- Home

- »

- Sector Reports

- »

-

Plastics Industry Trends, Research & Data Book, 2023-2030

Database Overview

Grand View Research’s plastics industry databook is a collection of market sizing information & forecasts, trade data, pricing intelligence, competitive benchmarking analyses, macro-environmental analyses, and regulatory & technological framework studies. Within the purview of the database, such information is systematically analyzed and provided in the form of outlook reports (1 detailed sectoral outlook report) and summary presentations on individual areas of research along with a statistics e-book.

Plastics Industry Data Book Scope

Attributes

Details

Areas of Research

- Plastic Resins Market

- Plastic Additives Market

- Plastic Compounds Market

- Recycled Plastics Market

Number of Reports/Presentations in the bundle

1 Sectoral Outlook Report + 4 Summary Presentations for Individual Areas of Research + 1 Statistics eBook

Cumulative Coverage of Countries

50+ Countries

Cumulative Coverage of Products

10+ Products

Highlights of Datasets

- Production Data, by Countries

- Import/Export Data, by Countries

- Demand/Consumption, by Countries

- Plastic Consumption Per Capita

- Competitive Analysis

- Plastic Types, Application

- Recycled plastic, by type

- Plastic Additives, by type

Plastics Industry Data Book Coverage Snapshot

Markets Covered

Plastics Industry

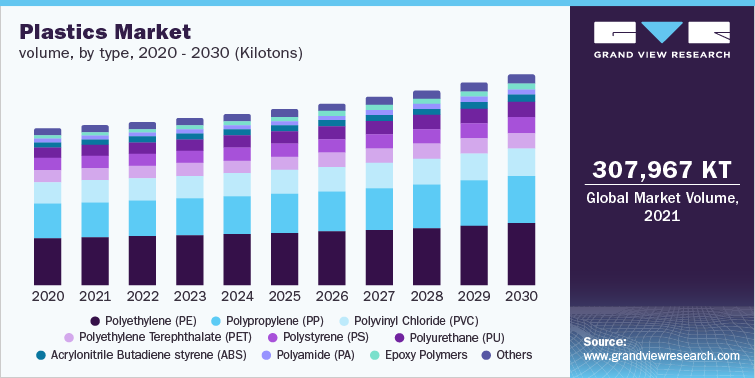

307,966.7 kilotones in 2021

Plastic Resins Market Size

349,628.9 kilotones in 2021

3.2% CAGR (2022-2030)

Plastic Additives Market Size

17,596.2 kilotones in 2021

4.5% CAGR (2022-2030)

Plastic Compounds Market Size

27,896.6 kilotones in 2021

3.7% CAGR (2022-2030)

Recycled Plastics Market Size

50,465.24 kilotones in 2021

3.3% CAGR (2022-2030)

Plastics Industry Outlook

The economic value generated by the industry was estimated at approximately 307,966.7 kilotons in 2021. This economic output is an amalgamation of businesses that are involved in the manufacturing of plastics & their additives, distribution & supply, and application of plastics.

The value chain of the market consists of raw material suppliers, intermediate additives and filler producers, plastic manufacturers, and distributors/suppliers along with industrial end users. They are extensively used in various end-use industries such as construction, automotive, and electrical & electronics, packaging, medical devices, agriculture, furniture & bedding, consumer goods, utility, and others.

Installed Production Capacity of Plastics, by Company, 2021

Company

Product

Production Facility Location

Production Capacity Analysis, 2021 (Kilotons per Annum)

Braskem

Polypropylene (PP)

America and Europe

4,045

HMC Polymers

Polypropylene (PP)

Asia

810

China Petrochemical Corporation

Polypropylene (PP)

Asia

350

LyondellBasell Industries Holdings B.V.

Polypropylene (PP)

America, Europe, Asia and others

5,270

Reliance

Polypropylene (PP)

Asia and others

3,500

BASF SE

Polypropylene (PP)

Europe, North America, Asia Pacific

2,610

Polyamide 6 and 66

820

Total Petrochemicals

Polyethylene (PE)

America, Europe, Asia and others

1,100

Polypropylene (PP)

2,950

Exxon Mobil Corporation

Polyethylene (PE)

Beaumont, Texas

1,700

Mont Belview, Texas

1,300

Low Density Polyethylene (LDPE)

Antwerp, Belgium

500

Meerhout, Belgium

300

Zwijndrecht, Belgium

200

SABIC

Polyethylene (PE)

Asia and others

1,500

Polypropylene (PP)

3,570

Indorama Ventures Public Company Limited

Polyethylene Terephthalate (PET)

America, Asia Pacific, Europe, and Middle East & Africa

4,200

Increasing demand for plastic polymers across the globe from industries such as automotive, electrical & electronics, textile, food & beverage, packaging, consumer goods, and various others, has propelled the competitive environment in the market. Companies are opting for strategies such as the introduction of new products, investment in research & development, and expansion of production capacities.

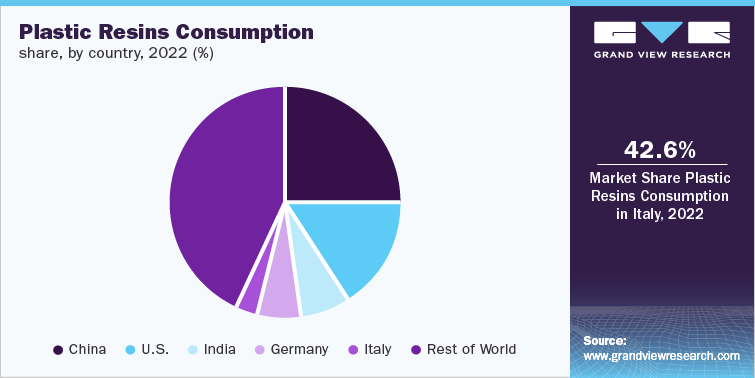

Plastic Resins Market Analysis And Forecast

The growth of the global plastics resins market is likely to be driven by increasing consumption of plastics in the construction, automotive, medical devices, and electrical & electronics industries. Regulatory intervention to reduce vehicle weight, enhance fuel efficiency, and ultimately reduce carbon emissions has encouraged automotive OEMs to adopt plastics for fabricating automotive components.

Plastic resins are synthetic materials commonly derived from natural gas and oil. They are extensively used in various end-use industries such as packaging, automotive, construction, electrical & electronics, logistics, consumer goods, textile & clothing, furniture & bedding, agriculture, medical devices, and others.

Crystalline resin including epoxy, polyethylene (PE), and polypropylene (PP); non-crystalline resin including polyvinyl chloride (PVC), polystyrene (PS), acrylonitrile butadiene styrene (ABS), and polymethyl methacrylate (PMMA); engineering plastics including nylon, polybutylene terephthalate (PBT), polycarbonate (PC), and polyamide (PA); and super engineering plastics including polyphenylene sulfide (PPS), polyether ether ketone (PEEK), and liquid crystal polymers (LCP) are some of the major types of plastic resins widely used in various end-use industries.

The global market is inherently fragmented with the presence of various key players such as BASF SE, Dow Inc., Sumitomo Chemical Co., Ltd., DuPont, Evonik Industries AG, SABIC, Arkema and Celanese Corporation and a few small and medium regional companies operating in different parts of the world. The global players are in intense competition with each other and with the regional players who have well-established distribution networks and good knowledge of suppliers and regulations.

Plastic Additive Market Analysis And Forecast

The demand for additives is ascending at a significant rate owing to their rising consumption in medical devices & equipment and various end-use industries such as healthcare, packaging, food & beverage, construction, automotive, personal care, and electronic goods. The additives are majorly used to enhance the physical and chemical properties of the materials, increase their shelf life, improve the aesthetic value and minimize the risk of microbes such as Legionella and MRSA.

Rapidly growing awareness of health-related issues in the emerging markets of Asia and North America is expected to drive the consumer industry, which in turn is expected to boost demand for additives over the forecast period.

Asia Pacific is expected to become the fastest-growing food additives market during the forecast period. China, Indonesia and India are major growth levers contributing to the construction sector growth in the region due to rising consumer disposable incomes and rising government spending on major infrastructure projects. In turn, the increasing demand for residential, commercial and institutional buildings in China due to the growing population contributes to the growth of the additives market.

Some of the key players in the additives market are Dow Inc., Clariant AG, LyondellBasell Industries N.V., BASF SE, Polyone Corporation, SANITIZED AG, King Plastic Corporation, Microban International (U.S.), Steritouch Ltd., and BioCote Limited.

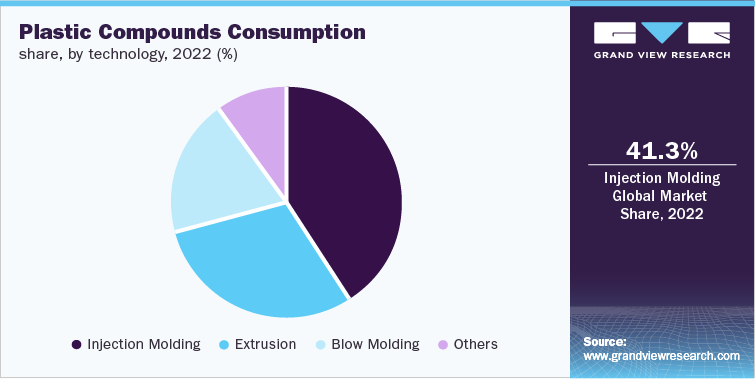

Plastic Compounds Market Analysis And Forecast

The global plastic compounding market is expected to be driven by increasing demand for plastic compounding in applications such as construction, automotive, packaging, healthcare and home appliances. The use of plastic composite products in automotive applications helps reduce fuel consumption as these products are lightweight compared to traditional materials such as rubber or metals.

Polypropylene (PP) was the leading segment in this market as of 2022. Properties such as good fatigue, chemical, and temperature resistance drive its demand in automotive, packaging, home appliances, furniture, and others. Polypropylene can be processed with all thermoplastic processing methods such as injection moulding, extrusion blow moulding and universal extrusion.

Asia Pacific was the leading regional market in 2022 and is expected to maintain its dominance over the forecast period. Rapid industrialization and robust growth in the end-use industry have fueled the growth of this market in the region. Economic developments and the resulting increase in consumer spending in emerging markets such as China and India as well as Southeast Asian countries have boosted demand for home appliances, further fueling market growth in the region.

The global plastic compounding market is inherently fragmented with the presence of various players such as BASF SE, Dow Inc., Borealis AG, DuPont, Asahi Kasei Corporation and Covestro AG, among others. Production capacity expansions, mergers and acquisitions, and new product developments are the popular strategies pursued by the majority of players operating in the market.

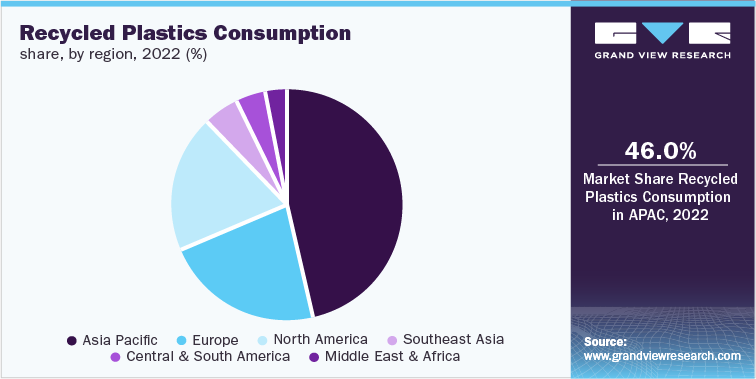

Recycled Plastics Market Analysis And Forecast

The global recycled plastics market is expected to witness growth on account of rising concerns related to plastic pollution coupled with the rising product demand from various application industries such as packaging, automotive, electrical & electronics, building & construction, and textiles. Packaging led the application segment and accounted for more than 37% share of the global volume in 2022. This is used to produce a wide range of products such as composite lumber, roofing tiles, insulation, bottles used for the packaging of food & household products, and cosmetics packaging products.

Global plastic waste recycling is only 9% per year and the rest of the plastic waste ends up in natural water bodies such as oceans and landfills. In 2019, the Chinese government banned the import of 24 types of plastics from the U.S. and European countries stating that the country will focus on its domestic waste recycling. After the ban, Southeast Asia became the plastic waste dumping ground for North American and European countries.

Increasing concerns related to plastic pollution, harmful emissions with the use of petrochemicals, and depleting crude oil reserves have been driving the demand for recycled plastics. Government regulations restricting the consumption of petro-based plastics in certain applications and implementation of taxes on using non-recycled packaging products, such as food & consumer goods packaging, are expected to incentivize the production of recycled plastics.

The global market is inherently fragmented as various players such as Biffa; sterile cycle; Republic Services, Inc.; REMONDIS SE & Co. KG; Waste Management, Inc.; Veolia; and PLASTIPAK HOLDINGS, INC. as well as various medium and small players at regional and national levels operating in different parts of the world.

Competitive Insights

The global plastics industry is fragmented in nature with the presence of various key players such as BASF SE, Dow Inc., DuPont, Evonik Industries AG, SABIC, Sumitomo Chemical Co., Ltd., Arkema, and Celanese Corporation as well as a few medium and small regional players operating in different parts of the world. The global plastic molding companies face intense competition from each other as well as from the regional players who have strong distribution networks and good knowledge about suppliers & regulations.

The companies in the market compete on the basis of product quality offered and the technology used for the production of plastics. Major players compete on the basis of application development capability and new technologies used in product formulation. Recognized players such as BASF SE are investing in research & development activities to formulate new and advanced plastics, which gives them a competitive edge over the other players. In March 2019, BASF SE inaugurated a new research & development center in Shanghai, China, which has a special automotive application center for handling research & development activities specific to the automotive industry. The centre is intended to develop innovative products and meet the increasing demand from the automotive, consumer goods, and construction industries.

A majority of the companies are expected to target Asia Pacific, Central & South America, and the Middle East & Africa for regional expansion owing to the high growth potential in construction and automotive industries in these regions.

-

In June 2022, Huafon Group, a china based company has been named as the buyer of DuPont’s polytrimethylene terephthalate (PTT) business. The deal includes Sorona which is a biobased PTT fiber for different applications such as carpets and fabrics.

-

In April 2022, Woodbridge launched a product with the brand name TrimVisible that is a bio-based replacement for petroleum-based materials in polyurethane seat foams that help produce net-zero foam and reduce carbon footprint.

-

In December 2021, Coverstro AG intended to increase production capacity by building new plants for thermoplastic polyurethanes at the Shanghai site, in China. The facility is scheduled to be completed in 2023.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified