- Home

- »

- Next Generation Technologies

- »

-

5G Fixed Wireless Access Market Size, Industry Report, 2030GVR Report cover

![5G Fixed Wireless Access Market Size, Share & Trends Report]()

5G Fixed Wireless Access Market (2025 - 2030) Size, Share & Trends Analysis Report By Offering (Hardware, Services), By Operating Frequency, By Demography, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-037-2

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2019 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

5G Fixed Wireless Access Market Summary

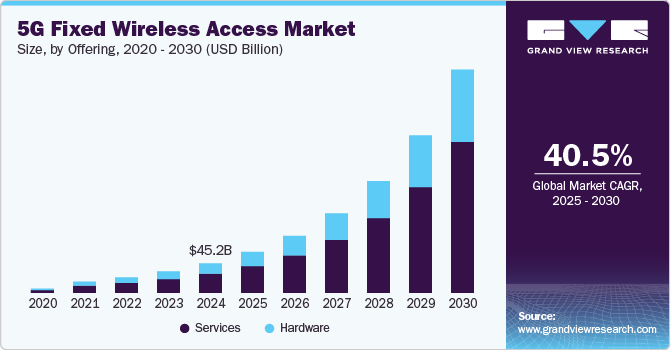

The global 5g fixed wireless access market size was estimated at USD 45,170.3 million in 2024 and is projected to reach USD 342,829.8 million by 2030, growing at a CAGR of 40.5% from 2025 to 2030. The rising need for high-speed internet access, as well as the increased usage of innovative technologies such as the millimeter-wave and Internet of Things (IoT) in 5G fixed wireless access (FWA), are driving the market growth.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, services accounted for a revenue of USD 41,125.7 million in 2024.

- Services is the most lucrative offering segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 45,170.3 million

- 2030 Projected Market Size: USD 342,829.8 million

- CAGR (2025-2030): 40.5%

- North America: Largest market in 2024

The global 5G fixed wireless access market size was estimated at USD 45.17 billion in 2024 and is projected to grow at a CAGR of 40.5% from 2025 to 2030. The rising need for high-speed internet access, as well as the increased usage of innovative technologies such as the millimeter-wave and Internet of Things (IoT) in 5G fixed wireless access (FWA), are driving the market growth. 5G FWA technology uses the capabilities of 5G networks to offer high-speed internet services to households and businesses without the need for physical fiber connections. At the same time, the trend toward remote work and online learning is likely to boost the demand for high-speed internet access. This is projected to fuel additional expansion in the 5G FWA market as solution providers continue to explore cost-effective solutions to address the rising demand for high-speed internet access.

Numerous 5G FWA access solution providers are focusing on releasing advanced solutions to accommodate the rising demand from various consumers globally. For instance, in January 2023, Mavenir, a telecommunications software company, launched its Fixed Wireless Access (FWA) solution that supports 5G Non-Standalone (NSA), 5G Standalone (SA), and 4G deployments. Mavenir stated that its FWA system also supports massive Multiple Input Multiple Output (MIMO) radio technology and 5G millimeter-wave (mmWave) frequency bands. According to Mavenir, several clients, including RINA Wireless, 360 Communications, and Triangle Communications in the U.S., have implemented their FWA solution.

The expansion of 5G coverage is expected to drive the growth of the 5G FWA market. With the advent of 5G technology, FWA has become a popular option for delivering high-speed internet to homes and businesses in areas where fiber or cable infrastructure is limited. With 5G, wireless connectivity can be delivered at gigabit speeds, making it a viable alternative for wired broadband services. As 5G networks continue to expand and reach more users there will be an increase in the adoption of the 5G FWA technology, particularly in areas where wired infrastructure is limited or non-existent.

Private networks are becoming increasingly crucial for enterprises that need to ensure secure and reliable connectivity. With 5G FWA, enterprises can set up private networks that are not reliant on wired infrastructure, making them more flexible and easier to deploy. As a result, it is expected that there will be an increase in the adoption of 5G FWA for private networks, particularly in industries such as manufacturing, logistics, and energy. Moreover, the integration of 5G FWA with edge computing is also expected to revolutionize industries such as healthcare, manufacturing, and transportation and create new use cases for smart cities and homes.

The growth of the Internet of Things (IoT) and smart home devices also drives demand for high-speed broadband connectivity, thereby contributing to market growth. With 5G FWA, devices can be connected directly to the internet and communicate with each other in real time without the need for a wired connection. This creates a more connected and efficient home environment, where devices can communicate with each other to automate tasks and improve the user experience. Service providers are developing specialized 5G FWA packages for IoT and smart home devices to meet the unique needs of these markets. However, 5G FWA technology can be expensive to deploy, particularly for service providers who need to build out new infrastructure, which is a significant factor that is expected to impact the market growth.

Offering Insights

The services segment accounted for the largest share of 65.26% in 2024. With the increasing proliferation of data-intensive applications and the rise of the Internet of Things (IoT), businesses and consumers are demanding faster and more reliable connectivity. The low latency and high bandwidth of 5G FWA networks make them an ideal solution for meeting these demands, and service providers are rapidly expanding their offerings to meet this demand. In addition to basic connectivity, service providers are offering value-added services, such as cloud-based services which can be accessed remotely, enterprise connectivity, IoT services, and more. As these services become more widespread, the services segment of the 5G FWA market is expected to grow and account for a substantial market share in the future.

The hardware segment is expected to grow at the significant CAGR during the forecast period. Improved Customer Premises Equipment (CPE) and access units are an important trend driving the growth of the hardware segment in the 5G Fixed Wireless Access (FWA) market. CPE refers to the hardware devices that are located on the customer's premises, such as modems or routers, and are used to connect to the 5G FWA network. Hardware manufacturers are investing in developing improved CPE to meet the needs of consumers and businesses. In addition, the ability of the CPEs to integrate with smart home features to control smart home devices, such as thermostats, security cameras, and lighting, is a significant factor driving the segment's growth.

Operating Frequency Insights

The Sub-6 GHz segment held the largest market share in 2024. The ability of the Sub-6 GHz operating frequency to offer enhanced coverage through obstacles such as buildings and walls more effectively and offer better connectivity for indoor and outdoor environments is a major factor driving the segment growth.Sub-6 GHz spectrum has better propagation characteristics, which is particularly important for indoor coverage, where higher frequency bands can struggle to provide consistent and reliable signal strength. Moreover, by using the Sub-6 GHz operating frequency for 5G FWA deployments, network operators can provide high-speed, low-latency internet connectivity to remote areas without the need for extensive fiber infrastructure.

The 24-39 GHz segment is expected to grow at a significant CAGR during the forecast period. The rising demand for high bandwidth availability for better internet connectivity is a major factor driving the segment growth. The 24-39 GHz operating frequency offers higher bandwidth compared to the Sub-6 GHz spectrum which means that it can provide faster internet speeds and support a greater number of devices simultaneously. Moreover, the 24-39 GHz spectrum has lower latency which makes them important for applications that require real-time responsiveness, such as online gaming and video conferencing.

Demography Insights

The urban segment dominated the market in 2024. Several factors such as increasing demand for high-speed broadband, growing adoption of smart city initiatives, rising number of connected devices, and advancements in the 5G technology are the major factors driving the growth of the 5G FWA solutions in urban areas. With the increasing reliance on internet-based services, the demand for high-speed broadband in urban areas has significantly increased. Moreover, as the number of connected devices is expected to increase significantly in the coming years, particularly in urban areas, 5G FWA solutions can support a large number of connected devices, which is essential for applications such as the Internet of Things (IoT) and smart home automation.

The semi-urban segment is projected to grow at the fastest CAGR over the forecast period. Students in semi-urban areas require high-speed internet access to participate in virtual classrooms and access educational resources. 5G FWA solutions can provide a reliable and fast internet connection, which is essential for online learning. At the same time, the rising adoption of e-commerce is on the rise in semi-urban areas, which has created a need for reliable internet access, making it an ideal option for consumers who need to shop online. Such factors bode well for the growth of the segment over the forecast period.

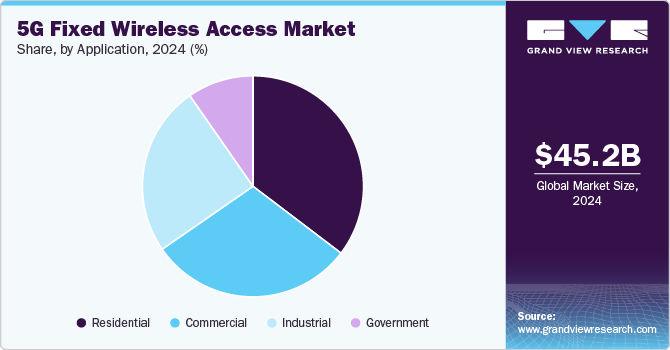

Application Insights

The residential segment dominated the market in 2024. Factors such as the growing adoption of smart home technology, the rise in remote work and telecommuting, and the rising demand for high-speed broadband are the major factors contributing to the segment growth. As more people rely on internet-based services for work, entertainment, and communication, there is a growing demand for high-speed broadband in residential areas. 5G FWA provides faster internet speeds and more reliable connectivity than traditional wired broadband services, making it an attractive option for residential consumers. Such factors bode well for the growth of the segment in the forecast period.

The commercial segment is expected to rise significantly over the forecast period. The growing advancements in IoT technology and the growing adoption of video conferencing solutions is a significant factors driving the segment growth. As businesses rely more on cloud-based services, the demand for high-speed internet is growing. 5G FWA can provide faster internet speeds and more reliable connectivity than traditional wired broadband services, making it an attractive option for commercial consumers, Moreover, due to the rise of remote work, the use of video conferencing is becoming more common in commercial applications.

Regional Insights

The North America 5G fixed wireless access market accounted for 27.8% share of the overall market in 2024. Rising investments in 5G infrastructure is a major factor driving regional growth. North America is seeing significant investments in 5G infrastructure, including the deployment of small cells, fiber-optic cables, and other network components. Moreover, the North American government is supporting the deployment of 5G technology through various initiatives and policies aimed at improving network infrastructure. Such factors bode well for the region's growth over the forecast period.

U.S. 5G Fixed Wireless Access Industry Trends

The U.S. quantum communication industry held a dominant position in 2024. As traditional broadband infrastructure, such as fiber, often proves costly and time-consuming to deploy in these regions, FWA has emerged as a cost-effective and scalable alternative.

Europe 5G Fixed Wireless Access Industry Trends

The 5G Fixed Wireless Access (FWA) market in Europe is propelled by the region's growing emphasis on enhancing broadband connectivity and closing the digital divide. With a significant portion of rural areas still underserved by traditional fiber or cable networks, FWA presents a cost-effective and efficient alternative for delivering high-speed internet. European Union initiatives, such as the Digital Decade targets, are driving investments in advanced network infrastructure, including 5G FWA, to achieve widespread gigabit connectivity by 2030. In addition, the increasing reliance on remote work, e-learning, and digital entertainment is fueling demand for flexible and scalable broadband solutions, positioning FWA as a key component of Europe’s digital strategy.

The German 5G fixed wireless access market is expected to experience significant growth in the coming years, driven by the German government’s “Gigabit Germany” initiative aims to provide high-speed internet to rural and underserved regions, where traditional broadband options are often limited or unavailable.

Asia Pacific 5G Fixed Wireless Access Industry Trends

The Asia Pacific 5G fixed wireless industry held a significant share in 2024. Countries such as China, India, and Japan are taking charge, each focusing on addressing specific connectivity challenges. Urban areas are seeing increased demand for high-speed alternatives to traditional broadband, while rural regions benefit from FWA's cost-effectiveness and ease of deployment. Government-backed digital initiatives, rising smartphone penetration, and the surge in data consumption from activities such as video streaming, remote work, and IoT adoption are fueling growth. The Asia Pacific region’s diverse economies and widespread investments in 5G infrastructure position it as a global hub for FWA innovation and deployment.

The China 5G fixed wireless access market held a substantial market share in 2024. China's 5G Fixed Wireless Access (FWA) market is driven by the country’s rapid deployment of 5G networks and its commitment to being a global leader in next-generation connectivity. With robust government support and significant investments by leading telecom providers, such as China Mobile, China Telecom, and China Unicom, FWA is being deployed to enhance broadband penetration, particularly in rural and remote areas. The growing adoption of smart cities, industrial IoT, and advanced digital services is further fueling demand for high-speed internet solutions, making FWA a critical component of China’s broader 5G strategy.

The India 5G fixed wireless access industry held a significant share in 2024. India's 5G FWA market is experiencing rapid growth, driven by the country’s increasing focus on improving digital infrastructure and closing the connectivity gap. Telecom operators such as Jio and Bharti Airtel are investing heavily in 5G rollouts, targeting both urban and rural areas where traditional wired broadband is limited. Government initiatives, including the "Digital India" program, are accelerating the adoption of cost-effective technologies like FWA to bring high-speed internet to underserved regions.

Key 5G Fixed Wireless Access Company Insights

Some of the major players in the 5G fixed wireless access market include Verizon Communications Inc., Huawei Technologies Co., Ltd., Nokia, and Telefonaktiebolaget LM Ericsson, among others. These companies are at the forefront of driving advancements in 5G FWA technology, leveraging strategic initiatives such as partnerships, acquisitions, and investments in research and development to strengthen their market positions. By expanding their product portfolios and collaborating with key stakeholders, they aim to address the rising demand for reliable, high-speed broadband solutions in both urban and rural markets. Their focus on innovation is crucial in enabling cost-effective deployment and improved connectivity to support the growing reliance on data-intensive applications across industries.

-

Verizon Communications Inc. has emerged as a prominent company in the 5G FWA space, with its "5G Home Internet" and "5G Business Internet" offerings providing high-speed connectivity to underserved areas. Verizon continues to invest heavily in expanding its 5G Ultra Wideband network while collaborating with technology providers to enhance the user experience. Its focus on millimeter wave (mmWave) technology enables faster data speeds and improved capacity, making it a strong player in the FWA market.

-

Huawei Technologies Co., Ltd. is leveraging its expertise in telecommunications to drive 5G FWA adoption globally. The company offers an extensive portfolio of FWA solutions designed to deliver high-speed broadband to rural and hard-to-reach areas. Huawei's strategic investments in R&D and its partnerships with telecom operators worldwide underline its commitment to enabling seamless connectivity. Its innovations in Massive MIMO and AI-based optimization have further enhanced the efficiency of its FWA offerings.

Key 5G Fixed Wireless Access Companies:

The following are the leading companies in the 5G fixed wireless access market. These companies collectively hold the largest market share and dictate industry trends.

- Huawei Technologies Co., Ltd.

- Telefonaktiebolaget LM Ericsson

- Nokia

- Samsung

- Inseego Corp.

- Qualcomm Technologies, Inc

- Intel Corporation

- MediaTek Inc.

- COMMSCOPE

- Verizon Communications Inc.

Recent Developments

-

In September 2024, Dutch operator Odido has announced the launch of its Klik&Klaar Internet, a Fixed Wireless Access (FWA) service leveraging its newly deployed 3.5 GHz spectrum to deliver high-speed internet across the Netherlands. The service will provide speeds of up to 300 Mbps to nearly 20,000 locations where fiber optic cables are not available. With 75-80% nationwide coverage, Odido aims to offer an alternative to traditional fixed internet connections, using plug-and-play modems and an easy installation app for seamless setup. By the end of 2024, all Odido antennas will be upgraded to support the 3.5 GHz frequency, ensuring enhanced mobile and broadband speeds

-

In August 2024, Inseego Corp. has launched the Inseego Wavemaker 5G indoor router FX3110, a multi-carrier device certified on all major U.S. networks, offering fast 5G connectivity, robust security, and easy remote management. Designed for diverse applications like retail, education, and remote work, the FX3110 features dual SIM capability, dual-band Wi-Fi 6, and integrated antennas for quick, plug-and-play deployment. Built with the Snapdragon® X62 5G Modem-RF System, it supports up to 64 wireless connections and includes advanced security features like encryption, VPN/ZTNA support, and TAA compliance. The router is complemented by Inseego Connect™ and SD EDGE™ SaaS platforms, enabling remote management, geofencing, and advanced network configuration.

5G Fixed Wireless Access Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 62.65 billion

Revenue forecast in 2030

USD 342.83 billion

Growth rate

CAGR of 40.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2019 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Offering, operating frequency, demography, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Huawei Technologies Co., Ltd.; Telefonaktiebolaget LM Ericsson; Nokia; Samsung; Inseego Corp.; Qualcomm Technologies, Inc; Intel Corporation; MediaTek Inc.; COMMSCOPE; Verizon Communications Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global 5G Fixed Wireless Access Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2030. For the purpose of this study, Grand View Research has segmented the global 5G fixed wireless access market report based on offering, operating frequency, demography, application and region:

-

Offering Outlook (Volume, Units; Revenue, USD Million, 2019 - 2030)

-

Hardware

-

Customer Premises Equipment (CPE)

-

Indoor CPE

-

Outdoor CPE

-

-

Access Units

-

Femto Cells

-

Pico Cells

-

-

-

Services

-

-

Operating Frequency Outlook (Volume, Units; Revenue, USD Million, 2019 - 2030)

-

Sub-6 GHz

-

24-39 GHz

-

Above 39 GHz

-

-

Demography Outlook (Volume, Units; Revenue, USD Million, 2019 - 2030)

-

Urban

-

Semi-Urban

-

Rural

-

-

Application Outlook (Volume, Units; Revenue, USD Million, 2019 - 2030)

-

Residential

-

Commercial

-

Industrial

-

Oil & Gas

-

Mining

-

Utility

-

Others

-

-

Government

-

-

Regional Outlook (Revenue, USD Million, Volume, Units 2019 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global 5G fixed wireless access market size was estimated at USD 45.17 billion in 2024 and is expected to reach USD 62.65 billion in 2025.

b. The global 5G fixed wireless access market is expected to grow at a compound annual growth rate of 40.5% from 2025 to 2030 to reach USD 342.83 billion by 2030.

b. North America dominated the 5G fixed wireless access with a share of 27.8% in 2024. Rising investments in 5G infrastructure is a major factor driving the regional growth.

b. Some key players operating in the 5G fixed wireless access market include Huawei Technologies Co., Ltd.; Telefonaktiebolaget LM Ericsson; Nokia; Samsung; Inseego Corp.; Qualcomm Technologies, Inc; Intel Corporation; MediaTek Inc.; COMMSCOPE; Verizon Communications Inc.

b. Key factors driving the 5G fixed wireless access market growth include rising demand for high-speed internet, advancements in 5G technology, the rise of remote working, and the expansion of 5G network coverage .

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.