- Home

- »

- Food Safety & Processing

- »

-

Wrapping Machine Market Size, Share, Industry Report, 2030GVR Report cover

![Wrapping Machine Market Size, Share & Trends Report]()

Wrapping Machine Market (2025 - 2030) Size, Share & Trends Analysis Report By Machine Type (Stretch, Shrink), By Mode Of Operation (Automatic, Semi-automatic), By Application (Beverages, Food, Chemicals, Personal Care, Pharmaceuticals), And Segment Forecasts

- Report ID: GVR-3-68038-971-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Wrapping Machine Market Size & Trends

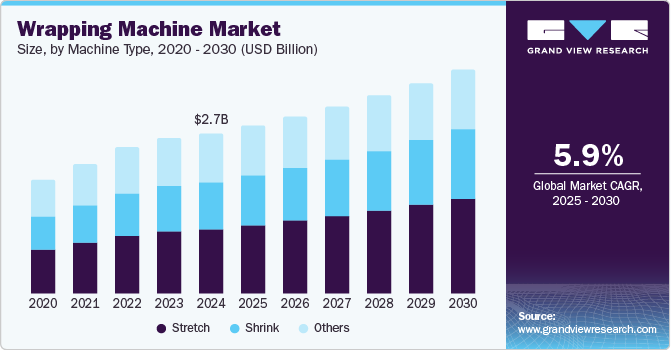

The global wrapping machine market size was valued at USD 2.68 billion in 2024 and is projected to grow at a CAGR of 5.9% from 2025 to 2030. This growth can be attributed to rapid industrialization and increasing investments in sectors such as food and beverage, which are significant contributors to demand. In addition, the rise in consumer preferences for packaged goods and a growing focus on convenience enhance the need for efficient wrapping solutions. Furthermore, technological advancements, such as PLC control systems, improve productivity and efficiency in packaging processes, further boosting market growth across various industries, including pharmaceuticals and consumer products.

A wrapping machine is a device designed to enclose products in protective packaging, ensuring their safety during storage and transportation. The wrapping machine market is currently undergoing notable transformations within the industrial packaging sector, with a pronounced shift towards sustainability, automation, and advanced connectivity. Manufacturers increasingly focus on eco-friendly solutions to enhance productivity while minimizing environmental impact. This includes integrating smart technologies in wrapping machines, which are becoming essential as global trade and e-commerce expand.

The rising awareness of environmental issues propels demand for sustainable packaging solutions, leading manufacturers to incorporate biodegradable and compostable materials into their wrapping machines. In addition, energy-efficient designs are gaining traction as companies strive to reduce electricity consumption. Automation and smart technologies are revolutionizing the wrapping machine industry by enabling higher production rates, improved efficiency, and enhanced product quality. Furthermore, the adoption of robotics, artificial intelligence (AI), and machine learning (ML) is facilitating data-driven decision-making and predictive maintenance, particularly in the food and beverage sector, where consistency and hygiene are paramount.

Moreover, there is a growing need for customized wrapping machines tailored to niche markets, driven by diverse product offerings across industries such as pharmaceuticals, cosmetics, and consumer electronics. The rise of e-commerce further fuels this demand for personalization, necessitating on-demand packaging solutions.

Machine Type Insights

The stretch machine segment held the dominant position in the market and accounted for the largest revenue share of 40.3% in 2024, primarily driven by the increasing demand for efficient packaging solutions across various industries, particularly food and beverage, and pharmaceuticals. In addition, the rise in processed and convenience foods necessitates robust packaging to ensure product safety during transportation. Furthermore, advancements in technology, such as automation and smart features, enhance the performance and reliability of stretch machines, making them more appealing to manufacturers seeking to optimize their packaging processes.

The shrink machine segment is expected to grow at a CAGR of 6.7% over the forecast period, owing to the rising need for secure packaging that conforms tightly to products. This type of wrapping is particularly favored for its ability to protect items from dust and damage while maintaining a visually appealing presentation. In addition, the expansion of e-commerce has also fueled demand for shrink-wrapped products, as businesses seek efficient ways to package items for shipping. Furthermore, innovations in shrink film technology are improving sustainability and efficiency, attracting more companies to adopt shrink-wrapping solutions in their operations.

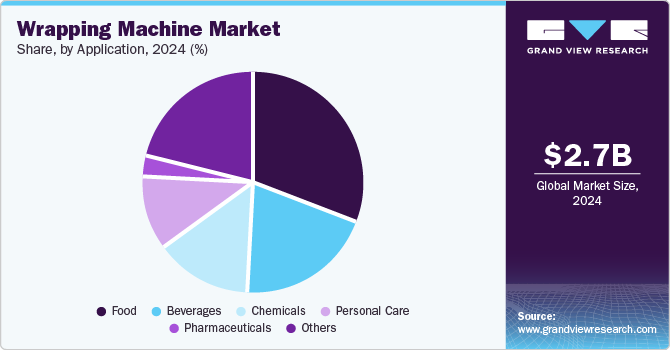

Application Insights

The food application segment dominated the market and accounted for the largest revenue share of 31.4% in 2024, primarily driven by the rising consumption of processed and convenience foods. As consumers increasingly seek ready-to-eat meals and packaged products, manufacturers are compelled to adopt advanced wrapping solutions that ensure product safety and extend shelf life. Furthermore, stringent regulations regarding food safety and hygiene further necessitate the use of efficient wrapping machines, enhancing their demand in the food industry to minimize contamination and preserve quality during transportation.

The pharmaceutical application segment is expected to grow at a CAGR of 8.6% over the forecast period, owing to the escalating need for secure and compliant packaging solutions for medicines and healthcare products. In addition, the pharmaceutical industry demands high standards of hygiene and safety, which wrapping machines can provide through advanced technology. Furthermore, the increasing production of pharmaceuticals, driven by a growing global population and rising health consciousness, fuels the demand for efficient packaging solutions. Moreover, regulatory requirements for tamper-proof and child-resistant packaging also contribute to adopting specialized wrapping machines in this sector.

Mode Of Operation Insights

The semi-automatic mode of operation led the market and accounted for the largest revenue share of 50.9% in 2024. This growth can be attributed to its feature of offering a balance between manual intervention and automation. This mode allows for flexibility in packaging processes, making it suitable for businesses with varying production volumes. In addition, the rising popularity of semi-automatic wrapping machines can also be attributed to their lower initial investment costs than fully automatic systems, appealing to small and medium-sized enterprises. Furthermore, the adaptability of semi-automatic machines to different product types and sizes enhances their appeal in diverse industries, driving their growth in the global market.

The automatic mode of operation segment is expected to grow at a CAGR of 6.7% from 2025 to 2030, owing to the increasing demand for industrial automation across various sectors. As manufacturers aim to enhance productivity and reduce labor costs, automatic wrapping machines provide efficient solutions that streamline packaging processes. In addition, the ability to operate at high speeds and maintain consistent quality further attracts businesses looking to optimize their operations. Furthermore, technological advancements in automation and smart features contribute to the appeal of automatic machines, making them essential for modern packaging needs.

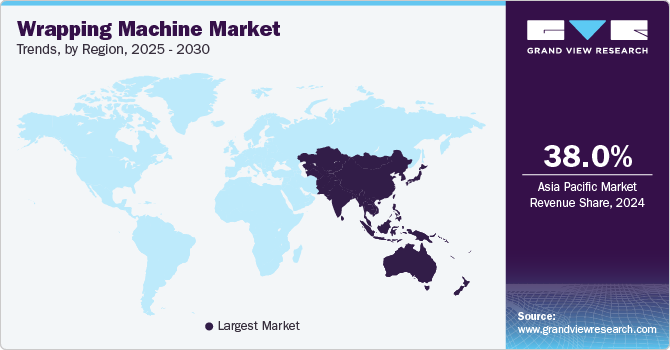

Regional Insights

The wrapping machine market in North America accounted for a significant revenue share of 22.9% in 2024, owing to technological advancements and an expanding healthcare sector. Favorable government policies supporting sustainable packaging practices encourage manufacturers to invest in modern wrapping solutions. Furthermore, the region's strong consumer base for packaged foods creates opportunities for innovative packaging technologies. As companies prioritize efficiency and compliance with safety regulations, the demand for advanced wrapping machines continues to rise across various industries.

Asia Pacific Wrapping Machine Market Trends

The Asia Pacific wrapping machine market dominated the global market and accounted for the largest revenue share of 38.0% in 2024. This growth can be attributed to the region's experiencing robust growth, driven by rapid industrialization and urbanization. In addition, the expansion of the food and beverage sector, fueled by increasing consumer demand for packaged products, significantly contributes to this trend. Furthermore, the rise of e-commerce is propelling the need for efficient packaging solutions. Investments in advanced technologies and automation further enhance production capabilities, making wrapping machines essential for manufacturers aiming to optimize their operations in this dynamic market.

The wrapping machine market in China led the Asia Pacific market and accounted for the largest revenue share in 2024, driven by the booming food and beverage industry and a surge in manufacturing activities. The country's large population and rising disposable incomes are driving demand for packaged goods. Furthermore, government initiatives promoting industrial automation and technological advancements facilitate the adoption of modern wrapping solutions. Moreover, as manufacturers seek to improve efficiency and product safety, wrapping machines are integral to meeting domestic and international packaging standards.

Latin America Wrapping Machine Market Trends

The Latin American wrapping machine market is expected to grow at a CAGR of 7.0% over the forecast period, owing to a recovering food and beverage industry following economic challenges. Countries such as Brazil are leading this resurgence, supported by GDP growth and increased industrial development. Furthermore, there is a growing inclination towards automation in packaging processes, which enhances efficiency and reduces labor costs. Moreover, as consumer preferences shift towards convenience and quality in packaged products, the demand for advanced wrapping machines is expected to rise across the region.

Europe Wrapping Machine Market Trends

The wrapping machine market in Europe is expected to witness significant growth over the forecast period, owing to increasing demand for sustainable packaging solutions and regulatory compliance in various industries. In addition, the region's focus on environmentally friendly practices encourages manufacturers to adopt innovative wrapping technologies that minimize waste. Furthermore, rising household incomes and urbanization also contribute to a greater need for packaged goods. Countries such as Germany are at the forefront of this trend, emphasizing automation and efficiency in production processes to maintain competitiveness in the global market.

Germany wrapping machine market is expected to grow substantially in 2024, driven by its strong manufacturing base and emphasis on technological innovation. The country's advanced industrial landscape fosters significant investments in automation and smart technologies, enhancing production efficiency. Furthermore, stringent product safety and sustainability regulations drive demand for high-quality wrapping solutions. Moreover, as German manufacturers seek to optimize their packaging processes while adhering to environmental standards, wrapping machines play a crucial role in achieving these objectives.

Key Wrapping Machine Company Insights

Key companies in the global wrapping machine industry include Lantech, Phoenix Wrappers, Durapak, and others. These companies are adopting strategies focused on new product development to enhance their offerings and meet evolving consumer demands. They are also pursuing strategic agreements and collaborations to leverage complementary strengths, expand market reach, and share technological advancements. Furthermore, companies are investing in research and development to innovate and integrate smart technologies, ensuring their products remain competitive in a rapidly changing landscape.

-

Lantech manufactures advanced wrapping machines, particularly stretch wrapping technology. The company offers a diverse range of products, including automatic and semi-automatic stretch wrappers, rotary arm machines, and orbital stretch wrappers.

-

Phoenix Wrappers manufactures both automatic and semi-automatic stretch wrappers and specialized equipment for shrink-wrapping applications. The company operates within the industrial packaging segment, serving sectors such as food processing, pharmaceuticals, and consumer products.

Key Wrapping Machine Companies:

The following are the leading companies in the wrapping machine market. These companies collectively hold the largest market share and dictate industry trends.

- Robopac

- Orion Packaging Systems LLC

- Lantech

- Phoenix Wrappers

- Durapak

- Matco International

- ProMach Inc.

- Coesia S.p.A

- I.M.A. Industria Macchine Automatiche S.p.A.

- Syntegon Technology GmbH

Recent Developments

-

In August 2023, Orion Packaging Systems unveiled its redesigned MA Series, a fully automatic rotary stretch wrapping machine, at PACK EXPO 2023. This innovative wrapping machine is engineered for high throughput in end-of-line applications and accommodates various load types. Key features include a four-legged design for stability, enhanced safety measures, and a user-friendly control system. The MA Series significantly reduces installation time and improves load protection during transit.

Wrapping Machine Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.82 billion

Revenue forecast in 2030

USD 3.75 billion

Growth Rate

CAGR of 5.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Machine type, mode of operation, application, region

Regional scope

North America; Asia Pacific; Europe; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; China; India; Japan; South Korea; Australia; Germany; UK; France; Italy; Spain; Brazil; Saudi Arabia; UAE

Key companies profiled

Robopac; Orion Packaging Systems LLC; Lantech; Phoenix Wrappers; Durapak; Matco International; ProMach Inc.; Coesia S.p.A; I.M.A. Industria Macchine Automatiche S.p.A.; Syntegon Technology GmbH.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Wrapping Machine Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the wrapping machine market report based on machine type, mode of operation, application, and region.

-

Machine Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Stretch

-

Shrink

-

Others

-

-

Mode of Operation Outlook (Revenue, USD Million, 2018 - 2030)

-

Automatic

-

Semi-automatic

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Food

-

Beverages

-

Chemicals

-

Personal Care

-

Pharmaceuticals

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Russia

-

UK

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

Australia

-

India

-

-

Latin America

-

Brazil

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.