- Home

- »

- Communication Services

- »

-

A2P Messaging Market Size & Share, Industry Report, 2033GVR Report cover

![A2P Messaging Market Size, Share & Trends Report]()

A2P Messaging Market (2026 - 2033) Size, Share & Trends Analysis Report By Component (Platform, Services), By Deployment Mode, By Enterprise Size, By SMS Traffic, By Application, By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-961-0

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

A2P Messaging Market Summary

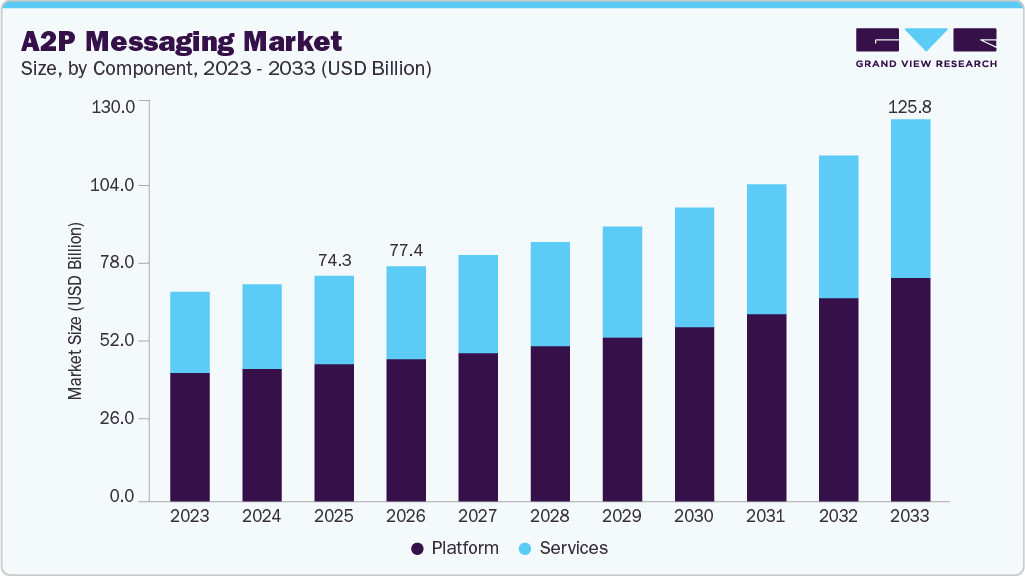

The global A2P messaging market size was estimated at USD 74.27 billion in 2025, and is projected to reach USD 125.79 billion by 2033, growing at a CAGR of 7.2% from 2026 to 2033. The increasing adoption of A2P messaging for business communications is expected to drive market growth.

Key Market Trends & Insights

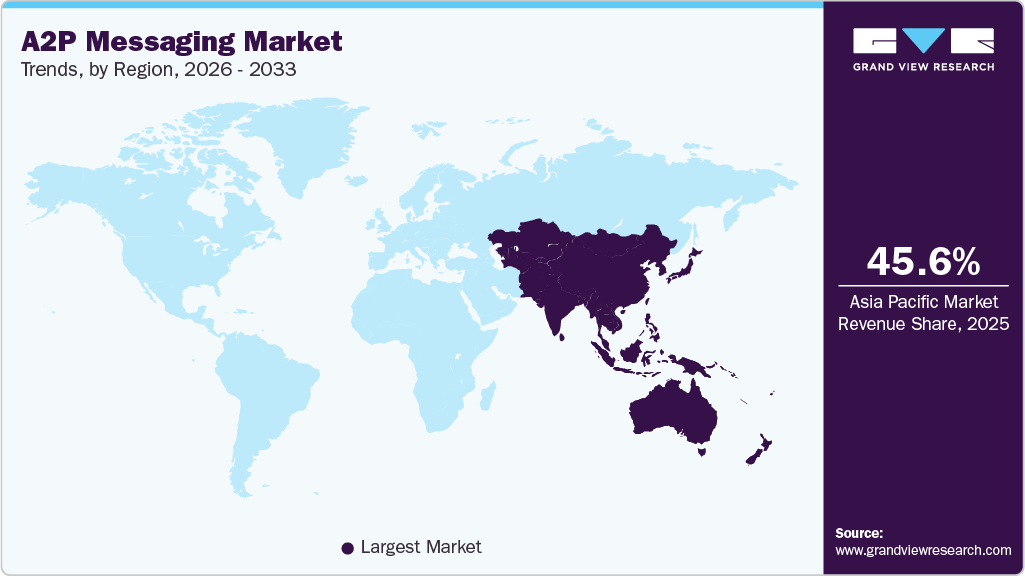

- The Asia Pacific A2P messaging industry accounted for a 45.6% share of the overall market in 2025.

- The China A2P messaging industry held a dominant position in 2025.

- By component, the platform segment dominated the A2P messaging industry, accounting for the largest share of 60.8% in 2025.

- By deployment mode, the cloud segment held the largest market share in 2025.

- By enterprise Size, the large enterprise segment dominated the market in 2025.

Market Size & Forecast

- 2025 Market Size: USD 74.27 Billion

- 2033 Projected Market Size: USD 125.79 Billion

- CAGR (2026-2033): 7.2%

- Asia Pacific: Largest market in 2025

Business communication includes the exchange of information between people present in workplaces and outside the company. For business communication, A2P messaging can be used for placing orders, sending invoices, and sending shipping notifications, among others. Compared to traditional SMS, A2P messaging offers various benefits, such as better deliverability, more reliability & security, and less chance of getting blocked. These factors propel the adoption of A2P messaging in business communications. By integrating A2P SMS into business models, organizations can reach directly to their customers with access to real-time alerts, along with instant feedback on their products and services. Industries and sectors such as IT & telecommunication, government, retail, and media & entertainment are shifting their focus toward integrating A2P SMS in their applications, such as customer relationship management, which helps in appointment reminders, follow-up surveys, and purchase confirmation, among others.

Apart from integrating A2P SMS in customer relationship management (CRM) applications, businesses can also integrate it in query and search-related services, such as contact information, due dates, bank balances, as well as interactive services, such as charity donations and voting. This factor fuels the adoption of A2P messaging among businesses. For instance, in October 2023, Twilio Inc. collaborated with SoftBank by initiating a new reseller deal. This partnership enabled SoftBank to distribute Twilio's cloud-based communication Application Programming Interface (API) service across Japan.

Moreover, the global expansion of mobile subscriber bases is driving robust market growth. This growth is bolstered by the widespread availability of affordable, high-speed data services and the recent deployment of 5G networks, which have accelerated the adoption of mobile services worldwide. Taking into account the burgeoning number of mobile subscribers, enterprises, application developers, and Mobile Network Operators (MNOs) are increasingly leveraging A2P messaging solutions to effectively reach and engage their diverse customer bases across international markets.

Component Insights

The platform segment accounted for the largest share of 60.8% in 2025. The growth of this segment can be attributed to the extensive use of the A2P messaging platform across sectors such as BFSI, travel & tourism, media & entertainment, and healthcare. In addition, the demand for A2P messaging, online transactions, notifications, and alerts has increased after the COVID-19 pandemic due to the rising number of remote transactions. The platform provides users with direct access to multiple brands and services within the messaging application.

Services is expected to grow at the fastest CAGR during the forecast period. The service segment comprises integration, authentication, consulting, and support & maintenance services, among others. The growth of the segment can be attributed to the increasing adoption of smartphones, new OTT businesses, and MNOs, which have curtailed P2P messaging services and increased the adoption of the A2P platform. This factor is expected to drive the adoption of supporting services. Services play a key role in the success and retention rate of the product utilized by the customer. Companies offering services include a complete suite with built-in software support and provide separate services to customers.

Deployment Mode Insights

The cloud segment held the largest market share in 2025. Cloud deployment in the A2P messaging communication platform enables enterprises to improve customer experience with seamless and personalized bulk messaging services. Moreover, it enables access to benefits such as data-driven, AI-based automated suggestions for messaging campaigns, cross-platform backup migration, and long-term data retention. Cloud-based A2P messaging offers an effective and integrated marketing campaign that supports client interaction.

On-premise is expected to grow at a significant CAGR during the forecast period. The growth of the on-premise segment can be attributed to the increasing demand from on-premises data/contact centers for the administration, deployment, maintenance, and scaling of hardware and software. In addition, as these solutions are expensive and difficult to manage and deploy, the adoption of cloud-based platforms is expected to accelerate over the forecasted period. Large enterprises primarily employ on-premise-based platforms as they provide in-house data security.

Enterprise Size Insights

The large enterprise segment dominated the market in 2025. The pandemic has significantly shifted consumer behavior and purchasing habits. Enterprise/business messages help boost brand recognition, customer satisfaction, and responsiveness, and there has been a rapid increase in the adoption of A2P messaging. For instance, Levi's surpassed 85% customer satisfaction scores by adopting A2P messaging and drove 30 times more store-related questions than web chat. Large enterprises are adopting A2P messaging solutions to send bulk, transactional, and promotional SMS.

The SMEs segment is projected to grow at the fastest CAGR over the forecast period. The small & medium enterprises segment is anticipated to witness an upward trajectory as small & medium enterprises prefer utilizing A2P messaging to describe the variety of products, updates, and promotional activities. A2P messaging platforms play a vital role in product development as enterprises can advertise the new product launch and benefit from brand recognition. Small & medium enterprises are expected to become key adopters of A2P messaging due to its low cost and efficient way of contacting many potential customers.

SMS Traffic Insights

The national segment dominated the market in 2025 due to the increasing demand for reliable and secure communication channels driven by the widespread adoption of mobile banking and payment services. Various industries are undergoing digital transformation, which necessitates effective customer engagement and verification methods.

Cross-border is projected to grow at the fastest CAGR over the forecast period. The globalization of businesses and the expansion of multinational corporations have prompted the need for cross-border communication with customers, partners, and employees. The rise of international e-commerce has fueled demand for transactional messages, order confirmations, and shipping notifications across borders.

Application Insights

The customer relationship management (CRM) services segment held a significant share in the market in 2025. The growth of the segment can be attributed to the increasing adoption of A2P messaging for CRM across industry verticals. CRM services are useful in assessing customer behavior and trends, and they assign and manage customer relationships by sending A2P SMS services. CRM-driven A2P messaging allows enterprises to efficiently manage and strengthen customer interactions and target potential audiences to drive sales.

Promotional campaigns is projected to grow at the fastest CAGR over the forecast period. The growth of this segment is attributed to the increasing adoption of A2P services for various promotional campaigns, such as providing promotional offers, delivering customer rewards, and disseminating promotional messages to customers. Emerging start-ups and businesses are conducting marketing and promotional activities by sending A2P messages to customers for brand recognition. It helps businesses target a bulk customer base with cost-effective strategies.

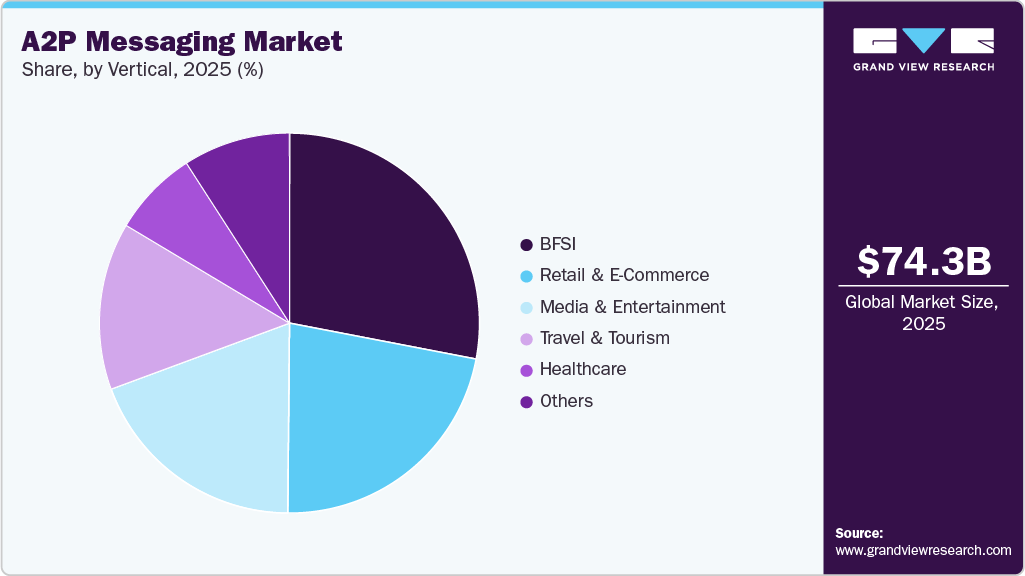

Vertical Insights

The BFSI segment dominated the market in 2025. The growth of the BFSI segment is attributed to the burgeoning payment transactions and growing adoption of online A2P messaging in the BFSI industry. Financial institutions and banks utilize A2P messaging for payment reminders, balance statements, notifications, one-time passwords, and anti-fraud alerts. An A2P messaging system aids banking and financial institutions in connecting with and establishing a strong relationship with clients by announcing transaction information, consumer actions, and needs-related retail banking operations.

Media & entertainment is projected to grow at the fastest CAGR over the forecast period. The market growth in the media & entertainment segment is attributed to the increasing adoption of A2P messaging in voting-based reality shows in a bid to reach maximum viewers. Key players such as Sinch AB (publ) and Comviva are providing content distribution solutions, including rich content enhancement in messages to make them personalized and newsworthy, and foster engagement with instant media alerts.

Regional Insights

The North America A2P messaging market held a significant share in 2025. The North American region's high smartphone penetration fosters widespread consumer access and adoption, amplifying the reach and effectiveness of A2P messages. Regulatory frameworks, such as the Telephone Consumer Protection Act (TCPA) and Canada's Anti-Spam Legislation (CASL), provide a stable environment for businesses to leverage A2P messaging while safeguarding consumer interests. This, as a result, is expected to drive the regional market growth.

U.S. A2P Messaging Market Trends

The A2P messaging market in the U.S. held a dominant position in 2025. The U.S. is a pioneer in technological innovation, which continuously advances mobile networks and digital infrastructure to support seamless A2P communication. This market scenario encourages widespread adoption across diverse industries, including finance, healthcare, and retail, where A2P messaging is important for transaction alerts, appointment reminders, and customer service notifications.

Europe A2P Messaging Market Trends

The A2P messaging market in Europe was identified as a lucrative region in 2025. The region's cultural diversity and multilingualism necessitate adaptable messaging strategies, making A2P messaging a versatile tool for personalized customer engagement and marketing campaigns tailored to local preferences. In addition, the proliferation of smart technologies and IoT devices in Europe further expands the use cases for A2P messaging in automated notifications, remote monitoring, and device management, contributing to the regional market's growth.

The UK A2P messaging market is expected to grow rapidly in the coming years due to the increasing smartphone penetration and mobile subscriber base in the UK The growing popularity of mobile marketing as a medium to engage customers is driving A2P SMS traffic volume in the UK The country's regulatory framework, including the Privacy and Electronic Communications Regulations (PECR), ensures robust data protection standards, bolstering consumer trust and encouraging businesses to leverage A2P messaging for secure communication purposes.

The A2P messaging market in Italy is accelerating digitalization and wider e-commerce adoption, which pushes businesses (banks, retailers, and healthcare providers) to use A2P for OTPs, order/ delivery notifications, and customer alerts. Smartphone penetration and regulatory encouragement for digital channels make A2P the reliable, low-friction channel for transactional and promotional communication.

Germany A2P messaging market is growing due to strong enterprise digitization and high CPaaS/RCS adoption by banks, logistics, and large retailers, which increases demand for rich, verified business messaging and secure transactional SMS. Germany’s mature operator ecosystem and high market revenues support the rapid commercial roll-out of A2P services.

Asia Pacific A2P Messaging Market Trends

The A2P messaging market in the Asia Pacific accounted for a 45.6% share of the overall market in 2025. The thriving e-commerce sector across Asia-Pacific countries is creating growth opportunities for the regional market. A2P messaging platform assists e-commerce businesses in order confirmations, delivery updates, and customer support, among other activities.

Japan A2P messaging market is expected to grow rapidly in the coming years, owing to the aging population in the country and the increasing need for efficient communication in healthcare and elderly care services. A2P messaging solutions can help with appointment reminders, medication alerts, and emergency notifications.

The A2P messaging market in China held a substantial market share in 2025, owing to its focus on rapid digital transformation, propelled by tech-savvy consumers and innovative mobile platforms such as WeChat and Alipay. It promotes a favorable ecosystem for A2P messaging to thrive in various areas, such as transactional notifications, customer service, and marketing campaigns.

Key A2P Messaging Company Insights

Some of the key companies in the market include AT&T Inc., China Mobile Limited, Genesys, Orange, Tata Communications, and others. Organizations are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

AT&T Inc. is a telecommunications company offering various services, including wireless communications, broadband and internet services, local and long-distance telephone services, managed networking, telecommunications equipment, and wholesale services. AT&T Inc.’s 10DLC (10 Digit Long Codes) solution allows businesses to engage with customers through SMS, MMS, and voice with easy setup, high deliverability, and improved customer experiences using a single 10-digit number. This solution helps businesses build local trust and increase engagement with a recognizable number while adhering to CTIA Messaging Guidelines and Best Practices.

-

Genesys develops both cloud-based and on-premises solutions for customer experience and contact centers. They also offer SIP communication solutions for virtual call centers and contact centers, including telephony, enterprise communications for administration, provisioning, reporting, and system management, as well as WebRTC communications for voice and face-to-face interactions. In addition, the company provides an interactive voice response platform that integrates self-service applications, video capabilities, and agent-assisted transactions. This platform enables proactive customer communications and callbacks across channels through calls, voice messages, emails, SMS, and web chat.

Key A2P Messaging Companies:

The following are the leading companies in the A2P messaging market. These companies collectively hold the largest Market share and dictate industry trends.

- AT&T Inc.

- China Mobile Limited

- Genesys

- Infobip Ltd.

- Orange S.A.

- Proximus

- Sinch

- Tata Communications

- Twilio Inc.

- VONAGE

Recent Developments

-

In March 2025, Globe Teleservices Pte. Ltd. (GTS), a Singapore-headquartered global telecom solutions provider, signed a three-year contract with CelcomDigi, Malaysia's largest mobile network operator, to deploy advanced A2P SMS firewalls and international traffic solutions, enhancing secure messaging worldwide. GTS's platform delivers real-time threat detection and filtering to block phishing, spam, SMS fraud, unauthorized traffic, and scams before reaching users, ensuring subscribers receive only verified enterprise communications while monetizing legitimate A2P traffic amid rising mobile messaging reliance.

-

In January 2025, Business Telecommunications Services, Inc. (BTS), a Miami-based global CommTech provider powering 18+ billion voice minutes annually across 180+ countries via its AI-driven S1 Platform, was appointed the international A2P SMS aggregator for BBIX, Inc., SoftBank Corp.'s wholly-owned official gateway, building on a five-year partnership. This mandates that all communications providers route A2P SMS traffic destined for SoftBank's network through BTS, ensuring seamless, secure delivery with enhanced efficiencies, a better customer experience, and support amid rising fraud threats.

A2P Messaging Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 77.43 billion

Revenue forecast in 2033

USD 125.79 billion

Growth rate

CAGR of 7.2% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Component, deployment mode, enterprise size, SMS traffic, application, vertical, region

Regional scope

North America; Europe, Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

AT&T Inc.; China Mobile Limited; Genesys; Infobip Ltd.; Orange S.A.; Proximus; Sinch; Tata Communications; Twilio Inc.; VONAGE

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global A2P Messaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global A2P messaging market report based on component, deployment mode, enterprise size, SMS traffic, application, vertical, and region:

-

Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Platform

-

Services

-

-

Deployment Mode Outlook (Revenue, USD Billion, 2021 - 2033)

-

On-premise

-

Cloud

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2021 - 2033)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

SMS Traffic Outlook (Revenue, USD Billion, 2021 - 2033)

-

National

-

Cross-border

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Pushed Content Services

-

Interactive Services

-

Promotional Campaigns

-

Customer Relationship Management (CRM) Services

-

Others

-

-

Vertical Outlook (Revenue, USD Billion, 2021 - 2033)

-

BFSI

-

Healthcare

-

Media & Entertainment

-

Retail & E-commerce

-

Travel & Tourism

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global A2P messaging market size was estimated at USD 74.27 billion in 2025 and is expected to reach USD 77.43 billion in 2026.

b. The global A2P messaging market is expected to grow at a compound annual growth rate of 7.2% from 2026 to 2033 to reach USD 125.79 billion by 2033.

b. Asia Pacific dominated the A2P messaging market with a share of 45.6% in 2025. This is attributable to the increased enterprise use of short messaging services (SMS) as A2P messaging is low-cost and universal reach.

b. Some key players operating in the A2P messaging market include Twilio Inc., Dialogue Communications, Infobip ltd., Sinch, Proximus, Tata Communciations, AT&T Inc., China Mobile Limited, Orange S.A., Genesys.

b. Key factors that are driving the A2P messaging market growth include increasing number of mobile users and growing number of marketing and advertising firms.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.