- Home

- »

- Healthcare IT

- »

-

Accountable Care Solutions Market, Industry Report, 2030GVR Report cover

![Accountable Care Solutions Market Size, Share & Trends Report]()

Accountable Care Solutions Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Software, Services), By Solution, By Delivery Mode, By End Use (Providers, Payers), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-982-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Accountable Care Solutions Market Summary

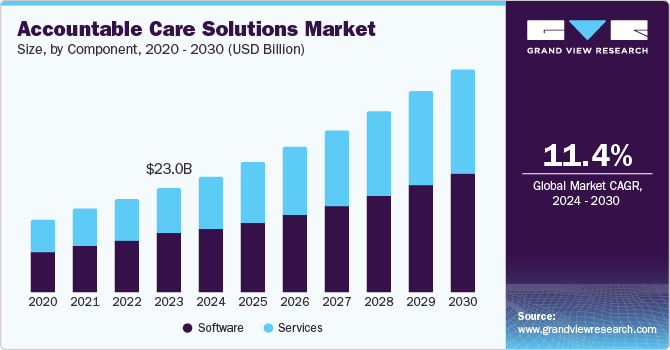

The global accountable care solutions market size was valued at USD 23.0 billion in 2023 and is projected to reach USD 49.3 billion by 2030, growing at a CAGR of 11.4% from 2024 to 2030. This growth is driven by the increasing emphasis on value-based care models, which is pushing healthcare providers to adopt accountable care solutions to improve patient outcomes while reducing costs. Additionally, the rising prevalence of chronic diseases and the aging population are creating a greater need for efficient healthcare management systems.

Key Market Trends & Insights

- The North America accountable care solutions industry led the global industry in 2023, capturing the largest revenue share of 51.3%.

- The U.S. accountable care solutions market dominated North America in 2023

- By component, The software segment accounted for a revenue share of 56.7% in 2023.

- By solution, Population Health Management (PHM) Solutions held the largest market revenue share of 18.6% in 2023.

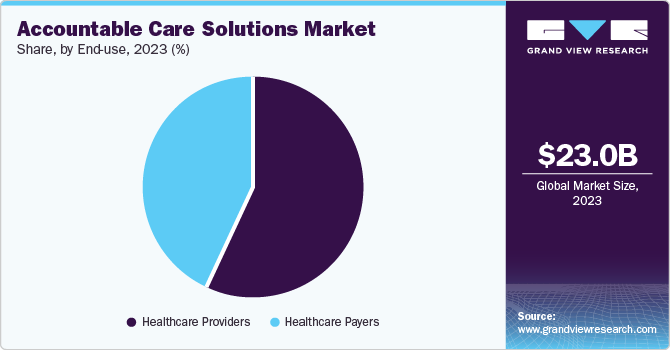

- By end use, Healthcare providers accounted for the largest market revenue share of 57.4% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 23.0 Billion

- 2030 Projected Market Size: USD 49.3 Billion

- CAGR (2024-2030): 11.4%

- North America: Largest market in 2023

Technological advancements, such as the integration of artificial intelligence (AI) and data analytics, are significantly enhancing the capabilities of accountable care solutions, making them more effective and user-friendly. AI is revolutionizing healthcare by enabling early disease detection, improving diagnostic accuracy, and optimizing treatment plans. For instance, AI algorithms can analyze vast amounts of medical data to identify patterns and predict patient outcomes, thereby aiding in personalized medicine. Additionally, the use of data analytics helps healthcare providers monitor patient health in real-time, manage chronic diseases more efficiently, and reduce hospital readmissions.

The growing use of wearable devices and mobile health (mHealth) applications is empowering patients to take charge of their health by tracking vital signs and managing chronic conditions from home. The rise of telehealth, accelerated by the COVID-19 pandemic, is providing remote consultations and continuous patient monitoring, thus expanding access to healthcare services. Looking ahead, there is an increased adoption of blockchain technology for secure patient data management and the use of 3D printing for customized medical devices and implants.

Supportive government initiatives and policies are playing a crucial role in driving the growth of accountable care solutions. In the U.S., the Centers for Medicare & Medicaid Services (CMS) has implemented several programs, such as the Medicare Shared Savings Program (MSSP) and the Next Generation ACO Model, which incentivize healthcare providers to improve care coordination and reduce costs. Additionally, the Health Information Technology for Economic and Clinical Health (HITECH) Act promotes the adoption of electronic health records (EHRs) by providing financial incentives to healthcare providers. Globally, initiatives such as the European Union’s Digital Health Strategy aim to enhance healthcare delivery through digital transformation, focusing on interoperability, data security, and patient empowerment.

Component Insights

The software segment accounted for a revenue share of 56.7% in 2023 attributed to the increasing adoption of advanced software solutions designed to streamline healthcare operations and improve patient outcomes. These software solutions include EHRs, population health management (PHM) systems, and revenue cycle management (RCM) tools, which are essential for the efficient functioning of accountable care organizations (ACOs). The integration of artificial intelligence (AI) and machine learning (ML) into these software solutions is further enhancing their capabilities, enabling predictive analytics, personalized treatment plans, and improved decision-making processes. Additionally, the shift towards value-based care models is driving healthcare providers to invest in comprehensive software solutions that can help them meet regulatory requirements, reduce costs, and improve the quality of care.

The services segment is expected to grow at a CAGR of 12.7% during the forecast period driven by the increasing demand for consulting, implementation, and support services that are crucial for the successful deployment and operation of accountable care solutions. Healthcare providers are increasingly relying on these services to navigate the complexities of healthcare regulations, optimize their workflows, and ensure the seamless integration of new technologies into their existing systems. The rise in the adoption of cloud-based solutions is also contributing to the growth of the services segment, as it necessitates ongoing support and maintenance services to ensure data security and system reliability. Furthermore, the growing focus on patient engagement and care coordination is leading to a higher demand for training and education services that empower healthcare professionals to effectively use accountable care solutions.

Solution Insights

Population Health Management (PHM) Solutions held the largest market revenue share of 18.6% in 2023 attributed to the increasing need for comprehensive healthcare management systems that can effectively address the growing prevalence of chronic diseases and the aging population. PHM solutions enable healthcare providers to aggregate and analyze patient data from various sources, facilitating better care coordination and management of patient populations.

The healthcare analytics segment is projected to grow fastest from 2024 to 2030 driven by the increasing adoption of data-driven decision-making processes in the healthcare sector. Healthcare analytics solutions enable providers to analyze large volumes of data to uncover insights that can improve patient care, optimize operational efficiency, and reduce costs. The use of advanced analytics techniques, such as predictive modeling and machine learning, allows healthcare organizations to identify trends, predict patient outcomes, and make informed decisions.

End Use Insights

Healthcare providers accounted for the largest market revenue share of 57.4% in 2023, driven by the widespread adoption of advanced technologies to optimize operations and patient care. Regulatory demands, cost reduction imperatives, and the pursuit of enhanced care quality have been key drivers of this technology uptake. The COVID-19 pandemic accelerated the adoption of telehealth and remote patient monitoring, further boosting this trajectory. In addition, the growing focus on personalized medicine and patient engagement tools is reshaping healthcare delivery systems.

The on-premises segment is expected to grow significantly during the forecast period attributed to the increasing demand for customized and secure healthcare solutions that can be tailored to the specific needs of healthcare organizations. On-premises solutions offer greater control over data security and compliance, which is particularly important for healthcare providers dealing with sensitive patient information.

Delivery Mode Insights

The web and cloud-based segment dominated the market in 2023. The rising popularity of cost-efficient and scalable web and cloud-based healthcare solutions is increasing. Cloud technology's flexibility and accessibility allow healthcare providers to share real-time data and collaborate effectively. Increased security functionalities and adherence to regulatory guidelines contribute to the attractiveness of cloud solutions. The continued digitalization in healthcare and growing amounts of data are pushing the adoption of these solutions.

On-premises is expected to grow significantly during the forecast period due to rising concerns about maintaining privacy and control over handling delicate patient details. Many healthcare institutions opt for on-premises systems as they can provide more customization and integration with current IT infrastructure. Regulatory compliance requirements play a role in the preference for on-premises solutions, as they can be better controlled in a local IT environment.

Regional Insights

North America accountable care solutions market dominated the global market attributable to its robust healthcare infrastructure, regulatory framework, and substantial investments in healthcare technology. The region's emphasis on cost reduction and quality improvement has spurred the adoption of innovative digital solutions. The presence of leading healthcare IT companies and ongoing R&D initiatives further contribute to its market leadership. Increasing collaboration among hospitals, insurers, and government entities is expected to fuel market expansion.

U.S. Accountable Care Solutions Market Trends

The U.S. accountable care solutions market dominated North America in 2023 due to initiatives such as the Affordable Care Act, which promoted value-based payments, as well as the transition to digital health systems. The U.S. also boasts the majority of leading global companies specializing in population healthcare management, healthcare interoperability, and data analytics solutions, positioning the country as a frontrunner in technological advancement and specialized knowledge within the healthcare industry.

Europe Accountable Care Solutions Market Trends

Europe was identified as a lucrative region for the accountable care solutions market in 2023 attributed to the growing demand for efficient healthcare services and the need to manage healthcare costs effectively. The market's expansion is primarily fueled by technological advancements and the incorporation of Electronic Health Records (EHRs). Furthermore, adherence to GDPR regulations is imperative for data management.

The UK accountable care solutions market is expected to grow rapidly in the coming years. The increasing financial strain on the NHS due to healthcare costs serves as a key catalyst for the adoption of these solutions. In addition, factors such as longer life expectancy and the worsening prevalence of health conditions such as diabetes, heart disease, and obesity are expected to drive effective care management, thereby boosting the UK accountable care solutions market.

Asia Pacific Accountable Care Solutions Market Trends

The accountable care solutions market in the Asia Pacific region is anticipated to witness significant growth due to rising healthcare costs and a growing emphasis on digital healthcare infrastructure. As the middle class expands and the population ages, the need for quality healthcare services increases. In response, governments are shifting their focus from fee-for-service models to value-based care and integrating healthcare information technology solutions. This favorable policy environment has created an ideal climate for the introduction of accountable care solutions.

Japan's accountable care solutions market held a substantial market share in 2023. The country's ability to leverage data analytics for population health management and its increasing adoption of digital health tools have facilitated care coordination and patient engagement.

Key Accountable Care Solutions Company Insights

Some key companies in the accountable care solutions market include UNITEDHEALTH GROUP., Aetna, Inc., Veradigm LLC (Allscripts Healthcare Solutions, Inc.), and others. The industry is characterized by intense competition driven by innovative product offerings from existing players and the emergence of new market entrants. This competitive landscape has contributed to rapid market growth.

-

Veradigm LLC, formerly known as Allscripts, is a provider of data-driven healthcare solutions and insights. The company plays a significant role in the accountable care solutions market by offering a range of products and services designed to enhance care coordination, improve patient outcomes, and reduce costs. Veradigm’s solutions include EHRs, practice management systems, and healthcare analytics tools, which are essential for the efficient functioning of ACOs.

Key Accountable Care Solutions Companies:

The following are the leading companies in the accountable care solutions market. These companies collectively hold the largest market share and dictate industry trends.

- Cerner Corporation (Oracle)

- IBM Corporation

- UNITEDHEALTH GROUP

- Aetna, Inc.

- Veradigm LLC (Allscripts Healthcare Solutions, Inc.)

- Epic Systems Corporation

- MCKESSON CORPORATION

- ZeOmega

- Verisk Analytics, Inc.

- eClinicalWorks

Recent Developments

-

In July 2024, eClinicalWorks successfully integrated Sunoh.ai at North Arkansas Regional Medical Center (NARMC). This integration resulted in a significant five-minute reduction in clinical documentation time per patient encounter. Sunoh.ai seamlessly integrated with the eClinicalWorks EHR, streamlining the documentation process, especially for initial patient visits.

-

In April 2024, InVio Health Network and CVS Accountable Care Organization, Inc. announced a partnership to participate in a new Medicare program facilitated by the Center for Medicare & Medicaid Innovation (CMMI). The REACH ACO, designed to improve patient outcomes and access to care, will focus on providing coordinated, high-quality care to traditional Medicare beneficiaries. This initiative aims to address health disparities and enhance patient satisfaction.

Accountable Care Solutions Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 25.7 billion

Revenue forecast in 2030

USD 49.3 billion

Growth Rate

CAGR of 11.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, Solution, Delivery Mode, End Use, Region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Russia, China, Japan, India, Singapore, Australia, Brazil, Argentina, Saudi Arabia, UAE, South Africa

Key companies profiled

Cerner Corporation (Oracle); IBM Corporation; UNITEDHEALTH GROUP.; Aetna, Inc.; Veradigm LLC (Allscripts Healthcare Solutions, Inc.); Epic Systems Corporation; MCKESSON CORPORATION; ZeOmega; Verisk Analytics, Inc; eClinicalWorks

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Accountable Care Solutions Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global accountable care solutions market report based on component, solution, delivery mode, end use, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Services

-

-

Solution Outlook (Revenue, USD Million, 2018 - 2030)

-

Electronic Health Records

-

Healthcare Analytics

-

Revenue Cycle Management Solutions (RCM)

-

Patient Engagement Solutions

-

Population Health Management (PHM) Solutions

-

Claims Management Solutions

-

Healthcare Information Exchange (HIE)

-

Others

-

-

Delivery Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Web & Cloud-Based

-

On-Premises

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Healthcare Providers

-

Healthcare Payers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Singapore

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.