- Home

- »

- Consumer F&B

- »

-

Vegan Yogurt Market Size & Share, Industry Report, 2030GVR Report cover

![Vegan Yogurt Market Size, Share & Trends Report]()

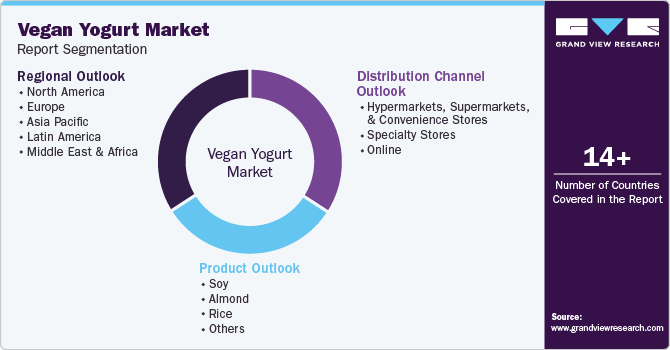

Vegan Yogurt Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Soy, Almond, Rice, Others), By Distribution Channel (Hypermarkets, Supermarkets, And Convenience Stores, Specialty Stores, Online), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-758-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Vegan Yogurt Market Summary

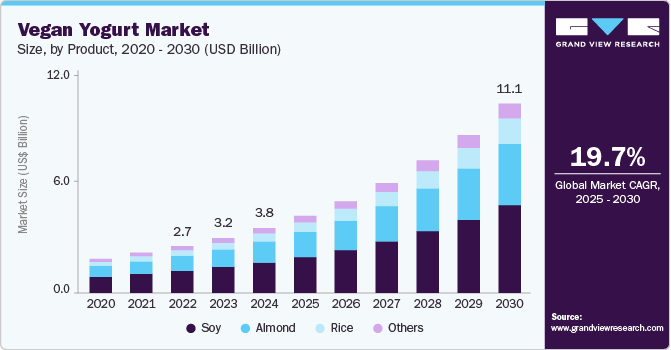

The global vegan yogurt market size was valued at USD 3.82 billion in 2024 and is projected to reach USD 11.11 billion by 2030, growing at a CAGR of 19.7% from 2025 to 2030. Shifting traction towards dairy-free products among millennials on a global level is expected to promote the scope of plant-based nutritional products such as vegan yogurts.

Key Market Trends & Insights

- The Europe vegan yogurt market held the largest share of 50.2% in 2024.

- The U.S. dominated the regional vegan yogurt industry in 2024.

- By product, the soy yogurt segment accounted for the largest market revenue share of 46.9% in 2024.

- By distribution channel, the hypermarkets, supermarkets, & convenience stores segment dominated the vegan yogurt industry in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.82 Billion

- 2030 Projected Market Size: USD 11.11 Billion

- CAGR (2025-2030): 19.7%

- Europe: Largest market in 2024

- Asia Pacific: Fastest growing market

The yogurt is rich with probiotics and helpful gut bacteria, making it extremely useful for gut health and digestion. Consumers have also been increasing their spending on plant-based products as a result of the increased prevalence of disorders, including milk allergies, among the general public in developed economies of North America and Europe. Dairy consumption has been on the decline for decades, with each generation drinking less milk than its predecessor. Vegan diet has been gaining popularity among the common masses, and they are rapidly looking to replace the use of dairy products, including vegan yogurt. Vegan yogurts containing live probiotics and cultures offer the same digestive benefits as dairy-based yogurts; sometimes, vegan yogurts offer nutrients that even dairy-based yogurts fail to provide.

For instance, flax milk, yogurt, and hemp yogurt contain natural omega-3 fatty acids and fiber. Many other varieties of vegan yogurt are fortified with vitamins and minerals to make them healthier. Vegan yogurt is just as rich, smooth, and creamy as conventional yogurt and does not require adaptation of taste and texture.

Makers of vegan yogurt have been focused on experimenting and innovating with new bases and unique flavors to position their product as mainstream. Vegan yogurt is made from milk derived from nuts, seeds, and grains. Nuts used to make the product include coconut, macadamia, hazelnuts, pistachios, pili, almond, and cashew. Seeds used in the making of vegan yogurt include soy, flax, and hemp, whereas grains include oats.

Product Insights

Soy yogurt accounted for the largest market revenue share of 46.9% in 2024. Vegan food products are gaining popularity among consumers, including dairy-alternative products such as soy yogurt. Moreover, these seed-based yogurts are an excellent source of protein when compared to dairy-based yogurt. Soy-based yogurt helps to reduce cholesterol and blood sugar levels in the body. These benefits are promoting the demand for soy-based vegan products, thereby driving the market.

Almond yogurt is a creamy and light alternative to traditional dairy yogurt. Rich in probiotics, it supports digestive health naturally. One cup of Almond yogurt is around 237 grams and contains nearly 189 calories, 6.3 grams of protein, 7.9 grams of fat, and 24 grams of carbohydrates. Almond milk is a good source of Vitamin E, which is a powerful antioxidant that may fight inflammation and stress.

A rice-based yogurt is made by adding rice flour in milk during the preparation of yogurt. Fat contents in rice based yogurt varies between 3.25 - 2.90 %. MozzaRisella's Yo-Ger plant-based yogurt is a first of its kind creation made with sprouted brown rice, which is free from lactose, gluten, nuts and soya.Sprouted brown rice has beneficial minerals, mineral salts and vitamins, as well as fatty acids and fiber. Brown rice sprouts are said to have a similar amino acid composition and micronutrient content to human breast milk.

Distribution Channel Insights

The hypermarkets, supermarkets, & convenience stores dominated the vegan yogurt industry in 2024. Companies including Walmart, Target, 7Eleven, SPAR, Aldi, Carrefour, and Lidl have large grocery store chains across the globe with a large customer base. For instance, according to the Target Inc. company website, the company is expected to open around 26 new stores across the U.S. (to change). Rising consumer preference for non-dairy yogurt is driving the market. These consumer trends are anticipated to maintain the dominance of this distribution channel over the forecast period.

Online channel is expected to witness the fastest growth on account of rising penetration of smartphones among millennials on a global level. These channels have the ability to provide extra-convenience, and ease of shopping. A variety of features offered by e-retailers, including several value-added services such as discounted prices, cash-on-delivery, and cashbacks, are expected to promote the growth of the online channel in the coming years.

Regional Insights

North America vegan yogurt market share is projected to grow at a significant CAGR from 2025 - 2030. With nearly 50 million Americans-out of a population of 330 million-affected by lactose intolerance and unable to digest dairy products, there's a growing opportunity for the rise of vegan-based diets and plant-based dairy alternatives. The term “vegan” was found on 16,490 menus in North America. The growth in the term “vegan” in restaurants in North America shows no slowing down.

U.S. Vegan Yogurt Market Trends

The U.S. dominated the regional vegan yogurt industry in 2024 owing to increasing number of people moving towards plant-based diets, and many shifting toward dairy-free options like vegan yogurt. According to a 2023 survey, approximately 4% of Americans identified as vegans. However, other estimates place the figure closer to 1%. Given that the U.S. population in 2023 was approximately 336 million, these figures suggest that the number of vegans in the country is approximately 3.36 million.

Europe Vegan Yogurt Market Trends

The Europe vegan yogurt market held the largest share of 50.2% in 2024. In the developed economies including Germany, UK, and France, the positive outlook toward plant-based foods among consumers of the region as a result of an increased number of campaigns on social media and satellite television channels is projected to keep the dominance of the region.

The Germany vegan yogurt market held a substantial market share in 2024 owing concern over animal welfare and climate change is pushing German consumers toward plant-based alternatives like vegan yogurt. The proportion of plant-based yoghurt has risen from 18.1% in 2021 to 28.7% in early 2024. As the dairy industry faces backlash for unsustainable practices and lobbying efforts, consumers increasingly view plant-based choice as ethical, eco-friendly, and aligned with their values.

Asia Pacific Vegan Yogurt Market Trends

The Asia Pacific vegan yogurt market is anticipated to grow at the fastest CAGR during the forecast period. Strong visibility of soy yogurt in countries such as Japan owing to increased awareness about gluten-free products on a domestic level is projected to remain an influential force in the upcoming years. In addition, the rising number of lactose intolerant people and growing consumer preference for a vegan diet has been driving the growth of the market in the region.

A 2021 survey found that 2.2% of Japanese people are identified as vegan. The Japan vegan yogurt industry is expected to grow rapidly in the coming years due to rising health awareness and lifestyle-related disease prevention. Environmental concerns are prompting consumers to reduce animal product consumption. Food companies are innovating with soy, rice, and plant-based versions of traditional dishes. Together, these factors are reshaping Japan’s food landscape toward more sustainable choices like vegan yogurt.

Key Vegan Yogurt Company Insights

Key companies have been launching innovative products to expand their portfolios and consumer base. Lately, companies have been increasing their consumer reach by investing in the online distribution channel. General Mills Inc. launched a dairy-free product line of French-style yogurt under its Oui brand. Some of the key companies in the vegan yogurt industry include, Daiya Foods Inc., Nush Foods, Danone, General Mills Inc., and others.

-

Nush Foods is a UK-based company specializing in dairy-free, plant-based yogurt alternatives. Nush is known for being the first UK producer of nut milk yogurts, which are available in flavors like raspberry, vanilla fudge, and natural.

-

Daiya Foods Inc. is a Canadian company specializing in dairy-free, plant-based alternatives. Their offerings are free from dairy, gluten, and soy, catering to various dietary needs. Daiya's products are available in over 25,000 grocery stores across North America and internationally.

Key Vegan Yogurt Companies:

The following are the leading companies in the vegan yogurt market. These companies collectively hold the largest market share and dictate industry trends.

- Hain Celestial

- Danone

- General Mills Inc.

- Stonyfield Farm, Inc.

- Daiya Foods.

- Good Karma Foods

- Hudson River Foods

- Nancy's.

- Kite Hill Store

- COYO Pty Ltd.

- Chobani, LLC

Recent Developments

-

In April 2024, Dutch supermarket chain Jumbo introduced a new line of plant-based yogurts made with Dutch-grown soy. This development is aimed at promoting local, sustainable food production while offering consumers a nutritious and environmentally friendly dairy alternative.

-

In March 2025, The Coconut Collab expanded its Protein Yogurt range by launching a new Strawberry Protein flavor. This plant-based yogurt combines a creamy coconut and almond base with a naturally sweet strawberry flavor.

Vegan Yogurt Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.52 billion

Revenue forecast in 2030

USD 11.11 billion

Growth Rate

CAGR of 19.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

May 2025

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, distribution channel and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; South Korea; Australia; Brazil; South Africa

Key companies profiled

Hain Celestial; Danone; General Mills Inc.; Stonyfield Farm, Inc.; Daiya Foods.; Good Karma Foods; Hudson River Foods; Nancy's.; Kite Hill Store; COYO Pty Ltd.; Chobani, LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Vegan Yogurt Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global vegan yogurt industry report based on product, distribution channel, and region.

-

Vegan Yogurt Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Soy

-

Almond

-

Rice

-

Others

-

-

Vegan Yogurt Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets, Supermarkets, & Convenience Stores

-

Specialty Stores

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.