- Home

- »

- Next Generation Technologies

- »

-

Drone Logistics And Transportation Market Size Report, 2030GVR Report cover

![Drone Logistics And Transportation Market Size, Share & Trends Report]()

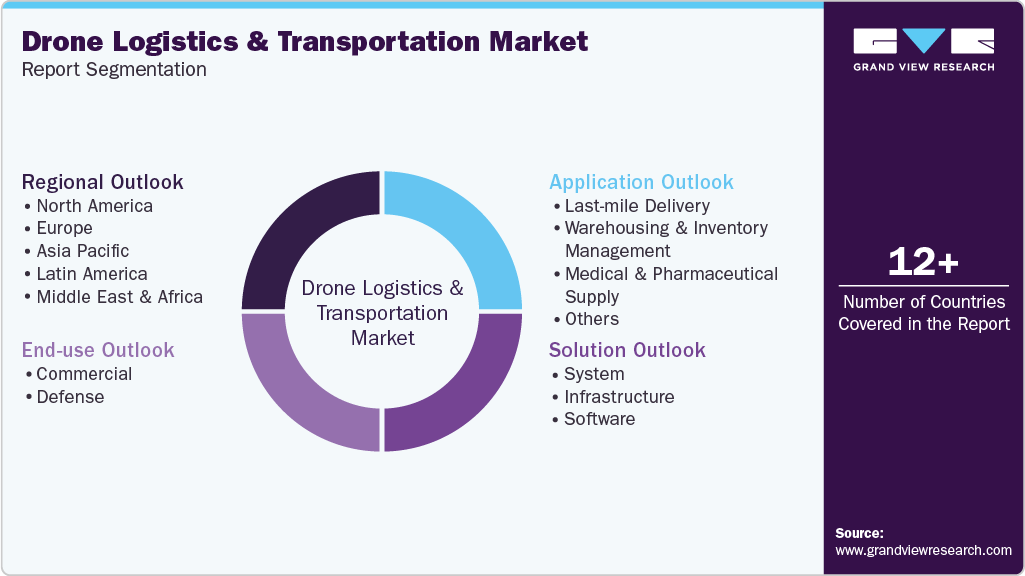

Drone Logistics And Transportation Market (2025 - 2030) Size, Share & Trends Analysis Report By Solution (System, Infrastructure, Software), By Application (Last-mile Delivery, Warehousing and Inventory Management ), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-601-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2020 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Drone Logistics And Transportation Market Summary

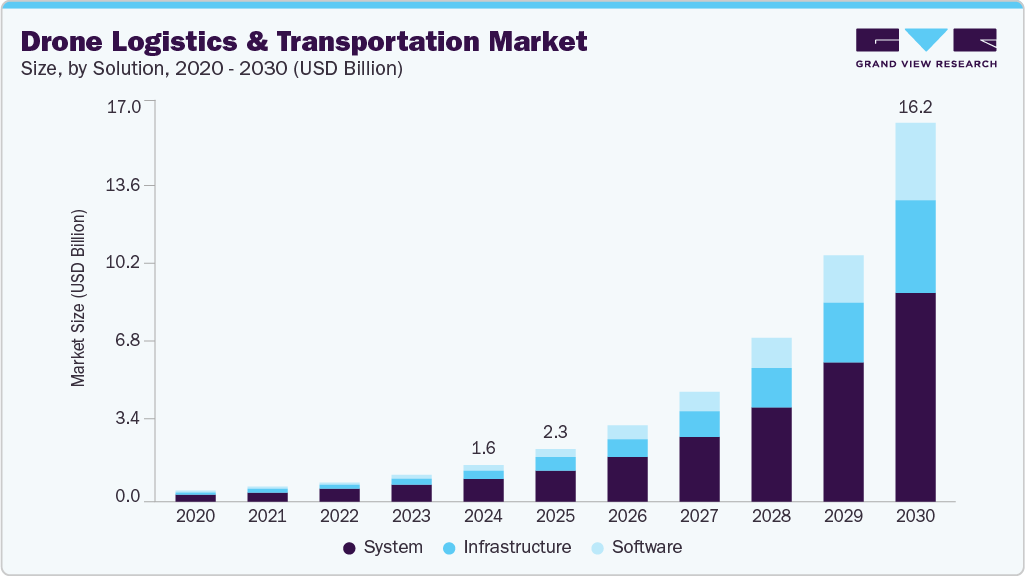

The global drone logistics and transportation market size was estimated at USD 1.61 billion in 2024 and is projected to reach USD 16.15 billion by 2030, growing at a CAGR of 48.1% from 2025 to 2030. The rapid expansion of e-commerce and same-day delivery expectations can be attributed to the market growth.

Key Market Trends & Insights

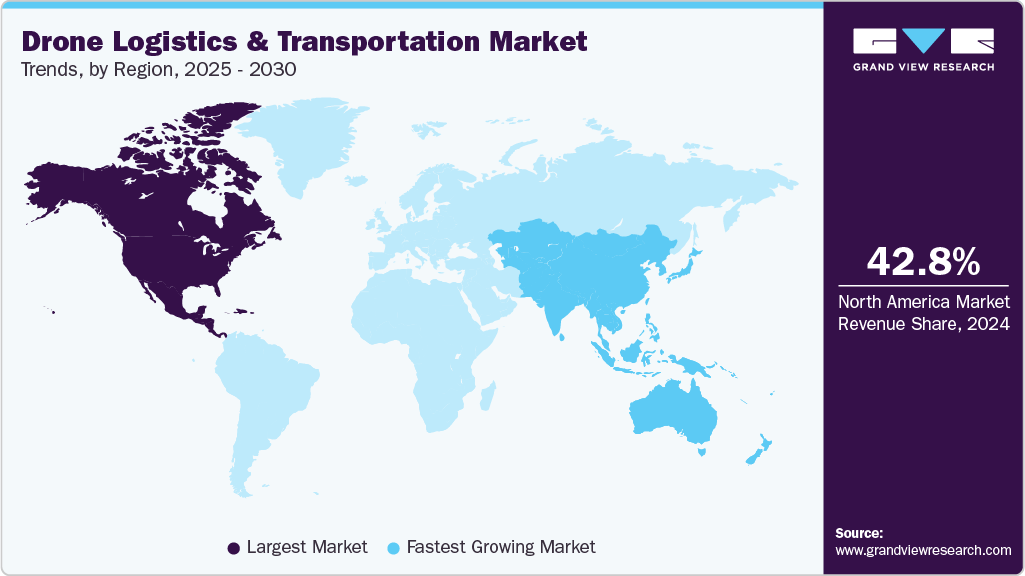

- North America dominated the drone logistics and transportation market with the largest revenue share of 42.76% in 2024.

- The drone logistics and transportation market in the U.S. held a dominant position in the region in 2024.

- By solution, the system segment led the market with the largest revenue share of 61.5% in 2024.

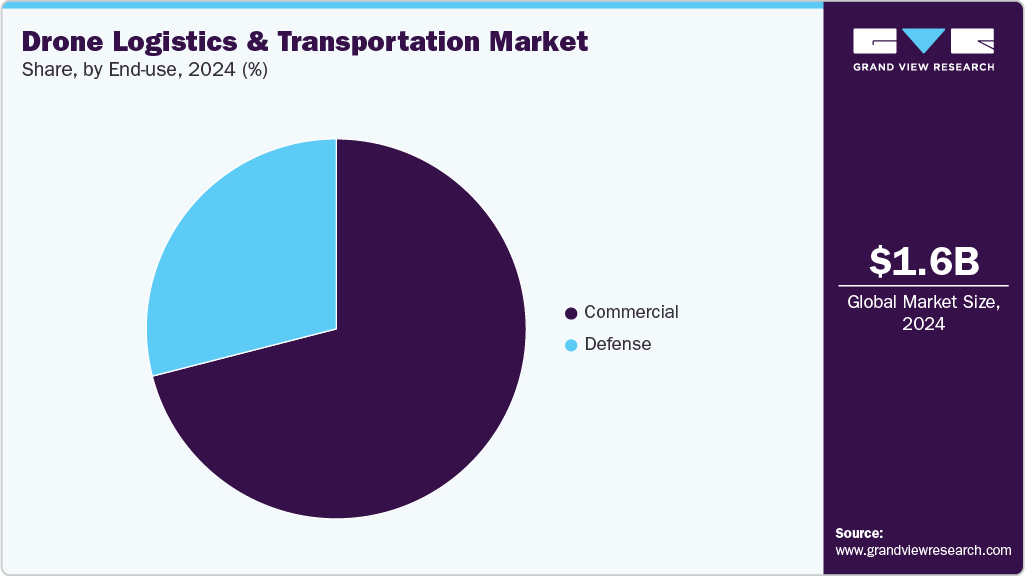

- By end use, the commercial segment accounted for the largest market revenue share in 2024.

- By application, the last-mile delivery segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.61 Billion

- 2030 Projected Market Size: USD 16.15 Billion

- CAGR (2025-2030): 48.1%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The growth of e-commerce has significantly changed consumer behavior, with many now expecting ultra-fast delivery services. Traditional logistics often struggles to meet same-day or same-hour delivery demands, especially in urban and remote regions. Drones offer a solution by bypassing road traffic and reaching destinations faster. Major retailers and logistics providers are actively investing in drone delivery programs to reduce delivery times and improve efficiency.

Drone hardware and software are improving rapidly, making drones more reliable and suitable for commercial logistics. Innovations such as longer battery life, better payload capacities, GPS precision, and obstacle detection are enabling drones to perform complex delivery tasks. These improvements also reduce the risk of in-flight failure, increasing operational confidence. Drones are becoming more autonomous and intelligent, making their commercial scalability increasingly feasible, thereby driving the growth of the drone logistics and transportation industry.

Drones are proving particularly effective for delivering medical supplies, blood, and vaccines to hard-to-reach areas. In various countries across the globe, drones have been used to improve healthcare access in rural communities. Their speed and ability to bypass poor road infrastructure make them ideal for time-sensitive deliveries. This application highlights drones' practical benefits and strengthens public and government support for their wider use.

Smart cities are exploring ways to integrate drones into urban infrastructure for delivery and transportation. Drones can reduce ground traffic congestion by offering aerial alternatives for last-mile logistics. Infrastructure such as drone ports, automated landing pads, and air traffic control systems is being developed in pilot cities. This trend signals a broader shift toward a multi-modal, tech-enabled logistics ecosystem in urban environments.

However, the drone logistics and transportation industry faces several growth challenges, including regulatory hurdles, safety and security concerns, and technological limitations. High initial investment costs for drone fleets and supporting infrastructure further hinder scalability. In addition, public resistance to noise pollution and privacy intrusions, coupled with insurance and liability complexities, slows adoption. In emerging markets, underdeveloped telecommunications networks and unreliable GPS coverage exacerbate operational inefficiencies. These factors collectively restrain the drone logistics and transportation industry's expansion despite its transformative potential.

Solution Insights

The system segment led the market with the largest revenue share of 61.5% in 2024. The system segment, which includes the physical components of drones such as airframes, propulsion systems, sensors, navigation tools, and communication modules, represents the largest share of the solution market. Growth in this segment is fueled by the rising demand for high-performance drones capable of carrying heavier payloads over longer distances and operating in varied environments. Manufacturers are continuously innovating with lightweight materials, better propulsion systems, and enhanced battery life to meet commercial logistics demands, thereby propelling the segment’s growth.

The software segment is expected to grow at the fastest CAGR during the forecast period. The software tools play a critical role in enabling autonomous functionality, route optimization, and operational management of drone fleets. The rapid advancement in artificial intelligence and machine learning is driving innovation in autonomous navigation, obstacle detection, and predictive maintenance. Furthermore, as drone logistics operations scale, the need for cloud-based fleet management platforms and seamless integration with enterprise logistics systems becomes essential. The software segment is expected to witness strong growth due to its role in ensuring safety, compliance, and operational efficiency, especially for Beyond Visual Line of Sight and high-density urban drone operations.

Application Insights

The last-mile delivery segment accounted for the largest market revenue share in 2024. The surge in e-commerce has heightened the demand for rapid and efficient delivery solutions. Drones offer a promising avenue for last-mile deliveries, especially in urban areas where traffic congestion can impede traditional delivery methods. Companies such as Amazon, Walmart, and Zipline are actively exploring drone deliveries to enhance customer satisfaction and reduce delivery times.

The warehousing and inventory management segment is expected to register at the fastest CAGR during the forecast period. Drones are also being utilized within warehouses for inventory management and internal logistics. They assist in scanning barcodes, monitoring stock levels, and transporting items within large warehouse facilities. While this application is still emerging, it offers promising efficiency improvements in warehouse operations.

End Use Insights

The commercial segment accounted for the largest market revenue share in 2024. The segment’s growth is driven primarily by the growth of the e-commerce sector, demand for rapid delivery, and rising operational costs in traditional logistics. Businesses are increasingly adopting drone solutions to optimize last-mile deliveries, reduce delivery times, and cut fuel and labor expenses. Beyond retail, industries such as healthcare, agriculture, construction, and mining are leveraging drones to transport critical supplies, tools, and components in remote or hard-to-reach locations. In addition, advancements in autonomous navigation, AI-powered route optimization, and regulatory support for commercial drone operations are accelerating growth in this segment.

The defense segment is expected to grow at the fastest CAGR during the forecast period. The defense segment remains a significant contributor to the market growth, with armed forces worldwide utilizing drones to streamline supply delivery, medical evacuation, and tactical resupply missions in hostile or inaccessible environments. Military logistics benefit from drones’ ability to reduce the need for human involvement in high-risk operations and enhance real-time situational awareness through surveillance integration. Defense agencies are investing heavily in robust, long-range, and heavy-payload UAV systems capable of supporting complex logistical tasks. Growth is further fueled by increased defense budgets, geopolitical tensions, and the need for rapid response in modern warfare scenarios.

Regional Insights

North America dominated the drone logistics and transportation market with the largest revenue share of 42.76% in 2024. The regional growth is driven by a robust infrastructure, a favorable regulatory environment, and widespread adoption of advanced technologies. The region's strong focus on innovative solutions to streamline supply chains and enhance last-mile delivery capabilities has propelled the market’s growth.

U.S. Drone Logistics and Transportation Market Trends

The drone logistics and transportation market in the U.S. held a dominant position in the region in 2024. The country’s growth is driven by strong investment from tech giants, a robust startup ecosystem, and progressive regulatory developments by the Federal Aviation Administration (FAA). The country’s large and mature e-commerce sector, combined with growing demand for same-day delivery, is further accelerating adoption. In addition, the U.S. military continues to invest in drone logistics for tactical and medical supply delivery, supporting dual-use innovation across commercial and defense applications.

Europe Drone Logistics and Transportation Market Trends

The drone logistics and transportation market in Europe is expected to register at a moderate CAGR from 2025 to 2030. Europe showcases a strong commitment to adopting drone technologies for logistics, with a robust regulatory framework that promotes innovation in drone logistics. The region's focus on innovation and technology, along with the presence of start-ups and research institutions, contributes to its significant market share.

The UK drone logistics and transportation market is expected to register at a notable CAGR from 2025 to 2030. The country is focusing on high-value drone use cases, particularly in urban logistics and medical supply chain enhancements. Strong support for smart city infrastructure and sustainability goals also aligns with drone logistics, especially for reducing carbon emissions in last-mile delivery. These factors position the UK as a forward-looking and innovation-driven market in Europe.

The drone logistics and transportation market in Germany held a substantial market share in 2024. Germany’s position as a logistics and engineering powerhouse makes it a major market for drone logistics development. With its strong automotive, industrial, and logistics sectors, Germany is exploring drones for intra-facility transport, warehouse automation, and last-mile delivery, thereby driving the growth of the drone logistics industry in the country.

Asia Pacific Drone Logistics and Transportation Market Trends

The drone logistics and transportation market in Asia Pacific is anticipated to grow at a significant CAGR of 50.4% during the forecast period. Asia Pacific is witnessing rapid growth, fueled by the booming e-commerce sector, government initiatives supporting drone technology, and investments in infrastructure development. Countries such as China, Japan, and India are at the forefront of drone adoption for logistics and transportation purposes.

The India drone logistics and transportation market is expected to grow at the fastest CAGR during the forecast period. Increasing demand for drone logistics for the last-mile delivery application is expected to contribute to the growth of the market. With vast rural areas lacking efficient logistics infrastructure, drones offer a transformative solution for the last-mile delivery of medical supplies, agricultural inputs, and essential goods. The government’s Medicine from the Sky program and increasing private sector pilots by e-commerce firms are accelerating deployment.

The drone logistics and transportation market in China held a substantial market share in Asia Pacific in 2024. China is at the forefront of drone technology development and large-scale logistics integration. Companies like JD.com Inc. and Meituan are already deploying drones for regular deliveries in urban and rural areas, supported by strong government backing and national strategies for intelligent logistics. China’s dense population, advanced drone manufacturing ecosystem, and innovation in AI and automation give it a competitive edge in scaling drone delivery networks.

Key Drone Logistics And Transportation Company Insights

Some of the key companies in the drone logistics and transportation industry include Zipline, United Parcel Service of America, Inc., and Hardis Group, among others. These players are taking several strategic initiatives, such as new product launches, business expansions, partnerships, collaborations, and agreements, among others.

-

Zipline is a company that designs, manufactures, and operates autonomous delivery systems, aiming to provide equitable access to goods and services worldwide. The company specializes in using drones for last-mile logistics, particularly in healthcare and medicine, but also extends to retail and other areas.

-

United Parcel Service of America, Inc. operates across more than 220 countries and territories, offering transportation, distribution, trade, and brokerage services. The company has been actively developing and deploying drone logistics solutions, with a focus on small package deliveries and specialized use cases such as vaccine transportation.

Key Drone Logistics And Transportation Companies:

The following are the leading companies in the global drone logistics and transportation market. These companies collectively hold the largest market share and dictate industry trends.

- Zipline

- United Parcel Service of America, Inc.

- Drone Delivery Canada

- Hardis Group

- Wing Aviation LLC.

- Flytrex Inc.

- Zing

- Wingcopter

- Elroy Air

- Joby Aviation

Recent Developments

-

In May 2025, New Century Logistics (BVI) Limited, a prominent logistics solutions provider based in Hong Kong, signed a Memorandum of Understanding (MOU) with Soradynamics Inc., a Japanese advanced technology company. The partnership aims to develop and deploy a cutting-edge in-vehicle drone logistics system collaboratively. This initiative is designed to tackle key challenges in the U.S. logistics sector, specifically high last-mile delivery costs and labor shortages, by leveraging advanced technology to drive a transformative boost in operational efficiency.

Drone Logistics And Transportation Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.27 billion

Revenue forecast in 2030

USD 16.15 billion

Growth rate

CAGR of 48.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2020 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Solution, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; and South Africa

Key companies profiled

Zipline; United Parcel Service of America, Inc.; Drone Delivery Canada; Hardis Group; Wing Aviation LLC.; Flytrex Inc.; Zing; Wingcopter; Elroy Air; Joby Aviation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Drone Logistics And Transportation Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2020 to 2030. For this study, Grand View Research has segmented the global drone logistics and transportation market report based on solution, application, end use, and region:

-

Solution Outlook (Revenue, USD Million, 2020 - 2030)

-

System

-

Infrastructure

-

Software

-

-

Application Outlook (Revenue, USD Million, 2020 - 2030)

-

Last-mile Delivery

-

Warehousing and Inventory Management

-

Medical & Pharmaceutical Supply

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2020 - 2030)

-

Commercial

-

Defense

-

-

Regional Outlook (Revenue, USD Million, 2020 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global drone logistics and transportation market size was estimated at USD 1.61 billion in 2024 and is expected to reach USD 2.27 billion in 2025.

b. The global drone logistics and transportation market is expected to grow at a compound annual growth rate of 48.1% from 2025 to 2030 to reach USD 16.15 billion by 2030.

b. The system segment accounted for the largest share of 61.5% in 2024. Growth in this segment is fueled by the rising demand for high-performance drones capable of carrying heavier payloads over longer distances and operating in varied environments.

b. Some key players operating in the drone logistics and transportation market include Zipline, United Parcel Service of America, Inc., Drone Delivery Canada, Hardis Group, Wing Aviation LLC., Flytrex Inc., Zing, Wingcopter, Elroy Air, and Joby Aviation.

b. The rapid expansion of e-commerce and same-day delivery expectations can be attributed to the growth of the drone logistics and transportation market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.