Last-Mile Innovation in the Middle East: From Drones to Autonomous Delivery

The final kilometer of logistics has always been the most expensive and complex. But in the Middle East, the last mile is fast becoming the most innovative. From drone corridors in Saudi Arabia to autonomous delivery robots in Dubai, the region is transforming how goods reach customers. This transformation is about more than convenience it is a critical piece of the Middle East’s strategy to build smart, sustainable, and self-reliant economies in the digital age.

From E-Commerce Explosion to Delivery Revolution

The last mile is the backbone of e-commerce growth. The Middle East’s online retail market has surged in the past five years, creating massive demand for faster, cheaper, and more transparent deliveries. According to Grand View Research, the MEA last-mile delivery market was valued at USD 15.6 billion in 2023 and continues to grow rapidly as digital adoption accelerates.

Saudi Arabia, the UAE, and Egypt have all placed logistics innovation at the center of their national strategies. Under Saudi Vision 2030, the logistics sector is recognized as a key pillar of economic diversification, with explicit goals to improve delivery times and reduce logistics costs from 14% to 8% of GDP. Similarly, Dubai’s Smart Mobility Strategy 2030 and Abu Dhabi’s Logistics 4.0 initiatives are testing autonomous, electric, and AI-enabled delivery systems designed for both sustainability and scale.

Why the Last Mile Matters

In logistics, the first 1,000 kilometers may be automated, but the final 10 define customer satisfaction. Last-mile costs account for up to 50% of total logistics expenses, driven by inefficiencies in routing, congestion, and failed deliveries. For fast-growing e-commerce economies like those in the Gulf, solving this bottleneck is a strategic necessity.

The challenge is not only cost, but also carbon. Delivery fleets and packaging waste contribute heavily to urban emissions. The shift toward electric, shared, and autonomous last-mile systems represents both a business and environmental opportunity.

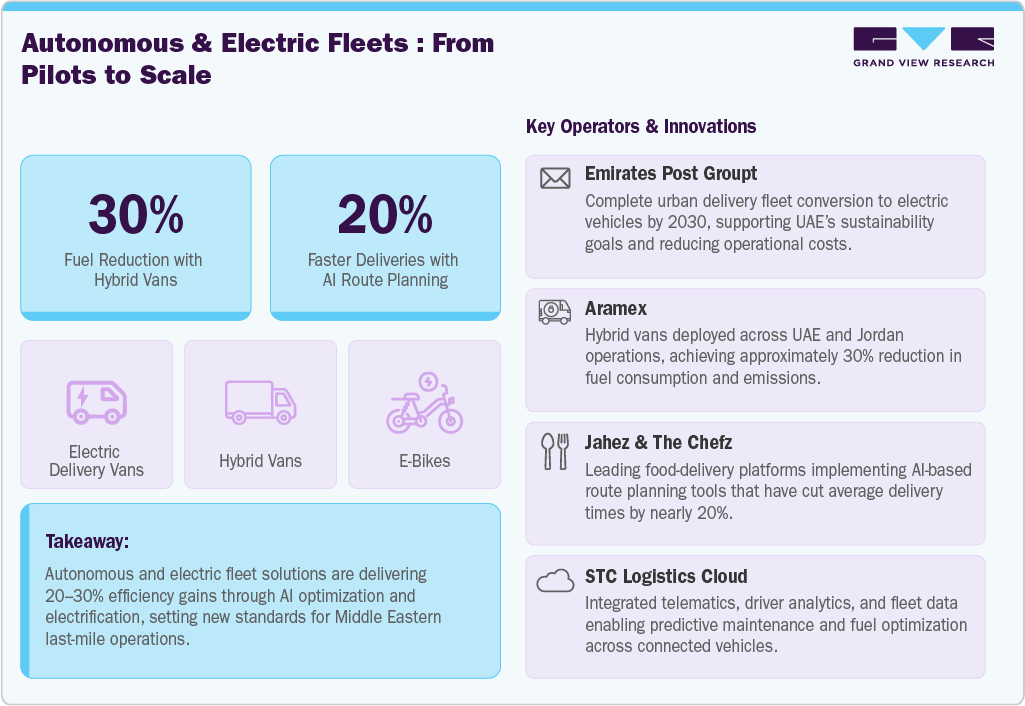

Autonomous and Electric Delivery Fleets

The Gulf is rapidly transitioning toward intelligent, low-emission delivery networks. Emirates Post, Aramex, and Amazon Middle East are all piloting electric delivery vans and route optimization software to lower emissions and improve delivery speed.

In Saudi Arabia, Jahez and The Chefz, two leading food-delivery platforms, have begun using AI-based route planning tools that cut delivery times by nearly 20%. STC’s Logistics Cloud integrates telematics, driver analytics, and fleet data to enable predictive maintenance and fuel optimization.

Emirates Post Group has announced plans to convert its urban delivery fleet to electric vehicles by 2030, while Aramex operates hybrid vans in the UAE and Jordan, reducing fuel consumption by over 30%. These steps signal that sustainability is no longer an optional add-on but a central component of logistics strategy.

Drones: The New Delivery Frontier

Perhaps the most exciting development in the region’s last-mile evolution is the rise of drone delivery. Drones are emerging as the fastest, cleanest, and most flexible mode of short-distance logistics ideal for dense cities and remote areas alike.

Saudi Arabia’s National Drone Delivery Program, launched by the General Authority of Civil Aviation (GACA) and the Saudi Logistics Hub, aims to build regulated drone corridors connecting logistics centers with hospitals, retail zones, and residential districts. Pilot projects in Riyadh and NEOM are testing autonomous drone deliveries for medical supplies and small parcels.

In the UAE, Dubai Future Foundation has partnered with global drone companies to create dedicated air corridors for urban delivery. Emirates Post and SkyGo recently tested drone delivery between logistics hubs in Abu Dhabi, while Bee’ah is exploring drone-enabled smart waste collection.

According to industry estimates, the global drone logistics and transportation market is projected to surpass USD 30 billion by 2030, with the Middle East representing one of the fastest-growing regions for adoption due to supportive regulations and smart-city infrastructure.

Robotics and the Rise of Autonomous Delivery

On the ground, robots are complementing drones as the face of urban logistics. Talabat and Carrefour in Dubai have trialed autonomous delivery robots capable of navigating pedestrian areas and smart neighborhoods.

In 2023, Dubai Roads and Transport Authority (RTA) partnered with Kiwibot and Talabat UAE to launch the region’s first robot delivery service in Dubai Silicon Oasis. These robots, powered by AI and IoT connectivity, can travel up to 6 km/h, carrying small parcels directly to customers’ doorsteps.

Meanwhile, Neom’s Oxagon in Saudi Arabia is developing a fully autonomous logistics district where robotic vehicles and drones will handle last-mile distribution. This model could redefine how smart cities manage deliveries, combining automation with renewable energy for zero-emission logistics.

Smart Warehousing and Fulfillment Networks

Last-mile innovation is inseparable from smarter warehousing. The region’s fulfillment centers are evolving into data-driven nodes that use predictive analytics and robotics to optimize inventory and delivery routing.

Amazon’s UAE Fulfillment Center, one of the largest in the region, uses AI to predict demand spikes and reallocate goods closer to delivery zones. Noon, headquartered in Riyadh and Dubai, has invested heavily in micro-fulfillment centers that shorten delivery times from days to hours. Namshi and Flow Progressive Logistics are integrating warehouse management systems that link directly to autonomous fleets and delivery drones, ensuring seamless handoffs.

According to Grand View Research, the MEA digital logistics market is valued at USD 1.41 billion in 2024 and is expected to grow at nearly 19% CAGR through 2030. This underscores the speed with which technology and data are becoming embedded in every aspect of logistics.

Regulation and Collaboration

Last-mile innovation depends as much on regulation as it does on technology. Governments are moving fast to create frameworks for drone and robot deliveries while ensuring safety and privacy.

Saudi Arabia’s Civil Aviation Authority has introduced licensing and airspace rules for commercial drone use. The UAE’s SIRA and RTA have developed pilot zones for autonomous delivery systems and guidelines for integrating them into existing traffic networks.

Cross-border collaboration is also growing. The Digital Cooperation Organization (DCO), which includes Saudi Arabia, the UAE, and Bahrain, is exploring regional digital logistics standards to harmonize data sharing and cross-border last-mile operations.

What Leaders Should Prioritize

-

Invest in autonomous and electric delivery ecosystems. Build mixed fleets combining EVs, drones, and ground robots.

-

Strengthen regulatory sandboxes. Create test zones for drone and robot delivery to accelerate commercialization.

-

Develop smart fulfillment infrastructure. Use AI and IoT to connect inventory systems with last-mile assets.

-

Focus on sustainability metrics. Measure and report carbon savings from electric and autonomous deliveries.

-

Upskill the workforce. Train teams to operate and maintain AI-driven logistics systems safely and efficiently.

The Bottom Line: Redefining the Last Mile

The Middle East’s logistics transformation will be judged not only by what it builds but by how it delivers. Drones, electric fleets, and autonomous robots are turning the last mile from the weakest link into the region’s most advanced frontier.

What began as a race for faster e-commerce fulfillment has evolved into a showcase of technological and environmental innovation. The region that once depended on global supply routes is now exporting its own ideas on how cities can deliver smarter, cleaner, and more sustainably.

The future of logistics in the Middle East is not waiting at the warehouse it is already hovering above it.