Wooden Decking Market Size & Trends

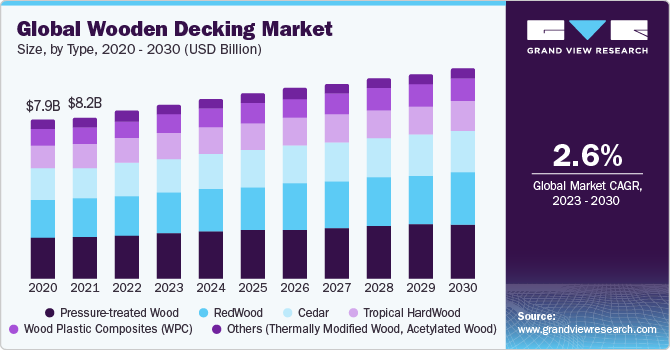

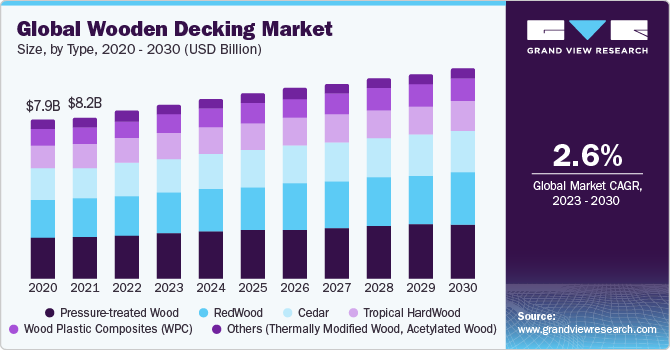

The global wooden decking market size was valued at USD 8.48 billion in 2022 and is expected to grow at a CAGR of 2.6% over the forecast period. Wooden decking refers to the construction of outdoor platforms using wooden boards or planks and is commonly used in outdoor spaces like gardens, patios, balconies, and around swimming pools. Wooden decking offers an attractive and natural aesthetic, making it a popular choice for outdoor areas. The growing construction industry across the globe due to increasing urbanization and the growing popularity of wooden decking to increase the living space with limited interior square footage are driving the demand for wooden decking demand.

The outbreak of the COVID-19 pandemic had a mixed impact on the wooden decking market since the building & construction industry, a major consumer of wooden decks witnessed a slowing down of ongoing construction projects due to mobility restrictions. Furthermore, the closure of trade boundaries disrupted global supply chains, causing delays in the production and distribution of decking materials. This led to increased costs of raw materials as well as wooden decking products and shortages in some regions.

The COVID-19 pandemic’s positive influence on the wooden decking market is reflected by an unprecedented demand for wood plastic composite decking products. The stay-at-home restrictions drove the demand for DIY wooden decking products as consumers in developed countries engaged in repairing their existing wooden decks. Furthermore, the option of a wood-plastic composite deck emerged as a viable substitute for the complete wooden decking which faced material shortage issues and supply issues during COVID-19.

Type Insights

Based on the type, the wooden decking market is segmented into pressure-treated wood, redwood, cedar, tropical hardwood, wood plastic composites, and others. The pressure-treated wood-based wooden decking held the largest market share in 2022. The high market share is attributed to its ability to resist decay, durability, good abrasive resistance, and high usage life compared to other types. Furthermore, their cost-effectiveness compared to other types of wooden decking further supports their high market demand.

Type of Construction Insights

On the basis of type of construction, the wooden decking market is segmented into repairs & remodeling and new decks on new constructions. In restoration projects, wooden decking is often used to replace or refurbish existing decks. Restoration may involve repairing or replacing damaged or deteriorated wooden components. This work requires an understanding of structural engineering to ensure the deck remains safe and functional. New construction projects offer design flexibility, allowing architects and homeowners to choose the type of wood, deck size, and layout that best suits the desired aesthetic and functional requirements.

Application Insights

On the basis of application, the wooden decking market is segmented into railing, floor, wall, and others. In the application segment, the floor is the dominant application consuming wooden decks. Wooden decking boards can be used in indoor and outdoor flooring. Wooden decking board used for indoor flooring requires additional treatment and finishing to meet interior design standards. The pressure-treated wooden decking is the preferred choice for the flooring application.

Wooden decking is used in railing for protective measures and for improving the aesthetic of the balcony, stairs, and deck. Aluminum railings and other metal railings are often used as an alternative to wooden decks in rail applications. The sturdiness and good durability of metal rails pose a significant challenge for the wooden deck in rail applications.

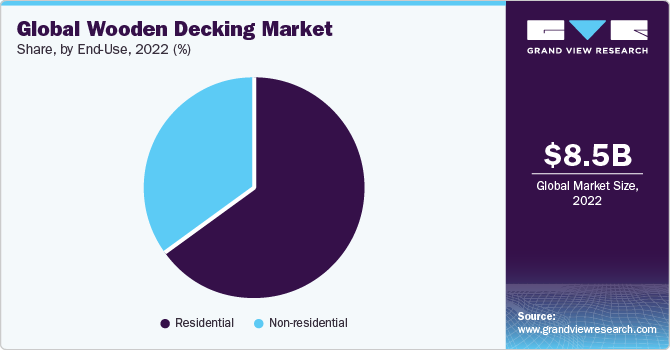

End-Use Insights

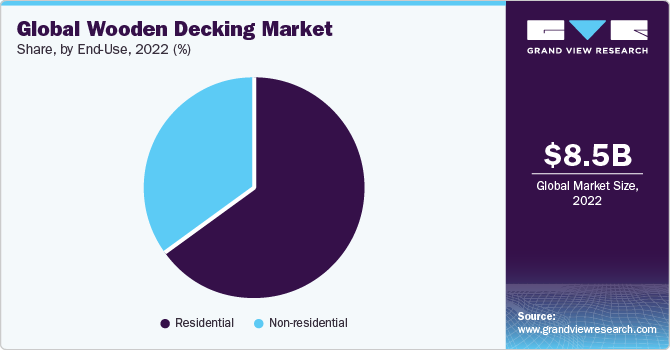

Based on end use, the wooden decking market is segmented into residential and non-residential structures. The residential sub-segment dominates the wooden decking market. The growing urbanization and population are driving the residential construction market which positively impacts the wooden decking consumption. There has been a growing trend in recent years to create outdoor living space in residential properties which further drives the consumption of wooden decking in the residential end-use segment.

In non-residential structures, low maintenance is given preference over aesthetics. Non-residential environments often prioritize materials that are. This leads to the preference for alternative materials like concrete, steel, or composite decking due to their strength, resistance to fire, and low maintenance requirements. Non-residential spaces frequently experience heavy foot traffic, making durability and long-term performance key factors that ultimately limit the wooden decking market demand in the non-residential end-use segment.

Regional Insights

North America dominated the market in 2022. North America has a strong construction sector. According to the Associated General Contractors of America (AGC), there were more than 919,000 construction establishments in the U.S. in the 1st quarter of 2023. Also, as per the statistics provided by the U.S. Department of Housing and Urban Development and the U.S. Census Bureau, the building permits in the U.S. for August 2023 were 6.9% higher than that of July 2023. Also, according to Canada Construction Association, the construction sector of Canada accounts for 7.4% of the country’s GDP. The growing construction sector in North America can positively influence the demand for wood decking in the region. Also, North America has a significant presence of wooden decking companies such as Trex Company Inc., Humboldt Sawmill Company LLC, Weyerhaeuser Company, West Fraser Timber Co. Ltd., UFP Industries Inc., and AZEK Company Inc, which further indicates a strong market potential for the wooden decking in the region.

Asia-Pacific is expected to witness the fastest CAGR over the forecast period. Rapidly growing population, coupled with increasing disposable income and growing urbanization is driving the demand for residential projects in the region. The region's expanding middle-class population has led to higher disposable incomes and a growing desire for comfortable and aesthetically pleasing outdoor spaces, which drives the demand for wooden decking. The houses in Japan use wood for flooring and the majority of houses in Japan use wood as a major raw material. Japan’s major landmass is forested; hence the country has significant lumber sources available which can support the wooden decking market growth in the country.

Key Companies & Market Share Insights

Key players operating in the market are UPM Kymmene Corporation, Trex Company Inc., Weyerhaeuser Company, Setra Group AG, Metsä Group, UFP Industries Inc., Latham PLC, and VETEDY. The market participants are constantly working towards expansion, M&A activities, new product development, and other strategic alliances to strengthen their market presence. The following are some instances of strategic initiatives:

-

In August 2023, Metsä Group and SRV, a Finnish construction company inked an agreement to establish a new Kerto LVL mill in Äänekoski, Finland. The Metsä Group’s Kerto LVL is a laminated veneer lumber used in construction projects. The billet is sawn into LVL planks, beams, or panels. This strategic expansion can increase the wooden deck production capacity of Metsä Group.

-

In July 2023, Mid-Am Building Supply, Inc. and Oldcastle APG's entered into a strategic partnership to extend the distribution network of its composite decking collection under the brand name MoistureShield. This collaboration aims to increase the accessibility of MoistureShield products to customers in Missouri; Mt., Chillicothe, Missouri; Moberly, and Centralia, Illinois.