- Home

- »

- Market Trend Reports

- »

-

Daratumumab (DARZALEX): Cornerstone Anti-CD38 Therapy For Multiple Myeloma

Report Overview

The Daratumumab (DARZALEX) market is experiencing notable developments, influenced by evolving regulatory standards, increasing demand, and shifting competitive dynamics within the pharmaceutical industry. As the market expands, it is essential to consider factors impacting its growth trajectory, emerging trends, and strategies employed by competitors. This report provides a detailed analysis of current market conditions, competitive positioning, and potential growth opportunities, delivering key insights to support strategic business decisions and investment opportunities within the pharmaceutical sector.

Key Report Deliverables

-

Analyze the Daratumumab (DARZALEX) market landscape, detailing its current size, growth drivers, and key industry trends shaping the pharmaceutical sector.

-

Evaluate the competitive environment, identifying key players, their strategic moves, and the distribution of market share to understand competitive positioning.

-

Forecast market growth by projecting future trends, highlighting emerging opportunities, and assessing potential risks to growth.

-

Identify regulatory and market barriers, providing insights into challenges that could impact future market expansion and product development.

-

Concurrent Competitive Landscape, Assessing the current competitive environment, examining both direct and indirect competitors within the market.

Current Market Scenarios

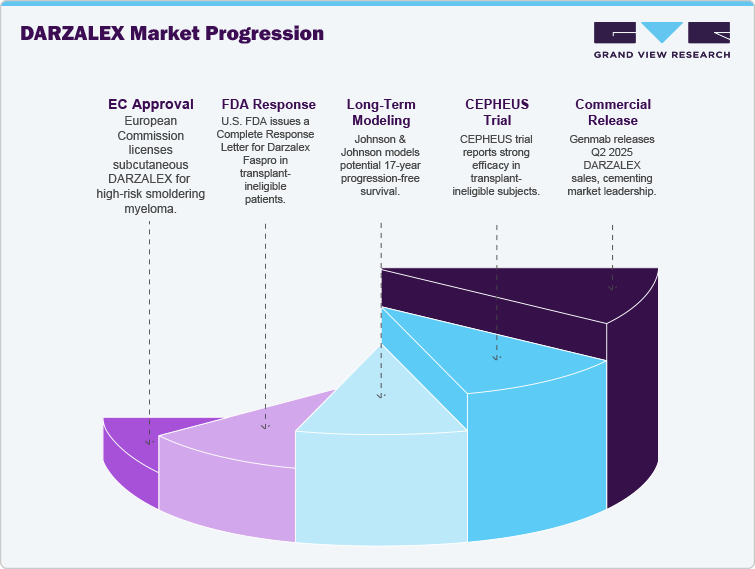

The Daratumumab (DARZALEX) market remains dynamic with important regulatory, clinical, and commercial events. In July 2025, the European Commission licensed subcutaneous Daratumumab (DARZALEX) in patients with high-risk smouldering multiple myeloma, representing the first approved therapy in this early disease stage. The European Commission approved it based on the Phase 3 AQUILA study, demonstrating a 51% progression or death reduction and 5-year PFS 63% compared to 41% with monitoring. Conversely, the U.S. FDA provided a Complete Response Letter in August 2025 for Darzalex Faspro in the newly diagnosed, transplant-ineligible patient setting.

Johnson & Johnson made long-term modeling in April 2025 based on PERSEUS and CEPHEUS studies, which showed potential 17 years progression-free survival in transplant-eligible patients receiving daratumumab plus VRd. Reports from the CEPHEUS trial at ASCO 2025 substantiated strong efficacy in transplant-ineligible subjects, with MRD negativity in a high percentage. Genmab commercially released Q2 2025 DARZALEX USD 3.54 billion net sales, cementing its market leading position despite rising competition from novel myeloma therapies.

The global multiple myeloma therapeutics market size was estimated at USD 20.87 billion in 2023 and is projected to reach USD 30.30 billion by 2030, growing at a CAGR of 5.5% from 2024 to 2030. This is owing to continuous research and development activities by key pharmaceutical companies, regulatory approvals by authorities, and an increasing number of products and new therapies launch.

Market Dynamics

The Power of Aiming at CD38: DARZALEX’s New Way to Act

Daratumumab (DARZALEX) is the first of its kind. It hits CD38, a key protein on myeloma cells, but keeps most good tissues safe. By using this special way, DARZALEX kills tumors & boosts the immune take down. This shifts how we treat myeloma today.

-

Direct Anti-Tumor Action: Binding to CD38 on malignant plasma cells triggers apoptosis and inhibits enzymatic functions crucial for tumor survival. This direct targeting results in reduced tumor burden and improved disease control across both frontline and relapsed patient populations.

-

Immune-Powered Death of Cells: Beyond direct action, DARZALEX recruits the body’s immune system to attack myeloma cells. Through mechanisms such as antibody-dependent cellular cytotoxicity (ADCC), complement-dependent cytotoxicity (CDC), and antibody-dependent cellular phagocytosis (ADCP), it harnesses natural killer cells, complement proteins, and macrophages to eliminate cancer cells more effectively.

This dual pathway of action-direct tumor suppression and immune system engagement-distinguishes DARZALEX from conventional chemotherapies and even other monoclonal antibodies. It provides a more comprehensive therapeutic strategy, contributing to improved progression-free and overall survival, and establishing DARZALEX as a cornerstone in modern multiple myeloma management.

Side Effects and Risks Associated with Daratumumab (DARZALEX)

Daratumumab (DARZALEX) has shown remarkable efficacy in multiple myeloma, but its administration is linked to some notable side effects. The most common are infusion-related reactions (IRRs), which typically occur during the first infusion. Symptoms include nasal congestion, cough, throat irritation, nausea, and chills, though they are usually manageable with premedication and supportive care. The development of the subcutaneous formulation (Darzalex Faspro) has significantly lowered both the frequency and severity of these reactions, offering a more convenient and tolerable option for patients. Despite these improvements, clinicians must still closely monitor patients during initial doses to ensure safety and provide immediate management if reactions occur.

Beyond infusion reactions, DARZALEX carries risks related to hematologic and immune complications. Patients may experience neutropenia, thrombocytopenia, or anemia, which elevate risks of infections, bleeding, and fatigue. Infections, particularly respiratory tract infections, are among the most reported, and reactivation of latent conditions such as hepatitis B virus has also been observed, requiring pre-treatment screening. Another unique risk is interference with blood typing and cross-matching, since CD38 is expressed on red blood cells; this can complicate transfusion practices, making advance blood typing essential. These risks highlight the importance of preventive strategies, ongoing monitoring, and coordinated supportive care throughout treatment.

“Capitalizing on Expanding Multiple Myeloma Treatment Opportunities”

DARZALEX presents strong growth opportunities as it expands into earlier lines of therapy and new patient populations. The European Commission’s approval (2025) for high-risk smouldering multiple myeloma (SMM) created a first-mover advantage in an untapped early-disease market. This positions DARZALEX as not only a treatment for advanced multiple myeloma but also a preventive strategy, delaying progression and broadening its patient base. The subcutaneous (SC) regimen approval in frontline settings further strengthens adoption by reducing treatment burden and making therapy more practical for large-scale use.

Another opportunity lies in the real-world uptake of SC DARZALEX (Faspro), which improves patient convenience, shortens clinic visits, and enhances healthcare resource utilization. With payers and providers favoring cost-effective and efficient therapies, the SC formulation positions DARZALEX strongly against competing agents. Ongoing trials such as PERSEUS and CEPHEUS indicate long-term survival benefits, reinforcing its role as a cornerstone therapy. Expansion in emerging markets, where diagnosis and treatment capacity are improving, also offers a significant growth avenue. Collectively, these factors secure DARZALEX’s platform for sustained market leadership.

“DARZALEX Market Expands with Evolving Myeloma Care”

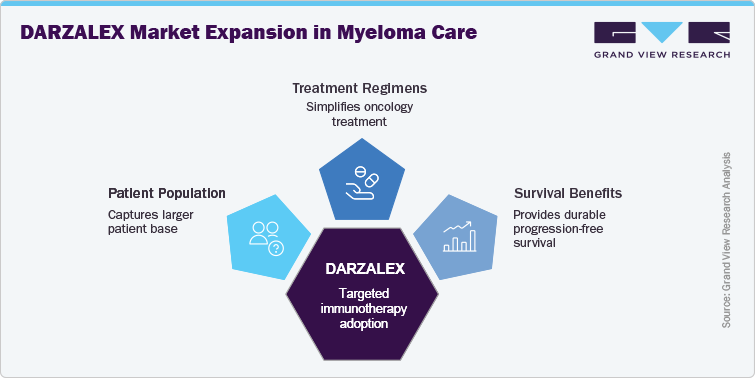

- Growing Adoption in Earlier Lines of Therapy:

DARZALEX is increasingly used in frontline multiple myeloma regimens and high-risk smouldering multiple myeloma (SMM) following regulatory approvals in Europe. Expansion into earlier disease stages reflects a broader trend of adopting targeted immunotherapies sooner, allowing earlier intervention and delayed disease progression. This trend positions DARZALEX to capture a larger patient population and reinforces its role as a cornerstone therapy.

- Preference for Subcutaneous, Patient-Friendly Formulations:

The subcutaneous formulation (Darzalex Faspro) has gained traction due to reduced administration time, improved tolerability, and patient convenience. This aligns with the trend of simplifying oncology treatment regimens and optimizing clinic workflows, enhancing patient adherence and making treatment more scalable in diverse healthcare settings.

- Increasing Focus on Long-Term Survival and Real-World Outcomes:

There is growing emphasis on therapies providing durable progression-free survival (PFS) and overall survival benefits, supported by PERSEUS and CEPHEUS studies. DARZALEX’s proven long-term efficacy drives adoption among physicians and payers, reflecting a trend toward sustainable, clinically meaningful outcomes alongside manageable safety profiles in multiple myeloma care.

Competitive Landscape

Janssen Biotech, Inc., the authorized manufacturer of Daratumumab (DARZALEX), has strategically expanded its production and distribution capabilities to meet growing global demand for multiple myeloma therapies. The company focuses on both intravenous and subcutaneous formulations (Darzalex Faspro) to improve patient convenience and reduce clinic time. Investments in state-of-the-art manufacturing infrastructure aim to ensure a consistent supply, support frontline and relapsed/refractory settings, and strengthen global adoption of this first-in-class anti-CD38 therapy.

Other key players in the market, including Bristol-Myers Squibb, Genzyme Corporation, Juno Therapeutics, Millennium Pharmaceuticals, Novartis AG, Celgene Corporation, Johnson & Johnson, and Amgen, Inc., contribute to competitive dynamics through pipeline developments, combination therapies, and research into next-generation anti-CD38 antibodies. Their R&D initiatives, strategic collaborations, and licensing agreements enhance therapeutic innovation while intensifying market rivalry in multiple myeloma care, fostering both treatment accessibility and clinical advancements.

The market is further shaped by manufacturing expansion, regulatory approvals, and global commercialization strategies. Janssen and competitors aim to optimize production capacity, meet growing patient demand, and ensure treatment availability in emerging and established markets. Strategic investments in subcutaneous delivery and patient-friendly formulations are enhancing market penetration, while continuous clinical research supports long-term efficacy and safety profiles. Together, these initiatives reinforce DARZALEX’s position as a cornerstone therapy and sustain its market leadership.

Regional Analysis

North America Daratumumab (DARZALEX) Market

In the U.S, DARZALEX's patent is set to expire in 2029, with additional patent protections extending into the early 2030s. This timeline positions the U.S. market for increased competition from biosimilars starting in 2029, potentially affecting market dynamics and pricing strategies. The introduction of the subcutaneous formulation, DARZALEX Faspro, has enhanced patient convenience and treatment adherence. However, the approaching patent expiry necessitates strategic planning to maintain market position amidst anticipated biosimilar entries.

Europe Daratumumab (DARZALEX) Market

In Europe, the patent for DARZALEX is expected to expire between 2031 and 2032. This impending expiration may lead to the introduction of biosimilars, increasing market competition and potentially impacting pricing and market share. While the subcutaneous formulation has been approved, the approaching patent expiry underscores the need for strategic positioning to navigate the evolving competitive landscape.

Asia Pacific Daratumumab (DARZALEX) Market

The Asia Pacific region's market for DARZALEX is influenced by varying patent expiration dates. In Japan, the patent is set to expire in 2029, aligning with the U.S. timeline. This positions Japan for increased biosimilar competition from 2029 onwards. In contrast, other countries in the region may experience different patent expiration schedules, affecting the timing and impact of biosimilar entries. Strategic market entry and lifecycle management will be crucial to navigate these varying timelines and maintain market presence.

Latin America Daratumumab (DARZALEX) Market

In Latin America, the patent expiration timeline for DARZALEX varies by country. The U.S. patent expiry in 2029 may influence regional markets, with potential biosimilar entries aligning with this timeline. However, the introduction of biosimilars may be subject to local regulatory approvals and market dynamics. Strategic partnerships and market access strategies will be essential to mitigate the impact of impending patent expirations and biosimilar competition.

Middle East and Africa Daratumumab (DARZALEX) Market

The Middle East and Africa (MEA) region's market for DARZALEX is also influenced by the patent expiration timeline. The U.S. patent expiry in 2029 may set a precedent for biosimilar entries in the region. However, varying regulatory environments and market access challenges may affect the timing and impact of biosimilar competition. Tailored strategies addressing local market conditions and regulatory landscapes will be crucial for maintaining market position post-patent expiration.

Darzalex Patent Cliff Analysis

Darzalex is currently shielded by composition-of-matter patents until March 2026 across the U.S., Europe, and Japan, with additional layers of protection through Patent Term Extensions (PTEs) and Supplementary Protection Certificates (SPCs). These measures extend exclusivity to 2029 in the U.S., 2030 in Japan, and 2031 in Europe, creating a staggered expiry timeline that sets the stage for a phased patent cliff.

The implications of this schedule are significant. The U.S. market, representing a dominant share of Darzalex revenues, will be the first to experience exposure in 2029. At this inflection point, sales at risk are estimated to increase by 18%, reflecting the weight of U.S. contribution to the global revenue base. By 2030, competitive pressures will intensify with the expiry of protections in Japan and the introduction of biosimilars. This is projected to elevate sales at risk to 28%.

The European market, with its extensive adoption and reimbursement landscape, represents the final major region to face expiry in 2031. Once this protection lapses, the erosion of branded sales is expected to accelerate, driving sales at risk to 34% globally. By 2033, as biosimilars gain deeper penetration and pricing pressures amplify across all regions, branded sales are forecasted to contract by up to 70%.

This trajectory underscores the progressive impact of staggered regional patent expiries and the intensifying biosimilar landscape. For stakeholders, the critical window lies between 2029 and 2031, a period during which strategic responses-including lifecycle management, portfolio diversification, and potential next-generation therapies-will be pivotal in mitigating the full force of the revenue decline.

Analyst Perspective

“Daratumumab (DARZALEX) continues to strengthen its position as a cornerstone therapy in multiple myeloma, supported by subcutaneous adoption, earlier-line approvals, and strong real-world outcomes. While facing challenges from biosimilars and novel immunotherapies, its clinical depth, brand equity, and lifecycle strategies ensure sustained market leadership and growth potential.”

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

-

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified