- Home

- »

- Market Trend Reports

- »

-

Emicizumab (Hemlibra) Market: Navigating Biosimilar Competition & Strategic Shifts Post-Patent Expiration

Report Overview

Hemlibra, developed by Roche, has become a key treatment for Hemophilia A, especially for patients with inhibitors to factor VIII, offering significant clinical benefits since its approval in 2017. The drug’s success is driven by its ability to reduce bleeding episodes and provide a reliable alternative to traditional factor VIII replacement therapies. As its patent approaches expiration in 2032, the entry of biosimilars will create increased competition, potentially reshaping treatment protocols and pricing dynamics. Pharmaceutical companies will need to focus on lifecycle management, differentiation, and market access strategies to maintain their position in an increasingly competitive environment.

Key Report Deliverables

-

Market Landscape Analysis, examining the current Emicizumab market, identifying growth drivers and trends, especially with the upcoming patent expiration in 2032 and the impact of biosimilars entering the market.

-

Market Growth Forecast, focusing on biosimilar opportunities and risks post-patent expiration, assessing competitive pressures and market shifts.

-

Regulatory and Market Barriers, identifying challenges biosimilars may face in gaining approval and market access, including regulatory hurdles and manufacturing standards.

-

Competitive Landscape: analyzing key players in the Emicizumab market, including Roche and potential biosimilar developers, focusing on strategic moves and competitive positioning.

-

Regulatory Barriers, assessing the regulatory challenges for biosimilars, particularly regarding approval processes in major markets like the U.S. and Europe, and their impact on market expansion.

-

Strategic Implications, evaluating strategic moves for Roche and competitors, including lifecycle management, product differentiation, and market access strategies to maintain leadership post-patent expiration.

Patent Cliff Analysis

The expiration of the patent for Emicizumab (Hemlibra) in 2032 will introduce a significant shift in the Hemophilia A treatment market. As the drug loses exclusivity, the door will open for biosimilar developers to enter, aiming to provide cost-effective alternatives. However, the path to market entry for biosimilars is not straightforward due to the complex nature of Emicizumab, which is a bispecific monoclonal antibody.

Unlike traditional monoclonal antibodies, Emicizumab's structure and mode of action, which mimics factor VIII activity, pose unique challenges for biosimilar manufacturers. They will need to demonstrate equivalency in terms of safety, efficacy, and quality through extensive clinical trials, which could delay the availability of biosimilars. Regulatory authorities like the FDA and EMA have stringent requirements for the approval of biosimilars for biologics with complex structures, meaning the approval process will be lengthy and rigorous.

At present, no biosimilars for Emicizumab have completed all necessary clinical trials or received approval. While some biosimilar candidates are in development, including a preclinical candidate from Prestige BioPharma, their progress is still in the early stages, with regulatory approval timelines uncertain. The lack of granted patents in the U.S. provides an opportunity for biosimilar developers, but the technical and regulatory barriers could result in a slower-than-expected market entry.

For pharmaceutical companies, the expiration of Emicizumab’s patent requires proactive strategies in product lifecycle management, including the development of next-generation therapies, ensuring competitive pricing, and optimizing market access. Companies should prepare for an increasingly crowded market once biosimilars are approved, as competition will intensify and pricing pressures will rise.

Current Market Scenarios

Emicizumab (Hemlibra), developed by Roche, has significantly impacted the treatment landscape for Hemophilia A, particularly in patients with inhibitors to factor VIII. Since its approval in 2017, Hemlibra has offered a subcutaneous prophylactic treatment alternative to traditional factor VIII replacement therapies, demonstrating substantial clinical efficacy. The drug's market success is attributed to its ability to reduce bleeding episodes and improve patient quality of life.

As the patent for Hemlibra approaches expiration in 2032, the market dynamics are poised for transformation. The entry of biosimilars is anticipated to introduce increased competition, potentially impacting pricing structures and market share. However, the development of biosimilars for Hemlibra presents unique challenges due to its bispecific monoclonal antibody structure, which differs from traditional monoclonal antibodies. This complexity may result in a more extended development timeline for biosimilars, with regulatory bodies requiring comprehensive clinical data to establish biosimilarity.

Currently, there are no approved biosimilars for Hemlibra. While some candidates are in the preclinical or early clinical stages, their market entry is contingent upon successful completion of clinical trials and regulatory approvals. The absence of granted patents in the U.S. suggests that biosimilar developers may have a pathway to market entry; however, the intricate nature of Hemlibra's design could present significant hurdles.

For Roche, the impending patent expiration necessitates strategic planning to maintain market leadership. This includes focusing on product differentiation, enhancing patient support programs, and exploring next-generation therapies. Additionally, Roche may consider strategies to mitigate the impact of biosimilar competition, such as engaging in early negotiations with payers and healthcare providers to secure favorable reimbursement terms.

In summary, while the expiration of Hemlibra's patent in 2032 presents opportunities for biosimilar entry, the complexities associated with its bispecific monoclonal antibody structure may delay the availability of biosimilars. Roche's proactive strategies will be crucial in navigating the evolving market landscape and sustaining its position in the Hemophilia A treatment arena.

Market Dynamics

“Biosimilars will drive pricing pressures, pushing Roche to adjust pricing strategies and maintain value for Hemlibra”

The introduction of biosimilars will inevitably apply downward pressure on pricing, especially in regions with well-established cost-containment measures. Hemlibra is currently one of the more expensive treatments for Hemophilia A, and as more cost-effective biosimilars enter the market, healthcare systems will likely shift toward these alternatives. This will require Roche to reconsider its pricing strategies, potentially lowering costs or offering value-added services to justify the higher price point of the originator drug.

Moreover, Roche will need to continue investing in strategies that reinforce Hemlibra’s value proposition, such as emphasizing clinical differentiation, expanding its use in new indications, and ensuring superior patient outcomes. The pricing pressure from biosimilars will likely reshape the competitive landscape, compelling Roche to focus on both cost efficiency and innovation to maintain market share.

“Navigating evolving regulations and ensuring access across markets will be key for Roche as biosimilars emerge”

The regulatory environment for biosimilars is evolving, with both the U.S. FDA and EMA accelerating the approval processes for these products to ensure faster market entry. This shift in regulatory policy is designed to foster competition, improve treatment access, and ultimately lower drug costs for patients. However, the complexity of Emicizumab’s molecular structure means that demonstrating biosimilarity will require extensive clinical trials and data, potentially delaying the widespread availability of biosimilars.

Global market access will also be a key consideration. In developed markets, Roche will need to engage proactively with payers and healthcare providers to maintain favorable reimbursement terms as biosimilars enter the market. In emerging markets, where the need for affordable biologic treatments is particularly high, biosimilars will play a critical role in expanding patient access. Roche’s ability to navigate these diverse regulatory and access landscapes will be crucial for maintaining its leadership position as competition intensifies.

“Biosimilars will drive pricing pressures, pushing Roche to adjust pricing strategies and maintain value for Hemlibra”

The introduction of biosimilars will inevitably apply downward pressure on pricing, especially in regions with well-established cost-containment measures. Hemlibra is currently one of the more expensive treatments for Hemophilia A, and as more cost-effective biosimilars enter the market, healthcare systems will likely shift toward these alternatives. This will require Roche to reconsider its pricing strategies, potentially lowering costs or offering value-added services to justify the higher price point of the originator drug.

Moreover, Roche will need to continue investing in strategies that reinforce Hemlibra’s value proposition, such as emphasizing clinical differentiation, expanding its use in new indications, and ensuring superior patient outcomes. The pricing pressure from biosimilars will likely reshape the competitive landscape, compelling Roche to focus on both cost efficiency and innovation to maintain market share.

“Biosimilars present both challenges and opportunities, with complex development required to compete with Hemlibra’s unique structure”

The expiration of Emicizumab’s patent will create opportunities for biosimilar developers to enter the market, with several biosimilar candidates currently in development. These biosimilars are expected to be priced 15-40% lower than the originator drug, making them attractive alternatives in markets with tight healthcare budgets. The development of biosimilars for Emicizumab, however, presents significant challenges due to the bispecific monoclonal antibody structure, which is more complex compared to traditional monoclonal antibodies.

Despite these complexities, regulatory bodies like the U.S. FDA and EMA are expected to fast-track approvals for biosimilars in an effort to promote competition and reduce costs. The first wave of biosimilars is expected to enter the market soon after the patent expiration, with regulatory approval likely in key markets like the U.S. and Europe. As biosimilars gain traction, Roche will need to focus on ensuring continued patient access to Hemlibra, particularly through strategic pricing and reimbursement arrangements.

“Roche strengthens patient access initiatives and support programs, ensuring continued patient loyalty amid biosimilar competition”

Roche has established comprehensive patient access and support programs for Hemlibra to facilitate treatment adherence and improve patient outcomes. These programs are designed to assist patients in navigating the complexities of treatment, including financial assistance, educational resources, and reimbursement support. Such initiatives are particularly important in markets where cost barriers exist, and they ensure that patients can continue using Hemlibra even as alternative treatments, like biosimilars, enter the market. Roche's support structure is integral to maintaining access to Hemlibra and ensuring that patients have the necessary resources to manage their treatment effectively.

Additionally, Roche's patient access programs help streamline the approval process by working closely with healthcare providers and insurers to ensure that Hemlibra is included in treatment protocols and covered by insurance. This is especially relevant as biosimilars emerge, as Roche will need to demonstrate the value of Hemlibra through patient and healthcare provider engagement. These efforts not only secure continued access for current patients but also foster long-term loyalty to the brand, ensuring that Hemlibra remains the preferred treatment choice despite the competition from lower-cost alternatives.

Overview of Alternative Therapeutics

As the Emicizumab (Hemlibra) market faces growing competition, several alternative treatments are emerging in the Hemophilia A space. Traditional factor VIII replacement therapies, such as Advate and Kogenate FS, remain widely used for prophylaxis, but they require frequent intravenous infusions, limiting patient convenience compared to Emicizumab’s subcutaneous administration. These established treatments, while effective, are increasingly challenged by newer options that offer improved convenience and efficacy.

Gene therapy is gaining momentum as a long-term alternative to Emicizumab. Products like Roctavian (BioMarin), which aims to deliver a one-time treatment to produce factor VIII in the body, are advancing through clinical trials and offer a potential cure, reducing the need for ongoing infusions. Gene therapies could disrupt the market by providing a more permanent solution for Hemophilia A, though widespread adoption is still in its early stages.

Additionally, biosimilars for Emicizumab, such as those from developers like Amgen and Biocon, are being developed to provide cost-effective alternatives while maintaining similar therapeutic outcomes. These biosimilars are expected to offer a more affordable option, especially in cost-sensitive regions, further intensifying competition for Hemlibra. As the market evolves, these alternative therapies-along with biosimilars-will reshape the competitive landscape, particularly in terms of treatment cost and patient convenience.

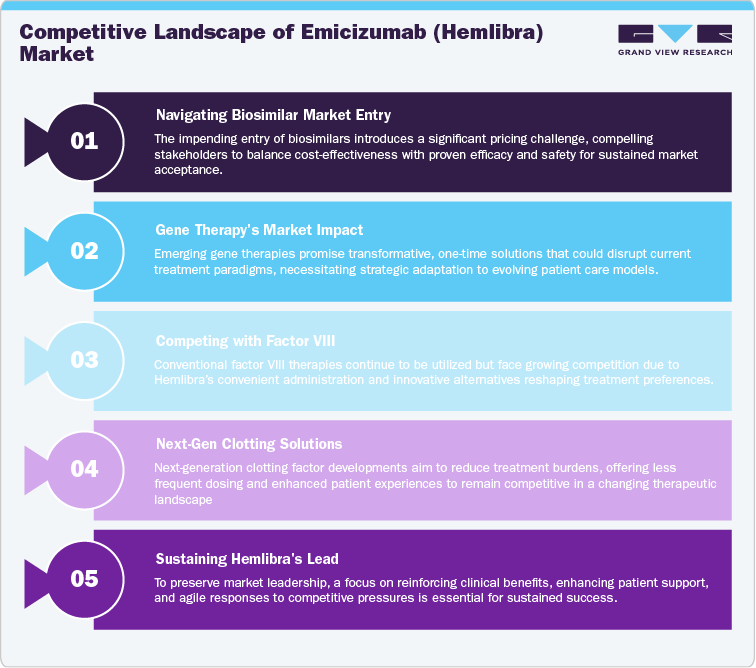

Competitive Landscape

The competitive landscape for Emicizumab (Hemlibra) is undergoing a significant shift as its patent expiration in 2032 approaches. Hemlibra currently holds a dominant position in the Hemophilia A market, but the entry of biosimilars from companies like Amgen, Biocon, and Samsung Bioepis will introduce substantial price competition. These biosimilars, expected to be priced 15-40% lower than Hemlibra, will likely gain traction in cost-sensitive markets, though they will need to demonstrate equivalent efficacy and safety to Hemlibra, which could delay widespread adoption.

Gene therapies, notably BioMarin’s Roctavian, also present a long-term threat by offering a potential one-time treatment for Hemophilia A. This could eliminate the need for ongoing infusions, posing a major challenge to Hemlibra’s market. Traditional factor VIII replacement therapies from Baxter, Grifols, and CSL Behring remain in use but are increasingly disadvantaged by Hemlibra’s subcutaneous administration and the advent of gene therapies. Additionally, Bayer and Amgen are developing next-generation clotting factor therapies that may reduce treatment frequency and compete with Hemlibra.

For Roche, maintaining leadership will require reinforcing Hemlibra’s clinical advantages, optimizing patient support, and responding strategically to the growing competition from biosimilars, gene therapies, and other biologics. Roche will need to stay agile, ensuring Hemlibra remains a preferred choice in a rapidly evolving market.

North America Emicizumab (Hemlibra) Market

North America Emicizumab (Hemlibra) market continues to be a leading treatment option for Hemophilia A, with strong support from the U.S. healthcare system. Both Medicare and private insurers offer favorable reimbursement, ensuring broad access to the drug. However, with the expiration of its patent in 2032, biosimilars are expected to enter the market, introducing price competition. In the U.S., where healthcare cost containment is a priority, these biosimilars will likely challenge Hemlibra’s market share. Roche will need to manage this competition by emphasizing the clinical benefits of Hemlibra while addressing pricing pressures, particularly in a market increasingly focused on affordability.

Europe Emicizumab (Hemlibra) Market

In Europe, the adoption of biologics for Hemophilia A has been growing, particularly in countries like Germany, France, and the UK. However, with the expiration of Hemlibra’s patent in 2032, biosimilars are expected to enter the European market, adding price competition, especially in price-sensitive regions. European markets are increasingly focused on cost containment, with reimbursement strategies targeting more affordable alternatives. Despite this, Hemlibra’s established clinical efficacy and Roche’s reputation in the biologic space give it a strong foundation in Europe. Roche will need to navigate the biosimilar competition effectively to maintain Hemlibra's strong position in the region.

Asia Pacific Emicizumab (Hemlibra) Market

Asia Pacific Hemlibra market growth is driven by rising healthcare access and the increasing prevalence of Hemophilia A, particularly in countries like Japan, China, and India. Japan remains a strong market for Hemlibra due to its advanced healthcare system. However, in emerging markets like China and India, biosimilars are expected to gain traction, driven by their cost-effectiveness. While Hemlibra’s clinical outcomes continue to support its position, Roche will need to adapt to the growing biosimilar competition in these cost-sensitive markets. Ensuring affordability and access will be key for Roche to maintain its market share in Asia Pacific.

Latin America Emicizumab (Hemlibra) Market

Latin America, demand for Hemlibra is growing as healthcare access improves and awareness of Hemophilia A increases. Key markets such as Brazil, Mexico, and Argentina are seeing a shift toward biologics. However, the region remains cost-sensitive, and the entry of biosimilars will create competition, particularly in markets where affordability is prioritized. While Hemlibra’s proven clinical efficacy provides a strong market position, Roche will need to address the affordability challenge, as biosimilars may offer a more accessible alternative in the region.

Middle East and Africa Emicizumab (Hemlibra) Market

In the Middle East and Africa Emicizumab (Hemlibra) market is expanding as healthcare infrastructure improves and awareness of Hemophilia A rises. In developed markets like the UAE and Saudi Arabia, there is growing demand for biologics, with Hemlibra becoming a preferred treatment due to its efficacy. However, in emerging markets across Africa and parts of the Middle East, cost concerns could limit access to Hemlibra, with biosimilars likely to increase in prevalence. Roche will need to consider these market dynamics and focus on ensuring that Hemlibra remains accessible in the region, where affordability is a key concern.

Analyst Perspective

As Emicizumab (Hemlibra) approaches patent expiration in 2032, biosimilars will create significant price competition, particularly in cost-sensitive regions like North America and Europe. While biosimilars, developed by companies like Amgen and Biocon, will offer lower-cost alternatives, the complex bispecific antibody structure of Hemlibra presents development challenges, delaying widespread adoption. Roche must focus on demonstrating Hemlibra’s clinical advantages, optimizing patient access, and adapting pricing strategies to maintain market leadership amidst growing biosimilar and alternative competition.

Case Study (Recent Engagement): Keytruda Patent-Cliff & Price- Erosion Impact Model

PROJECT OBJECTIVE

To evaluate the potential revenue, price, and patient access implications of Keytruda’s 2028 patent cliff, incorporating biosimilar entry dynamics, country-specific adoption curves, and Merck’s lifecycle defense strategies (remarkably the subcutaneous formulation). The goal was to provide the client with a transparent, scenario-based model to anticipate outcomes and inform strategy

GVR SOLUTION

-

Built a bottom-up commodity-flow and analogue-based model, anchored on Merck’s $29.5B Keytruda sales in 2024.

-

Integrated jurisdictional LOE timelines (EU mid-2028, U.S. 2028-2029 pending litigation outcomes).

-

Modeled biosimilar adoption S-curves calibrated to oncology antibody analogues (EU faster via tenders, U.S. slower via contracting).

-

Applied price-erosion benchmarks (EU -15-30% Yr-1, deepening to -45-60% by Yr-3; U.S. -10-25% net decline over same horizon).

-

Layered lifecycle defenses (SC uptake assumptions of 25-40% of innovator units, combo refresh, contracting) to quantify buffers.

-

Delivered outputs as a dynamic Excel scenario tool and a management-ready PPT deck with revenue bridges, sensitivity tornadoes, and SC migration visuals.

IMPACT FOR CLIENT

-

Enabled the client to quantify downside vs. defense-optimized revenue trajectories:

-

Base case: 30-40% global revenue decline by Year-3 post-LOE.

-

Downside: 45-55% decline in tender-heavy markets.

-

Defense-optimized: Contained erosion to ~-20-25% with strong SC adoption.

-

-

Gave the client a clear view of which markets drive early erosion (EU) and where strategic contracting or SC migration can preserve share (U.S.).

-

Equipped decision-makers with a playbook of watch-points (tender concentration, litigation outcomes, SC IP coverage, combo pipeline) to guide commercial strategy.

-

Provided a transparent methodology that could be presented to boards/investors with evidence-backed assumptions

WHY THIS MATTERS

-

Keytruda is the world’s best-selling cancer drug, representing nearly one-third of Merck’s revenue.

-

Patent expiry will reshape both Merck’s earnings profile and global oncology access dynamics.

-

Payers and governments stand to benefit from biosimilar entry through lower costs, but manufacturers need to manage cliff risk while capturing upside from lifecycle innovations.

-

Understanding how quickly revenues erode and how patient access expands post-biosimilar is critical for:

-

Biopharma companies (strategic planning, pipeline prioritization).

-

Investors (valuing Merck’s cash flows beyond 2028).

-

Payers and policymakers (budgeting for oncology drug spend).

-

A robust patent cliff model helps clients navigate the dual challenge of price erosion and patient expansion, ensuring strategies are grounded in real-world benchmarks.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

-

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified