- Home

- »

- Sector Reports

- »

-

Recycled Plastics Industry Growth, Analysis Data Book, 2030

![Recycled Plastics Industry Growth, Analysis Data Book, 2030]()

Recycled Plastics Industry Data Book - Recycled Polyethylene, Recycled Polyethylene Terephthalate (rPET), Recycled Polypropylene, Recycled Polyvinyl Chloride (PVC) and Recycled Polystyrene Market Size, Share, Trends Analysis, And Segment Forecasts, 2023 - 2030

- Published Date: Jul, 2023

- Report ID: sector-report-00199

- Format: Electronic (PDF)

- Number of Pages: 350

Database Overview

Grand View Research’s recycled plastics sector data book is a collection of market sizing information & forecasts, trade data, pricing intelligence, competitive benchmarking analyses, macro-environmental analyses, and regulatory & technological framework studies. Within the purview of the database, such information is systematically analyzed and provided in the form of outlook reports (1 detailed sectoral outlook report) and summary presentations on individual areas of research along with a statistics e-book.

Recycled Plastics Industry Data Book Scope

Attribute

Details

Research Areas

- Recycled Polyethylene Market

- Recycled Polyethylene Terephthalate Market

- Recycled Polypropylene Market

- Recycled Polyvinyl Chloride Market

- Recycled Polystyrene Market

- Other Recycled Plastics Market

Number of Reports/Presentations in the bundle

1 Sectoral Outlook Report + 6 Summary Presentations for Individual Areas of Research + 1 Statistic ebook

Cumulative Coverage of Countries

50+Countries

Cumulative of Appication

5+Appication

Highlights of Datasets

- Production Data, by Countries

- Import/Export Data, by Countries

- Demand/Consumption, by Countries

- Plastic Consumption Per Capita

- Competitive Landscape

- Recycled Polyethylene Market, by Appication

- Recycled Polyethylene Terephthalate Market, by Appication

- Recycled Polypropylene Market, by Appication

- Recycled Polyvinyl Chloride Market, by Appication

- Recycled Polystyrene Market, by Appication

- Other Recycled Plastics Market, by Appication

Recycled Plastics Industry Data Book Coverage Snapshot

Markets Covered

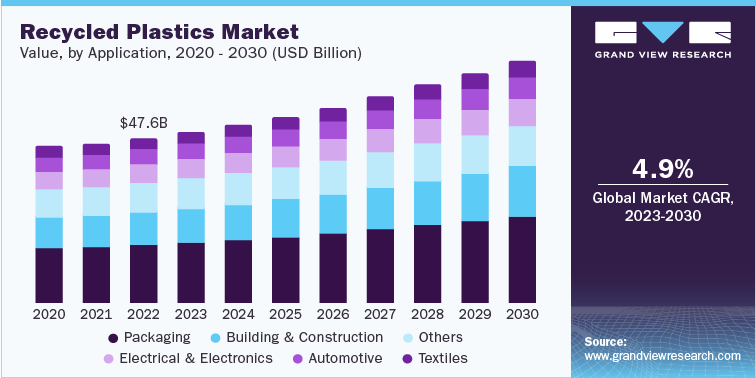

Recycled Plastics Industry

USD 47.61 billion in 2022

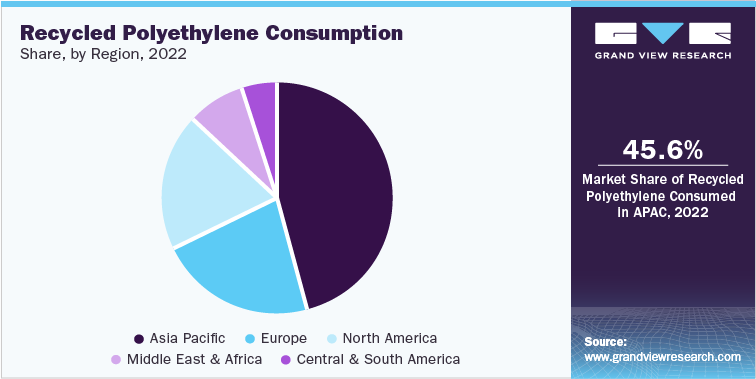

Recycled Polyethylene Market Size

USD 12.37 billion in 2022

5.2% CAGR (2023-2030)

Recycled Polyethylene Terephthalate Market Size

USD 5.20 billion in 2022

5.1% CAGR (2023-2030)

Recycled Polypropylene Market Size

USD 11.11 billion in 2022

5.6% CAGR (2023-2030)

Recycled Polyvinyl Chloride Market Size USD 6.25 billion in 2022

4.7% CAGR (2023-2030)

Recycled Polystyrene Market Size

USD 4.48 billion in 2022

4.2% CAGR (2023-2030)

Other Recycled Plastics Market Size

USD 8.20 billion in 2022

4.0% CAGR (2023-2030)

Recycled Plastics Sector Outlook

The economic value generated by the recycled plastics industry was estimated at approximately USD 47.61 Billion in 2022. This economic output is an amalgamation of businesses involved in the raw material suppliers, manufacturers of recycled plastic-based packaging products, distribution & supply, and application of recycled plastics.

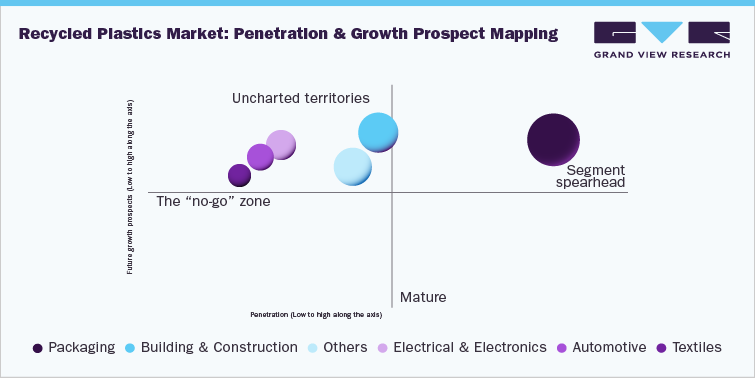

The global recycled plastics market is expected to grow due to rising concerns related to plastic pollution coupled with the rising product demand from various application industries such as packaging, automotive, electrical & electronics, building & construction, and textiles. Recycled plastic products, such as composite lumber, roofing tiles, insulation, rocks, and fences, are widely used in the building & construction industry owing to rising environmental concerns. Furthermore, properties of recycled plastics, such as lower carbon footprint and low cost compared to virgin plastics, are aiding the demand for recycled plastics. Building & construction application is anticipated to be one of the significant contributors to the growth of recycled plastics in the Asia Pacific region.

Rapid industrialization and urbanization in emerging economies such as China and India are expected to create massive demand for the use of recycled plastics in the construction sector, which, in turn, is likely to fuel the market for recycled plastics. In addition, increasing infrastructure spending and a rising number of government initiatives, such as smart cities and FDI in the construction sector, are propelling the growth of the construction industry. Moreover, the growing popularity of green buildings across the globe is further anticipated to drive the development of the construction industry, which, in turn, is additionally expected to fuel the demand for recycled plastics over the forecast period.

The packaging application segment dominated the recycled plastics market in 2022 and is anticipated to dominate over the forecast period. Recycled plastics are extensively utilized in packaging applications such as food and non-food containers, beverage bottles, personal care products, household care products, and film & sheets. Polyethylene terephthalate, polypropylene, polyethylene, and polystyrene are significant recycled plastics used for packaging. The excellent shock-absorbing properties of plastic packaging make it ideal for storing and transporting fragile items such as electronic equipment, consumer goods, wines, healthcare, and chemical products.

Increasing concerns related to plastic pollution, harmful emissions using petrochemicals, and depleting crude oil reserves have been driving the demand for recycled plastics. Government regulations restricting the consumption of petro-based plastics in certain applications and implementation of taxes on using non-recycled packaging products, such as food & consumer goods packaging, are expected to incentivize the production of recycled plastics.

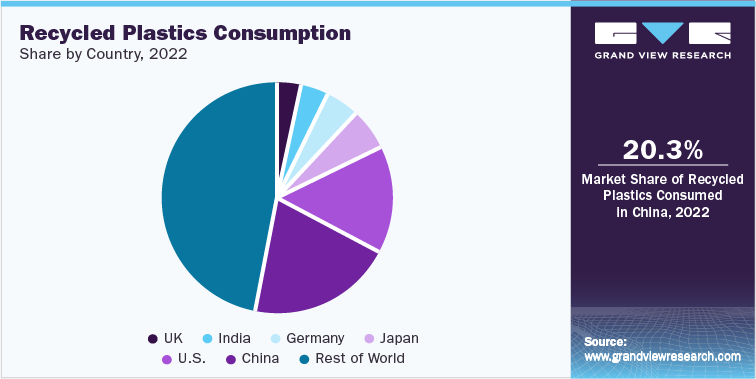

The global production of recycled plastic materials is mainly from Asia Pacific & Southeast Asia, North America, and Europe. The increasing usage of recycled plastics in many industries such as textiles, automotive, packaging, electrical & electronics, and building & construction is anticipated to increase the demand for recycled plastics across the globe.

Recycled Polyethylene Market Analysis And Forecast

Polyethylene includes high-density polyethylene (HDPE) and low-density polyethylene (LDPE). Polyethylene dominated the recycled plastics market in 2022 and is estimated to maintain its dominance over the forecast period. This can be attributed to the rising consumption of polyethylene for producing reusable bags, agriculture films, toys, milk bottles, housewares, containers, shampoo bottles, trays, food packaging films, and toys. Furthermore, properties such as excellent solvent resistance, high tensile strength, flexibility, toughness, and relative transparency drive the demand for polyethylene in the recycled plastics market. Recycled HDPE is mainly used to manufacture milk cartons, cutting boards, garbage bins, pens, plastics, fencing, tables, lumber, and bottles. Recycled HDPE offers stiffness with a highly crystalline structure and high density. LDPE waste is mainly generated from household products such as grocery bags, squeezable bottles, plastic wraps, and frozen food containers. Recycled LDPE produces bubble wraps, furniture, garbage cans, and floorings.

In several countries, such as Japan, the plastic recycling rate is 84%, the highest in Asia. The most common plastic waste generated in the country includes polyethylene, polypropylene, polystyrene, and polyvinyl chloride. The country recycles 23% of its plastic waste through mechanical recycling, 4% through chemical recycling, and the rest through thermal recycling by burning the plastic to produce energy. According to an article published by Medium, the country produces 30 billion plastic bags per year and 740 polyethylene terephthalate bottles per second. The country has the highest rate of recycling polyethylene terephthalate bottles, 84.8%. In addition, the Japanese government aims to reduce plastic waste generation by 25% by the year 2030 and introduce a law to charge additional for plastic bags in retail shops and stores.

Recycled Polyethylene Terephthalate (rPET) Market Analysis And Forecast

Various types of clothing, such as t-shirts and jackets, use fiber from recycled PET. It is also used in manufacturing automobile seat covers, sofa & chair seat covers, and carpets. The low production cost of clothing and favorable government regulations are the factors expected to drive the demand for recycled PET. Increasing investments in sports activities globally are augmenting the growth of the sports clothing & accessories market, which, in turn, are expected to drive the demand for recycled PET fibers. Jerseys for sports teams are the most common products manufactured using recycled PET fiber. The market for jerseys has grown substantially in Asia Pacific over the past ten years due to increased sports activities in the region, especially in China and India.

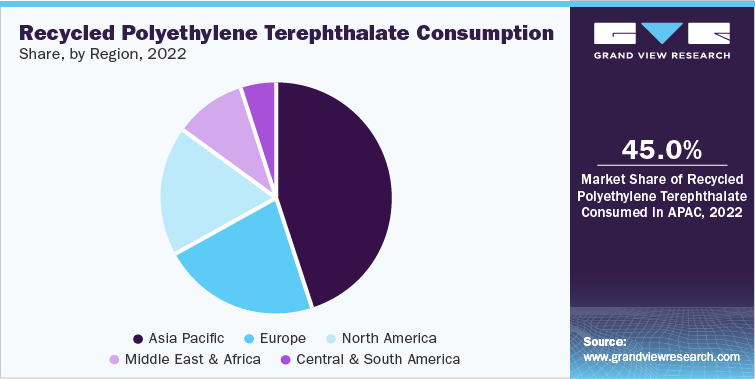

The recycled PET market is the largest in the Asia Pacific because of a strong manufacturing industry wherein rPET is widely used across several applications. A broad customer base, government initiatives, and cheap production costs are expected to grow the rPET market. Asia Pacific will continue to be the largest market for rPET owing to a strong network of manufacturing facilities located in economically viable countries in the region. The high import of post-consumer PET bottles and primary production sites due to relaxed regulations is expected to drive market growth.

Polyethylene terephthalate is known for its durability, transparency, and resistance to moisture. These properties have made cosmetics product manufacturers consider PET for packaging. Glass and metals have been used considerably in manufacturing. However, the cost associated with these materials positions PET and other plastics at a lower level, thus bringing down the overall cost of the final product. Since cosmetic products are high priced, the rise in packaging costs can hamper the manufacturers' profit margins.

Recycled Polypropylene Market Analysis And Forecast

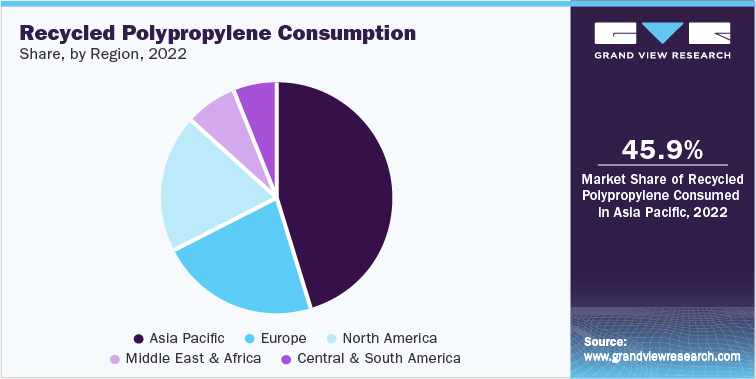

Polypropylene offers excellent chemical and mechanical properties, which make it suitable for use in various industries such as automotive, packaging & labeling, and medical devices. Recycled polypropylene is also used to manufacture battery cases, signal lights, battery cables, brooms and brushes, ice scrapers, kitchen utensils, plastic lumber, outdoor rugs, and oil funnels.

Polypropylene is one of the most formulated plastics across the globe. Properties of polypropylene, such as low moisture & vapor transmission, excellent optical clarity in biaxially oriented films & stretch blow molded containers, and chemical and electrical resistance, are further propelling its demand in the recycled plastics market. Moreover, it manufactures garden rakes, storage bins, shipping pallets, and trays.

Recycled Polyvinyl Chloride (PVC) Market Analysis And Forecast

Sorting and separation are significant challenges in the polyvinyl chloride recycling process. Different formulations composed of various additives are used to produce PVC plastic products, and separating different types of plastics, fillers, and stabilized flame retardants takes work. Furthermore, contamination of other waste streams, such as polyethylene terephthalate, polystyrene, and polyethylene with polyvinyl chloride, carries a significant risk of releasing hydrochloric acid (HCI) at elevated temperatures. These issues associated with PVC recycling affect its demand in the recycled plastics market.

Polyvinyl chloride is found in rigid bottles, clamshells, flexible medical & bedding bags, shrink wrap, wire/cable insulation-coated fabrics, and flooring. Recycled polyvinyl chloride is used to manufacture windows, pipes, floor tiles & mats, gutters, electrical boxes, traffic cones, garden hoses, fencing, films & sheets, cassette trays, electrical boxes, mobile home skirting, and binders, among others.

Europe has the highest plastic recycling rate owing to the adoption of the circular economy by the European Commission for reducing plastic waste. The region recycles approximately 45% of its plastic waste and produces recycled plastics. These recycled plastics are used in various industries, including building & construction, packaging, agriculture, automotive, and electrical & electronics.

In Europe, recycled plastics produce products such as pipes, insulation boards, corrugated boards, garbage bags, bubble wraps, bottles, backpacks, shoes, hangers, cable casings, and bumpers. The region has witnessed a decline of 44% in plastic landfill from 2006 to 2018. Plastic Europe is working closely with the European Union to introduce 10 million tons of recycled plastics in Europe and further increase the recycling rate by 2025

Competitive Insights

The global recycled plastics market is fragmented in nature with the presence of various players, such as Biffa, Placon, Clear Path Recycling LLC, Verdeco Recycling, Inc., Indorama Ventures Public Ltd., Zhejiang Anshun Pettechs Fibre Co., Ltd., PolyQuest, Evergreen Plastics, Inc., Phoenix Technologies, and Libolon, as well as various medium and small regional and country-level players, operating in different parts of the world. The global players face intense competition from each other and regional players with strong distribution networks and good knowledge about suppliers and regulations.

Expanding application areas within the packaging, construction, agriculture, and consumer goods, among other industries, are anticipated to offer growth opportunities for crucial and small and medium market players. In addition, regional players know local competition and recycled plastics demand, which gives them a competitive edge over other players. Therefore, the market players are focusing on strengthening their market positions in the emerging markets of Asia Pacific and Europe through different geographical expansion strategies.

-

On February 15, 2023, NOVA Chemicals Corporation established NOVA Circular Solutions, a new line of business focusing on lower-emission, recycled solutions that will help reshape a better, more sustainable world. NOVA Circular Solutions will be home to the SYNDIGOTM brand’s newest recycled polyethylene (Rpe) portfolio.

-

In December 2022, ExxonMobil launched one of the most extensive advanced recycling facilities in Baytown, Texas, U.S. The facility at the company’s integrated manufacturing complex uses proprietary technology to break down hard-to-recycle plastics and transform them into raw materials for new products. It can process more than 80 million pounds of plastic waste annually, supporting a circular economy for post-use plastics and helping divert plastic waste currently sent to landfills.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified