- Home

- »

- Market Trend Reports

- »

-

Nivolumab Market Outlook: Label Expansion & Biosimilar Pipeline Shaping Future Dynamics

Report Overview

Nivolumab, marketed as Opdivo by Genentech (a Roche subsidiary), has become a cornerstone treatment for oncology indications, including metastatic colorectal cancer, non-small cell lung cancer, and glioblastoma. Its strong market performance has been driven by its anti-angiogenic efficacy and extensive clinical applications. As key patents continue to expire, the Nivolumab market is poised for significant change. The evolving patent cliff creates both challenges and opportunities, particularly with the rise of biosimilars. The entry of biosimilars into the market will introduce competitive pressures, potentially reshaping treatment protocols and market share dynamics in the oncology space.

Key Report Deliverables

-

Analyze the Nivolumab (Opdivo) Market Landscape, focusing on market size, growth drivers, and industry trends, especially the impact of patent expiration and emerging biosimilars like those from Amgen and Sandoz on the competitive dynamics.

-

Forecast Market Growth, projecting future trends and risks, particularly how biosimilars will provide cost-effective alternatives and capture market share from the originator drug.

-

Identify Regulatory and Market Barriers, exploring challenges biosimilars face in gaining approval and market access, including pricing and healthcare system dynamics.

-

Concurrent Competitive Landscape, analyzing key players in the Nivolumab market, including Bristol Myers Squibb, Merck, Regeneron, and biosimilars developers, and their strategic responses to the post-patent environment.

-

Regulatory Barriers, assessing the regulatory challenges for Nivolumab biosimilars, including approval processes and market access restrictions, and their impact on market expansion.

-

Strategic Implications, evaluating Bristol Myers Squibb’s strategies to maintain leadership, including innovation, differentiation, patient support, and geographic expansion amid rising biosimilar competition.

Patent Cliff Analysis

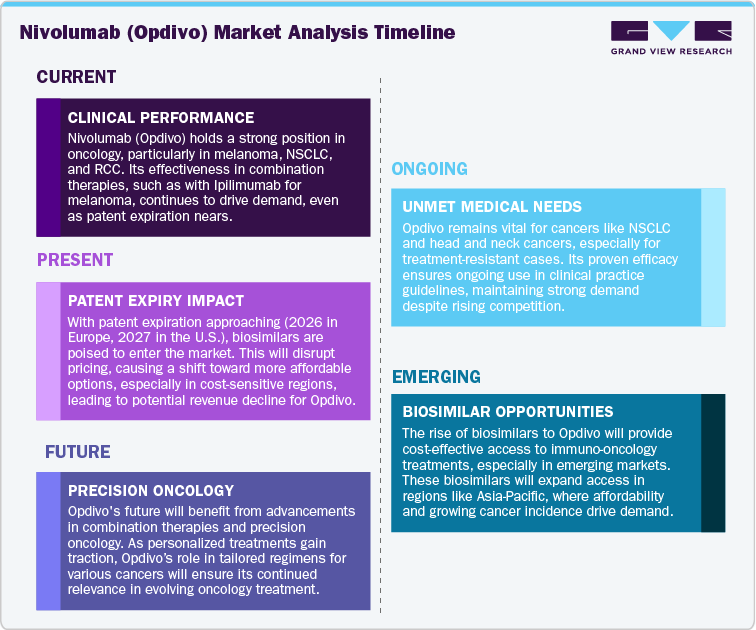

The patent expiration of Nivolumab (Opdivo) represents a significant turning point for the immuno-oncology sector. As Bristol Myers Squibb (BMS) approaches the loss of market exclusivity for Nivolumab, the drug faces competitive pressures, particularly from the anticipated launch of biosimilars. Nivolumab’s key patent in the U.S. is set to expire in 2027, while in Europe, it will likely expire earlier, in 2026. This expiration marks the beginning of a critical phase where biosimilar manufacturers, including Amgen and Sandoz, will attempt to capture market share with cost-effective alternatives.

The primary market impact post-patent expiry is the introduction of biosimilars. Biosimilars, although not exact replicas, offer similar efficacy and safety profiles, and their approval and adoption will result in significant cost reductions within oncology treatments. The uptake of biosimilars will disrupt the pricing model of Nivolumab, leading to downward pressure on pricing and reimbursement structures. For BMS, this challenge is compounded by the increasing number of competing PD-1 inhibitors in the market, including Merck’s Keytruda, Regeneron’s Libtayo, and other emerging players. As these competitors continue to advance in clinical trials and secure approvals, BMS may face additional challenges in maintaining market share.

Nivolumab’s revenue opportunities in the post-patent period will rely on its ability to differentiate itself through innovation, such as expanding its pipeline with combination therapies and new indications. BMS is also looking to leverage the subcutaneous formulation of Nivolumab to improve patient adherence and convenience, potentially offsetting some competitive pressures. The ongoing clinical studies for Nivolumab in various cancer indications, including its use in combination with other agents, will be critical to sustaining market position. However, the revenue model will inevitably shift towards a more cost-conscious environment, where biosimilars will play an increasingly prominent role.

BMS’s strategic responses post-patent expiry will likely focus on securing a robust portfolio of new treatments, optimizing existing formulations, and expanding into emerging markets. The competitive dynamics in the U.S., EU, and Asia-Pacific regions will differ, with the U.S. and Europe potentially adopting biosimilars more rapidly, while Asia-Pacific could present longer exclusivity periods due to local regulatory environments. In emerging markets, pricing strategies and patient access programs will become increasingly important to maintain market penetration.

As Opdivo approaches patent expiration, the sales at risk are projected to increase significantly, from 9% in 2025 to 40% by 2033. This rise in risk is largely due to the anticipated competition from biosimilars, which are expected to capture a significant portion of Opdivo’s market share. The increasing risk suggests a potential for substantial revenue loss as generic versions enter the market, driving down prices and reducing Opdivo’s ability to maintain its previous market dominance.

Current Market Scenarios

The Nivolumab (Opdivo) market is positioned as a significant treatment within the immuno-oncology sector, with approvals for a variety of indications in multiple regions, including the U.S., Europe, and Japan. Nivolumab, as a PD-1 immune checkpoint inhibitor, is utilized for treating cancers such as melanoma, non-small cell lung cancer (NSCLC), renal cell carcinoma (RCC), and others. The drug’s market presence has been supported by its use in combination therapies, such as with Ipilimumab for melanoma and NSCLC, which has expanded its clinical applications.

As of 2024, Nivolumab’s market share remains substantial, though it is experiencing increasing competition from other PD-1 inhibitors, most notably Merck’s Keytruda. Keytruda has gained a significant portion of the market, particularly in first-line treatments for melanoma and NSCLC. Other competitors, such as Regeneron’s Libtayo and other emerging immunotherapies, are also expanding their presence in the oncology market, presenting additional challenges for Nivolumab.

The introduction of biosimilars is a growing factor in the Nivolumab market, particularly with the approaching patent expiration. Biosimilars, while not identical to Nivolumab, are expected to offer similar therapeutic effects at reduced costs. This could influence market dynamics, particularly in regions like the U.S. and Europe, where cost-effectiveness is a significant consideration. The entry of biosimilars is expected to drive price competition and could result in a shift in market share, as healthcare systems and payers increasingly adopt more affordable alternatives.

The revenue potential for Nivolumab in the current environment will depend on the ongoing expansion of its indications. New approvals, particularly for combination therapies and the development of subcutaneous formulations, are expected to continue supporting market demand. The subcutaneous formulation, approved in late 2024, could also address patient convenience and adherence, potentially mitigating some of the pressure from competitors. Despite these opportunities, the market remains competitive, with biosimilars and other therapies increasing the level of market dynamics.

Market Dynamics

“Nivolumab’s growth is driven by expanded indications and combination therapies

The Nivolumab (Opdivo) market is primarily driven by the growing demand for targeted immuno-oncology therapies, particularly in advanced cancer treatment. The drug’s efficacy in treating multiple cancer types, including melanoma, non-small cell lung cancer (NSCLC), and renal cell carcinoma (RCC), positions it as a key player in the immunotherapy segment. The increasing approval of Nivolumab in combination therapies has significantly expanded its market presence. For instance, its combination with Ipilimumab (Yervoy) for melanoma and NSCLC has proven to enhance patient outcomes, contributing to higher adoption rates. Moreover, the approval of subcutaneous formulations in late 2024, which offer reduced infusion time and better patient adherence, is expected to further boost Nivolumab's appeal. This combination of effectiveness across multiple indications and patient convenience is helping Nivolumab maintain a strong foothold in an increasingly competitive oncology landscape.

Additionally, Nivolumab's market is supported by the increasing acceptance of immune checkpoint inhibitors as standard-of-care treatments in oncology. Its ability to deliver durable responses in patients with advanced and metastatic cancers, along with an established safety profile, is strengthening its position in key markets like the U.S. and Europe. The expanding pipeline for Nivolumab, including ongoing clinical trials in various cancers such as hepatocellular carcinoma (HCC) and colorectal cancer, continues to drive the drug’s market potential. As Nivolumab gains further regulatory approvals across these new indications, it is expected to tap into larger patient populations, which will drive market growth. These factors collectively serve as major drivers propelling the market for Nivolumab in the current and future healthcare environment.

“Competition from Keytruda and other PD-1 inhibitors poses a threat to Nivolumab’s market share”

Despite its strong market position, the Nivolumab (Opdivo) market faces several restraints that could limit its future growth. One of the primary challenges is the increasing competition from other PD-1 inhibitors, most notably Merck’s Keytruda. Keytruda has gained significant traction in several indications, including melanoma and NSCLC, due to its broader approval in first-line treatments and its strong clinical performance. As Keytruda and other competitors expand their market share, Nivolumab may experience pricing pressures and potential shifts in market dynamics. Moreover, the aggressive expansion of Regeneron’s Libtayo and other emerging immunotherapies further intensifies competition, which could hinder Nivolumab’s ability to retain its market leadership across all indications.

Another significant restraint is the potential impact of biosimilars in the post-patent era. The expiration of Nivolumab’s key patents, set for 2027 in the U.S. and 2026 in Europe, will open the door for biosimilars, which are expected to drive down prices and potentially capture market share from the originator drug. These biosimilars, while not identical, offer cost-effective alternatives, which could pressure reimbursement structures and healthcare budgets. In particular, countries with cost-sensitive healthcare systems, such as those in Europe, may prioritize biosimilars over branded drugs, leading to a reduction in Nivolumab's market share and overall revenue potential. As the market shifts toward biosimilars, the pricing landscape for Nivolumab will become increasingly challenging, potentially limiting its future growth.

“Growth opportunities lie in new cancer indications, combination strategies, and subcutaneous formulations.”

The Nivolumab market presents significant opportunities in both established and emerging oncology indications. One of the key opportunities lies in its expansion into additional cancer types, particularly in combination therapies. Nivolumab has already demonstrated promising results when used alongside chemotherapy or other immune checkpoint inhibitors, such as Ipilimumab and Relatlimab. Ongoing clinical trials are exploring the combination of Nivolumab with novel agents, such as targeted therapies and other immune modulators, in cancers like hepatocellular carcinoma (HCC), colorectal cancer, and gastric cancer. These combinations are expected to further strengthen Nivolumab’s market positioning by offering patients more effective treatment options, particularly in cancers with high unmet medical needs. As more indications are approved, Nivolumab’s potential market size will increase, providing a substantial opportunity for growth.

Additionally, the advent of Nivolumab’s subcutaneous formulation in late 2024 presents a unique opportunity to enhance patient convenience and improve treatment adherence. This formulation, which reduces the time required for administration compared to the intravenous version, is expected to address one of the key challenges in cancer care: patient adherence to long-term therapies. The shift to subcutaneous formulations aligns with the broader industry trend toward patient-centric solutions, potentially improving patient outcomes and increasing market demand. This move is particularly relevant in markets like the U.S. and Europe, where healthcare providers and patients alike are seeking more convenient treatment options. As the healthcare landscape continues to focus on improving patient experience and cost-effectiveness, Nivolumab’s subcutaneous formulation could become a key driver for sustaining its market position.

“Combination therapies and early-stage cancer treatments are emerging trends shaping Nivolumab’s market trajectory”

-

Combination Therapies Gaining Momentum

The trend of combining Nivolumab with other therapies, such as Ipilimumab and Relatlimab, is expanding in oncology. This approach enhances treatment efficacy across various cancer types, particularly melanoma and NSCLC. Combining immune checkpoint inhibitors with targeted therapies or other immunotherapies, especially in solid tumors, is expected to grow, benefiting patients with high mutational burdens. This trend reflects the broader shift in oncology toward multi-modal treatments designed to improve survival rates and overall patient outcomes.

-

Increasing Use in Early-Stage Cancers

Nivolumab’s role is expanding beyond advanced cancers to include neoadjuvant and adjuvant settings. Clinical trials and recent approvals, such as for resectable NSCLC and Stage IIB/C melanoma, highlight this shift. The use of Nivolumab in early-stage cancers addresses a growing need for improved survival in these patients. As more data emerges, Nivolumab’s potential in treating earlier-stage cancers could lead to a larger patient population and a significant increase in market opportunity.

-

Focus on Personalized Oncology

Nivolumab is increasingly part of the personalized oncology movement, with treatments tailored to individual patient profiles, particularly in solid tumors. This trend aligns with the broader shift towards precision medicine, where therapies are designed to target specific genetic and molecular characteristics of cancers. Nivolumab’s ability to combine with other agents to personalize treatment regimens for patients with diverse cancer profiles is expected to drive demand as healthcare providers seek more effective, individualized therapeutic options.

Overview of Alternative Therapeutics

The Nivolumab (Opdivo) market is facing significant competition from alternative immunotherapies, primarily PD-1/PD-L1 inhibitors like Merck’s Keytruda and Regeneron’s Libtayo, which are gaining approval for similar cancer indications. Keytruda, with a stronger presence in first-line treatments for melanoma and NSCLC, poses a direct challenge to Nivolumab’s market share.

Biosimilars, expected post-patent expiry, are emerging as cost-effective alternatives. These biosimilars will impact pricing and market dynamics, particularly in regions with a focus on cost-efficiency, such as Europe and the U.S. Additionally, the pipeline for novel immunotherapies, including next-generation immune checkpoint inhibitors and antibody-drug conjugates (ADCs), is expanding, further intensifying competition.

Companies must strategically respond to the growing biosimilar market and the increasing presence of new immunotherapies to maintain their market positions.

Competitive Landscape

The competitive environment for Nivolumab (Opdivo) is primarily influenced by Merck’s Keytruda, which remains a dominant player in the PD-1/PD-L1 inhibitor market, particularly in melanoma, non-small cell lung cancer (NSCLC), and head and neck cancers. Additionally, Regeneron’s Libtayo has strengthened its position in advanced cancers like cutaneous squamous cell carcinoma (CSCC) and NSCLC, demonstrating notable efficacy in combination therapies. As these direct competitors gain ground, the market dynamics for Nivolumab are increasingly pressured by their strong clinical data and expanding approvals.

In addition to these direct competitors, the market is facing an emerging threat from biosimilars. With Nivolumab’s patents nearing expiration, companies like Amgen and Xbrane Biopharma are developing biosimilars, which will offer lower-cost alternatives, intensifying price competition. To maintain its market position, Bristol Myers Squibb is expanding Nivolumab’s indications and introducing new formulations, such as the subcutaneous version, to enhance patient convenience and improve adherence. These strategic initiatives are critical as the competitive landscape evolves with the rise of biosimilars and new therapies.

North America Nivolumab (Opdivo) Market

In North America, the Nivolumab (Opdivo) market is primarily driven by its strong presence in the treatment of melanoma, non-small cell lung cancer (NSCLC), and renal cell carcinoma (RCC). The growing adoption of immunotherapies in oncology is reinforcing Nivolumab’s position, particularly in combination therapies where it is used with Ipilimumab for melanoma and NSCLC. The competitive landscape is influenced by Merck's Keytruda, which has gained significant traction in first-line treatments, positioning it as the leading PD-1 inhibitor in the region. However, Nivolumab’s well-established clinical profile and its expanded indications are expected to sustain its relevance. The market is also impacted by the impending arrival of biosimilars, which will introduce cost-effective alternatives and increase pricing pressures. Despite this, Nivolumab remains integral to many treatment regimens in both private and public healthcare systems, with continued preference for biologic treatments in oncology care.

Europe Nivolumab (Opdivo) Market

In Europe, Nivolumab continues to be a key player in the immuno-oncology market, especially for melanoma, NSCLC, and RCC. Regulatory support for immunotherapies has facilitated its widespread adoption across multiple countries. However, the increasing use of PD-1 inhibitors such as Merck’s Keytruda and the development of biosimilars are exerting pressure on Nivolumab’s market share. Biosimilars, following Nivolumab's patent expiry, will likely contribute to cost reductions, particularly in public healthcare systems where cost containment is a priority. Nivolumab still maintains its position in first-line treatments for several cancers, but the increasing preference for combination therapies and the growing penetration of biosimilars are expected to reshape the competitive landscape. The ongoing trend toward personalized medicine and expanding immunotherapy combinations will continue to influence treatment protocols and the market dynamics in Europe.

Asia-Pacific Nivolumab (Opdivo) Market

The Asia-Pacific region presents a rapidly evolving market for Nivolumab, driven by the rising cancer burden, particularly in countries such as China, Japan, and India. Nivolumab’s approval for a range of cancers, including melanoma and NSCLC, has positioned it as a cornerstone treatment in several oncology indications. However, competition from Merck's Keytruda and the growing availability of biosimilars will influence market dynamics. The regulatory landscape in countries like Japan has facilitated faster access to immunotherapies, and the increasing demand for cost-effective alternatives is driving biosimilar development. As healthcare access improves, the preference for biologic therapies will likely remain strong, but the shift toward biosimilars in cost-sensitive markets will challenge Nivolumab’s market share. The market's evolution will be influenced by the expanding availability of combination therapies and the increasing integration of immuno-oncology treatments in early-stage cancer care.

Latin America Nivolumab (Opdivo) Market

In Latin America, the Nivolumab market is impacted by the rising cancer incidence, particularly in countries such as Brazil and Mexico, where melanoma and lung cancer rates are increasing. Nivolumab continues to be a preferred treatment for advanced cancers, but the entry of biosimilars is beginning to alter the market landscape. Biosimilars are gaining acceptance in the region, particularly in public healthcare systems, where cost-effective options are essential due to limited healthcare budgets. Nivolumab’s market share in Latin America faces growing pressure from lower-cost biosimilars, especially as healthcare infrastructure improves and the demand for affordable cancer treatments rises. While Nivolumab remains a key player in the treatment of melanoma and NSCLC, the increasing adoption of biosimilars and the shift toward more affordable biologic alternatives will likely reduce its dominance over time.

Middle East and Africa Nivolumab (Opdivo) Market

In the Middle East and Africa (MEA), the Nivolumab market is still developing, with significant opportunities arising from improving healthcare infrastructure. In countries like Saudi Arabia and South Africa, Nivolumab is used in the treatment of melanoma, NSCLC, and RCC, but access to biologic therapies remains limited in some regions. The increasing focus on oncology care and investments in healthcare infrastructure are expected to drive growth in the adoption of Nivolumab and its biosimilars. Biosimilars are becoming a critical component of the competitive landscape in the MEA region, where cost-effectiveness is a priority. As access to biologic therapies improves, the market for Nivolumab is expected to grow, but competition from biosimilars will intensify, particularly in countries with limited healthcare budgets. The preference for biologic therapies is expected to continue rising, especially as access to cancer treatments expands across the region.

Analyst Perspective

The Nivolumab (Opdivo) market is facing significant competition from Merck’s Keytruda and Regeneron’s Libtayo, particularly in melanoma and NSCLC. As Nivolumab’s patent expiration approaches, biosimilars are expected to enter the market, which will introduce pricing pressures, especially in cost-sensitive regions. In response, Bristol Myers Squibb is expanding Nivolumab’s clinical indications, including its use in early-stage cancers, and introducing subcutaneous formulations to enhance patient adherence and convenience. The focus on combination therapies and patient access programs will be essential to maintain Nivolumab’s market position amidst growing competition and cost pressures.

Case Study (Recent Engagement): Keytruda Patent-Cliff & Price- Erosion Impact Model

PROJECT OBJECTIVE

To evaluate the potential revenue, price, and patient access implications of Keytruda’s 2028 patent cliff, incorporating biosimilar entry dynamics, country-specific adoption curves, and Merck’s lifecycle defense strategies (remarkably the subcutaneous formulation). The goal was to provide the client with a transparent, scenario-based model to anticipate outcomes and inform strategy

GVR SOLUTION

-

Built a bottom-up commodity-flow and analogue-based model, anchored on Merck’s $29.5B Keytruda sales in 2024.

-

Integrated jurisdictional LOE timelines (EU mid-2028, U.S. 2028-2029 pending litigation outcomes).

-

Modeled biosimilar adoption S-curves calibrated to oncology antibody analogues (EU faster via tenders, U.S. slower via contracting).

-

Applied price-erosion benchmarks (EU -15-30% Yr-1, deepening to -45-60% by Yr-3; U.S. -10-25% net decline over same horizon).

-

Layered lifecycle defenses (SC uptake assumptions of 25-40% of innovator units, combo refresh, contracting) to quantify buffers.

-

Delivered outputs as a dynamic Excel scenario tool and a management-ready PPT deck with revenue bridges, sensitivity tornadoes, and SC migration visuals.

IMPACT FOR CLIENT

-

Enabled the client to quantify downside vs. defense-optimized revenue trajectories:

-

Base case: 30-40% global revenue decline by Year-3 post-LOE.

-

Downside: 45-55% decline in tender-heavy markets.

-

Defense-optimized: Contained erosion to ~-20-25% with strong SC adoption.

-

-

Gave the client a clear view of which markets drive early erosion (EU) and where strategic contracting or SC migration can preserve share (U.S.).

-

Equipped decision-makers with a playbook of watch-points (tender concentration, litigation outcomes, SC IP coverage, combo pipeline) to guide commercial strategy.

-

Provided a transparent methodologythat could be presented to boards/investors with evidence-backed assumptions

WHY THIS MATTERS

-

Keytruda is the world’s best-selling cancer drug, representing nearly one-third of Merck’s revenue.

-

Patent expiry will reshape both Merck’s earnings profile and global oncology access dynamics.

-

Payers and governments stand to benefit from biosimilar entry through lower costs, but manufacturers need to manage cliff risk while capturing upside from lifecycle innovations.

-

Understanding how quickly revenues erode and how patient access expands post-biosimilar is critical for:

-

Biopharma companies (strategic planning, pipeline prioritization).

-

Investors (valuing Merck’s cash flows beyond 2028).

-

Payers and policymakers (budgeting for oncology drug spend).

-

A robust patent cliff model helps clients navigate the dual challenge of price erosion and patient expansion, ensuring strategies are grounded in real-world benchmarks.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

-

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified