- Home

- »

- Reports

- »

-

Artificial Intelligence (AI) Procurement Intelligence Report, 2030

![Artificial Intelligence (AI) Procurement Intelligence Report, 2030]()

Artificial Intelligence Procurement Intelligence Report, 2024 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Published Date: Aug, 2023

- Base Year for Estimate: 2023

- Report ID: GVR-P-10520

- Format: Electronic (PDF)

- Historical Data: 2021 - 2022

- Number of Pages: 60

Artificial Intelligence - Procurement Trends

“The artificial intelligence market growth is driven by the increasing technology adoption in healthcare, banking, retail, automotive and transportation.”

Artificial Intelligence (AI) procurement has garnered popularity, helping organizations unlock new digital potentials and foster efficiencies. The global market is expected to depict a CAGR of 36.6% from 2024 to 2030. Heightened investment by tech giants in research & development, availability of vast amounts of first and third-party data, and surging demand from end-use industries such as healthcare and banking are driving market growth. To illustrate, for FY23, about USD 9,616 million was sanctioned in funding by the U.S. federal government for AI R&D compared to USD 8,573 million in FY22.

The global artificial intelligence market size was estimated at USD 196.6 billion in 2023. Stakeholders are bullish on the prospect of Edge AI, increasing focus on digital ethics & governance, and augmented analytics. As of 2021, approximately 20% of healthcare firms across the globe polled indicated that they were in the early stages of AI model implementation. This meant that their products had been in the market for less than two years. Under ten percent of healthcare firms had used AI for more than five years. Functions linked to healthcare data integration and Natural Language Processing (NLP) were the most commonly used features of AI software by healthcare users. Although 60 percent of companies at the mature level of deployment reported that patients should be able to use the AI technologies developed, whereas doctors and providers were the primary intended users of AI.

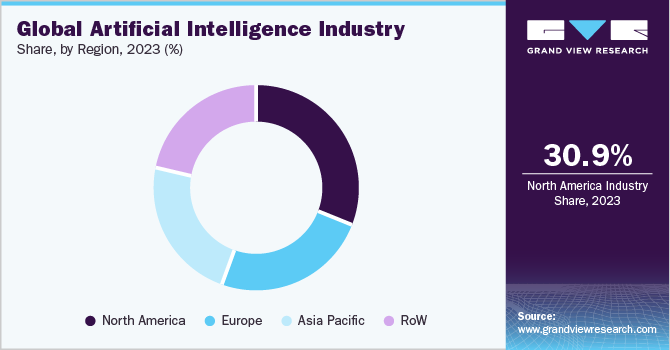

In 2023, North America spearheaded the global market share on the back of rising technology adoption and robust government initiatives. Governments in North America are injecting funds into AI research and development, establishing specialized research institutes and centers, and funding AI-related projects.

It was estimated in Europe that a physician's working time was split equally between treating patients and administrative activities. However, it was predicted that with the deployment of AI in healthcare, physicians would be able to spend about 20% more of their time on patients because the time they spend on administrative work would be reduced. Moreover, it was predicted that nurses would be able to spend around 8% more time with patients as a result of the reduction in time spent on administrative and regulatory activities.

In addition, the rising concerns toward data traceability and quick transactions are expected to aid artificial intelligence market expansion.

Supplier Intelligence

“What is the nature of the artificial intelligence industry? What are the initiatives taken by the suppliers in this market?”

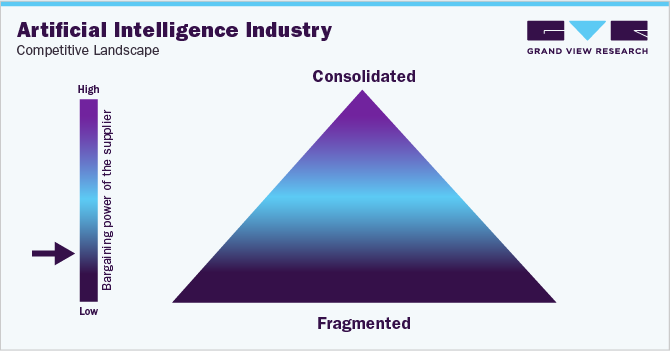

Artificial intelligence is a highly fragmented market, with several players in the ecosystem. Companies are continuously partnering with technology providers to implement this state-of-the-art technology in their businesses and boost their procurement prowess. For instance, in February 2023, Amazon.com Inc. teamed with startup Hugging Face Inc. to build a Chat GPT rival. The move will reportedly help developers optimize their models.

The competition among players is fierce because many large and small players provide a variety of services. The number of suppliers of this technology, such as developers and programmers, has grown over time, lowering the supplier's power somewhat. Suppliers can exercise more bargaining power when it comes to specialized artificial intelligence protocols or platforms.

Key suppliers covered in the industry:

-

Advanced Micro Devices Inc.

-

AiCure LLC

-

Amazon Web Services Inc.

-

Arm Limited

-

Atomwise Inc.

-

Avenga International GmbH (Ayasdi AI)

-

Baidu Inc.

-

Clarifai Inc.

-

Cyrcadia Health

-

Enlitic, Inc

-

Google LLC

-

H2O.ai, Inc.

-

HyperVerge

-

IBM Corporation

-

Intel Corporation

-

Iris AI AS

-

Microsoft Corporation Inc.

-

Nvidia Corporation

-

Sensely, Inc

-

Zebra Technologies Corporation

Pricing and Cost Intelligence

“What are some of the major cost components in developing or implementing this technology? Which factors impact the cost of artificial intelligence development?”

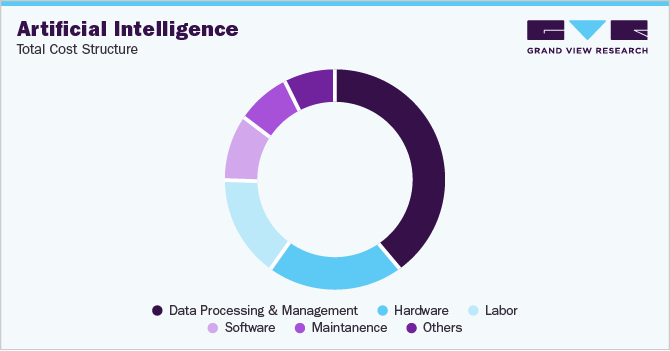

Hardware, software, data processing & management, and labor form the major cost components when it comes to implementing artificial intelligence technology. The size and complexity of the project, the type of solution, and the amount of experience required can influence the pricing of these solutions and procurement decisions. All these aspects should be carefully considered by businesses when pricing their solutions to guarantee that they are competitive and profitable.

According to an IBM report, the storage cost of AI data is about USD 7 - USD 25 per terabyte (TB) per month, along with a regular server, which costs around USD 10,000. The development of custom AI applications may cost from USD 5,000 to 150,000. The prices of the technology may vary depending on reactive machines, limited memory, theory of mind, or self-aware technology.

The following chart provides various costs incurred in implementing this technology. The major cost heads are shown below:

Several factors can impact the cost of building and managing an artificial intelligence system. First of all, the network's complexity and the individual software applications used can influence expenses. More complicated networks may need more powerful technology, resulting in greater initial costs. Furthermore, the solution's scalability is critical, as the cost of growing the network might vary greatly. Also, the regulatory environment and legal constraints associated with this technology might have an impact on prices since compliance efforts may incur additional expenditures. Finally, the degree of skill and technical resources needed to build, install, and maintain an AI system will influence the overall cost.

Sourcing Intelligence

“Which countries are the leading sourcing destination for artificial intelligence development?”

North America is a major region in the development of AI technology and is aggressively investing in it. Over 85% of North American financial service firms are implementing this technology. In terms of artificial intelligence sourcing intelligence, the top five countries preferred for this technology are China, Japan, the U.S., the U.K., and Germany.

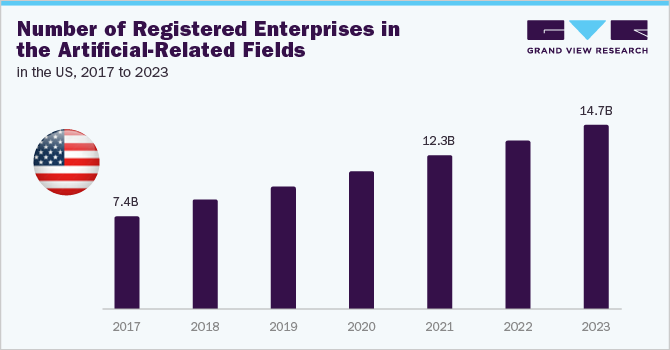

The U.S. government heavily promotes artificial intelligence technology and is the industry's leading global promoter. Since 2017, the number of firms associated with this technology has more than quadrupled; 14,700 start-ups were anticipated by the end of 2023. The U.S. government is extending its usage in developing regulatory rules with the creation of an artificial intelligence risk management framework. To help artificial intelligence-based firms, the government plans to provide industrial standards, property insurance licenses, and tariff advantages.

Western Europe and Asia Pacific will be among the first to invest heavily in this technology. Top pharma and healthcare businesses are aggressively collaborating with artificial intelligence technology suppliers to address their growing needs for innovative technologies in their respective sectors. For instance, In November 2022, Nuance Communications and NVIDIA are integrating AI models in medical imaging directly into the clinical setting. The strategic relationship amongst them permits the deployment of diagnostic imaging AI models learned in current large-scale clinical applications for all.

In terms of engagement, multinational corporations choose either a partial or complete outsourcing approach. Many sectors are racing to maximize the potential of cutting-edge technologies. Employing an internal team would be advantageous, but firms are confronted with substantial problems such as personnel shortages, onboarding concerns, and infrastructure expenditures, all of which have a large financial impact.

Big organizations in the healthcare, real estate, insurance, and logistics sectors choose a comprehensive outsourcing strategy to underpin procurement with enhanced transparency, decreased risks and frauds, and increased protection against outside assaults. It allows them to acquire access to specialist teams, which may be useful in the long run. It is witnessed that implementing an offshore strategy can assist a corporation in reducing employee expenses by more than 40% - 60%.

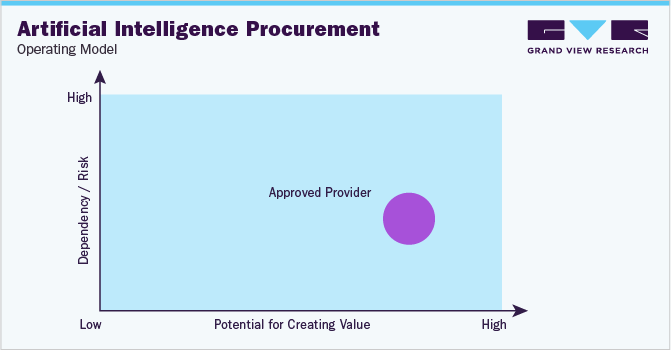

“In the approved provider model, the supplier meets the predefined set of qualifications, quality standards, and other criteria.”

Because of its superior value generation potential, the most popular operating model is an approved provider model. In this approach, the artificial intelligence technology supplier must fulfill a stated set of standards, such as prior-proven performance, platform access, privacy conditions, and a number of other criteria.

Healthcare providers are investigating artificial intelligence technologies for securely storing and maintaining patient medical information, as well as boosting clinical trial transparency and efficiency. They work with technology and platform/software providers to create platforms/solutions that track and verify clinical trial data, ensure the integrity of medical records, provide end-to-end traceability of pharmaceutical products, and create systems that track drug movement and prevent counterfeit drugs from entering the supply chain.

The report also provides details regarding peer analysis, recent supplier developments, supply-demand analysis, competitive landscape, KPIs, SLAs, risk assessment, negotiation strategies and low-cost/best-cost sourcing analysis. In the report, we have tried to provide a holistic industry perspective, an overview of the supplier landscape – the presence of different types of players and the competitive pressure within the industry as a whole (PORTER’s). Similarly, the supply chain practices under sourcing are also covered. One such instance is the operating or engagement model which encompasses all the business processes conducted within an organization. It is an integral aspect of the company's operations and plays a crucial role in its success.

Artificial Intelligence Procurement Intelligence Report Scope

Report Attribute

Details

Growth Rate

CAGR of 36.6% from 2024 to 2030

Base Year for Estimation

2023

Pricing Growth Outlook

8% - 10% (annual)

Pricing Models

Fixed fee pricing, cost plus pricing

Supplier Selection Scope

Cost and pricing, past engagements, productivity, geographical presence

Supplier Selection Criteria

Type, technical expertise, security measures, cost and value, support and maintenance, regulatory compliance, and others

Report Coverage

Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Key Companies Profiled

Advanced Micro Devices, AiCure, Arm Limited, Atomwise, Inc., Ayasdi AI LLC, Baidu, Inc., Clarifai, Inc, Cyrcadia Health, Enlitic, Inc., Google LLC, H2O.ai., HyperVerge, Inc., International Business Machines Corporation, Intel Corporation, Iris.ai AS., Lifegraph, Microsoft, NVIDIA Corporation, Sensely, Inc., Zebra Medical Vision, Inc

Regional Scope

Global

Historical Data

2021 - 2022

Revenue Forecast in 2030

USD 1,811.75 billion

Quantitative Units

Revenue in USD billion and CAGR from 2024 to 2030

Customization Scope

Up to 48 hours of customization free with every report.

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Frequently Asked Questions About This Report

b. The global artificial intelligence market size was valued at approximately USD 196.6 billion in 2023 and is estimated to witness a CAGR of 36.6% from 2024 to 2030.

b. The heavy investment by tech giants in research & development, availability of vast amounts of first and third-party data, and growing demand in end-use industries such as healthcare, banking, and others are driving the growth of the market.

b. According to the LCC/BCC sourcing analysis, China, and the U.S., are the ideal destinations for sourcing artificial intelligence development.

b. This market is highly fragmented with the presence of many large players competing for the market share. Some of the key players are IBM Corporation, Google LLC, NVIDIA Corporation, Intel Corporation, and H2O.ai.

b. Hardware, software, data processing & management, and labor are the major cost components of this industry. Other key costs include the size and complexity of the project, the type of solution, and the level of expertise required.

b. Cost-saving measures such as complete service sourcing, verifying the performance of the service providers, and maintaining open communication with suppliers to address any issue are some of the best sourcing practices.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself...

Add-on Services

Should Cost Analysis

Component wise cost break down for better negotiation for the client, highlights the key cost drivers in the market with future price fluctuation for different materials (e.g.: steel, aluminum, etc.) used in the production process

Rate Benchmarking

Offering cost transparency for different products / services procured by the client. A typical report involves 2-3 case scenarios helping clients to select the best suited engagement with the supplier

Salary Benchmarking

Determining and forecasting salaries for specific skill set labor to make decision on outsourcing vs in-house.

Supplier Newsletter

A typical newsletter study by capturing latest information for specific suppliers related to: M&As, technological innovations, expansion, litigations, bankruptcy etc.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified