Hyperscale Data Centers and Colocation Hubs - The New Digital Frontier in the Desert

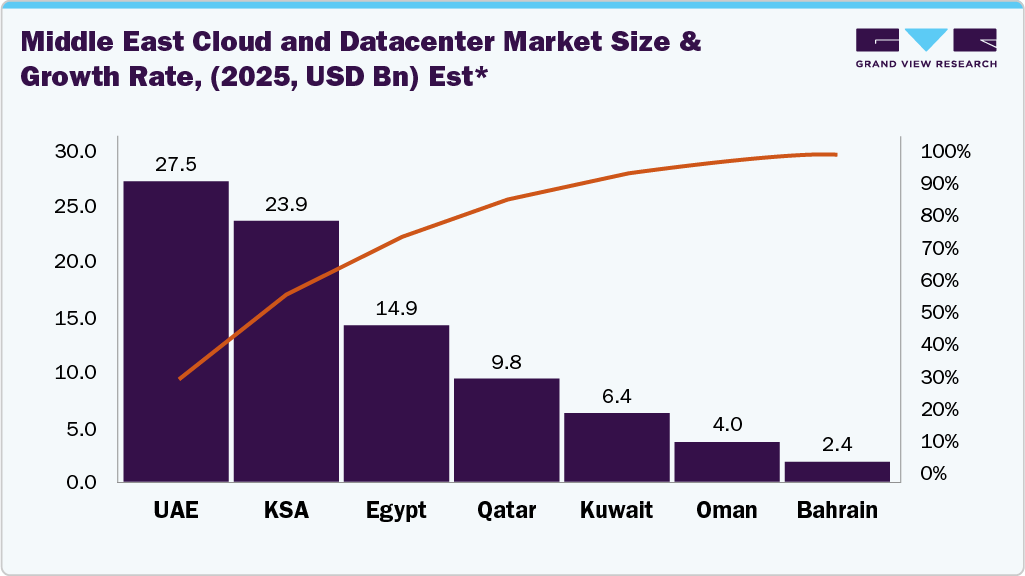

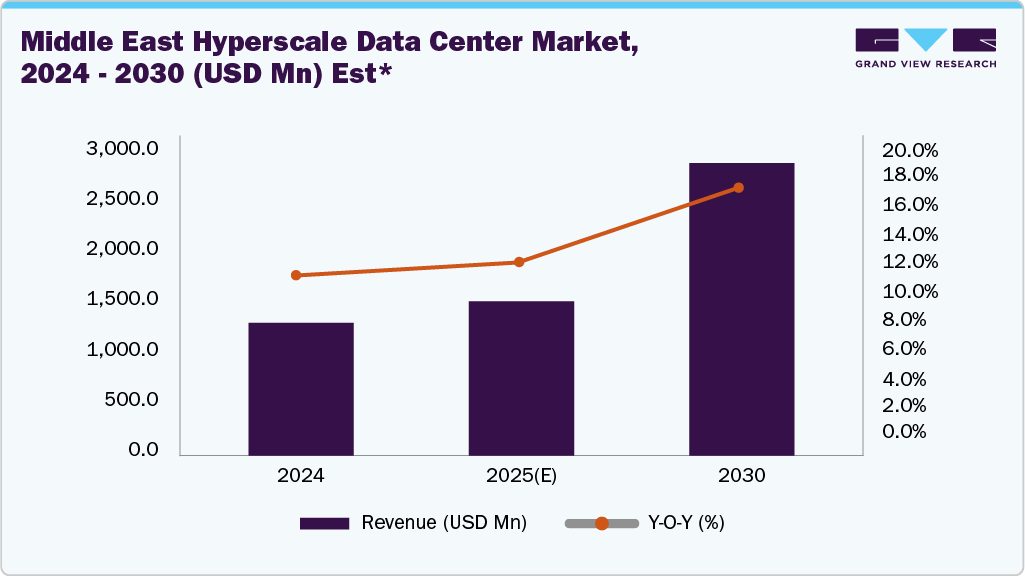

The Middle East, long recognized for its energy exports, is now emerging as a digital hub, powering data along with oil. The currency of power is shifting from barrels of oil to bytes of data, as the region gears up to dominate the new digital trade routes. Fueled by sovereign cloud initiatives, government-backed digital transformation programs, and national AI ambitions, hyperscale data centers have advanced from mere pilot projects a few years ago to a multi-billion-dollar build-out today. Recent estimates by Grand View Research project a double-digit annual growth in the cloud & datacenter market as cloud providers and AI workloads scale in the region.

Hyperscalers Powering the Middle East’s Digital Leap

The Middle East is undergoing a significant digital transformation. This is evident from the influx of investments made by the tech giants. Hyperscale giants like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud are no longer just serving the region from data centers in Europe; they are building massive, multi-billion-dollar cloud regions directly within countries like the UAE, Saudi Arabia, Qatar, and Oman. AWS has announced it will be launching an infrastructure Region in Saudi Arabia in 2026, with a planned investment of over USD 5.3 billion, with an aim to meet cloud demand locally, improve performance, and address data governance concerns.

Moving infrastructure onshore has allowed these hyperscale giants to slash the latency, offering instantaneous response times required for AI model training and high-frequency trading. More importantly, it has played an instrumental role in solving the critical issue of data residency, allowing governments, banks, and healthcare providers to adopt cloud services while keeping sensitive information within national borders. In Qatar, for example, Microsoft’s first global datacenter region was explicitly framed to align with Qatar National Vision 2030. It is expected to add more than $18 billion to Qatar’s economy over five years and create over 36,000 new jobs. As hyperscale investments surge in the coming years, the Middle East will attract more software companies, startups, and digital enterprises, all eager to build on top of this infrastructure.

Colocation: The Unsung Hero of Digital Growth

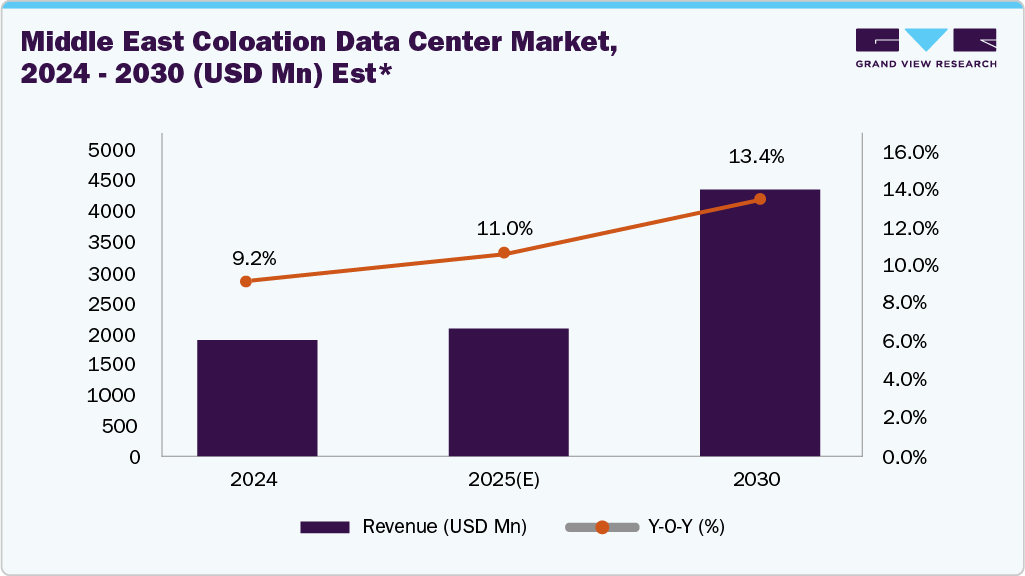

While hyperscale developments in the region have been grabbing all the headlines of late, colocation hubs are quietly powering enterprise resilience, providing them with a scalable and secure connection with cloud providers. The colocation market in the Middle East is forecasted to grow more than double in capacity and register double-digit annual compounded growth in terms of investments over the next few years, serving as a backbone for the region's evolving digital ecosystem. The surge in cloud computing, AI-driven workloads, and big data analytics is accelerating the shift from traditional on-premise data centers to advanced colocation facilities. These facilities provide high-performance computing, edge capabilities, and seamless direct interconnectivity with major cloud providers. At the same time, the exponential growth of video streaming, e-commerce, digital payments, and smart cities is impelling the need for low-latency, high-bandwidth infrastructure, making colocation a preferred choice for organizations seeking redundancy, security, and regulatory compliance.

Demand is particularly strong in cities like Dubai, Riyadh, and Doha, where many enterprises are shifting from in-house server rooms to colocation providers that offer higher uptime, energy efficiency, and compliance with regional regulations. Sectors like financial services, oil & gas, and government sectors that prioritize data sovereignty are increasingly favoring colocation data centers.

For the Middle East, these hubs are essential catalysts, lowering the barrier to entry for digital businesses and fostering a competitive market that drives innovation. They are the enablers ensuring that the benefits of the digital boom are accessible to the entire economy, not just large players.

Investments: The Clearest Signal of Ambition

The region’s ability to interconnect Europe, Asia, and Africa gives it a unique advantage in hosting hyperscale campuses that can serve multiple continents simultaneously. Governments and private sector players are investing heavily in digital infrastructure as part of ambitious programs like Saudi Arabia’s Vision 2030 and the UAE’s smart city projects. The UAE is positioning itself as a neutral interconnect hub, while Saudi Arabia’s ‘Vision 2030’ sees data centers as critical to its ambition of becoming a leading digital economy.

|

Country |

Notable Data Center Investments |

Strategic Advantages |

|

Saudi Arabia |

$6 billion data center plan, 100MW+ campuses |

Location at digital trade crossroads, low energy costs, and renewables |

|

UAE |

Largest MENA live IT capacity, expanding Tier III/IV hubs |

Leading colocation market, regional cloud zones |

|

Qatar, Oman |

Expanding government-led cloud regions, edge computing |

Growing smart city projects, emerging markets |

Conclusion: From Oil Fields to Server Fields

Just as oil once powered the world’s industrial age, data is powering today’s digital age, and the Middle East is positioning itself at the center of this new economy. Hyperscale data centers and colocation hubs are laying the groundwork for decades of digital growth ahead, while helping economies meet current demand.

With major investments like $5.3 billion by AWS in Saudi Arabia, over $18 billion through Microsoft in Qatar, and multi-billion-dirham expansions by Khazna in the UAE, the region is setting new benchmarks in digital transformation. Therefore, for companies vying to do business in the Middle East, the competitive advantage will increasingly be measured not just in barrels, but in bytes as well. Those who invest early in resilient, sovereign, and sustainable infrastructure will be best placed to ride the wave of transformation and gain an early mover advantage.