- Home

- »

- Market Trend Reports

- »

-

Aflibercept (Eylea) Market: Strategic Shifts Post-Patent Expiry And Biosimilar Impact

Overview

Aflibercept (Eylea) is a key anti-VEGF therapy used to treat wet age-related macular degeneration, diabetic macular edema, diabetic retinopathy, and retinal vein occlusion. It is widely adopted due to its strong efficacy and convenient dosing schedule compared with other anti-VEGF agents. Market growth is supported by an expanding diabetic population and rising prevalence of retinal disorders globally. Recent developments focus on high-dose formulations and extended dosing intervals, improving patient adherence. However, the market faces challenges from emerging biosimilars, price pressures, and competition from alternative therapies like faricimab and ranibizumab biosimilars, making innovation and lifecycle management critical for sustained adoption.

Key Report Deliverables

-

Analyze the Aflibercept (Eylea) market landscape, detailing the current market size, growth drivers, and key industry trends, particularly in light of the upcoming patent expiration and the impact of biosimilars entering the market.

-

Forecast Market Growth, projecting future trends for the Aflibercept market, highlighting emerging opportunities within the biosimilar space, and assessing potential risks to growth as competition increases following patent expiry.

-

Identify Regulatory and Market Barriers, providing insights into regulatory and market barriers that could impact future market expansion and product development, with a specific focus on the challenges biosimilars may face in gaining approval and market access.

-

Concurrent Competitive Landscape, identifying key players in the Aflibercept market, including both originator and biosimilar manufacturers. Examine their strategic moves, partnerships, and distribution of market share to understand competitive positioning and potential shifts as biosimilars are introduced.

-

Regulatory Barriers, identifying key regulatory challenges related to the entry of Aflibercept biosimilars, including approval processes and market access restrictions, and assessing their potential impact on the speed and scope of market expansion.

-

Strategic Implications, evaluating strategic moves for Janssen Biotech and its competitors to maintain leadership in the Aflibercept market. This includes exploring innovation, differentiation, potential patient support programs, and geographic expansion strategies.

Patent Cliff Analysis

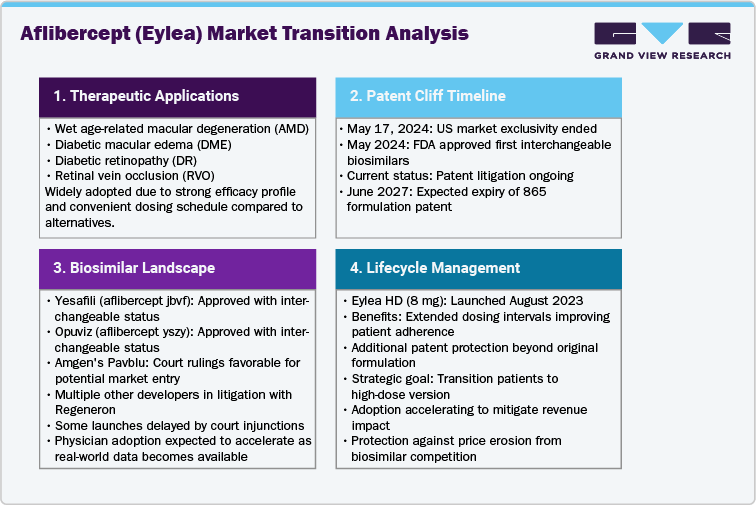

Aflibercept (Eylea) is entering a key transition period as market exclusivity ended in the United States on May 17, 2024. This milestone allowed the Food and Drug Administration (FDA) to approve and designate interchangeable biosimilars, setting the stage for competition. In May 2024, the FDA approved Yesafili (aflibercept jbvf) and Opuviz (aflibercept yszy) as interchangeable biosimilars, enabling potential market entry.

Regeneron Pharmaceuticals continues to protect Eylea’s market position through patent enforcement. The company asserts the 865 formulation patent with an expected expiry in June 2027, making it a focal point in litigation against multiple biosimilar developers. Courts have granted injunctions in some cases, delaying launches, while rulings in late 2024 allowed Amgen to prepare for potential entry.

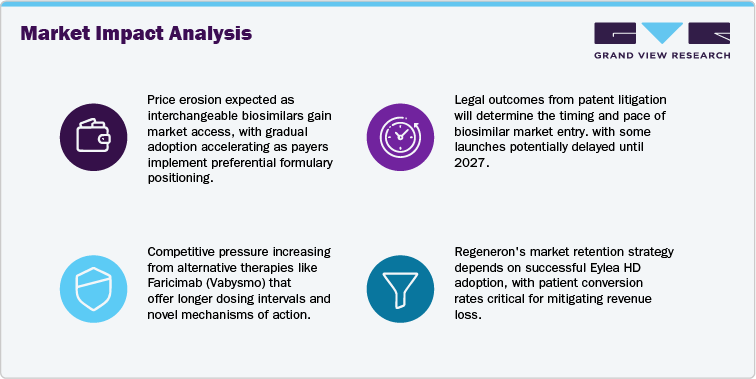

The major business risk is price erosion and market share loss as biosimilars gain availability. Payer adoption and physician switching to lower-cost alternatives are likely once products launch. Regeneron’s lifecycle management strategy focuses on Eylea HD (8 mg), which offers extended dosing intervals and is protected by additional patents.

Eylea’s patent cliff is expected to be gradual, with key patents protected until mid-2027. The timing of biosimilar launches will depend on pending litigation outcomes and commercial agreements, while Regeneron’s strategy integrates legal defense and high-dose product roll-out to support market share retention and mitigate revenue impact.

Eylea retained full market exclusivity through May 2024, resulting in limited revenue risk during this period. The FDA approved the first interchangeable biosimilars, Yesafili (aflibercept-jbvf) and Opuviz (aflibercept-yszy), in May 2024. However, commercial launches were delayed by patent litigation and injunctions, and most payers and clinics continued prescribing branded Eylea through the end of 2024.

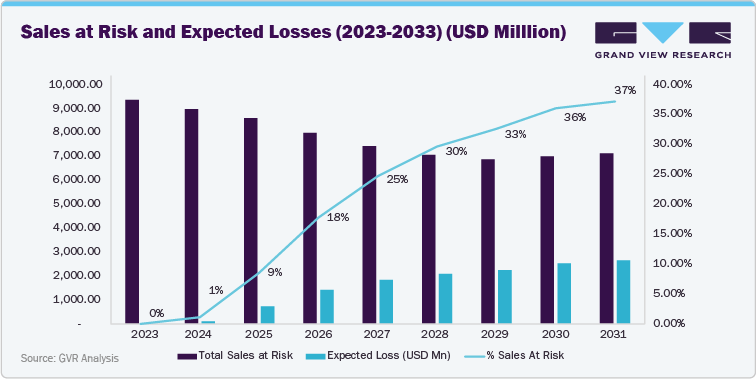

Sales at risk rise from 9% in 2025 to 25% in 2027, reflecting the phased market entry of multiple biosimilars and expanded payer contracting. Competitive pressure intensifies as additional developers, including Amgen, Sandoz, and Alvotech, prepare for launch. The expiration of the 865-formulation patent in June 2027 allows for broader competition, driving both price adjustments and accelerated market share shifts toward biosimilars.

Sales at risk peak at 30% in 2028 and remain between 33% and 37% through 2033. This represents a mature competitive environment where biosimilar penetration reaches a steady state, and payer contracting reflects fully adjusted pricing. Conversion to Eylea HD (8 mg) provides partial mitigation by supporting longer dosing intervals and sustaining a portion of branded product demand.

The primary factors influencing this trend include the loss of regulatory exclusivity in 2024, the availability of interchangeable biosimilars, price compression from payer negotiations and tendering, and physician adoption of biosimilars as real-world data builds confidence. Lifecycle management initiatives, including the rollout of Eylea HD, are expected to slow but not fully offset the revenue impact.

Current Market Scenarios

Aflibercept (Eylea) remains a leading therapy for wet age-related macular degeneration (AMD), diabetic macular edema (DME), diabetic retinopathy (DR), and retinal vein occlusion (RVO). Its established clinical profile and widespread use have made it a first-line treatment across major markets, contributing significantly to Regeneron’s portfolio and maintaining strong adoption among ophthalmologists.

U.S. regulatory exclusivity ended in May 2024, opening the door for biosimilar competition. The FDA approved interchangeable biosimilars Yesafili (aflibercept jbvf) and Opuviz (aflibercept yszy), signaling a major shift in the competitive landscape. Launch timelines are shaped by patent litigation and settlements. Regeneron’s IP strategy centers on the 865-formulation patent expiring in June 2027, with courts issuing injunctions to delay some launches while allowing Amgen’s Pavblu to prepare for market entry, indicating phased biosimilar adoption.

To mitigate biosimilar impact, Regeneron launched Eylea HD (8 mg) in August 2023, offering longer dosing intervals and additional patent coverage. The company’s goal is to transition patients to the high-dose version and maintain treatment continuity.

Competitive pressure is rising as payers encourage biosimilar adoption, physician confidence grows with real-world data, and alternative anti-VEGF therapies like Faricimab (Vabysmo) expand market share.

The aflibercept market is in a transition phase, with litigation outcomes, settlement agreements, and Eylea HD uptake determining how quickly biosimilars gain share and how well Regeneron manages revenue risk. Physician engagement, payer alignment, and lifecycle management will be critical for sustaining market presence.

Market Dynamics

“Expanding Retinal Disease Burden Aflibercept Market Growth”

The key driver of the Aflibercept (Eylea) market is the rising prevalence of retinal disorders including wet age-related macular degeneration (AMD), diabetic macular edema (DME), diabetic retinopathy (DR), and retinal vein occlusion (RVO). These conditions are leading causes of vision impairment, and their incidence is increasing in line with global population aging and rising diabetes prevalence. According to international health agencies, the proportion of the population over 60 continues to grow, significantly expanding the eligible patient pool for anti-VEGF therapy.

Additionally, the worldwide diabetes epidemic is creating a sustained flow of patients at risk for diabetic eye disease, which is one of the fastest-growing segments within ophthalmology. Eylea’s broad clinical indication coverage positions it as a first-line treatment choice for ophthalmologists, supported by robust clinical trial evidence and real-world data. Improvements in screening programs, early diagnosis rates, and treatment accessibility in emerging markets are expected to further increase therapy initiation rates. These trends collectively underpin strong demand for anti-VEGF agents such as aflibercept, ensuring that the drug maintains a central role in the standard of care across multiple geographies, even as the market begins to shift toward new entrants and biosimilar competition.

“Biosimilar Entry and Competitive Pressure limit Aflibercept growth”

The most significant restraint for the Aflibercept (Eylea) market is the entry of biosimilars and intensifying competition from other anti-VEGF agents. The loss of U.S. regulatory exclusivity in May 2024 opened the market to biosimilar competition, with the FDA approving Yesafili (aflibercept jbvf) and Opuviz (aflibercept yszy) as interchangeable biosimilars. Legal proceedings and patent litigation continue to shape the timing of market launches, but several developers including Amgen, Sandoz, and Biocon are preparing for entry as early as 2025–2026. This development will likely drive price erosion as payers implement formulary management strategies to encourage use of lower-cost alternatives.

Physician adoption of biosimilars may begin cautiously but is expected to rise with real-world clinical data and payer incentives. At the same time, competition from innovative therapies such as faricimab, which offers dual pathway inhibition and extended dosing intervals, is gaining momentum and capturing a portion of new patient starts. Together, these dynamics pose a risk of market share erosion and will likely shift prescribing patterns away from the reference product over the next few years, making competitive differentiation increasingly important for Regeneron.

“Lifecycle Extension through Eylea HD for Aflibercept Growth”

A major opportunity in the Aflibercept (Eylea) market lies in the successful adoption of Eylea HD (8 mg), which was approved by the FDA in August 2023. This high-dose formulation offers the potential for extended dosing intervals, reducing treatment burden for patients and improving clinic scheduling efficiency for providers. The product is supported by additional patent protection, which can delay the impact of biosimilar substitution for the original 2 mg dose.

Regeneron’s strategy involves transitioning existing patients to Eylea HD and leveraging its clinical data to strengthen physician confidence and payer support. This approach also creates a differentiated value proposition compared to biosimilars, which are initially approved only for the 2 mg formulation. By combining educational initiatives, real-world evidence generation, and patient support programs, Regeneron can encourage sustained use of the branded product and slow revenue erosion. In addition, markets outside the U.S. with varying patent landscapes provide further opportunity for staggered rollouts and pricing optimization. The successful uptake of Eylea HD will be a key factor in preserving market leadership and extending the commercial life cycle of aflibercept as competitive pressures intensify globally.

“Accelerated Biosimilar Approvals and Market Entry, Shift to High-Dose Formulations and Dosing Innovation, Competitive Landscape and Cost Pressures contributing to the market “

-

Accelerated Biosimilar Approvals and Market Entry

The Aflibercept (Eylea) market is entering a competitive phase following the FDA approval of interchangeable biosimilars Yesafili (aflibercept jbvf) and Opuviz (aflibercept yszy) in May 2024. Legal decisions, including the Federal Circuit’s denial of an injunction, have allowed companies such as Amgen to prepare for U.S. launch. In Europe, the European Commission approved Afqlir and Mynzepli, signaling multi-region biosimilar availability and increased substitution pressure.

-

Shift to High-Dose Formulations and Dosing Innovation

The approval of Eylea HD (8 mg) in August 2023 introduced extended dosing intervals of up to 16 weeks, supporting patient adherence and clinic efficiency. This formulation is a cornerstone of Regeneron’s lifecycle management strategy to retain market share and create differentiation from biosimilars targeting the 2 mg dose.

-

Competitive Landscape and Cost Pressures

The market is facing competition from faricimab (Vabysmo), which offers dual pathway inhibition and flexible dosing schedules. Payers in the U.S. and Europe are prioritizing cost containment through formulary management and tender systems, accelerating biosimilar adoption once available. These dynamics are expected to drive price pressure and require proactive market access and physician engagement strategies.

Overview of Alternative Therapeutics

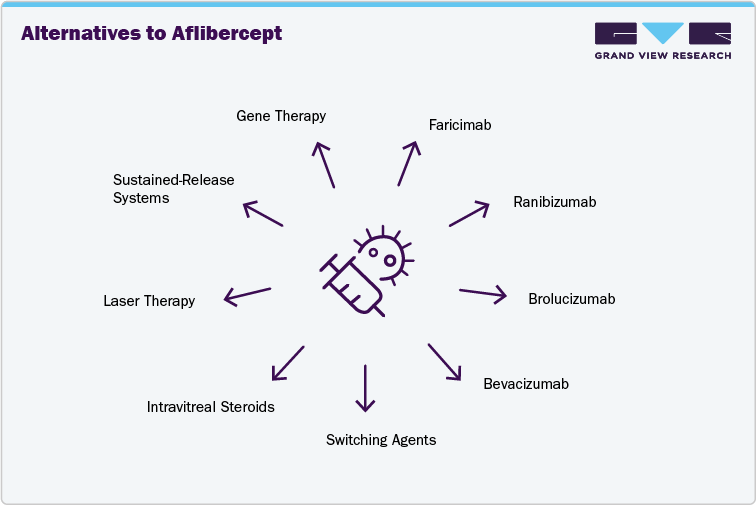

The primary alternatives to Aflibercept (Eylea) include Faricimab (Vabysmo), Ranibizumab (Lucentis and biosimilars), Brolucizumab (Beovu), and Bevacizumab (Avastin, off-label use). Faricimab is a bispecific antibody targeting VEGF and Ang-2, allowing extended dosing intervals and demonstrating comparable visual outcomes to Eylea in wet AMD and diabetic macular edema. Ranibizumab, now available with multiple biosimilars, remains widely used in retinal care. Brolucizumab offers high molar concentration and potential for longer dosing gaps. Bevacizumab, though not formally approved for ocular indications, is used off-label for cost-sensitive patients and markets.

For patients with suboptimal response to anti-VEGF therapy, clinicians consider switching agents, adding intravitreal steroids such as dexamethasone implants or triamcinolone, or using laser therapy or photodynamic therapy as adjunctive measures. These approaches address persistent fluid, inflammation, or disease activity when monotherapy is insufficient.

The market is evolving toward sustained-release delivery systems, gene therapy, and next-generation pathway inhibitors targeting angiogenesis, inflammation, and neuroprotection. These innovations aim to reduce treatment burden and improve long-term outcomes. Several programs are in clinical development with the potential to disrupt current anti-VEGF treatment paradigms and reshape the competitive landscape for retinal disease therapies.

Competitive Landscape

Aflibercept (Eylea) remains a central treatment in the anti-VEGF market with use across wet age-related macular degeneration (AMD), diabetic macular edema (DME), and diabetic retinopathy (DR). Regeneron and Bayer are focusing on the rollout of Eylea HD (8 mg), approved by the FDA in August 2023, to support extended dosing intervals of eight to sixteen weeks. This lifecycle management strategy aims to transition patients to the high-dose formulation and sustain payer coverage to limit biosimilar substitution.

The competitive environment is shifting with FDA approval of interchangeable biosimilars Yesafili (aflibercept jbvf) and Opuviz (aflibercept yszy) in May 2024. The Federal Circuit’s decision allowing Amgen’s Pavblu to prepare for launch accelerates competitive entry. Regeneron’s settlement with Sandoz will enable Enzeevu to launch by late 2026. In Europe, the European Commission approved Afqlir and Mynzepli, creating multi-sponsor competition across key markets.

Roche Susvimo implant has relaunched with new approvals for DME and DR, offering a continuous delivery alternative to injections. Faricimab (Vabysmo) is gaining share due to its dual VEGF and Ang-2 inhibition and flexible dosing intervals. Ranibizumab biosimilars and Brolucizumab (Beovu) continue to influence treatment patterns and price negotiations. Astellas acquisition of Iveric Bio strengthens its position in retina with the commercialization of Izervay for geographic atrophy. Bausch + Lomb acquisition of Xiidra and other Novartis ophthalmology assets expands its presence in the eye-care market, enhancing its ability to compete in retina therapeutics.

The market is entering a phase of intense competition driven by biosimilar launches, next-generation biologics, and delivery innovations. Regeneron’s ability to drive Eylea HD conversion, maintain reimbursement alignment, and manage launch sequencing will be critical to sustaining market share as pricing pressure and treatment mix shifts accelerate.

Regional Analysis

North America Aflibercept (Eylea) Market

In North America, particularly the United States, the market is transitioning toward a competitive phase following the FDA approval of interchangeable biosimilars Yesafili (aflibercept jbvf) and Opuviz (aflibercept yszy) in May 2024. The Federal Circuit decision in late 2024 cleared Amgen’s Pavblu to move toward launch, making biosimilar entry a near-term reality. Regeneron is prioritizing the conversion of patients to Eylea HD (8 mg), which allows eight-to-sixteen-week dosing intervals and differentiates from biosimilars targeting the 2 mg dose. Payers are preparing formulary strategies, step therapy protocols, and rebate negotiations to capture savings once biosimilars launch. Roche’s Susvimo implant, relaunched with approvals for diabetic macular edema and diabetic retinopathy in 2025, introduces an alternative delivery platform that can reduce injection frequency and compete for patients who need lower treatment burden solutions.

Europe Aflibercept (Eylea) Market

Europe is at the forefront of biosimilar adoption due to centralized procurement systems and cost-containment priorities. The European Commission approved Afqlir in late 2024 and Mynzepli in August 2025, paving the way for multi-sponsor competition across major EU markets. Tender processes are expected to drive rapid uptake once pricing contracts are awarded, potentially resulting in faster share erosion compared to the U.S. To defend market share, Eylea 8 mg received a label update in June 2025 permitting six-month dosing intervals for nAMD and DME, which strengthens its competitive positioning. National variations in interchangeability policy and physician preference will influence the pace of biosimilar substitution, but price-sensitive markets such as the UK, Germany, and Nordics are likely to see early and substantial adoption.

Asia Pacific Aflibercept (Eylea) Market

Asia Pacific is seeing steady growth driven by rising diabetes prevalence and improved access to ophthalmology services. Japan approved Eylea 8 mg in January 2024, supporting longer dosing intervals and aligning with clinical adoption trends. Faricimab (Vabysmo) has gained traction across key markets including Japan, South Korea, and Australia, offering dual pathway inhibition and extended dosing intervals. Local biosimilar programs are advancing, particularly in South Asia and China, with some approvals expected ahead of global launches. Market execution depends heavily on reimbursement coverage, with private sector uptake often preceding public sector inclusion. Companies are focusing on physician training, screening initiatives, and patient support programs to drive adoption and manage competition.

Latin America Aflibercept (Eylea) Market

Latin America remains a cost-sensitive region where bevacizumab off-label use is common due to affordability constraints. Regulatory frameworks are evolving to encourage biosimilar uptake, with Brazil’s RDC 875/2024 streamlining comparability requirements for biosimilar registration. This development may accelerate aflibercept biosimilar approvals and procurement tenders in Brazil and neighboring markets. Originator strategies focus on highlighting dosing efficiency and clinical outcomes to justify premium positioning in public tenders and private pay settings. In major urban markets, private insurance and specialty clinics are expected to adopt Eylea HD earlier, while public systems will likely shift to biosimilars once pricing is competitive and supply is secured.

Middle East and Africa Aflibercept (Eylea) Market

In the Middle East and Africa, the key market driver is the high and rising diabetes burden leading to increased incidence of diabetic retinopathy. Access remains uneven, with treatment largely concentrated in urban centers and tertiary care hospitals. Public health systems are beginning to incorporate retinopathy screening programs, which will expand diagnosis and treatment demand. Biosimilars are expected to play an important role in improving access as governments seek cost-effective solutions for growing patient volumes. Originator companies are focusing on key account management, training for retinal specialists, and promoting the benefits of extended dosing intervals to optimize clinic capacity. Adoption rates will depend on reimbursement decisions, logistics infrastructure, and the pace of ophthalmology workforce development.

Analyst Perspective

The Aflibercept (Eylea) market is positioned at a critical inflection point. The FDA approval of interchangeable biosimilars Yesafili and Opuviz in May 2024, along with the Federal Circuit’s decision allowing Amgen’s Pavblu to advance toward launch, signals the beginning of competitive entry in the United States. Regeneron’s Eylea HD (8 mg), with its eight-to-sixteen-week dosing schedule, is central to the company’s defense strategy and patient conversion efforts. In Europe, the approvals of Afqlir and Mynzepli and the label update permitting six-month intervals for Eylea 8 mg highlight both the speed of biosimilar adoption and the importance of differentiating through dosing flexibility. The market is further shaped by Roche’s Susvimo implant re-entry and Faricimab (Vabysmo) uptake, which broaden treatment choice. Over the forecast period, analysts expect significant price erosion and formulary-driven share shifts, with originator performance hinging on HD uptake and payer alignment.

Case Study (Recent Engagement): Keytruda Patent-Cliff & Price-Erosion Impact Model

PROJECT OBJECTIVE

To evaluate the potential revenue, price, and patient access implications of Keytruda’s 2028 patent cliff, incorporating biosimilar entry dynamics, country-specific adoption curves, and Merck’s lifecycle defense strategies (remarkably the subcutaneous formulation). The goal was to provide the client with a transparent, scenario-based model to anticipate outcomes and inform strategy.

GVR SOLUTION

-

Built a bottom-up commodity-flow and analogue-based model, anchored on Merck’s $29.5B Keytruda sales in 2024.

-

Integrated jurisdictional LOE timelines (EU mid-2028, U.S. 2028-2029 pending litigation outcomes).

-

Modeled biosimilar adoption S-curves calibrated to oncology antibody analogues (EU faster via tenders, U.S. slower via contracting).

-

Applied price-erosion benchmarks (EU -15-30% Yr-1, deepening to -45-60% by Yr-3; U.S. -10-25% net decline over same horizon).

-

Layered lifecycle defenses (SC uptake assumptions of 25-40% of innovator units, combo refresh, contracting) to quantify buffers.

-

Delivered outputs as a dynamic Excel scenario tool and a management-ready PPT deck with revenue bridges, sensitivity tornadoes, and SC migration visuals.

IMPACT FOR CLIENT

-

Enabled the client to quantify downside vs. defense-optimized revenue trajectories:

-

Base case: 30-40% global revenue decline by Year-3 post-LOE.

-

Downside: 45-55% decline in tender-heavy markets.

-

Defense-optimized: Contained erosion to ~-20-25% with strong SC adoption.

-

-

Gave the client a clear view of which markets drive early erosion (EU) and where strategic contracting or SC migration can preserve share (U.S.).

-

Equipped decision-makers with a playbook of watch-points (tender concentration, litigation outcomes, SC IP coverage, combo pipeline) to guide commercial strategy.

-

Provided a transparent methodology that could be presented to boards/investors with evidence-backed assumptions

WHY THIS MATTERS

-

Keytruda is the world’s best-selling cancer drug, representing nearly one-third of Merck’s revenue.

-

Patent expiry will reshape both Merck’s earnings profile and global oncology access dynamics.

-

Payers and governments stand to benefit from biosimilar entry through lower costs, but manufacturers need to manage cliff risk while capturing upside from lifecycle innovations.

-

Understanding how quickly revenues erode and how patient access expands post-biosimilar is critical for:

-

Biopharma companies (strategic planning, pipeline prioritization).

-

Investors (valuing Merck’s cash flows beyond 2028).

-

Payers and policymakers (budgeting for oncology drug spend).

-

-

A robust patent cliff model helps clients navigate the dual challenge of price erosion and patient expansion, ensuring strategies are grounded in real-world benchmarks.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

-

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified