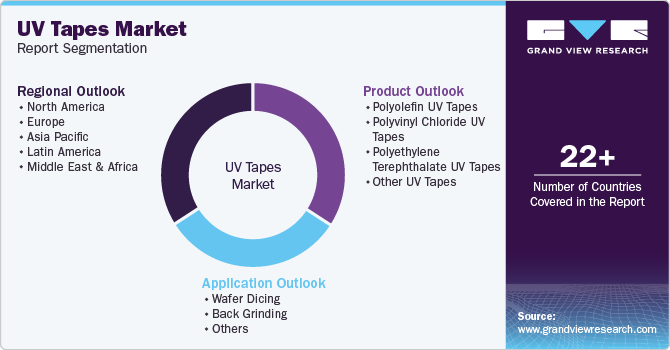

Global UV Tapes Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global UV tapes market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, Volume in Million Square Meters, 2018 - 2030)

-

Application Outlook (Revenue, USD Million, Volume in Million Square Meters, 2018 - 2030)

-

Wafer dicing

-

Back grinding

-

Others

-

Regional Outlook (Revenue, USD Million, Volume in Million Square Meters, 2018 - 2030)