- Home

- »

- Market Trend Reports

- »

-

Risankizumab (Skyrizi): Novel Solution For The Management Of Moderate-To-Severe Plaque Psoriasis

Report Overview

The Risankizumab (Skyrizi) market is experiencing notable developments, influenced by evolving regulatory standards, increasing demand, and shifting competitive dynamics within the pharmaceutical industry. As the market expands, it is essential to consider factors impacting its growth trajectory, emerging trends, and strategies employed by competitors. This report provides a detailed analysis of current market conditions, competitive positioning, and potential growth opportunities, delivering key insights to support strategic business decisions and investment opportunities within the pharmaceutical sector.

Key Report Deliverables:

-

Analyze the Risankizumab (Skyrizi) market landscape, detailing its current size, growth drivers, and key industry trends shaping the pharmaceutical sector.

-

Evaluate the competitive environment, identifying key players, their strategic moves, and the distribution of market share to understand competitive positioning.

-

Forecast market growth by projecting future trends, highlighting emerging opportunities, and assessing potential risks to growth.

-

Identify regulatory and market barriers, providing insights into challenges that could impact future market expansion and product development.

- Concurrent Competitive Landscape, Assessing the current competitive environment, examining both direct and indirect competitors within the market.

Market Introduction and Sales Growth

Risankizumab (Skyrizi) has become a cornerstone in AbbVie’s immunology portfolio, primarily targeting moderate-to-severe plaque psoriasis and other autoimmune disorders. Since its launch, it has experienced strong sales growth, driven by its high clinical efficacy, favorable safety profile, and infrequent dosing schedule, which improves patient adherence. Skyrizi’s performance is particularly strong in key markets, including the U.S., Europe, and Asia Pacific, supported by robust physician confidence and insurance reimbursement frameworks. The drug’s rapid adoption has reinforced AbbVie’s position in the IL-23 inhibitor market, allowing consistent revenue expansion prior to patent expiry.

Impact of Patent Protection on Sales

Sales of Skyrizi up to the 2033 patent expiry are heavily influenced by market exclusivity. The core patents grant AbbVie the ability to maintain pricing power without immediate competition from biosimilars or generics, protecting profit margins. During this period, AbbVie benefits from a stable market environment, with limited competitive pressure from other IL-23 inhibitors. The company leverages this exclusivity to maximize revenue, expand market presence, and strengthen physician relationships. Furthermore, regulatory protections and patent enforcement in key geographies allow AbbVie to capture peak sales while delaying the impact of potential competitors.

Expansion and Market Penetration Strategies

AbbVie’s strategy to maintain Skyrizi’s sales includes geographic expansion, patient access programs, and exploring additional indications beyond psoriasis. Entry into new markets, particularly in Asia Pacific and Latin America, has provided significant growth opportunities. The company also invests in awareness campaigns, supporting physician education and patient adherence initiatives. By ensuring broader market penetration and accessibility, AbbVie strengthens Skyrizi’s competitive position. Even in the face of emerging competitors, delayed biosimilar entry allows continued revenue growth. These strategic efforts ensure that pre-patent expiry sales remain robust, securing Skyrizi’s place as a leading immunology therapy.

Future Outlook Until Patent Expiry

Up to 2033, Skyrizi’s sales trajectory is expected to remain strong, with peak revenue reached during this period. The absence of direct biosimilar competition, combined with regulatory protection and payer acceptance, supports sustained market performance. AbbVie’s continued focus on new indications, pricing strategies, and market access further reinforces growth. However, the company must anticipate gradual competitive pressures from other IL-23 inhibitors in select markets. Overall, the pre-patent expiry period represents a critical window for maximizing profitability, ensuring AbbVie captures the full value of Skyrizi before biosimilars enter the market, which will later influence pricing and market share.

Current Market Scenarios:

The Risankizumab (Skyrizi) market is witnessing robust growth due to the rising prevalence of moderate-to-severe plaque psoriasis globally. Psoriasis is a chronic autoimmune skin disorder that affects millions, with the highest prevalence reported in developed regions such as North America and Europe. Improved disease awareness, earlier diagnosis, and expanding healthcare access in emerging markets are contributing to market expansion. Patients increasingly demand therapies that combine efficacy with convenient dosing and minimal side effects. Skyrizi’s targeted IL-23 inhibition and long dosing interval cater to these needs, providing an effective solution in a competitive dermatology landscape.

Clinical evidence has positioned Skyrizi as a leading therapy among biologics for plaque psoriasis. Pivotal trials including UltIMMa-1, UltIMMa-2, and IMMvent have demonstrated superior efficacy compared to other biologics, with high PASI 90 and PASI 100 response rates. The therapy’s favorable safety profile and reduced dosing frequency improve patient adherence, a key factor in long-term disease management. These clinical advantages are driving adoption in both established and emerging markets, reinforcing Risankizumab’s growth potential.

The market outlook for Risankizumab (Skyrizi) is supported by rising awareness of psoriasis’ psychosocial and economic impact. Patients seek therapies that improve both physical symptoms and quality of life. Backed by real-world evidence and post-marketing studies, Skyrizi holds a strong position among biologics. With healthcare systems focusing on value-based care, therapies with sustained efficacy, better adherence, and reduced hospital visits are preferred, driving Skyrizi’s market growth and wider acceptance.

Market Dynamics

Precision in Immunology: Risankizumab’s Targeted IL-23 Inhibition

Risankizumab (Skyrizi) operates through a highly selective mechanism that sets it apart from conventional psoriasis therapies. By targeting the IL-23 (interleukin-23) pathway, Risankizumab interrupts a key driver of chronic inflammation, offering durable clinical responses and improved patient quality of life.

-

IL-23 Blockade: IL-23 is central in the differentiation and survival of Th17 cells, which produce pro-inflammatory cytokines driving psoriasis. By inhibiting IL-23, Risankizumab effectively reduces skin inflammation, plaque formation, and associated symptoms, providing high rates of PASI 90 and PASI 100 responses.

-

Advantages Over Broader Biologics: Unlike older biologics that target TNF-α or both IL-12/23, Risankizumab’s selective IL-23 inhibition minimizes unnecessary immune suppression while maintaining superior efficacy and safety. This translates to fewer side effects, longer remission periods, and convenient dosing every 12 weeks.

This precise immunological approach allows Risankizumab to outperform many existing treatments, ensuring not just symptom relief but also long-term disease control. Its mechanism positions it as a next-generation therapy in dermatology, driving strong physician confidence and patient preference in the competitive psoriasis biologics market.

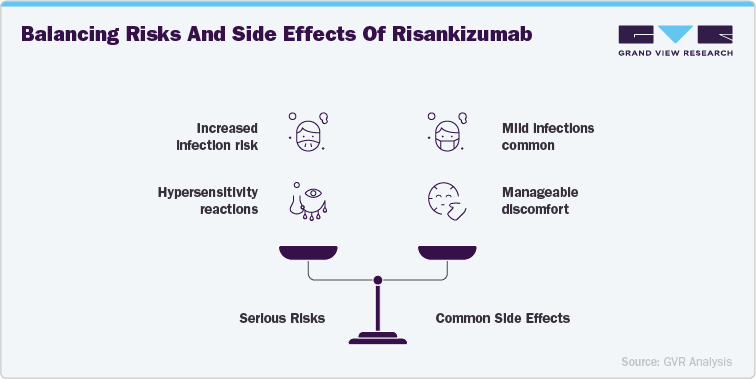

Side Effects and Risks Associated with Risankizumab (Skyrizi)

Risankizumab is generally well-tolerated, but like other biologic therapies, it is associated with certain risks that require careful monitoring. Serious risks include infections, hypersensitivity reactions, and potential effects on the immune system. Because Risankizumab targets IL-23, it may increase susceptibility to upper respiratory infections, tuberculosis, and other opportunistic infections. Hypersensitivity reactions, including angioedema and urticaria, have been reported in some cases. Patients with a history of chronic or recurrent infections should be screened prior to initiating treatment, and healthcare providers must monitor closely for new infections during therapy. Additionally, live vaccines should be avoided while on treatment.

The more common side effects of Risankizumab are typically mild to moderate and include upper respiratory tract infections, headache, fatigue, and injection site reactions such as redness or itching. These side effects are usually transient and do not require discontinuation of therapy. Some patients may also experience tinea infections and pruritus. While generally manageable, these side effects can influence patient comfort and adherence, particularly in long-term treatment scenarios. Healthcare providers are encouraged to educate patients about expected side effects and provide management strategies to ensure sustained treatment success and improved quality of life.

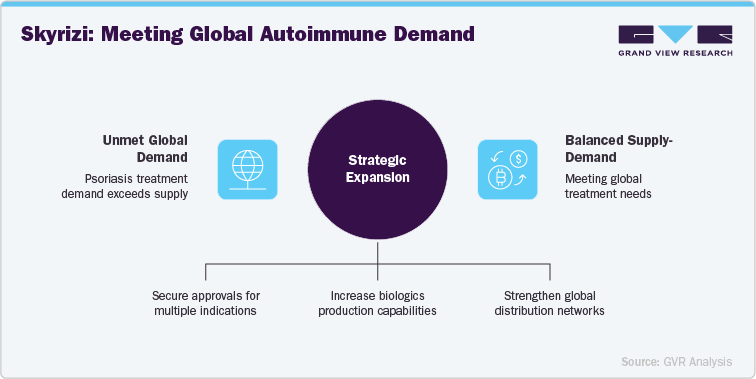

“Capitalizing on Global Demand for Psoriasis and Autoimmune Disease Treatment”

AbbVie’s expansion strategy for Risankizumab (Skyrizi) focuses not only on securing regulatory approvals across multiple indications but also on strengthening manufacturing capacity to meet rising global demand. With strategic investments in biologics production and global distribution networks, AbbVie is positioning Skyrizi to effectively balance supply-demand and ensure long-term commercial success. This approach enables AbbVie to maintain a competitive edge in developed markets while also expanding access to emerging regions, reinforcing its leadership in the immunology therapeutic area.

Skyrizi’s targeted IL-23 inhibition provides a unique advantage in the treatment of moderate-to-severe plaque psoriasis, while ongoing trials are expanding its reach into Crohn’s disease and ulcerative colitis. This broadening of therapeutic scope positions Skyrizi as a highly competitive biologic across multiple autoimmune disorders. As the global burden of psoriasis and inflammatory bowel diseases continues to rise, especially in regions such as Asia-Pacific and Latin America, Skyrizi’s demonstrated clinical efficacy, long dosing interval, and strong safety profile make it an increasingly appealing treatment option.

Furthermore, Skyrizi’s expanding global footprint, supported by a growing body of real-world evidence and clinical trial data, strengthens its role as a major player in the autoimmune disease biologics market. With increasing demand for effective, convenient, and durable biologic therapies, AbbVie is strategically positioned to capture significant market share. The continued expansion of Skyrizi’s indications, combined with rising adoption across geographies, underlines its potential to drive AbbVie’s long-term growth and reinforce its position in the immunology sector.

“Skyrizi Market Thrives with Global Expansion”

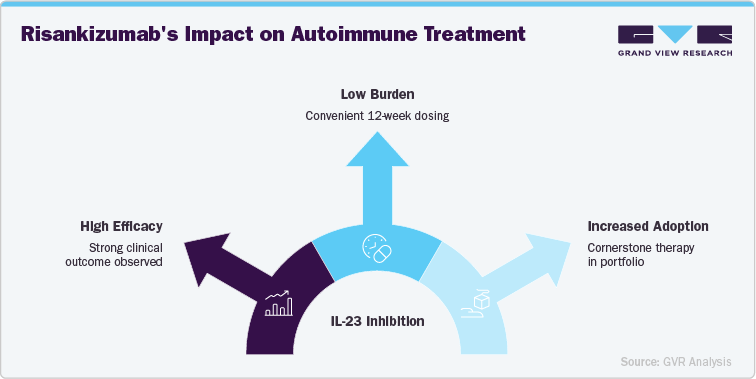

- Growing Preference for Targeted Biologics:

Risankizumab, with its selective IL-23 inhibition, is capitalizing on the rising adoption of targeted biologic therapies for plaque psoriasis and other autoimmune diseases. As patients and physicians increasingly prioritize treatments with high efficacy and favorable safety profiles, Skyrizi’s strong clinical outcomes and convenient 12-week dosing schedule position it as a preferred choice in the growing biologics market.

- Increased Demand for Autoimmune Disease Solutions:

The global burden of psoriasis, Crohn’s disease, and ulcerative colitis continues to rise, fueling demand for effective long-term treatments. Skyrizi’s expanding approval across multiple autoimmune indications, combined with consistent trial data demonstrating PASI 90/100 response rates, reinforces its value proposition. This trend is accelerating adoption among dermatologists and gastroenterologists, making Skyrizi a cornerstone therapy in AbbVie’s immunology portfolio.

- Shift Toward Long-Term, Low-Burden Regimens:

Patients are increasingly seeking sustainable treatment options with fewer administrations, and Skyrizi’s every-12-weeks dosing aligns perfectly with this shift. Compared to older biologics requiring more frequent injections, Skyrizi offers a low-burden regimen that enhances patient adherence and improves overall quality of life. This trend supports its growing global uptake and solidifies its position as a convenient, patient-friendly biologic in the competitive autoimmune disease market.

Overview of Alternative Therapeutics:

Alternative therapeutics for plaque psoriasis and other autoimmune diseases include several classes of biologic and non-biologic treatments. TNF-α inhibitors (e.g., adalimumab, etanercept) remain widely used but are often associated with broader immune suppression and increased infection risk. IL-17 inhibitors (e.g., secukinumab, ixekizumab) provide strong efficacy but require more frequent dosing compared to Risankizumab’s once-every-12-weeks schedule. IL-12/23 inhibitors (e.g., ustekinumab) target a broader pathway but may not achieve the same high rates of PASI 90/100 responses.

Conventional systemic therapies such as methotrexate and cyclosporine are commonly prescribed but can be limited by toxicity and long-term safety concerns. Phototherapy remains an option for some patients, though accessibility and treatment burden restrict widespread use. Inflammatory bowel disease patients may also rely on steroids and immunomodulators, though these approaches lack durability and carry significant side effects.

While these alternatives have established roles in autoimmune disease management, Risankizumab’s selective IL-23 inhibition offers superior long-term efficacy, a favorable safety profile, and convenient dosing, making it a differentiated option. By minimizing unnecessary immune suppression while achieving durable disease control, Skyrizi positions itself as a next-generation therapy compared to older biologics and systemic treatments.

Competitive Landscape :

AbbVie, the sole authorized manufacturer of Risankizumab (Skyrizi), has strategically strengthened its global immunology portfolio to secure leadership in the biologics market. Recognizing the rising demand for targeted therapies in autoimmune diseases such as plaque psoriasis, Crohn’s disease, and ulcerative colitis, AbbVie has made significant investments in research, manufacturing, and distribution networks to ensure reliable access and long-term commercial success for Skyrizi. In its First-Quarter 2025 Financial Results, AbbVie reported global Skyrizi net revenues of USD 3.425 billion, reflecting strong adoption across geographies and therapeutic areas.

A cornerstone of AbbVie’s strategy is its multi-billion-dollar investment in biologics manufacturing facilities, particularly in the U.S. and Europe, designed to expand capacity for monoclonal antibodies like Skyrizi. These sites integrate advanced bioprocessing technologies to ensure scalability, quality, and supply stability, supporting AbbVie’s ability to meet increasing patient demand while maintaining global regulatory compliance.

Beyond manufacturing, AbbVie is aggressively expanding Skyrizi’s indications through late-stage clinical trials, including gastrointestinal and dermatology disorders, solidifying its competitive positioning against rivals such as Stelara (ustekinumab), Cosentyx (secukinumab), and Taltz (ixekizumab). Internationally, AbbVie continues to broaden its presence in emerging markets like China, India, and Latin America, where growing prevalence of autoimmune diseases and improved access to biologics present significant opportunities.

These strategic efforts underscore AbbVie’s commitment to maximizing the global potential of Risankizumab (Skyrizi). By enhancing manufacturing infrastructure, driving clinical expansion, and leveraging a strong commercial network, AbbVie positions Skyrizi as a cornerstone therapy within the immunology treatment landscape, ensuring sustainable growth and long-term market leadership.

North America Risankizumab (Skyrizi) Market

North America is the largest market for Skyrizi, driven primarily by the U.S., where the drug is a key contributor to AbbVie’s immunology portfolio. Patent exclusivity in the U.S. is expected to last until 2033, protecting pricing and market share. Once the patent expires, biosimilar risankizumab may enter the market, creating potential pricing pressure. In Canada, exclusivity extends similarly into the early 2030s, and biosimilar competition is expected to intensify once regulatory approvals are secured. While initial adoption of biosimilars may be gradual due to physician familiarity with the branded product, price-sensitive payers are likely to drive uptake over time.

Europe Risankizumab (Skyrizi) Market

Europe represents a strong market for Skyrizi, with Germany, France, and the U.K. being the largest contributors. Supplementary Protection Certificates (SPCs) extend AbbVie’s exclusivity until around 2030–2031. After patent expiration, cost-conscious healthcare systems are likely to encourage switching to biosimilars. The regulatory approval process for biosimilars in Europe is stringent, which may delay immediate adoption. However, once approved, tender-based procurement systems and competitive pricing pressures will likely reshape market share in favor of biosimilars.

Asia Pacific Risankizumab (Skyrizi) Market

The Asia Pacific region offers significant growth opportunities for Skyrizi, particularly in China, India, and Japan, where the prevalence of autoimmune conditions such as psoriasis is increasing. China may see earlier biosimilar entry due to local patent challenges and strong government support for domestic biologics. In India, affordability is a key factor, and biosimilars are expected to gain rapid traction post-exclusivity. Japan, with strict regulatory requirements, may experience slower biosimilar adoption despite high clinical demand. Overall, regulatory approvals and local competition will strongly influence the market trajectory in this region.

Latin America Risankizumab (Skyrizi) Market

In Latin America, demand for immunology therapies like Skyrizi is growing, driven by increasing prevalence of psoriasis and other autoimmune diseases. Brazil, Mexico, and Argentina are the key markets, although high costs may limit access. Post-patent expiry, biosimilars are expected to become available, improving affordability and market penetration. Regulatory agencies in Brazil and Mexico are anticipated to facilitate approvals, while logistical challenges and healthcare infrastructure limitations may affect distribution in certain areas. Pricing strategies and access programs will be critical for both AbbVie and biosimilar developers.

Middle East and Africa Risankizumab (Skyrizi) Market

The Middle East and Africa (MEA) market for Skyrizi is emerging, with Saudi Arabia, the UAE, and South Africa as primary contributors. While awareness and demand for immunology therapies are growing, high costs currently limit access. Biosimilar risankizumab introduction post-patent expiry will be essential to expand availability. Regulatory pathways differ across countries; the UAE and Saudi Arabia provide more efficient approval processes, while other nations may experience delays. Over time, improving healthcare infrastructure and affordability programs are expected to drive long-term growth in the region.

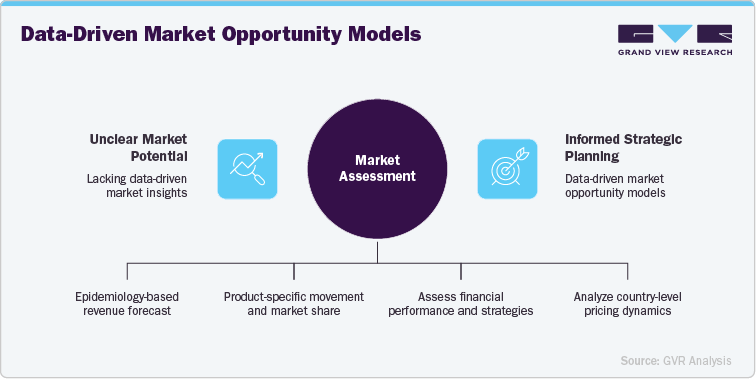

Case Study (Recent Engagement): GLP-1 Receptor Agonist Market Opportunity Assessment

Project Objective

A leading global life sciences client approached us to assess the market potential and commercialization strategy for GLP-1 receptor agonist therapies across type 2 diabetes and obesity indications. The project aimed to support strategic planning for a novel, oral GLP-1 pipeline candidate, with a focus on launch timing, competitive positioning, and regional expansion.

GVR Solution

-

Conducted an epidemiology-based revenue forecast (2021–2036) using patient flow and analogue modeling approaches across North America, Europe, Asia Pacific, and the Middle East.

-

Delivered product-specific movement and market share analysis for:

-

Risankizumab (Skyrizi)– used as a reference analogue for uptake modeling

- Orforglipron (pipeline)– projected using analogue-based scenarios from comparable oral GLP-1 launches

-

-

Benchmarked key players such as Eli Lilly and Novo Nordisk across financial performance, product pipeline, and global rollout strategies.

-

Assessed country-level pricing, regulatory, and reimbursement dynamics, supported by a custom launch timeline and uptake forecast for Orforglipron, modeled analogously to prior GLP-1 innovations.

-

Provided outputs (Excel, PPT, dashboard) and ongoing strategic support tailored to the client’s internal planning and commercialization team needs.

Impact for Client

-

Created market models for launch planning and portfolio prioritization.

-

Guided product strategy with pricing, uptake, and competitor insights.

-

Identified growth markets and shaped regulatory and launch plans.

Why this Matters

-

Build analogue-based forecasts for emerging therapies

-

Provide product insights for pipeline drugs with no historical sales

-

Offer strategic guidance on market entry, launch, and clinical-commercial integration

We bring the same level of analytical rigor, therapeutic market expertise, and consultative flexibility to your assessment of the pancreatic cancer microbubble-based therapy market.

Analyst Perspective

“Risankizumab (Skyrizi)’s selective IL-23 inhibition, strong clinical efficacy, and convenient once-every-12-weeks dosing give it a competitive advantage in the autoimmune disease treatment landscape, positioning it for continued growth in both developed and emerging markets. AbbVie’s strategic investments in manufacturing infrastructure, global distribution, and clinical expansion ensure that Skyrizi can meet increasing demand, further reinforcing its potential for long-term market leadership and sustained commercial success.”

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

-

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified