- Home

- »

- Next Generation Technologies

- »

-

5G Optical Transceiver Market Size & Trends Report, 2030GVR Report cover

![5G Optical Transceiver Market Size, Share & Trends Report]()

5G Optical Transceiver Market Size, Share & Trends Analysis Report By Type (25G Transceivers, 50G Transceivers), By Form Factor, By Wavelength, By Distance, By 5G Infrastructure, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-048-2

- Number of Pages: 116

- Format: Electronic (PDF)

- Historical Range: 2019 - 2021

- Industry: Technology

Report Overview

The global 5G optical transceiver market size was valued at USD 1,323.7 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 29.9% from 2023 to 2030. The optical transceiver is also known as a fiber optic transceiver, an interconnect component used to transmit and receive data. Optical transceiver leverages fiber optic technology to convert electrical signals to light and vice versa. Optical transceivers are a crucial component in 5G infrastructure’s fronthaul, backhaul, and midhaul. The growing demand for 5G is expected to drive the deployment of 5G optical transceivers in 5G infrastructure, thereby driving the market’s growth.

Optical transceivers are a core component of optical communication. In 5G communication, fiber optics transport 5G signals to and from the carrier’s wide area networks. According to research published by IEEE Communications Society, optical transceivers are essential components of 5G fronthaul, midhaul, and backhaul, and their costs account for around 50% to 70% of the total 5G network costs.

The demand for 5G is expected to rise significantly over the forecast period driving the demand for 5g optical transceivers. Telefonaktiebolaget LM Ericsson’s ‘Mobility Report’ predicts that 5G subscriptions will reach 5 billion by 2028. The growing demand for 5G infrastructure is expected to propel the 5G optical transceiver industry’s growth.

With the continuous roll-out of 5G, consumer expectations are shifting to high data rates. Telecom suppliers and 5G providers are focusing on increasingly moving towards the 800 Gbps optical ecosystem to keep pace with massive growth in data requirements and shifting consumer demand.

Additionally, 5G providers are looking for infrastructure components to help them achieve high bandwidth data transmission while keeping low costs and power consumption. To address these criteria, the optical transceiver market is looking to leverage Silicon-Photonic technology, which is expected to play a crucial role in driving the adoption of 5G optical transceivers over the forecast period.

Telecommunication providers are increasingly adopting 5G optical transceivers to support their 5G roll-outs. For instance, in October 2022, SoftBank Corp., a Japanese telecommunication service provider, announced that it would deploy Cisco QSFP ZR4 pluggable optical transceivers to support its 4G/5G, broadband, and enterprise services.

By leveraging these optical transceivers, SoftBank Corp. aims to reduce power consumption and carbon footprint, providing faster connectivity. The ability of 5G optical transceivers to provide higher network efficiency and high reliability and its ability to consume less rack space and low power consumption is contributing to operational efficiency and sustainability, thus driving the market demand.

As of December 2022, 5G networks are being deployed only in parts of the world, and many countries across the globe are still majorly using 4G and even 3G networks, which can hinder the adoption of 5G optical transceivers. However, the demand for 5G networks is expected to increase over the forecast period, which comes with its operational complexities.

As the demand for 5G increases, building standalone 5G infrastructure will become necessary. Building and maintaining 5G standalone infrastructure can be expensive and require significant investments in equipment. Hence, the growth of the 5G optical transceiver market depends on significant investments made by key market players in deploying 5G infrastructure.

However, considering the benefits provided by 5G networks, there are significant investments in the technology, which will foster the innovation and deployment of 5G optical transceivers.

COVID-19 Impact

The COVID-19 pandemic adversely affected the telecom industry and 5G deployments. Worldwide lockdowns and business shutdowns led to supply chain disruptions and halted the manufacturing of many 5G components, which led to delayed 5G deployment. Additionally, since companies across the globe suffered severe financial losses, the investments made in 5G infrastructure deployment were delayed, adversely affecting the market. However, as the world recovers from the adversities of the pandemic, 5G deployments are encouraged worldwide, and the investment influx has also increased, propelling the growth of the 5G optical transceiver market.

Type Insights

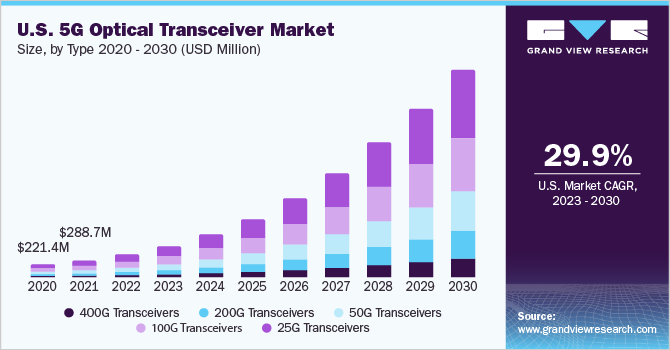

The 25G transceivers segment dominated the market in 2022 and accounted for a revenue share of more than 31.0%. 25G transceivers are suitable for the 5G front-haul connection, which uses direct fiber connection, due to their network construction efficiency. 25G transceivers combine multiple wavelengths into one single fiber by adopting wavelength division multiplexing (WDM) technology.

Due to this technology, 25G transceivers can support 300m and 10 km transmission distances. On the other hand, 5G macro base stations demand higher-speed optical transceivers and 25G transceivers suit the requirements of the 5G macro base station. As the number of 5G macro base stations increases, the demand for 25G optical transceivers will be simulated, driving the segment’s growth over the forecast period.

The 400G transceivers segment is anticipated to grow significantly over the forecast period. The adoption of 400G transceivers is expected to propel significantly over the forecast period. In 2017, the IEEE formally approved a 400G standard, which pushed different equipment manufacturers to work on different technologies to achieve 400G cost-effectively.

With the demand for data-intensive services growing, the investment in developing 400G has grown significantly. 400G transceivers are a massive upgrade in terms of speed from 100G and 200G, but another significant advantage of 400G transceivers is that they are 800G ready for potential future jumps. Even though the current investment required is significant for 400G, it is worth it due to its ability to upgrade to 800G, which is expected to drive the segment's growth over the forecast period.

Form Factor Insights

The SFP56 form factor segment dominated the market in 2022 and accounted for a revenue share of more than 28.0%. The optical transceivers with form factor SFP56 are widely adopted in 5G infrastructure due to their compatibility with 50G and 25G. Moreover, they are adopted for their high-speed connectivity, superior performance, higher quality, and reliability.

Considering the demand for SFP56 form factor in 5G, key market players are launching new product portfolios. For instance, in March 2022, Source Photonics announced it would showcase its 50G SFP56 optical transceivers. The product portfolio was explicitly launched for 5G fronthaul networks. Such initiatives are expected to foster the segment’s growth over the forecast period.

The QSFP28 segment is anticipated to register significant growth over the forecast period. QSFP28 optical transceivers support data rates up to 100 Gbps, making them an ideal fit for 5G networks. They also provide low latency, which is necessary for 5G network features such as video streaming and gaming.

Moreover, QSFP28 optical transceivers have small form factors, which reduce the cost of cabling and space requirements, reducing the overall costs. High data rate compatibility, low latency, and cost-effectiveness are driving the segment's growth. In September 2022, Eoptolink Technology Inc. announced QSFO28 50G PAM4 products which can be applied in 5G Mobile fronthaul, midhaul, and backhaul networks. Such initiatives are further propelling the segment's growth.

Wavelength Insights

The 1310nm band segment dominated the market in 2022 and accounted for a revenue share of more than 43.0%. The 1310nm band wavelength optical transceivers are predominantly used in 5G infrastructure for high-speed backhaul connections. Backhaul connections connect the core network with the cell site, which is necessary to transport large amounts of data.

The 1310nm band can be suitable as it experiences low attenuation and can transport the signal over extensive lengths without significant loss of signal strength. Additionally, 1310nm transceivers are relatively inexpensive and are widely available, making them an attractive choice for network infrastructure builders. The above-mentioned characteristic properties of the 1310nm band are driving the segment’s growth.

The 850nm band segment is anticipated to grow significantly over the forecast period. The 850nm band optical transceivers are usually used in 5G infrastructure for short-distance connectivity, such as between small cells or in-building distributed antenna systems. 850nm transceivers are compatible with multimode fiber optic cables, making them suitable for short-distance connectivity where higher bandwidth at lower costs is required. Additionally, 850nm transceivers are readily available and inexpensive, making them a suitable option for 5G infrastructure, propelling the segment’s growth.

Distance Insights

The more than 100 Km segment dominated the market in 2022 and accounted for a revenue share of more than 42.0%. Technological advancements have led to a greater need for reliable and stable data networks, making transceivers an essential part of any network’s hardware. The more than 100 Km optical transceivers can transfer data over vast distances.

One of the challenges faced by 5G network providers is the range of the network. More than 100 Km optical transceivers can help providers overcome this challenge and help them in providing a secure and stable network over an extensive range, making more than 100 Km range optical transceivers a suitable candidate for 5G infrastructure, thus contributing to the segment’s growth.

The 10 to 100 Km segment is anticipated to register significant growth over the forecast period. 5G networks require long-distance transmission to connect remote locations and provide seamless coverage across large areas. The 10 to 100 Km optical transceivers can transmit data across large areas and provide seamless coverage.

Additionally, the 5G optical transceiver industry is witnessing various initiatives, such as cost reduction innovation. One such cost-reduction innovation includes a coherent 100G transceiver which reduces the cost on-premise and meets transmission distance requirements within 200 Km. The aforementioned innovations are further propelling the segment’s growth.

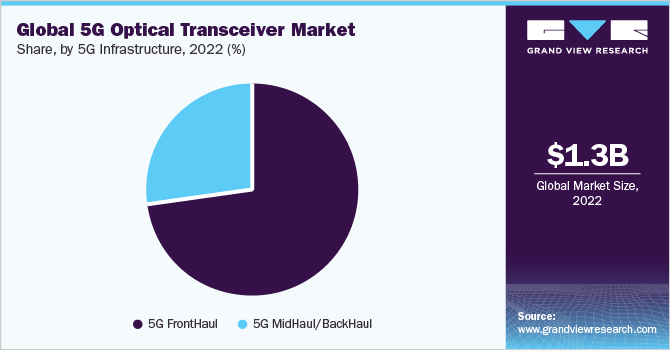

5G Infrastructure Insights

The 5G fronthaul segment dominated the market in 2022 and accounted for a revenue share of more than 73.0%. After the launch of 5G in 2019, 5G networks were quickly commercialized and adopted globally. Millions of 5G base stations were already deployed across the globe.

To cope with the construction and demand for base stations, network operators opted for optical transceivers, which would provide those high data rates, lower latencies, are readily available, and are cost-effective. Additionally, 5G network fronthaul has higher demands for data rate and optical interference for transceivers, driving the demand for optical transceivers in 5G fronthaul, thereby driving the market’s growth.

The 5G midhaul/backhaul segment is anticipated to register significant growth over the forecast period. 5G midhaul and backhaul are carried through the metro access layer, core layer, and convergence layer. The 50G/100G transceivers are commonly used for these layers.

The compatibility of optical transceivers for 5G network infrastructure is driving its adoption among the 5G midhaul/backhaul segment. Additionally, 5G optical transceivers can transmit high-speed data for applications such as video streaming, virtual reality, and augmented reality, among others. High-speed & long-distance transmission, low latency, and reliability are some crucial factors driving the adoption of 5G optical transceivers in midhaul/backhaul infrastructure, thus propelling the segment’s growth.

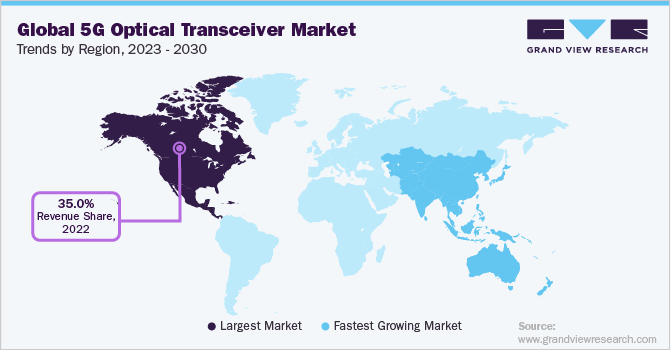

Regional Insights

North America dominated the market in 2022 and accounted for a more than 35.0% revenue share. The regional market’s growth can be attributed to the growing demand for deploying 5G infrastructure from the U.S. and Canada. Key market players in the region are launching new optical transceiver product portfolios suitable for 5G technology, which is harnessing the region’s growth.

For example, in September 2022, InnoLight partnered with Marvell to announce InnoLight’s first product portfolio suitable for 5G backhaul and aggregation applications. The product portfolio consists of 100G QSFP-DD optical transceivers. Such initiatives are fostering growth in the North American market.

Asia Pacific is anticipated to register significant growth over the forecast period. The Asia Pacific region is considered a leader in 5G deployments. China and South Korea were some of the first countries to deploy 5G networks. According to GSMA’s ‘The Mobile Economy Asia Pacific 2022’ report, there will be over 430 million 5G connections (excluding licensed cellular IoT) by the end of 2025.

The 5G deployment is on the rise in the Asia Pacific, fueling innovation, development, and investment influx in deploying 5G infrastructure. The growing adoption of 5G and deployment of 5G infrastructure bodes well for regional industry growth.

Key Companies & Market Share Insights

The market is fragmented and has a presence of several small players. It is a comparative niche market as the 5G technology is still newly commercialized. Post the commercialization of 5G networks, optical transceiver providers are engaging in partnerships and product launches to capture share in the 5G optical transceiver market. The growing demand for 5G optical transceivers is fueled by the growing demand for 5G and the increasing deployment of 5G infrastructure.

Vendors are focusing on launching new products, which is anticipated to foster the market’s growth over the forecast period. For instance, in March 2019, OE Solutions announced its 5G wireless fronthaul ready 25Gbps and 10Gbps DWDM optical transceiver. These transceivers are expected to increase network operators’ ability for using wavelength multiplexing, and economically deploy new wavelengths on existing fiber plants. Such launches are expected to be crucial in providing 5G, leveraging the existing optical fiber infrastructure. Some prominent players in the global 5G optical transceiver market include:

-

II-VI Coherent Corp.

-

INNOLIGHT

-

HiSilicon Optoelectronics Co., Ltd.

-

Cisco Acacia Communications, Inc.

-

Hisense Broadband, Inc.

-

Broadcom.

-

Source Photonics

-

Juniper Networks, Inc.

-

Eoptolink Technology Inc.

-

Molex, LLC

-

Accelink Technology Co. Ltd

-

Fujitsu Optical Components Limited

5G Optical Transceiver Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1,754.2 million

Revenue forecast in 2030

USD 10,938.4 million

Growth rate

CAGR of 29.9% from 2023 to 2030

Base year of estimation

2022

Historical data

2019 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Type, form factor, wavelength, distance, 5G infrastructure, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

II-VI Coherent Corp.; INNOLIGHT; HiSilicon Optoelectronics Co., Ltd.; Cisco Acacia Communications, Inc.; Hisense Broadband, Inc.; Broadcom.; Source Photonics; Juniper Networks, Inc.; Eoptolink Technology Inc.; Molex, LLC; Accelink Technology Co. Ltd; Fujitsu Optical Components Limited

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global 5G Optical Transceiver Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2030. For this study, Grand View Research has segmented the global 5G optical transceiver market report based on type, form factor, wavelength, distance, 5G infrastructure, and region:

-

Type Outlook (Revenue, USD Million, 2019 - 2030)

-

25G Transceivers

-

50G Transceivers

-

100G Transceivers

-

200G Transceivers

-

400G Transceivers

-

-

Form Factor Outlook (Revenue, USD Million, 2019 - 2030)

-

SFP28

-

SFP56

-

QSFP28

-

Others (QSFP56, CFP2, CFP8)

-

-

Wavelength Outlook (Revenue, USD Million, 2019 - 2030)

-

850 nm band

-

1310 nm band

-

Others (CWDM, DWDM, LWDM, 1270nm, 1330 nm)

-

-

Distance Outlook (Revenue, USD Million, 2019 - 2030)

-

1 to 10 Km

-

10 to 100 Km

-

More than 100 Km

-

-

5G Infrastructure Outlook (Revenue, USD Million, 2019 - 2030)

-

5G FrontHaul

-

5G MidHaul/BackHaul

-

-

Regional Outlook (Revenue, USD Million, 2019 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global 5G Optical Transceiver market size was estimated at USD 1.32 billion in 2022 and is expected to reach USD 1.75 billion in 2023.

b. The global 5G Optical Transceiver market is expected to grow at a compound annual growth rate of 29.9% from 2023 to 2030 to reach USD 10,938.4 billion by 2030.

b. North America dominated the 5G Optical Transceiver market with a share of 35.0% in 2022. The regional market’s growth can be attributed to the growing demand for deploying 5G infrastructure from the U.S. and Canada. Key market players in the region are launching new optical transceiver product portfolios suitable for 5G technology, which is harnessing the region’s growth.

b. Some key players operating in the 5G Optical Transceiver market include II-VI Coherent Corp., INNOLIGHT, HiSilicon Optoelectronics Co., Ltd., Cisco Acacia Communications, Inc., Hisense Broadband, Inc., Broadcom, Source Photonics, Juniper Networks, Inc., Eoptolink Technology Inc., Molex, LLC, Accelink Technology Co. Ltd, and Fujitsu Optical Components Limited.

b. Since optical transceivers are a crucial component in 5G infrastructure’s fronthaul, backhaul, and midhaul, the growing demand for 5G is a key factor expected to drive the deployment of 5G optical transceivers in 5G infrastructure, thereby driving the market’s growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."