- Home

- »

- Consumer F&B

- »

-

Vegan Dips Market Size, Share And Trends Report, 2030GVR Report cover

![Vegan Dips Market Size, Share & Trends Report]()

Vegan Dips Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (Hummus, Salsa), By Flavors (Classic, Spicy), By Packaging (Bottles, Containers/Tubs), By Distribution Channel (Convenience Stores, Online), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-154-0

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Vegan Dips Market Size & Trends

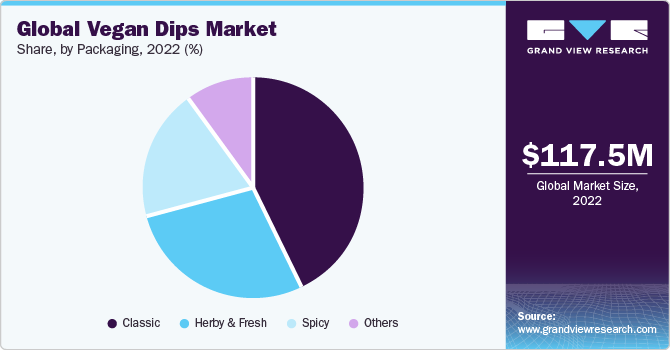

The global vegan dips market size was estimated at USD 117.5 million in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 7.7% from 2023 to 2030. The demand for vegan dips and food is experiencing significant growth due to shifting consumer preferences and societal trends. One driving factor is the increasing health consciousness among consumers, which leads them to seek healthier food options. Another contributing factor is the rising demand for animal cruelty-free products, which has fueled the growth of the vegan food market. As individuals prioritize their well-being and ethical considerations, the popularity of vegan dips and plant-based foods continues to rise.

The rise of a sedentary lifestyle has brought health challenges like obesity and cardiovascular problems to the forefront. However, adopting a vegan diet has shown significant benefits, including weight reduction, enhanced blood circulation, and a decreased risk of cardiovascular disease.

To meet the growing market demand, numerous food establishments, such as food chains, fine dining restaurants, and companies like Amy's Kitchen, Inc., are actively introducing new vegan products and recipes. These innovative offerings frequently feature nutritious ingredients like pumpkin, avocado, and other wholesome components, catering to health-conscious consumers who seek both delectable and nourishing culinary experiences. Several trends have further fueled the popularity of vegan food. The increased availability of vegan products, including dips, in grocery stores, restaurants, and online retailers has made them more accessible to consumers. Celebrity endorsements, media coverage, and documentaries have played a crucial role in promoting vegan diets and the consumption of vegan food, including dips. Developing delicious plant-based alternatives to traditional dairy products has also driven interest in vegan dips and other plant-based options.

The rise of vegan fast-food chains including plant-based choices in mainstream fast-food restaurants has made plant-based eating more convenient. Moreover, vegan food festivals and events worldwide have successfully showcased a diverse range of vegan products, including dips, while promoting the benefits of plant-based lifestyles. As these driving factors and trends continue to shape consumer choices, the demand for vegan dips and food is expected to grow.

Moreover, the increasing environmental consciousness among consumers of vegan food has led to a significant rise in demand for sustainable food packaging materials for meat-free products. As consumers become more aware of the environmental impact of packaging waste, they are actively seeking eco-friendly alternatives. In response to this trend, vegan product manufacturers, such as Oatly, are taking steps to address the issue by providing carbon labeling on their packaging. This allows consumers to make informed choices based on the environmental impact of the products they purchase.

The COVID-19 pandemic had a multifaceted impact on the market. On the contrary, the growing emphasis on maintaining a healthy diet to bolster the immune system led to increased demand for plant-based foods, including vegan dips. With people confined to their homes due to lockdowns and restrictions, there was a surge in home cooking and snacking, driving higher consumption of packaged food products such as vegan dips for convenient and nutritious meals. However, the pandemic disrupted supply chains worldwide, causing production, distribution, and availability challenges for vegan dip manufacturers.

The closure of food service outlets during lockdowns reduced demand for their products; however, some businesses adapted by introducing takeout and delivery options. As consumer preferences shifted amidst economic uncertainty, affordability and support for local and sustainable brands may have influenced the demand for vegan dips. The rise of e-commerce and online grocery shopping further impacted the market dynamics.

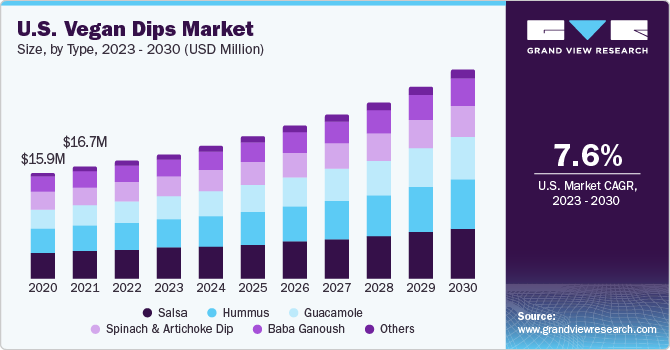

Type Insights

Based on type, the salsa vegan dips segment dominated the market with a share of 24.5% in 2022. The rise in the number of people adopting vegan or vegetarian diets has significantly boosted the popularity of salsa as a vegan dip. Salsa serves as a versatile and delicious option, ideal for dipping tortilla chips, as a topping for tacos, burritos, or bowls, and even as a marinade for various vegan dishes. As individuals seek flavorful and satisfying plant-based alternatives, manufacturers are responding by creating dips that complement a wide range of dishes and cater to diverse tastes. For instance, in June 2023, Fresh Cravings, a family-owned snacking brand, introduced three plant-based dips to Walmart stores, fire-roasted avocado salsa, fire-roasted red salsa, and everything bagel creamy dip. These new product additions will delight customers looking for flavorful and versatile dipping options.

The hummus vegan dips segment is estimated to grow at a CAGR of 8.8% during the forecast period. Hummus originates from the Middle East and is deeply rooted in various cultures. With globalization and the sharing of culinary traditions, hummus has found its way onto menus and grocery store shelves worldwide. The increasing interest in international cuisine has likely contributed to its rising popularity as people explore new and diverse tastes.

Flavors Insights

The classic vegan dips segment dominated the market with a share of 42.8% in 2022. Classic flavored vegan dips, like vegan ranch, buffalo cauliflower dip, or spinach-artichoke dip, have been gaining popularity recently. Classic flavored vegan dips often use plant-based ingredients that are naturally lower in saturated fats and cholesterol than their animal-based counterparts. For health-conscious consumers, these dips provide a guilt-free and nutritious option to enjoy with their favorite snacks and meals.

The herby & fresh vegan dips segment is anticipated to grow at the fastest CAGR of 8.5% over the forecast period. Herby and fresh-flavored vegan dips bring flavor and variety to dishes, making them appealing to vegans, vegetarians, and non-vegetarians alike. Their versatility allows them to complement various foods, such as vegetables, crackers, bread, dressings, or sandwich spreads.

Distribution Channel Insights

The supermarkets & hypermarkets segment dominated the market with a share of 36.8% in 2022. Supermarkets typically have a larger inventory of vegan dips compared to smaller stores. They stock a variety of flavors, brands, and packaging options, allowing consumers to choose from a wide selection based on their preferences. Supermarkets often provide both popular and niche brands, catering to diverse tastes and dietary requirements.

The online segment is estimated to grow at a CAGR of 8.5% over the forecast period. The convenience factor is driving a significant shift in consumer behavior as more and more people turn to online channels for their shopping needs. Online platforms offer attractive benefits like substantial discounts, a diverse selection of products available in one place, easy payment options, doorstep delivery, and more. This convenience has become a major driver of consumer demand.

Packaging Insights

The containers/tubs vegan dips segment dominated the market with a share of 33.9% in 2022. Containers or tubs are convenient and easy to use. They provide a ready-to-eat solution for consumers looking for quick and hassle-free options. These packaging formats allow individuals to enjoy vegan dips on the go, making them perfect for busy lifestyles, picnics, parties, or office lunches.

The sachets/pouches vegan dips segment is estimated to grow at a CAGR of 9.0% over the forecast period. Sachets and pouches provide a convenient and portable packaging solution for vegan dips. They are pre-portioned and easy to carry, making them ideal for on-the-go consumption. Individuals can grab a single-serving sachet or pouch without additional utensils or containers for picnics, office lunches, or quick snacks. This convenience factor resonates with busy, modern lifestyles, where consumers seek quick, hassle-free options.

Regional Insights

Europe dominated the market with a share of 32.4% in 2022. Europe has seen a rise in health consciousness among consumers. Many individuals are opting for plant-based diets, including vegan dips, as they are perceived to be healthier options compared to traditional dairy-based dips. Vegan dips are often made from nutrient-rich ingredients like legumes, nuts, and vegetables, providing a healthier alternative with lower saturated fat and cholesterol content.

Asia Pacific is expected to witness a CAGR of 8.7% from 2023 to 2030. The Asia Pacific region is increasingly influenced by global food trends, including the rise of veganism and plant-based diets in other parts of the world. The popularity of vegan dips in the West has had a ripple effect on Asian cuisines, leading to increased interest and adoption of plant-based dips in the region. Social media and international travel have also contributed to the spread of global food trends, including vegan options like dips.

Key Companies & Market Share Insights

Companies in the vegan dips industry are increasingly introducing products that aim to enhance the convenience and appeal of noodles as a snacking option. The market is highly competitive, with numerous rivals in the vegan food industry. These companies are closely attuned to consumer preferences in local markets and are developing a wide range of products to meet the diverse demands of consumers.

For instance, in January 2023, Asda launched two exciting vegan ranges, featuring a diverse selection of over 112 products. The first range, OMV!, is crafted to offer indulgent and delicious meat-free meals and snacks. It caters to those looking for mouthwatering plant-based options without compromising taste or enjoyment. The second range focuses on providing healthy and nutritionist-approved meat alternatives, appealing to health-conscious consumers.

Key Vegan Dips Companies:

- The Kraft Heinz Company

- Kite Hills

- Good Foods Group

- Wingreen World

- Galaxy Nutritional Foods Inc.

- SABRA DIPPING CO. LLC

- DAIYA FOODS INC.

- Frito-Lay North America Inc.

- Bolthouse Farms Inc.

- Siete

Vegan Dips Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 124.6 million

Revenue forecast in 2030

USD 209.5 million

Growth Rate

CAGR of 7.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type, flavors, packaging, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; Australia; Brazil; Argentina; UAE; South Africa; Turkey

Key companies profiled

The Kraft Heinz Company; Kite Hills; Good Foods Group; Wingreen World; Galaxy Nutritional Foods Inc.; SABRA DIPPING CO. LLC; DAIYA FOODS INC.; Frito-Lay North America Inc.; Bolthouse Farms Inc.; Siete

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Vegan Dips Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global vegan dips market report based on type, flavors, packaging, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Hummus

-

Salsa

-

Guacamole

-

Spinach and Artichoke Dip

-

Baba Ganoush

-

Others

-

-

Flavors Outlook (Revenue, USD Million, 2018 - 2030)

-

Classic

-

Spicy

-

Herby & Fresh

-

Others

-

-

Packaging Outlook (Revenue, USD Million, 2018 - 2030)

-

Bottles

-

Sachets/Pouches

-

Containers/Tubs

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

Central & South America

-

Brazil

-

Argentina

-

Middle East & Africa

-

UAE

-

South Africa

-

Turkey

-

-

Frequently Asked Questions About This Report

b. The global vegan dips market size was estimated at USD 117.5 billion in 2022 and is expected to reach USD 124.6 billion in 2023

b. The global vegan dips market is expected to grow at a compound annual growth rate of 7.7% from 2023 to 2030 to reach USD 209.5 billion by 2030

b. Europe dominated the vegan dips market with a market share of 32.4% in 2022. The region is recognized as one of the leading consumers worldwide. This growth can be primarily attributed to the rising demand for ready-to-eat and convenient food items.

b. Some key players operating in the vegan dips market include The Kraft Heinz Company, Kite Hills, Good Foods Group, Wingreen World, Galaxy Nutritional Foods Inc., SABRA DIPPING CO. LLC, DAIYA FOODS INC., Frito-Lay North America Inc., Bolthouse Farms Inc., Siete

b. Key factors driving the market growth include the increasing preference for ready-to-eat food options and the increasing middle-class population are key drivers of this growth

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.