- Home

- »

- Medical Devices

- »

-

Wound Closure Devices Market Size, Industry Report, 2030GVR Report cover

![Wound Closure Devices Market Size, Share & Trends Report]()

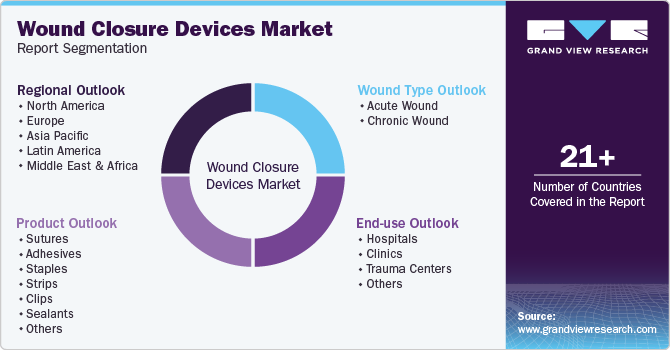

Wound Closure Devices Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Sutures, Adhesives, Staples, Strips), By Wound Type (Acute Wound, Chronic Wound), By End Use (Hospitals, Clinics), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-014-9

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Wound Closure Devices Market Summary

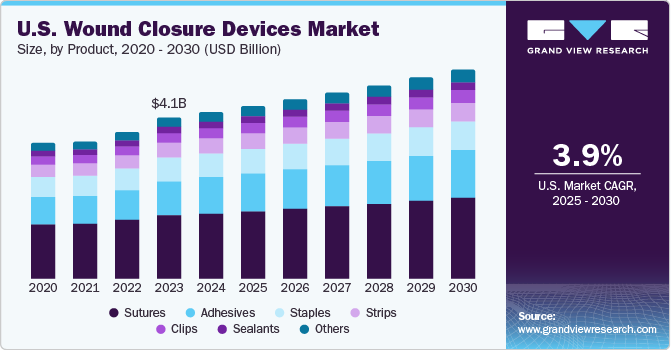

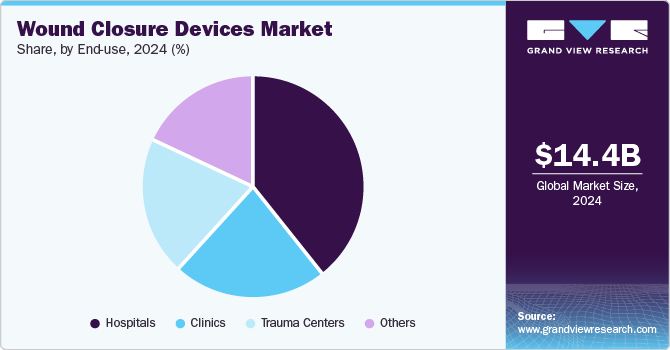

The wound closure devices market was estimated at USD 14.43 billion in 2024 and is projected to reach USD 21.15 billion by 2030, growing at a CAGR of 6.60% from 2025 to 2030. The growth is driven by the rising number of surgical procedures and accidental injuries, as well as the prevalence of chronic wounds such as diabetic foot ulcers and the growing geriatric population, who are more prone to such conditions.

Key Market Trends & Insights

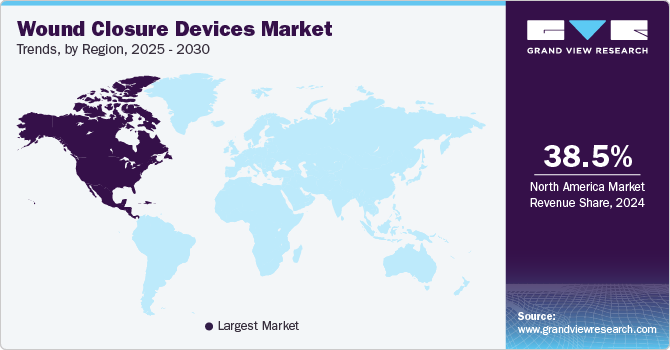

- North America held the largest revenue share of 38.48% in the wound closure devices market in 2024.

- The wound closure devices market in Europe is anticipated to grow with a CAGR of 8.95% in the coming years.

- By product, the sutures segment dominated the market accounting for over 40.00% of revenue share in 2024.

- By end use, The trauma centers segment is projected to experience the fastest growth over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 14.43 Billion

- 2030 Projected Market Size: USD 21.15 Billion

- CAGR (2025-2030): 6.60%

- North America: Largest market in 2024

In addition, technological advancements are improving safety and effectiveness, while growing awareness among healthcare providers about the benefits of these devices further supports market expansion. For instance, Corza Medical launched an innovative Onatec ophthalmic microsurgical sutures in October 2024 at the American Academy of Ophthalmology (AAO) Conference held in Chicago.

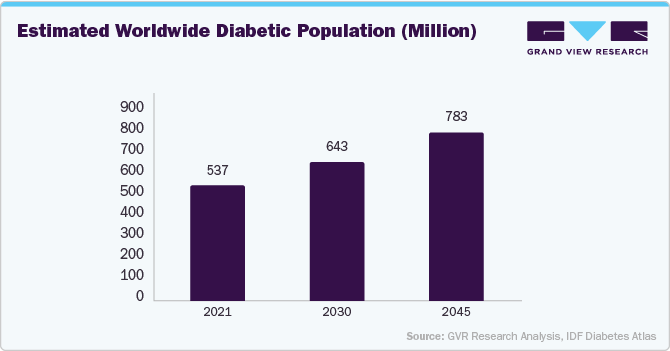

The rising prevalence of chronic conditions such as diabetes, which increases the risk of diabetic foot ulcers and pressure ulcers, is expected to drive market growth in the coming years. According to the International Diabetes Federation, approximately 783 million people worldwide will have diabetes by 2045. According to the article published in the journal Scientific Reports in July 2024, the incidence of pressure ulcers ranges from 0.4% to 38% globally in patients who have undergone some surgery. Also, as per the study reported in the same article, the prevalence of pressure ulcers in northwest Ethiopia was 10.2%, and a lifestyle that comprises smoking and being bedridden can worsen the condition.

Furthermore, the increasing incidence of injuries due to several factors, such as road accidents, assault, accidents in the workplace, etc., are expected to drive the demand for wound closure devices in the upcoming years. For instance, according to the data published by the World Health Organization in June 2024, three out of five deaths among people falling under 5-29 years of age are attributed to injuries. Six hundred eighty-four thousand people lose their lives due to falls every year. As per the statistics, unintentional injuries are responsible for 3.16 million deaths annually out of 4.4 million injury-related deaths. In addition, according to the news published by The Economic Times in April 2024, in the past two years, there has been a notable rise in the number of employees suffering from injuries at the workplace, and the challenge in reporting these and managing lies, especially among the blue-collar workers.

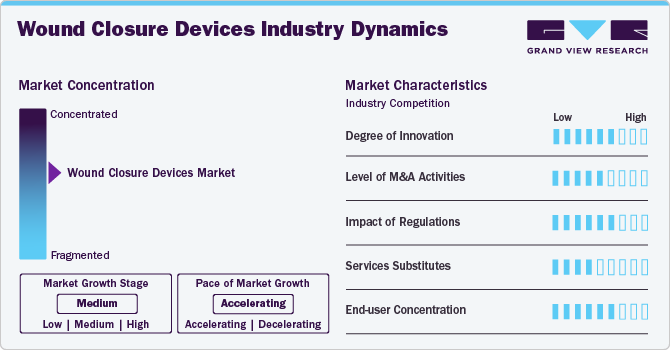

Market Concentration & Characteristics

The market growth stage is moderate, and the pace of growth is accelerating. The wound closure devices market is characterized by growth owing to rising cases of surgeries and accidental injuries, along with the growing availability of such devices.

Players in the industry and researchers are working on various initiatives to bring innovation to the wound closure devices market. Key players in the market are making an effort to develop and launch smart sutures equipped with sensors and bioactive material to assist in healing, which would revolutionize the laceration care sector. Moreover, various universities and research institutions are working on advanced manufacturing techniques, such as 3D bio-printing for personalized treatments.

Regulatory bodies such as the Food and Drug Administration (FDA), Health Canada, the European Union, and other agencies set quality and safety standards for medical equipment, including wound closure strips. The regulatory bodies categorize medical devices into different categories according to the risks associated with these products. These medical products are subject to scrutiny depending on their risk classes. For instance, as per the FDA, 3M STERI-STRIP skin closure is classified under tape and bandage adhesive regulations, and it is considered a low-risk medical device.

The market for wound closure devices is fragmented. This fragmentation can be attributed to the presence of numerous small, medium, and large firms offering various product types in such medical devices. For instance, Corza Medical, a key industry participant, offers different kinds of wound closure devices, such as absorbable and non-absorbable sutures, under various brands such as Quill barbed suture with helical barbed design, sharpoint surgical suture, sharpoint gut suture, and LOOK surgical suture. The players operating in the market often compete based on product differentiation, price, material quality, and end uses.

Manufacturers and firms working in the industry focus on expanding their presence in numerous countries. Several industry participants, such as 3M, Corza Medical., and B. Braun SE, offer their products in multiple countries, such as the U.S. and U.K., among others.

Product Insights

The sutures segment dominated the market and accounted for a revenue share of 40.00% in 2024. These high numbers are attributed to the established effectiveness, versatility, and acceptance of sutures in various medical procedures. Sutures offer flexibility in injury management as they can be tailored with respect to type- as absorbable or non-absorbable, also considering material synthetic or natural, and thickness, making them adaptable to various tissues and wound types. Developments and launches of new innovative products by key players in the industry further fuel the segment's growth. For instance, as per the news published in October 2024, Globus Medical, Inc. launched the TENSOR suture button system and expanded its orthopedic trauma portfolio.

The adhesives segment is projected to grow at the highest CAGR, which makes it the second fastest-growing segment over the forecast period. Medical adhesives offer a suture-free alternative that can be quickly applied, minimizing the time required for wound closure and reducing the pain associated with traditional suturing. Adhesives provide several advantages over conventional wound closure methods, such as its noninvasive application, reduced scarring, and enhanced patient comfort. In addition, new product launches, along with regulatory approval, contribute to the growth of the segment. For instance, in July 2024, Connexicon Medical’s tissue adhesive skin closure system received FDA approval under Class II device regulation.

Wound Type Insights

The acute wounds segment dominated the market in 2024 and is expected to continue its dominance with the highest CAGR of 7.17% over the forecast period. This growth is attributed to an increase in traumatic injuries and surgical procedures. For instance, according to the data published by the U.S. Department of Transportation in April 2024, an estimated 40,990 people died in 2023 due to road accidents, thus increasing hospital admissions. The growing global population and higher rates of accidents and injuries have led to a greater demand for effective injury management solutions. In addition, developments in wound closure technologies enhance healing efficacy and reduce complications, making them crucial in emergency care settings. Furthermore, the growing awareness of proper medical care practices among healthcare professionals and patients contributes to the increasing adoption of acute wound closure devices.

The chronic wound segment is expected to grow significantly during the forecast period due to the rising prevalence of conditions such as diabetes, obesity, and an aging population. These factors significantly increase the incidence of chronic injuries, such as diabetic ulcers and venous ulcers, needing innovative medical care solutions. In addition, the difficulty of managing such lesions requires innovative products that promote healing and prevent infections. Furthermore, the growing emphasis on improving patient outcomes and reducing healthcare costs drives investments in advanced medical technologies tailored for chronic wound management.

End Use Insights

The hospitals segment dominated the market and accounted for the largest revenue share of 39.44% in 2024, owing to the increasing number of surgical procedures and trauma cases. With a rise in chronic diseases and accidents, hospitals are witnessing a surge in patient admissions requiring effective wound management solutions. In addition, advancements in medical technology and surgical techniques enhance puncture management efficiency, increasing demand. Furthermore, hospitals also benefit from economies of scale, enabling them to invest in advanced medical devices, which improve patient outcomes and reduce complications.

The trauma centers segment is projected to experience the fastest growth during the forecast period, driven by the rising number of trauma cases, road accidents, and sports injuries. A study published by the National Library of Medicine in November 2021 reveals that trauma is a leading cause of death worldwide, resulting in over 5 million fatalities, while nearly 1 billion individuals seek medical care for injuries each year. This substantial volume of trauma injuries is expected to contribute significantly to the growth of this segment in the coming years.

Regional Insights

North America wound closure devices market held the largest revenue share of 38.48% in 2024, owing to continuous research in the wound care sector and growing product launches. For instance, in September 2024, a Los Angeles-based company, Tides Medical, introduced APLICOR 3D, a personalized wound care interoperative 3D printer. This device is capable of producing customized skin grafts for damage repair by using a person's tissue, artificial intelligence, and 3D printing technology. The region's introduction of advanced technologies is expected to contribute to the market growth during the forecast period.

U.S. Wound Closure Devices Market Trends

The wound closure devices market in the U.S. is expected to dominate the North American region over the forecast period due to the presence of key players and the advent of new technologies in the wound care segment. For instance, in April 2024, Vomaris Innovations, Inc. launched “PowerHeal,” a bioelectric bandage that closes the damaged site and helps in healing. This device functions similarly to the transepithelial potential mechanism and provides an antibacterial environment to heal the tear faster.

Europe Wound Closure Devices Market Trends

The wound closure devices market in Europe is anticipated to grow with a CAGR of 8.95% in the coming years. This growth can be attributed to the rising number of individuals undergoing surgeries. Moreover, the availability of domestic and international companies offering wound closure devices for managing surgical tears and minor cuts is anticipated to boost the market growth. For instance, Smith+Nephew is a UK-based company that produces and manufactures LEUKOSTRIP, ENTACT Septal Stapler, and other skin closure products that can be used in primary and secondary closure of skin wounds.

The UK wound closure devices market is expected to grow moderately over the forecast period. The growing number of patients who have diabetes is anticipated to propel the country’s market growth over the forecast period. According to the data published by the British Diabetic Association in March 2024, over 5 million individuals in the UK are living with diabetes. People under the age of 40 years are showing an exponential rise in the proportion of diabetes than in the older population.

The wound closure devices market in France is expected to experience growth over the forecast period, driven by the rising prevalence of chronic conditions and substantial healthcare spending. For instance, according to the 2023 Health Statistics published by the OECD, France dedicates 12.1% of its GDP to healthcare, compared to the OECD average of 9.2%.

Germany wound closure devices market is witnessing steady growth due to the increasing number of surgeries and favorable reimbursement policies. In addition, the growing number of injuries across the country is expected to drive the market in the coming years. According to data published by the Statistisches Bundesamt (Destatis) in February 2023, around 3,66,557 individuals were injured in Germany due to road traffic accidents in 2023.

Asia Pacific Wound Closure Devices Market Trends

The wound closure devices market in Asia Pacific is anticipated to grow with a significant CAGR over the forecast period. The wound closure devices market in the Asia Pacific region has been experiencing substantial growth, driven by several key factors, such as the increasing prevalence of chronic diseases, including diabetes, among the region's population. These chronic diseases can increase the number of surgeries and procedures that use wound closure devices. In addition, the advent of industry players in the region is anticipated to surge the market growth. For instance, as per the news published in August 2023, Healthium Medtech announced India's first exclusive range of sutures, designed for minimally invasive surgeries, called "TRUMAS."

China wound closure devices market is expected to grow throughout the forecast period, driven by increasing demand for solutions to address wound-related issues. The rise in the geriatric population further increases the burden of injuries due to falls and other reasons, thus boosting the demand for wound closure devices to propel market growth. For instance, according to the data published in September 2024, over one-fifth of the country's population is aged above 60 years, which is nearly 297 million people.

The wound closure devices market in Japan is expected to grow over the forecast period owing to several critical factors, including an increasing number of surgeries throughout the country and a growing elderly population. According to data published in September 2024, Japan has become house to 36.25 million elderly population who are aged above 65 years. Japan’s Ministry of Internal Affairs and Communications stated that the country has the highest proportion of the geriatric population, which accounts for 29.3%.

Middle East and Africa Wound Closure Devices Market Trends

The wound closure devices market in the Middle East and Africa is expected to witness significant growth in the coming years due to the growing healthcare expenditure and strategic activities to increase the focus on wound care and management. For instance, the 3rd Global Conference on Advanced Wound Care and Wound Management is going to be held in November 2024, which will bring together healthcare professionals in Dubai and further boost the wound care closure devices market.

Saudi Arabia wound closure devices market is anticipated to grow over the forecast period. The growing patient population suffering from diabetes, advancing healthcare infrastructure, and rising health expenditures can boost market growth in the coming years. For instance, according to the data released in October 2024, collaborative research in Bahrain to find innovative solutions for diabetic ulcers stated that novel biomaterial has the potential to heal wounds better than traditional dressings. Such studies are expected to impact the adoption of products positively.

The wound closure devices market in Kuwait is expected to grow over the forecast period due to rising healthcare expenditures and the increasing number of orthopedic procedures in the coming years.

Wound closure devices are used in ulcers associated with diabetes as they require longer to heal the damage in such patients. Thus, the growing prevalence of diabetes and the rising number of diabetic population across the globe increases diabetic foot ulcer expectancy and, hence, is anticipated to drive the demand for these medical devices in the coming years. The IDF Diabetes Atlas estimated that there will be around 643 million diabetic patients across the world by 2030, and this number is estimated to increase to 783 million by 2045.

Key Wound Closure Devices Company Insights

3M, Ethicon (Johnson & Johnson Services, Inc.), Medtronic, Baxter, Smith+Nephew, Stryker, Advanced Medical Solutions Group plc, Riverpoint Medical, DermaClip, AVITA Medical, Inc., and Corza Medical are some of the major players in the wound closure devices market. Companies are launching products to gain a competitive advantage in the coming years.

Key Wound Closure Devices Companies:

The following are the leading companies in the wound closure devices market. These companies collectively hold the largest market share and dictate industry trends.

- 3M

- Ethicon (Johnson & Johnson Services, Inc.)

- Medtronic

- Baxter

- Smith+Nephew

- Stryker

- Advanced Medical Solutions Group plc

- Riverpoint Medical

- DermaClip

- AVITA Medical, Inc.

- Corza Medical

Recent Developments

-

In October 2024, Mölnlycke Health Care collaborated with Transdiagen for advanced research in wound care. This partnership will give rise to innovative wound closure devices using expertise from both companies.

-

In July 2024, AVITA Medical, Inc. collaborated with Regenity Biosciences to strengthen the company's wound care portfolio with Regenity’s bioresorbable technology and expand its wound care product distribution.

-

In July 2024, Vernacare Ltd (H.I.G. Capital, LLC), a manufacturer of wound closure strips, transferred USD 4.54 million in surgical tool operations from China to the UK. This plan would allow the company to extend its manufacturing capacity at Worksop, Newtown, Wales, and England establishments and save about USD 324.60 million.

Wound Closure Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 15.36 billion

Revenue forecast in 2030

USD 21.15 billion

Growth rate

CAGR of 6.60% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends, and volume analysis

Segments covered

Product, wound type, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country Scope

U.S.; Canada; UK; Germany; Italy; France; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

3M, Ethicon (Johnson & Johnson Services, Inc.), Medtronic, Baxter, Smith+Nephew, Stryker, Advanced Medical Solutions Group plc, Riverpoint Medical, DermaClip, AVITA Medical, Inc., Corza Medical

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Wound Closure Devices Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global wound closure devices market report based on product, wound type, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Sutures

-

Absorbable

-

Non-Absorbable

-

-

Adhesives

-

Staples

-

Strips

-

Sterile

-

Non-Sterile

-

-

Clips

-

Sealants

-

Non-Synthetic

-

Collagen Based

-

Synthetic

-

-

Others

-

-

Wound Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Acute Wound

-

Chronic Wound

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Trauma Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

Italy

-

France

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global wound closure devices market size was estimated at USD 14.43 billion in 2024 and is expected to reach USD 15.36 billion in 2025.

b. The global wound closure devices market is expected to grow at a compound annual growth rate of 6.60% from 2025 to 2030 to reach USD 21.15 billion by 2030.

b. The sutures segment held the dominant market share in 2024 with a market share of more than 40.00% owing to the rising number of surgeries and burn cases globally.

b. Some key players operating in the wound closure devices market include 3M, Ethicon (Johnson & Johnson Services, Inc.), Medtronic, Baxter, Smith+Nephew, Stryker, Advanced Medical Solutions Group plc, Riverpoint Medical, DermaClip, AVITA Medical, Inc., Corza Medical.

b. Key factors driving the market growth include the prevalence of chronic wounds, increasing cases of accidents, and the rising number of surgeries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.