- Home

- »

- Pharmaceuticals

- »

-

Multiple Myeloma Therapeutics Market Size Report, 2030GVR Report cover

![Multiple Myeloma Therapeutics Market Size, Share & Trends Report]()

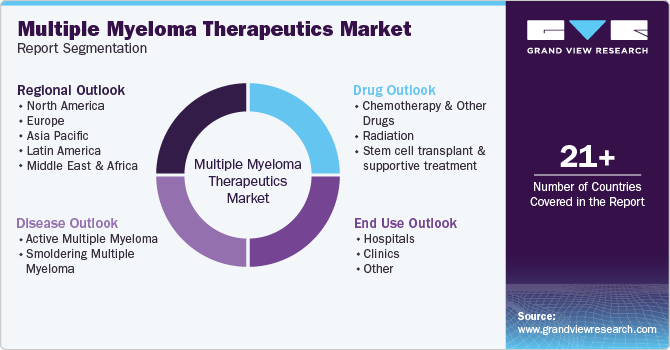

Multiple Myeloma Therapeutics Market (2024 - 2030) Size, Share & Trends Analysis Report By Drug, By Disease (Active Multiple Myeloma, Smoldering Multiple Myeloma), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-913-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Multiple Myeloma Therapeutics Market Summary

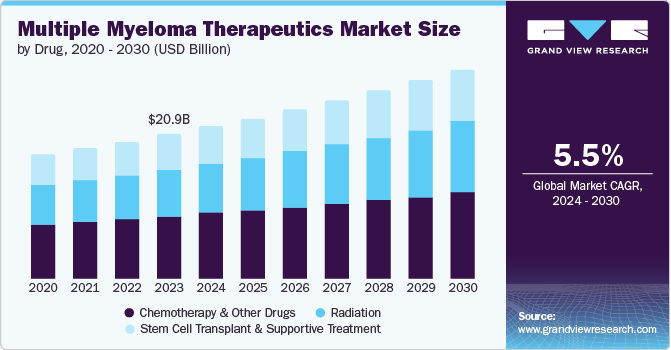

The global multiple myeloma therapeutics market size was estimated at USD 20.87 billion in 2023 and is projected to reach USD 30.30 billion by 2030, growing at a CAGR of 5.5% from 2024 to 2030. This is owing to continuous research and development activities by key pharmaceutical companies, regulatory approvals by authorities, and an increasing number of products and new therapies launch.

Key Market Trends & Insights

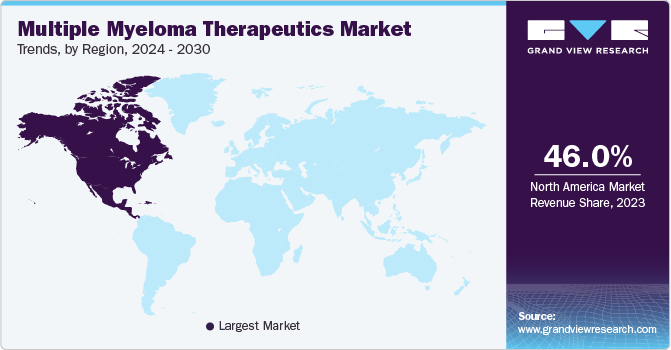

- North America multiple myeloma therapeutics market dominated the market with a revenue share of 46% in 2023.

- The multiple myeloma therapeutics market in Asia Pacific is expected to witness the fastest CAGR of 6.5% over the forecast period.

- Based on drug, the chemotherapy and other drugs segment dominated the market with the largest revenue share of 43.3% in 2023.

- Based on disease, the active multiple myeloma segment dominated the market with a market share of 71.2% in 2023.

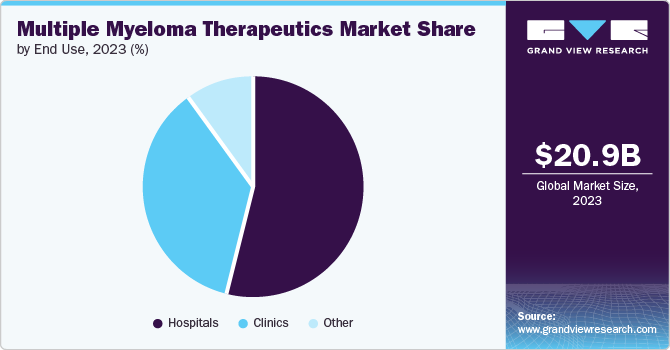

- Based on end use, the hospitals segment held the largest market share of 53.8% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 20.87 Billion

- 2030 Projected Market Size: USD 30.30 Billion

- CAGR (2024-2030): 5.5%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

The increasing awareness of disease symptoms and diagnostic capabilities has led to more patient being diagnosed with multiple myeloma.

According to World Health Organization 35 million new cancer cases are predicted in 2050. Despite being considered a rare form of cancer, multiple myeloma accounts for a notable number of cases worldwide. The increasing awareness of symptoms of the disease and increasing capabilities of diagnosis of multiple myeloma cancer is driving the market growth globally. This leads to demand of innovative treatment options in the market. The upcoming novel therapies which are in the pipeline of many pharmaceutical players in the market and ongoing research and development activities by key pharmaceutical companies are crucial factors contributing to market growth.

Companies are investing in developing new drugs and treatments for multiple myeloma with a mission of addressing unmet market needs and improving treatment outcomes. Pharmaceutical companies are introducing innovative drugs that offer enhanced efficiency and better management of the disease. In February 2022, the U.S. FDA approved CARVYKTI (ciltacabtagene autoleucel) to treat adult patient population with refractory or relapsed multiple myeloma post other line of therapies.

Drug Insights

The chemotherapy and other drugs segment dominated the market with the largest revenue share of 43.3% in 2023. It is further expected to retain its position over the forecast period. The dominance of the chemotherapy and other drugs segment can be attributed to factors such as their proven effectiveness, wide adoption by healthcare providers, synergistic effects in combination therapies, status as a standard of care treatment option, and cost considerations. Chemotherapy has been identified as an effective treatment in the diagnosis of multiple myeloma cancer. It works by targeting rapidly dividing cancer cells throughout the body. It has been extensively studied and used in the treatment of various cancers, including multiple myeloma.

The radiation segment is expected to grow at the fastest CAGR of 6.3% from 2024 to 2030. Radiation therapy, also known as radiotherapy, uses high energy radiation to target and kill cancer cells. The efficacy of radiation therapy in treating multiple myeloma has been studied which is leading to increased adoption of the treatment. The field of radiation oncology has witnessed significant technological advancements in recent years. Techniques such as intensity-modulated radiation therapy, stereotactic body radiation therapy, and proton therapy have improved the precision and effectiveness of delivering radiation to tumors while minimizing damage to surrounding healthy tissues. These advancements have made radiation therapy a preferred therapy for patients.

Disease Insights

Active multiple myeloma dominated the market with a market share of 71.2% in 2023. Active multiple myeloma is the stage of the disease where symptoms are present and require immediate treatment. Increased awareness about multiple myeloma among patients and healthcare professionals has led to earlier detection and diagnosis of the disease. The treatment for active multiple myeloma has evolved rapidly with the introduction of new therapies that specifically target the disease at this stage. Ongoing clinical trials by key pharmaceutical companies are leading to the introduction of new and improved drugs.

Smoldering Multiple Myeloma (SMM) is expected to grow at the fastest CAGR of 6.1% in the coming years. SMM is considered a sign of multiple myeloma, where individuals have higher levels of abnormal plasma cells but do not yet show symptoms or organ damage. The advancements of technology in the healthcare sector and increased awareness are leading to more cases of SMM being detected at an earlier stage. This allows for timely intervention and management before the disease develops to show symptoms of multiple myeloma.

End Use Insights

The hospitals segment held the largest market share of 53.8% in 2023. Hospitals have the infrastructure and resources necessary to manage complex cases of multiple myeloma effectively. Hospitals have specialized medical professionals, including oncologists and hematologists, who have expertise in diagnosing and treating multiple myeloma. This specialized care ensures that patients receive the most appropriate and effective treatment for their condition. Also, they have access to advanced treatment options such as stem cell transplants, targeted therapies, and immunotherapy which is leading to the segment growth.

The clinic segment is expected to grow at the fastest CAGR of 6.0% over the forecast period. This is owing to convenience for patients, clinics are conveniently located in urban areas or medical centers, making it easier for patients to access regular appointments, treatments, and supportive services without travel or logistical challenges. Clinics often collaborate with pharmaceutical companies to provide patients with access to novel drugs and therapies. These partnerships lead to the early adoption of new treatments.

Regional Insights

North America multiple myeloma therapeutics market dominated the market with a revenue share of 46.0 % in 2023. It is attributable to the high prevalence of multiple myeloma in the region. Advanced healthcare infrastructure, ongoing research and development, patient awareness, competition in the market and regulatory frameworks are leading to the market growth. This region invests significantly in research and development activities related to cancer treatments, including multiple myeloma which is leading to the introduction of innovative treatments for multiple myeloma.

U.S. Multiple Myeloma Therapeutics Market Trends

The U.S. dominated the North America multiple myeloma therapeutics market with a share of 83.3% in 2023. This is attributed to well-developed healthcare infrastructure and significant investment in research and development which has led to the development of innovative therapies and treatment options for the patients. The prevalence of multiple myeloma in the U.S. population is relatively high compared to other regions, leading to a larger market size for therapeutics. Moreover, increased awareness about the disease among patients and healthcare providers drives demand for advanced treatments. In March 2023, Janssen Pharmaceuticals launched a campaign, That’s My Word, to increase awareness and health outcomes for the population at risk of developing multiple myeloma.

Europe Multiple Myeloma Therapeutics Market Trends

The Europe multiple myeloma therapeutics market is projected to experience a growth at CAGR of 5.2% during the forecast period. This growth can be attributed to increasing research & development activities, technological advancements, and growing awareness of multiple myeloma disease and treatment. Government support through initiatives and funding for cancer research also plays a crucial role in driving the growth of the multiple myeloma therapeutics market in Europe.

The UK multiple myeloma therapeutics market is experiencing steady growth driven by technological advancements in early detection and treatment options, increasing prevalence of the disease the country, government initiatives supporting healthcare expenditure, ongoing research efforts, and advocacy from patient groups which are dedicated to raising awareness about multiple myeloma and advocating for improved access to care have also influenced market growth.

Germany multiple myeloma therapeutics market has witnessed substantial growth. This is owing to increasing incidence rates of the disease, advancements in diagnosis and treatment options, government initiatives supporting cancer care, healthcare infrastructure development, and ongoing research and development activities focused on finding new and effective therapies for multiple myeloma.

Asia Pacific Multiple Myeloma Therapeutics Market Trends

The multiple myeloma therapeutics market in Asia Pacific is expected to witness the fastest CAGR of 6.5% over the forecast period. Factors such as an aging population, improved healthcare infrastructure, and increasing awareness about cancer have contributed to the market expansion.

The market in China is expected to witness a robust growth driven by factors such as improvement in diagnosis technology, advancements in treatment options, rising healthcare expenditure, growing awareness about multiple myeloma, and government support through initiatives aimed at improving cancer care services. In March 2024, The National Medical Products Administration (NMPA) approved CAR-T therapy (CARsgen Therapeutics), based on LUMMICAR STUDY 1 results, a China based phase II clinical trial.

India multiple myeloma therapeutics market is experiencing growth driven by factors such as increasing disease prevalence, advancements in treatment options, rising healthcare expenditure, a growing geriatric population, government approval, and technological innovations.

Key Multiple Myeloma Therapeutics Company Insights

Some of the key companies in the myeloma therapeutic market include Sanofi; Takeda Pharmaceutical Company Limited; Merck & Co.; AbbVie Inc. Key players are undertaking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Bristol-Myers Squibb Company is working on advancing treatment options for multiple myeloma. It provides therapies that involve Revlimid, an oral immunomodulatory drug that curbs cell proliferation and enhances immune responses, Empliciti, a monoclonal antibody targeting myeloma cells and CAR T cell therapies such as Abecma and Breyanzi.

Key Multiple Myeloma Therapeutics Companies:

The following are the leading companies in the multiple myeloma therapeutics market. These companies collectively hold the largest market share and dictate industry trends.

- Johnson & Johnson Services, Inc.

- Novartis AG

- Amgen Inc.

- Sanofi

- Bristol-Myers Squibb Company

- Takeda Pharmaceutical Company Limited

- Merck & Co.

- AbbVie Inc.

- GLENMARK PHARMACEUTICALS LTD.

- DAIICHI SANKYO COMPANY, LIMITED

- bluebird bio, Inc.

Recent Developments

-

In April 2024, Bristol-Myers Squibb Company announced that the U.S. Food and Drug Administration approved Abecma (idecabtagene vicleucel; ide-cel) for the treatment of adult patients with relapsed or refractory multiple myeloma.

-

In May 2024, Novartis AG announced that it entered into an agreement for the acquisition of Mariana Oncology, which is a biotechnology company which is focused on developing radioligand therapies.

Multiple Myeloma Therapeutics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 21.98 billion

Revenue forecast in 2030

USD 30.30 billion

Growth Rate

CAGR of 5.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Drug, disease, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, and Kuwait.

Key companies profiled

Johnson & Johnson Services, Inc.; Novartis AG; Amgen Inc.; Sanofi; Bristol-Myers Squibb Company; Takeda Pharmaceutical Company Limited; Merck & Co.; AbbVie Inc.; GLENMARK PHARMACEUTICALS LTD.; DAIICHI SANKYO COMPANY, LIMITED; bluebird bio, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Multiple Myeloma Therapeutic Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global myeloma therapeutic market report based on drug, disease, end use and region.

-

Drug Outlook (Revenue, USD Million, 2018 - 2030)

-

Chemotherapy and other drugs

-

Traditional chemotherapy

-

Immunomodulating agents

-

Proteasome inhibitors

-

Histone Deacetylase (HDAC) inhibitors

-

Monoclonal Antibodies

-

-

Radiation

-

Stem cell transplant and supportive treatment

-

-

Disease Outlook (Revenue, USD Million, 2018 - 2030)

-

Active Multiple Myeloma

-

Smoldering Multiple Myeloma

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Other

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.