- Home

- »

- Reports

- »

-

Primary Market Research Services Cost Intelligence Report, 2030

![Primary Market Research Services Cost Intelligence Report, 2030]()

Primary Market Research Services Procurement Intelligence Report, 2024 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Published Date: Jul, 2024

- Base Year for Estimate: 2023

- Report ID: GVR-P-10589

- Format: Electronic (PDF)

- Historical Data: 2021 - 2022

- Number of Pages: 60

Primary Market Research Services - Procurement Trends

“The need for data-driven decision-making owing to evolving consumer preferences and increasing business competition is aiding growth.”

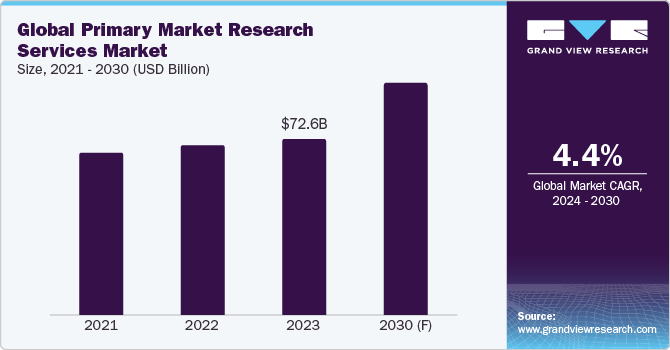

Primary market research services procurement includes acquiring insights and data from target audiences through various methods such as focus groups, surveys, and interviews, enabling companies to make better-informed decisions in their operational chain or product development journey or fine-tune customer experience. The global market research industry, as a whole, is expected to grow at a CAGR of 4.4% from 2024 to 2030. (*The primary research sector is expected to follow its parent industry CAGR for the same period). With advancements in technology, companies are leveraging different digital tools and methods, including social media, online platforms and analytics, to conduct a study.

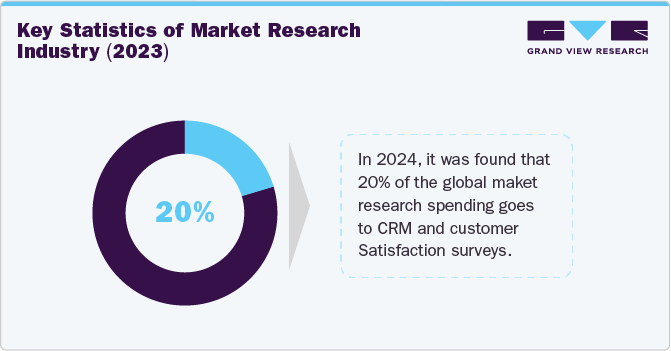

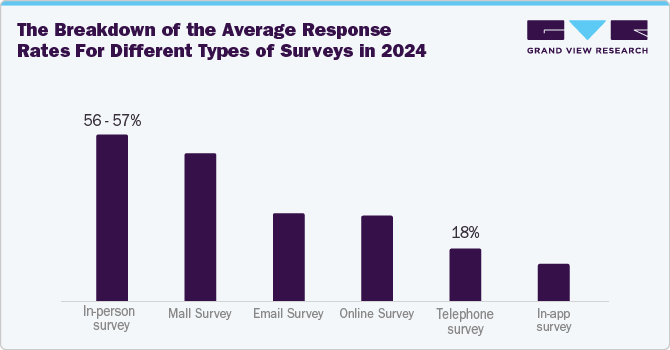

There are two main types of research in this industry - qualitative and quantitative. Quantitative methods consist of surveys, questionnaires, and data analysis. The qualitative method includes interviews, focus groups and case studies. Companies are investing more in gaining market insights to discover new opportunities and reduce risk. For instance, in 2024, it was found that 20%-22% of global market research spending went to CRM and customer satisfaction surveys. Similarly, it was found that for customer surveys and in-person surveys, the response rate is around 33%-35% and 56-57%, respectively, in 2024. Hence, traditional methods remain of prime importance for conducting an initial study.

The global market size was valued at USD 72.56 billion in 2023. It is expected that predictive analytics, AI, and automation will play key roles in this category. This, in turn, is expected to drive industry growth. In 2024, almost 95% of market research professionals found AI technology to have a substantial impact on this industry. This is because AI-powered tools can handle large amounts of data, detect patterns, and provide actionable insights. At the same time, ML algorithms can predict trends, assess sentiment across social media platforms, and provide personalized recommendations.

With mobile devices assuming the role of primary internet access points, in-app surveys are slowly gaining traction. Globally, almost 56%-57% of survey responses came from mobile devices in 2024. This can be attributed to their ease of use and capacity to engage a broader audience. Social media listening is also emerging as a tool to obtain insights into consumer sentiment and brand perception. Thus, by utilizing the latest tools, companies can effectively understand consumer behavior and tailor products, services, or marketing strategies to meet evolving demands.

In 2023, the U.S.held a 53% share of the global market research industry, making North America a prominent region in the landscape. This can be attributed to the increasing number of companies in the U.S. driven by significant advancements in technology, including digital data analytics, enterprise feedback management, and self-service platforms.

The top spending companies in market research emerge mainly from three sectors - pharmaceuticals, media and entertainment, and consumer goods (CPG). In 2023, pharmaceuticals accounted for 16% -17% of research spending. Enterprises are increasingly using user-generated content (UGC) as a valuable source of data, providing authentic insights into consumer behavior and preferences. UGC may come in various forms, such as online reviews, images or videos, social media contributions, product feedback or testimonials and hashtag campaigns. Through UGC analysis, companies can pinpoint areas for enhancement and acquire valuable insights into product advancement and marketing tactics. Furthermore, improved data collection methods combined with strict quality control procedures ensure the reliability and accuracy of market research results.

The breakdown of the average response rates for different types of surveys in 2024:

Supplier Intelligence

“How is the market concentration of primary market research services?”

This industry features a fragmented landscape with a mix of large multinational firms, mid-sized companies, and smaller agencies. This category includes a wide range of services, such as quantitative, qualitative, consumer behavior studies and surveys, leading to the existence of diversified players catering to specific niches within the market. At the same time, some companies may specialize in consumer sentiment analysis for the technology sector, while some companies may have expertise in segmentation studies for the healthcare sector. The clients can range from businesses and government agencies to nonprofit organizations. Each of these client types may have unique preferences and needs. Thus, the different segments and diverse specializations further contribute to the fragmentation.

The relatively low barrier to entry makes it easy for new firms to enter the industry. With the availability of technology and access to data, many new startups can establish themselves, further intensifying the competition within the companies. Certain basic services like surveys and data collection have become increasingly commoditized, which leads to price competition and shifting dynamics in procurement. Firms aim to distinguish themselves by improving cost efficiency and offering value-added services to clients. If suppliers have proprietary tools or access to specialized software, it can increase their negotiating power when dealing with clients.

Key service providers in the industry:

-

Ipsos SA

-

Kantar Group

-

The Nielsen Company (US), LLC.

-

Gartner, Inc.

-

Mintel Group Ltd

-

INTAGE Inc.

-

Prodege, LLC

-

PT Populix Informasi Teknologi

-

InterQ Research

-

Gold Research Inc.

-

NewtonX

-

BrandIQ

-

Forrester Research, Inc.

-

IQVIA Inc.

-

SIS International Market Research

Pricing and Cost Intelligence

“What is the total cost structure in providing primary market services?”

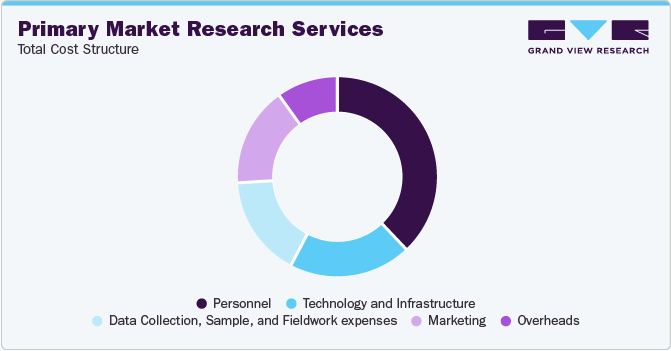

Personnel, technology and infrastructure, data collection, sample and fieldwork expenses, marketing, and overheads are some of the key components in the total cost structure. Personnel forms the largest expense for research companies as it includes the salaries, benefits, and training for analysts, project managers and associates. Data collection can be a significant expense depending on the methodology used for the study. For instance, this may include expenses related to survey administration, focus group facilitation, data processing and cleaning. In many cases, companies may have to provide incentives and rewards to collect information via surveys, which again, become part of the additional cost. Rewards and incentives may be in the form of cash, e-gift cards, or merchandise. Factors that impact the service cost are sample size, survey length and the methodology used.

On average, qualitative and quantitative research can range between USD 20,000-USD 50,000. A short quantitative online survey may cost between USD 15,000 and USD 30,000. On the other hand, using do-it-yourself (DIY) survey tools or platforms such as SurveyMonkey or Alchemer may result in lower costs. However, these tools may lack analytical complexity and sophisticated question logic and may have poor respondent logic.

The sample size is an important parameter when determining costs, as the latter (costs) will vary while conducting surveys or hosting focus groups. In-depth qualitative interviews can range from USD 100 to USD 300, depending on the participants. For instance, contractors or conducting professional interviews will be more expensive than DIYers or homeowners. A project cost can range between USD 1,500 and USD 30,000 depending on individual case and report expectations.

In this category, companies use a mix of pricing models-hourly rate, project-based pricing, retainer model, subscription model, and tiered pricing models. Each phase of research is different and involves different costs.In an hourly model, clients are billed according to the hours that the team spent on the project. Hourly rates can vary depending on the experience and expertise of the personnel involved. In a project-based model, the client is charged a fixed amount for the entire project. This is dependent on the number of primary interactions required, sample size, duration and complexity of the project and the list of deliverables. Large clients often choose a subscription pricing model for their recurring requirements.

Sourcing Intelligence

“What are some of the sourcing strategies followed in primary market services?"

Global large companies in the product development, pharmaceutical, consumer goods, and automotive sectors prefer outsourcing research-related activities to emerging economies, including India, China, the Philippines and Mexico. Clients mostly adopt a hybrid outsourcing model in this industry. Most of the large pharmaceutical or automotive companies will have their in-house research teams. However, when these companies want to assess market sentiments or brand perception or how the product is performing in different markets, they will additionally engage with third-party firms by outsourcing the key aspects they would like to focus on.

The Chinese market for consumer research is estimated to grow at 17%-18% per annum. Many highly qualified individuals, such as analysts, field workers, and researchers, are available in China and India and can perform effective primary research. Many people in these nations have advanced degrees and are skilled in a variety of techniques.Outsourcing services to India can help companies reduce costs by around 40%-60%.

Similarly, India is also a top choice for outsourcing research activities. In 2023, as per NASSCOM report, 50% of Fortune 500 organizations chose Indian service providers. 80% of the U.S. and European firms prefer India because of its highly skilled professionals, strong work ethics, and end-to-end visibility across operations. Most of the firms in India use advanced reporting systems to monitor project progress and share reports with clients which ensure streamlined collaboration and documentation.

“In the hybrid outsourcing model, the client outsources some parts of the overall operation to third parties. Generally, critical operations are carried out in-house by the client.”

As part of their procurement strategy, clients typically evaluate service providers based on several key parameters. These include the provider's experience and expertise, the research methodologies they employ, any industry-specific accreditations they may hold, their past projects and case studies, client feedback and testimonials, as well as budget and timelines.

The primary market research services procurement intelligence report also provides details regarding peer analysis, recent supplier developments, supply-demand analysis, competitive landscape, KPIs, SLAs, risk assessment, negotiation strategies, and low-cost/best-cost sourcing analysis. In the report, we have tried to provide a holistic industry perspective, an overview of the supplier landscape - the presence of different types of players and the competitive pressure within the industry as a whole (PORTER’s). Service providers must invest in personnel with expertise in survey conduct, data analysis, and advanced technology and tools, which significantly impact costs. Similarly, the supply chain practices under sourcing are also covered. One such instance is the engagement model that encompasses all the business processes conducted within an organization. It is an integral aspect of the company's operations and plays a crucial role in its success.

Primary Market Research Services Procurement Intelligence Report Scope

Report Attribute

Details

Growth Rate

CAGR of 4.4% from 2024 to 2030

Base Year for Estimation

2023

Pricing Growth Outlook

8% - 9% increase (Annually)

Pricing Models

Hourly rate, project-based pricing, retainer model, subscription model, and tiered pricing models

Supplier Selection Scope

Cost and pricing, Past engagements, Productivity, Geographical presence

Supplier Selection Criteria

Types of research (Quantitative, qualitative), services offered, platforms, technological and operational capabilities, and other functional capabilities.

Report Coverage

Revenue forecast, supplier ranking, supplier matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Key Companies Profiled

Ipsos SA, Kantar Group, The Nielsen Company (US), LLC., Gartner, Inc., Mintel Group Ltd, INTAGE Inc., Prodege, LLC, PT Populix Informasi Teknologi, InterQ Research, Gold Research Inc., NewtonX, BrandIQ, Forrester Research, Inc., IQVIA Inc., and SIS International Market Research

Regional Scope

Global

Revenue Forecast in 2030

USD 98.08 billion

Historical Data

2021 - 2022

Quantitative Units

Revenue in USD billion and CAGR from 2024 to 2030

Customization Scope

Up to 48 hours of customization free with every report.

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Frequently Asked Questions About This Report

b. The global primary market research services market size was valued at approximately USD 72.56 billion in 2023. It is estimated to witness a CAGR of 4.4% from 2024 to 2030.

b. Increasing competition, changing consumer preferences, and the need for data-driven decision-making in businesses are some of the factors driving the growth of this industry.

b. According to the LCC/BCC analysis, India, China, the Philippines, and Mexico are some of the ideal countries where clients can outsource their primary market research services.

b. This industry is fragmented with the presence of numerous players. Some of the key players are Ipsos SA, Kantar Group, The Nielsen Company (US), LLC., Gartner, Inc., Mintel Group Ltd, INTAGE Inc., Prodege, LLC, PT Populix Informasi Teknologi, InterQ Research, Gold Research Inc., NewtonX, BrandIQ, Forrester Research, Inc., IQVIA Inc., and SIS International Market Research.

b. Personnel, technology and infrastructure, data collection, sample, and fieldwork expenses, marketing, and overheads are some of the key components in the total cost structure.

b. As part of their procurement strategy, clients typically evaluate service providers based on several key parameters. These include the provider's experience and expertise, the research methodologies they employ, any industry-specific accreditations they may hold, their past projects and case studies, client feedback and testimonials, as well as budget and timelines.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself...

Add-on Services

Should Cost Analysis

Component wise cost break down for better negotiation for the client, highlights the key cost drivers in the market with future price fluctuation for different materials (e.g.: steel, aluminum, etc.) used in the production process

Rate Benchmarking

Offering cost transparency for different products / services procured by the client. A typical report involves 2-3 case scenarios helping clients to select the best suited engagement with the supplier

Salary Benchmarking

Determining and forecasting salaries for specific skill set labor to make decision on outsourcing vs in-house.

Supplier Newsletter

A typical newsletter study by capturing latest information for specific suppliers related to: M&As, technological innovations, expansion, litigations, bankruptcy etc.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified