- Home

- »

- Sensors & Controls

- »

-

2D Barcode Reader Market Size, Industry Report, 2030GVR Report cover

![2D Barcode Reader Market Size, Share, & Trends Report]()

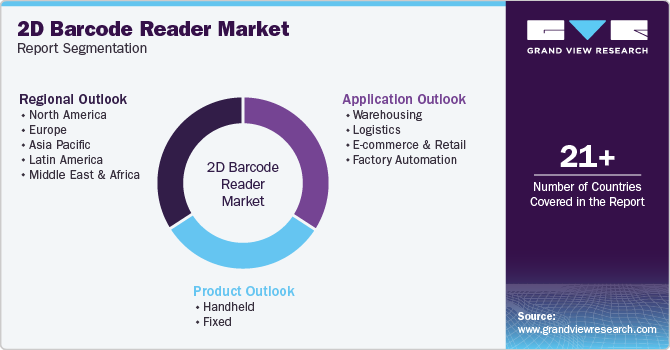

2D Barcode Reader Market (2025 - 2030) Size, Share, & Trends Analysis Report By Product (Handheld, Fixed), By Application (Warehousing, Logistics, E-commerce & Retail, Factory Automation), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-469-7

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

2D Barcode Reader Market Summary

The global 2d barcode reader market size was estimated at USD 8.14 billion in 2024 and is projected to reach USD 13.60 billion by 2030, growing at a CAGR of 9.4% from 2025 to 2030. Several key factors, including the rising demand for efficient inventory management and tracking systems across various industries, such as retail, logistics, and healthcare, drive market growth.

Key Market Trends & Insights

- The Asia Pacific 2D barcode reader industry dominated with the revenue share of 42.5% and is expected to grow significantly at a CAGR of over 11% from 2025 to 2030.

- The China 2D barcode reader industry held a substantial share in 2024.

- By product, the handheld segment accounted for the largest market share of over 67% in 2024.

- By application, the warehousing application segment accounted for the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 8.14 Billion

- 2030 Projected Market Size: USD 13.60 Billion

- CAGR (2025-2030): 9.5%

- Asia Pacific: Largest market in 2024

The increasing adoption of e-commerce has further amplified the need for accurate and reliable data capture solutions, enhancing the demand for 2D barcode readers. In addition, advancements in barcode scanning technology, including features like omnidirectional scanning, greater durability, and compatibility with mobile devices, have broadened their application scope. The growing emphasis on automation and digital transformation in business operations and regulatory compliance requirements in sectors like pharmaceuticals and food & beverage also significantly contribute to market expansion.The exponential growth of e-commerce has amplified the need for advanced barcode scanning solutions to support the vast scale of online retail operations. From warehouse management to last-mile delivery, 2D barcode readers play a pivotal role in ensuring accurate data capture and error-free tracking of goods. They are instrumental in streamlining order processing, reducing errors in package handling, and enhancing customer satisfaction. As the e-commerce sector expands, the adoption of 2D barcode readers is expected to rise in tandem.

The exponential growth of e-commerce has amplified the need for advanced barcode scanning solutions to support the vast scale of online retail operations. From warehouse management to last-mile delivery, 2D barcode readers play a pivotal role in ensuring accurate data capture and error-free tracking of goods. They are instrumental in streamlining order processing, reducing errors in package handling, and enhancing customer satisfaction. As the e-commerce sector expands, the adoption of 2D barcode readers is expected to rise in tandem.

Technological advancements in 2D barcode readers have significantly broadened their application across industries. Modern devices now feature omnidirectional scanning, which allows codes to be scanned from various angles, eliminating the need for precise alignment. These readers also offer enhanced durability, making them suitable for harsh environments such as manufacturing floors and outdoor logistics operations. Furthermore, the increasing compatibility with mobile devices has enabled greater flexibility, allowing businesses to deploy mobile barcode scanning solutions for improved productivity.

The growing emphasis on automation and digital transformation in business processes is another critical factor driving the market. 2D barcode readers are integral to automated systems, enabling faster and more reliable data collection for quality control, asset tracking, and customer engagement. As businesses adopt Internet of Things (IoT) technologies, the role of barcode readers in connecting physical assets to digital ecosystems becomes even more pronounced, driving their adoption across various sectors.

Strict regulatory requirements in the pharmaceuticals and food & beverage industries further boost the demand for 2D barcode readers. These devices ensure compliance by enabling precise tracking of product origins, manufacturing details, and expiration dates, which is critical for consumer safety and recall management. Governments and industry bodies are increasingly mandating traceability standards that require advanced barcode technologies, further fueling market growth.

Product Insights

The handheld segment accounted for the largest market share of over 67% in 2024. Handheld 2D barcode readers dominate the market segment due to their versatility, ease of use, and widespread applicability across industries. These devices offer portability and flexibility, allowing users to scan codes in various locations and positions, which is particularly advantageous in dynamic environments like warehouses, retail stores, and logistics operations. Handheld scanners are designed to handle high-volume tasks efficiently, with many models featuring ergonomic designs and lightweight structures to reduce user fatigue during prolonged use. Furthermore, wireless connectivity and battery technology advancements have enhanced their functionality, enabling seamless integration with mobile and stationary systems. The ability to read various barcode formats, including those on curved or damaged surfaces, has made handheld 2D barcode readers indispensable in applications requiring accuracy and reliability.

The fixed segment is expected to grow at a significant rate during the forecast period. Fixed 2D barcode readers are experiencing substantial growth in the product segment due to their ability to deliver high-speed, hands-free scanning and seamless integration into automated systems. These devices are particularly well-suited for industries like manufacturing, logistics, and retail, where continuous scanning of barcodes is essential for streamlining operations. Their compact and robust design allows them to be installed in production lines, kiosks, and conveyor systems, ensuring reliable performance in high-demand environments. Moreover, imaging technology and software advancements have enhanced their ability to decode complex and damaged barcodes with precision, further driving their adoption as businesses increasingly embrace automation and digital transformation.

Application Insights

The warehousing application segment accounted for the largest market share in 2024. Warehousing dominates the market segment due to these devices' critical role in streamlining inventory management, order fulfillment, and supply chain operations. In warehouses, 2D barcode readers enable the rapid and accurate scanning of product information, ensuring real-time tracking and minimizing errors in stock handling. Their ability to read high-density codes containing detailed data supports efficient organization and retrieval of goods, even in large and complex facilities. As warehouses increasingly adopt automation and data-driven technologies to meet the demands of e-commerce and omnichannel retail, the reliance on advanced 2D barcode readers for tasks such as inbound and outbound logistics, quality checks, and inventory audits has grown significantly. This extensive utility, coupled with the rising need for operational efficiency, solidifies warehousing as the leading application segment in the market.

The logistics segment is expected to grow at a significant rate during the forecast period due to the rising demand for efficient tracking and management of goods throughout the supply chain. These devices enable accurate data capture for parcel identification, shipment tracking, and route optimization, ensuring timely deliveries and reducing operational errors. With the rapid expansion of e-commerce and global trade, logistics providers increasingly rely on 2D barcode readers to handle high volumes of packages quickly and precisely. Furthermore, advancements in ruggedized wireless models have enhanced their usability in diverse logistics environments, driving their adoption further as companies prioritize efficiency and customer satisfaction.

Regional Insights

North America 2D barcode reader market held the major share of over 31% in 2024. The market is witnessing growth driven by the increasing adoption of automation and digitalization across retail, logistics, and healthcare industries. Companies leverage these devices to enhance operational efficiency, streamline inventory management, and comply with stringent regulatory standards. In addition, advancements in wireless and ruggedized barcode readers meet the demands of dynamic and harsh operational environments, further boosting their adoption in the region.

U.S. 2D Barcode Reader Market Trends

The 2D barcode reader industry in U.S. is expected to grow significantly from 2025 to 2030. The U.S. is a leading market for 2D barcode readers, primarily due to the rapid expansion of e-commerce and omnichannel retailing. The need for accurate and efficient tracking of goods in the supply chain propels demand, particularly in logistics and warehousing. Furthermore, the healthcare sector's focus on improving patient safety and adhering to strict regulatory requirements, such as the Drug Supply Chain Security Act (DSCSA), has driven the adoption of these devices.

Europe 2D Barcode Reader Market Trends

The 2D barcode reader industry in Europe is growing significantly at a CAGR of over 6% from 2025 to 2030. In Europe, the growing emphasis on Industry 4.0 and the adoption of smart manufacturing practices are key trends in the market. The region's focus on sustainable and efficient supply chain operations also fosters the adoption of advanced barcode scanning technologies. Furthermore, increasing regulatory requirements in the pharmaceutical and food & beverage industries drive demand for traceability solutions supported by 2D barcode readers.

The UK 2D barcode reader industry is expected to grow rapidly in the coming years. The UK market is shaped by the rising adoption of digital technologies in logistics and retail, driven by the growth of e-commerce and omnichannel strategies. Strict regulatory requirements in the food & beverage and pharmaceutical sectors are boosting the adoption of 2D barcode readers for compliance and traceability. Moreover, warehouse automation and supply chain optimization investments are further driving market growth.

The 2D barcode reader industry in Germany held a substantial market share in 2024. As a hub for advanced manufacturing and automation, Germany is a significant market for 2D barcode readers. Adopting these devices in industrial automation, production lines, and warehouse management reflects the country's strong focus on efficiency and precision. In addition, the growth of e-commerce and the increasing need for reliable logistics solutions fuel demand for advanced barcode scanning technologies.

Asia Pacific 2D Barcode Reader Market Trends

The Asia Pacific 2D barcode reader industry dominated with the revenue share of 42.5% and is expected to grow significantly at a CAGR of over 11% from 2025 to 2030. The Asia Pacific region is one of the fastest-growing markets for 2D barcode readers, driven by rapid industrialization, the expansion of e-commerce, and increasing investments in automation across sectors. The adoption of smart technologies in logistics and retail and government initiatives promoting digitalization in emerging economies further bolstered the market.

China 2D barcode reader industry held a substantial share in 2024. The key market drivers are China's booming e-commerce ecosystem, extensive logistics networks, and large-scale manufacturing sector. The government's focus on smart manufacturing, automation, and IoT integration supports adopting these devices as part of initiatives like "Made in China 2025".

The 2D barcode reader industry in Japan held a substantial share in 2024. Japan's market is characterized by the country's focus on precision, efficiency, and innovation. The adoption of these devices is widespread in manufacturing, retail, and healthcare, where advanced technological integration is a priority. Japan's leadership in robotics and automation also contributes to the increased use of 2D barcode readers in smart factories and automated systems.

India 2D barcode reader industry is expanding rapidly. The market is growing due to the proliferation of e-commerce and the rise of organized retail. The demand for efficient supply chain operations fuels the adoption of these devices in logistics, warehousing, and manufacturing. Government initiatives like "Digital India" and "Make in India" further promote the adoption of advanced technologies, including barcode readers, across industries.

Key 2D Barcode Reader Company Insights

Key players operating in the market include Casio Computer Co., Ltd., Cognex Corp., Datalogic S.p.A., Denso Wave Inc., General Data Company, Inc., Honeywell International, Inc., JADAK - A Novanta Company, Juniper Systems Inc., Keyence Corp., Marson Technology Co., Ltd., Omron Microscan Systems, Inc., Sato Holdings Corp., Scandit, SICK AG, Unitech Electronics Co., Ltd., Wasp Barcode Technologies, Zebex Industries Inc., and Zebra Technologies Corp. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals.

Key 2D Barcode Reader Companies:

The following are the leading companies in the 2D barcode reader market. These companies collectively hold the largest market share and dictate industry trends.

- Casio Computer Co., Ltd.

- Cognex Corp.

- Datalogic S.p.A.

- Denso Wave Inc.

- General Data Company, Inc.

- Honeywell International, Inc.

- JADAK - A Novanta Company

- Juniper Systems Inc.

- Keyence Corp.

- Marson Technology Co., Ltd.

- Omron Microscan Systems, Inc.

- Sato Holdings Corp.

- Scandit

- SICK AG

- Unitech Electronics Co., Ltd.

- Wasp Barcode Technologies

- Zebex Industries Inc.

- Zebra Technologies Corp.

Recent Developments

-

In April 2024, Keyence introduced the SR-X series, a new line of AI-powered code readers designed for enhanced performance and precision. The series includes five models: SR-X300, SR-X300+SR-XHR, SR-X300W, SR-X100W, and SR-X100. Each model is equipped with a CMOS sensor and features an autofocus function for optimal usability. The SR-X300, SR-X300+SR-XHR, and SR-X300W offer a resolution of 1920 x 1200 and are equipped with high-intensity red and white LED illumination. In contrast, the SR-X100 and SR-X100W provide a resolution of 1360 x 1024 with high-intensity red LED illumination. All models in the series feature a high-intensity green LED pointer as the light source, ensuring precise targeting and reliable operation.

-

In July 2023, Datalogic announced the launch of the new Gryphon 4500 Fixed Series, designed to support a wide range of self-service applications across retail, manufacturing, healthcare, and transportation & logistics sectors. This device combines advanced technological performance and robust durability with a compact form factor, enabling seamless integration into kiosks, self-check-in systems, information points, and access control setups. The Gryphon 4500 Fixed Series is available in two models to cater to diverse application needs. The GFS4500 model features an external housing, making it ready for immediate use and easy to mount from multiple sides, thanks to its versatile fixing points. The GFE4500, or "naked" version, is designed for more customized or integrated solutions, offering flexibility for tailored applications.

2D Barcode Reader Report Scope

Report Attribute

Details

Market size in 2025

USD 8.68 billion

Revenue forecast in 2030

USD 13.60 billion

Growth rate

CAGR of 9.4% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Casio Computer Co., Ltd.; Cognex Corp.; Datalogic S.p.A.; Denso Wave Inc.; General Data Company, Inc.; Honeywell International, Inc.; JADAK - A Novanta Company; Juniper Systems Inc.; Keyence Corp.; Marson Technology Co., Ltd.; Omron Microscan Systems, Inc.; Sato Holdings Corp.; Scandit; SICK AG; Unitech Electronics Co., Ltd.; Wasp Barcode Technologies; Zebex Industries Inc.; Zebra Technologies Corp.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global 2D Barcode Reader Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global 2D barcode reader market report based on product, application, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Handheld

-

Fixed

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Warehousing

-

Logistics

-

E-commerce & Retail

-

Factory Automation

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

U.A.E

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global 2D barcode reader market size was estimated at USD 8.14 billion in 2024 and is expected to reach USD 8.68 billion in 2025.

b. The global 2D barcode reader market is expected to grow at a compound annual growth rate of 9.4% from 2025 to 2030 to reach USD 13.60 billion by 2030.

b. The Asia Pacific region dominated the market for 2D barcode reader in 2024 and accounted for a global revenue share of over 42.54%. The growth can be attributed to the growing e-commerce and retail industry in the regional market.

b. Some key players operating in the 2D barcode reader market include Casio Computer Co., Ltd., Cognex Corp., Datalogic S.p.A., Denso Wave Inc., General Data Company, Inc., Honeywell International, Inc., JADAK - A Novanta Company, Juniper Systems Inc., Keyence Corp., Marson Technology Co., Ltd., Omron Microscan Systems, Inc., Sato Holdings Corp., Scandit, SICK AG, Unitech Electronics Co., Ltd., Wasp Barcode Technologies, Zebex Industries Inc., and Zebra Technologies Corp.

b. Several key factors, including the rising demand for efficient inventory management and tracking systems across various industries, such as retail, logistics, and healthcare, drive the growth of the 2D barcode reader market. The increasing adoption of e-commerce has further amplified the need for accurate and reliable data capture solutions, enhancing the demand for 2D barcode readers.

b. The handheld product segment dominated the 2D barcode reader market in 2022 and accounted for more than 67.0% of the revenue share.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.