Pioneering Patient Empowerment: Rise of Wearable Health Tech in the Middle East

Wearable technology is fundamentally transforming healthcare across the Middle East, shifting the paradigm from reactive to proactive, patient-driven care. This evolution is accelerating, fueled by rising health awareness, ongoing technological innovation, and robust government strategies. The UAE, with its dynamic digital health landscape, stands as both a leader and a reference point for neighboring markets. This analysis delves into the impact of wearables on patient care, examining key trends, growth drivers, and investment dynamics across the region.

Wearable Technology: The Cornerstone of Patient-Centric Healthcare

Smartwatches, fitness trackers, and advanced health sensors are empowering individuals with real-time health data, enabling more informed self-management of chronic conditions and overall wellbeing. For populations with limited access to traditional healthcare services, wearables bridge critical gaps by supporting remote patient monitoring, reducing unnecessary hospital visits, and facilitating the early identification of health issues. Regional market forecasts indicate rapid expansion, largely driven by the adoption of smartphones, a shift toward wellness-focused lifestyles, and advances such as AI, IoT, and miniaturized sensor technology

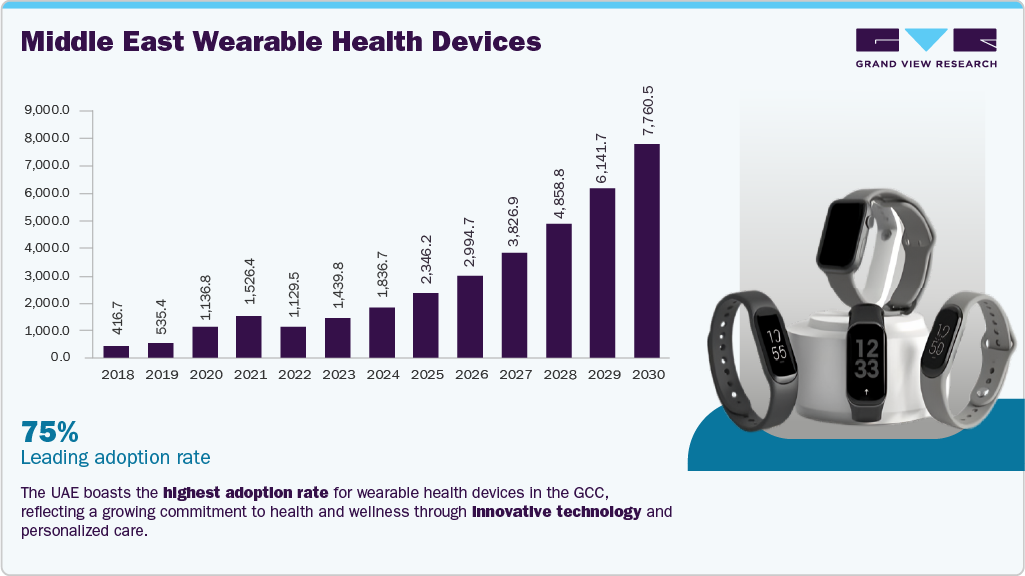

The Middle East wearable technology market is projected to reach unprecedented heights, with compound annual growth rates (CAGR) of over 25% through 2030. The regional market's growth is fueled by increasing smartphone adoption, lifestyle changes, and growing awareness of fitness and health maintenance. Critical advancements such as integration of AI, IoT, and miniaturized sensors enhance device capabilities, enriching user experience and clinical value.

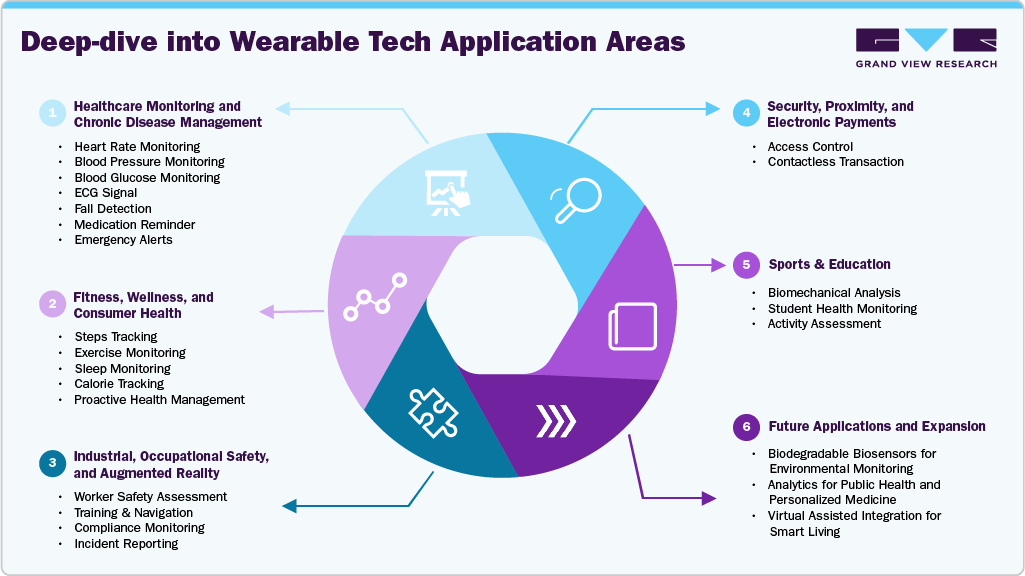

Wearable technology in the Middle East is experiencing fast-growing adoption across healthcare monitoring, chronic disease management, fitness, industrial safety, and consumer convenience, propelled by innovation in smartwatches, fitness trackers, biosensors, and augmented reality devices. Driven by rising health consciousness, expanding digital infrastructure, and supportive government initiatives, wearables are transforming health monitoring, enabling real-time data collection, proactive care, and personalized wellness, while also finding applications in multiple domains.

UAE and the Global Market: A Comparative Ecosystem Analysis

The UAE stands out as one of the fastest-growing wearable technology markets globally, with revenues projected to surpass USD 2.0 billion by 2030, growing at a compound annual growth rate (CAGR) of over 15.0% from 2025 onwards. This rapid growth is propelled by advanced digital health initiatives led by the government, robust IT infrastructure, and a tech-savvy population embracing wearable devices. The UAE Ministry of Health’s National Unified Medical Record (NUMR) platform exemplifies the integration of wearable data into nationwide health records, fostering interoperability and coordinated care.

Globally, the wearable technology market is significantly larger yet growing at a slightly lower CAGR of around 13.6%, with revenues expected to exceed USD 180 billion by 2030. The global market is led by countries like the U.S., where widespread innovation spans healthcare, consumer electronics, and industrial applications. Despite a smaller absolute market size, the UAE’s rapid adoption and concentrated innovation position as a regional and emerging global hub for smart wearable technology.

Challenges faced by the UAE, such as cost barriers, user education, and regulatory considerations reflect those seen worldwide but are addressed through tailored policies and strategic investments unique to its market dynamics. This comparative view highlights the UAE’s status as a leading agile market in the global wearables ecosystem, pioneering digital health transformations with significant future potential.

Investment Momentum and Innovation Ecosystems

Investment dynamics reveal a vibrant funding environment oriented towards wearable and digital health technologies in the Middle East. Key healthtech startups like Altibbi, based in UAE and Jordan, raised over USD 44.0 million in 2023, reflecting strong investor confidence in platforms that embed wearable-enabled remote monitoring and AI diagnostics. Governments are pivotal partners in this ecosystem, aligning digital health agendas with funding priorities, thus enabling scalable patient empowerment models.

Innovation is also thriving in the wearable segment with devices extending beyond fitness tracking to smart clothing with health monitoring, augmented reality wearables for industrial health and safety, and advanced sensors capable of ECG and blood oxygen monitoring. These technologies promise to extend wearable benefits to chronic disease management, elderly care, and occupational health, supporting ecosystem-wide resilience.

Future Trajectory and Strategic Opportunities

Wearable technology in the Middle East is evolving alongside broader digital health trends like artificial intelligence, telemedicine, and the integration of health records. The UAE, as a digital health trailblazer, sets standards in seamless data interoperability and consumer engagement. To unlock the full potential of wearable empowerment, industry leaders, startups, and policymakers must collectively address challenges around cost, regulation, and user education. Widespread adoption hinges on inclusive, collaborative efforts across the healthcare continuum.

In conclusion, wearable technology stands as more than just a commercial opportunity—it is redefining how patients across the Middle East interact with their health. By supporting policy, accelerating innovation, and harmonizing technology infrastructure, the region is poised to deliver healthcare that is smarter, more accessible, and profoundly patient-centric, a transformative leap toward a healthier future.