- Home

- »

- Consumer F&B

- »

-

Yogurt Drink Market Size & Share Report, 2030GVR Report cover

![Yogurt Drink Market Size, Share & Trends Report]()

Yogurt Drink Market (2022 - 2030) Size, Share & Trends Analysis Report By Product (Conventional, Vegan), By Packaging (Bottles, Tetra Packs), By Distribution Channel (Hypermarkets & Supermarkets, Online), And Segment Forecasts

- Report ID: GVR-2-68038-280-8

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global yogurt drink market size was valued at USD 49.30 billion in 2021 and is expected to exhibit a compound annual growth rate (CAGR) of 6.4% from 2022 to 2030. The growth of the market can be attributed to the rising consumer awareness regarding lifestyle disorders, and the resultant shift towards healthy and probiotics-rich food products. The product is rich in nutrients that help boost health and reduce the risk of diseases such as obesity. According to an article published in Multidisciplinary Digital Publishing Institute (MDPI), in February 2022, 70% of consumers prefer drinkable yogurt owing to its nutritious properties. The COVID-19 pandemic resulted in positive as well as negative impacts on the industry.

The onset of the pandemic resulted in grocery stockpiling, most notably in categories, such as dairy products and snacks, which initially caused shortages in market supply. Furthermore, stay-at-home orders mandated by the pandemic have accelerated yogurt’s return to relevance, as consumers prefer familiar, affordable, healthy products. According to an article published by Dairyreporter.com, in February 2021, the sale of yogurt increased by 4.1% during the lockdown phase. The increasing focus on healthy food habits due to the virus spread initiated an upward trend for these products. Companies in North America and the Asia Pacific have been promoting yogurt as an essential drink for good health, which is further expected to fuel market growth.

Moreover, companies are collaborating with dairy farms to ensure an efficient supply of raw materials for the production of yogurt drinks. For instance, in January 2021, Oikos Pro, a sub-brand of Danone North America launched high-protein, functional yogurt cups, and beverages that serve a new consumption occasion and the high-protein trend. The initiative was taken to expand the company line into health drinks, which is expected to have a positive impact on the industry in the forecast period. The rising demand for probiotic foods and healthier snacking food products among health-conscious consumers including both adults and children will further bolster the market growth. Many key brands have been launching products in this segment as consumers are shifting toward a healthier lifestyle.

For instance, in August 2021, Lactalis India, part of France’s Lactalis Group, launched Lactel Turbo Yogurt Drink in Chennai. The ‘on-the-go’ drink will be available in mango and strawberry flavors and is thicker in texture due to the presence of protein and fruits. Key players have been ramping up production to strengthen their market position and meet the increasing demand. For instance, in March 2021, Horizon Organic Growing Years expanded its line of milk-based products that focus on overall health and wellbeing. The new products were developed in partnership with pediatricians and are fortified with DHA, choline, & other nutrients and include new low-fat yogurt pouches, cultured dairy smoothies, reduced-fat milk half-gallons, & single-serve whole-milk boxes.

A large number of manufacturers is involved in R&D and innovation to develop new flavors to meet the rising demand. For instance, in March 2022, International Dairy Foods Association (IDFA) held a Yogurt & Cultured Innovation Conference on how manufacturers need to work on new ideas to develop yogurt and cultured dairy products. This is expected to propel the market growth over the forecast period. Yogurt manufacturers are likely to incur high costs due to the rise in environmental concerns pertaining to the expensive packaging processes of yogurt drinks. To tackle this, yogurt manufacturers are collaborating with local dairy distributors to enter the market in developing regions.

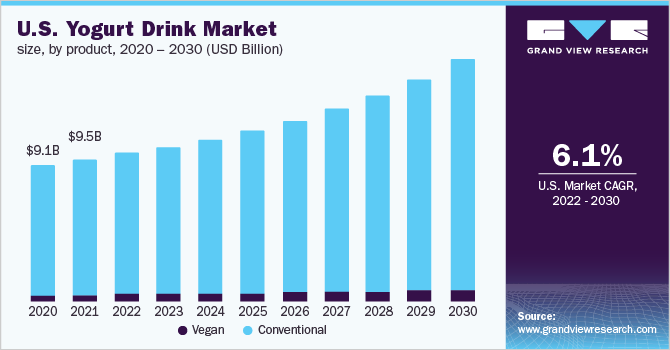

Product Insights

The conventional products segment led the market in 2021 and accounted for the largest share of more than 93.5% of the global revenue. The segment is expected to maintain its dominance in the forecast period. The rising cases of obesity are anticipated to be among the major growth-driving factors for the segment. Conventional drinks have been characterized as calcium- and phosphorus-enriched products that help in improving bone health. For instance, in March 2020, Japan’s dairy company, Megmilk Snow, launched a yogurt drink to relieve allergy symptoms. Proteins and vitamins in these drinks help in removing toxins from the body.

On the other hand, the vegan segment is projected to register the fastest CAGR during the forecast period. The possible ability of vegan products to reduce cholesterol levels, which reduces the chances of digestion-related problems, is projected to fuel the growth of this segment during the forecast period. According to an article published in Health Careers, in January 2020, 39% of consumers in the United States are adding more vegan food and drink options to their meals. Furthermore, the availability of diversified products in different flavors will boost the segment growth in the coming years.

Packaging Insights

On the packaging types, the market has been bifurcated into tetra packs and bottles. The tetra packs packaging segment held the largest share of more than 88.00% of the global revenue in 2021 and is expected to maintain its dominance in the forecast period. With significant changes in consumer lifestyles, a vast majority of consumers across the globe are opting for on-the-go products, which offer ease of consumption as well as waste disposal. This is expected to contribute to the segment growth during the forecast period. For instance, in October 2019, Tetra Pak launched a line of packaging for different yogurt products including stirred, set, drinking, concentrated, and ambient.

Also, tetra packs are considered to be more eco-friendly as compared to plastic bottles, which will increase product visibility among consumers. However, bottles are projected to register the fastest CAGR during the forecast period. With a change in lifestyle, a large number of people across the globe are opting for on-the-go products, which, in turn, is projected to fuel the segment growth over the forecast period. Furthermore, the availability of different sizes and shapes in accordance with consumer needs will support the segment growth. For instance, Epigamia offers its yogurt smoothie in bottles of 180ml and 200ml.

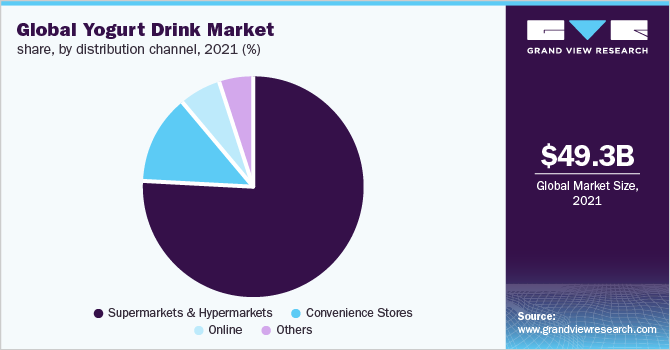

Distribution Channel Insights

The hypermarkets & supermarkets segment accounted for the largest share of 75.5% of the global revenue in 2021. An increasing number of these stores across various regions is the major growth-driving factor for the segment. For instance, in May 2021, Costco Wholesale reported that during the third quarter of 2021, which ended on May 9, its sales went up from USD 36.45 billion in 2020 to USD 44.38 billion in 2021. Moreover, the expansion of modern retail chains in Asia Pacific countries, such as Thailand, Malaysia, Philippines, and Indonesia, will support the segment growth over the coming years.

The online distribution channel segment is anticipated to register the fastest CAGR during the forecast years. The segment is poised to emerge as a steady source of revenue over the forecast period. Promising growth exhibited by e-commerce platforms in emerging countries, including India and China, is compelling manufacturers to reorient their retail strategies in these countries. For instance, in March 2021, Drums Food International, a yogurts & smoothies brand, switched to selling its products through e-commerce platforms. It has also introduced a range of new products, such as ghee-based chocolate spreads, cream cheese, and cottage cheese, apart from reintroducing its label products.

Regional Insights

The Asia Pacific made the largest contribution to the global market with a revenue share of 41.8% in 2021. This growth was credited to the rising product demand on account of the high awareness among consumers regarding following a healthy dietary pattern. In addition, the willingness of consumers to spend on healthy snacks and beverages has facilitated manufacturers to innovate and produce a variety of beverages in the region. Innovations by key manufacturers in this product segment will further drive its growth. For instance, in June 2021, IFF launched YO-MIX ViV, a solution for ambient yogurt and other fermented drinks, with a focus on China.

Launches of supportive products will further increase sales. Central & South America is expected to be the fastest-growing regional market from 2022 to 2030. A rise in the consumption of dairy products in the region, especially in developed countries, such as Argentina and Brazil, is expected to drive regional demand. Moreover, in the CSA region, yogurt is considered an ideal snack for kids, thus companies focus on launching new products. For instance, in February 2019, Brainiac launched a line childrens’ yogurts product line. The initiative was taken to further expand the company’s product portfolio and make products available to a wider audience.

Key Companies & Market Share Insights

The market is extremely competitive due to the presence of global companies as well as small-scale companies with high manufacturing volumes. A large number of companies are involved in research and development to offer improved and better-quality yogurt drinks. Most companies are focusing on new product launches and innovations to attract more consumers. Some of the key players operating in the global yogurt drink market include:

-

Danone

-

Nestlé

-

Yakult Honsha Co., Ltd.

-

General Mills Inc.

-

Meiji Holdings Co., Ltd.

-

Chobani, LLC

-

Fonterra Co-operative Group Ltd.

-

Arla Foods Amba

-

Lactalis Group

-

Benecol Ltd.

Yogurt Drink Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 52.01 billion

Revenue forecast in 2030

USD 86.08 billion

Growth rate

CAGR of 6.4% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, packaging, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Germany; U.K.; Italy; China; India; Japan; Brazil;

Key companies profiled

Danone; Nestlé; Yakult Honsha Co., Ltd.; General Mills Inc.; Meiji Holdings Co., Ltd.; Chobani, LLC; Fonterra Co-operative Group Ltd.; Arla Foods Amba; Lactalis Group; Benecol Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global yogurt drink market report based on product, packaging, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Vegan

-

Conventional

-

-

Packaging Outlook (Revenue, USD Million, 2017 - 2030)

-

Bottles

-

Tetra Packs

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Hypermarkets & Supermarkets

-

Convenience Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Europe

-

-

Germany

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global yogurt drink market size was estimated at USD 49.30 billion in 2021 and is expected to reach USD 52.01 billion in 2022.

b. The global yogurt drink market is expected to grow at a compound annual growth rate of 6.4% from 2022 to 2030 to reach USD 86.08 billion by 2030.

b. The Asia Pacific dominated the yogurt drink market with a share of 41.8% in 2021. This is attributed to the growing consumer inclination towards healthy dietary patterns.

b. Some key players operating in the yogurt drink market include Danone, Nestlé, Yakult Honsha Co., Ltd., General Mills Inc., Meiji Holdings Co., Ltd., Chobani, LLC, Fonterra Co-operative Group Limited, Arla Foods amba, Lactalis Group, and Benecol Limited

b. Key factors that are driving the yogurt drink market growth include rising consumer awareness regarding lifestyle disorders and the resultant shift towards healthy and probiotics-rich food products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.