Acrylic Acid Market Summary

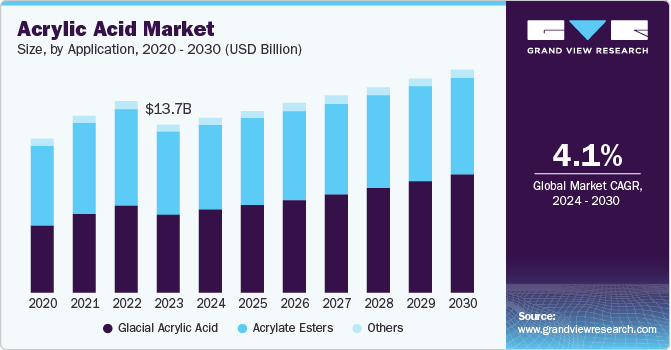

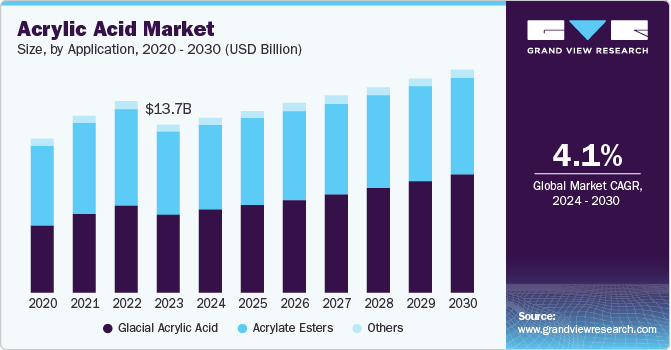

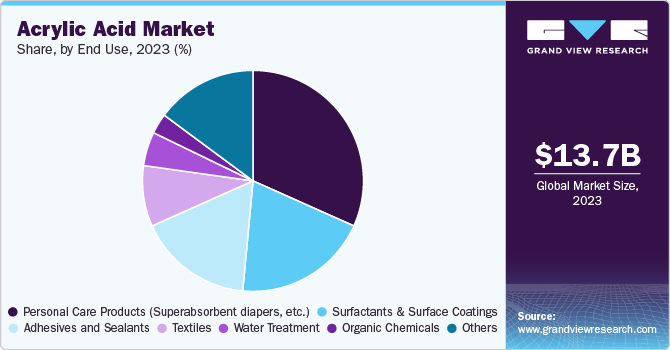

The global acrylic acid market size was estimated at USD 13.66 billion in 2023 and is projected to reach USD 18.11 billion by 2030, growing at a CAGR of 4.1% from 2024 to 2030. The acrylic acid market is booming due to robust construction and infrastructure growth, which demands paints, coatings, adhesives, and sealants.

Key Market Trends & Insights

- Asia Pacific market dominated the market with 40.0% of revenue share in 2023.

- The China acrylic acid market held largest share in 2023.

- By application, acrylate esters segment dominated the market with 56.8% of revenue share in 2023.

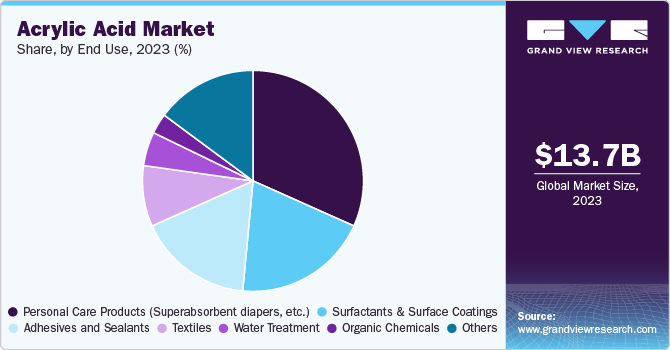

- By end use, personal care products accounted for the largest market revenue share of 31.8% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 13.66 Billion

- 2030 Projected Market Size: USD 18.11 billion

- CAGR (2024-2030): 4.1%

- Asia Pacific: Largest market in 2023

The personal care industry, especially for hygiene products, relies heavily on acrylic acid-based super absorbent polymers. Acrylic acid is a primary raw material for super absorbent polymers, widely used in diapers, sanitary napkins, and adult incontinence products.

The paints and coatings industry is one of the largest consumers of acrylic acid, primarily due to its role in producing acrylate esters, which are essential components in various coating formulations. Increased disposable incomes lead to higher consumption rates of consumer goods that utilize acrylic acid derivatives, including adhesives, sealants, textiles, and personal care products. The expansion of various end-use industries such as construction, automotive, textiles, and packaging is creating a robust demand for acrylic acid.

Superabsorbent polymers derived from acrylic acid are increasingly utilized in personal care products such as diapers and adult incontinence products. Their unique ability to absorb and retain large quantities of fluid makes them indispensable in these applications. Innovations in production technologies are enhancing the efficiency of acrylic acid manufacturing processes while reducing costs. Rapid industrialization and urbanization in emerging economies is contributing significantly to the growth of the acrylic acid market.

Application Insights

Acrylate esters dominated the market with 56.8% of revenue share in 2023. This is due to their versatile applications in various industries, including paints, coatings, adhesives, and textiles. Their versatility shines in coatings applications, where they enhance film formation, adhesion, and durability. The automotive industry is a major consumer, utilizing acrylate esters for superior finishes, while the construction sector benefits from their role in creating weather-resistant paints and coatings.

Glacial acrylic acid is anticipated to witness significant CAGR of 3.7% over the forecast period. This upward trend is due to its critical role as a precursor in the production of superabsorbent polymers (SAPs), which are widely used in personal care products such as diapers and feminine hygiene items. The rising global population and increasing awareness of hygiene are driving the demand for SAPs, consequently boosting the market.

End Use Insights

Personal care products accounted for the largest market revenue share of 31.8% in 2023 due to its use in superabsorbent polymers (SAPs). These polymers are essential components in diapers, adult incontinence products, and feminine hygiene products, where their ability to retain & absorb large amounts of liquid is crucial. The growing global population, especially in emerging economies, coupled with rising disposable incomes, is fuelling the demand for personal care products, thereby driving the market.

Adhesives and sealants are projected to grow at a CAGR of 4.5% over the forecast period. Acrylic-based adhesives are favored for their excellent bonding properties, flexibility, and resistance to environmental factors such as moisture and UV light. The booming construction industry, increasing repair and maintenance activities, and the growing automotive sector are driving demand for these products.

Regional Insights

The North America acrylic acid market is anticipated to grow at a CAGR of 3.6% during the forecast period. It is attributable to robust growth of end-use industries such as construction, automotive, and personal care. The region boasts a well-established manufacturing base for acrylic acid and its derivatives, coupled with a strong research and development ecosystem.

U.S. Acrylic Acid Market Trends

The U.S. acrylic acid market held a dominant position in 2023. The country's mature automotive and construction sectors, coupled with personal care industry, create substantial demand for acrylic acid-based products.

Europe Acrylic Acid Market Trends

The Europe acrylic acid market was identified as a lucrative region in 2023. The region is a significant hub for the production of paints and coatings, adhesives, and sealants, which are major consumers of acrylic acid. Furthermore, the increasing focus on sustainability and the adoption of eco-friendly materials are driving demand for acrylic acid-based products.

The UK acrylic acid market held a substantial market share in 2023. It has a robust manufacturing base that relies on acrylic acid for producing paints, coatings, adhesives, and textiles. Moreover, government initiatives aimed at promoting green technologies and materials have encouraged manufacturers to explore bio-based alternatives derived from acrylic acid.

Asia Pacific Acrylic Acid Market Trends

Asia Pacific market dominated the market with 40.0% of revenue share in 2023. The market is expected to grow during the forecast period due to the rapid industrialization, urbanization, and increasing disposable incomes. The region's burgeoning construction, automotive, and personal care sectors are driving demand for acrylic acid-based products.

The China acrylic acid market held largest share in 2023. The country's rapid economic growth, coupled with massive infrastructure projects, has created a robust market for paints, coatings, adhesives, and sealants. Furthermore, China's expanding automotive and personal care industries are fuelling demand for acrylic acid derivatives.

Key Acrylic Acid Company Insights

Some key companies in acrylic acid market include Vigon International, LLC., SMC, BASF SE, Arkema, LG Chem, and others.

-

NIPPON SHOKUBAI CO., LTD is a prominent chemical company based in Osaka, Japan, specializing in the manufacture and marketing of a diverse range of basic and functional chemicals.

-

Dow is a prominent American multinational corporation headquartered in Midland, Michigan. Company specializes in materials science and operates primarily as a supplier to various industries. Its product portfolio includes a wide range of chemicals, plastics, and agricultural products.

Key Acrylic Acid Companies:

The following are the leading companies in the acrylic acid market. These companies collectively hold the largest market share and dictate industry trends.

- Vigon International, LLC.

- SMC

- BASF SE

- Arkema

- LG Chem

- Shanghai Huayi Acrylic Acid Co., Ltd

- NIPPON SHOKUBAI CO., LTD.

- Dow

- Sinopec

- Formosa Plastics Corporation, U.S.A

- Sasol

- Wanhua

Recent Developments

- In May 2023, Nippon Shokubai announced that PT. NIPPON SHOKUBAI INDONESIA inaugurated acrylic acid (“AA”) facility in in Cilegon, Indonesia. The facility is with a production capacity of 100,000 MT/Y and the investment on the project is around USD 200 million.

Acrylic Acid Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 14.21 billion

|

|

Revenue forecast in 2030

|

USD 18.11 billion

|

|

Growth rate

|

CAGR of 4.1% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Quantitative units

|

Volume in Kilo Tons, Revenue in USD billion and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Application, end use, region

|

|

Regional scope

|

North America; Europe; Asia Pacific; Central & South America; MEA

|

|

Country scope

|

U.S.; Canada; Mexico; Belgium; Germany; France; China; Japan; India; Brazil; Saudi Arabia

|

|

Key companies profiled

|

Vigon International; LLC.; SMC; BASF SE; Arkema; LG Chem; Shanghai Huayi Acrylic Acid Co.; Ltd; NIPPON SHOKUBAI CO.; LTD.; Dow; Sinopec; Formosa Plastics Corporation; U.S.A. ; Sasol; Wanhua

|

|

Customization scope

|

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

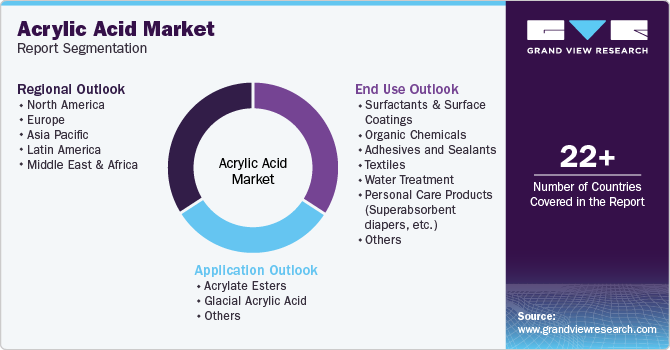

Global Acrylic Acid Market Report Segmentation

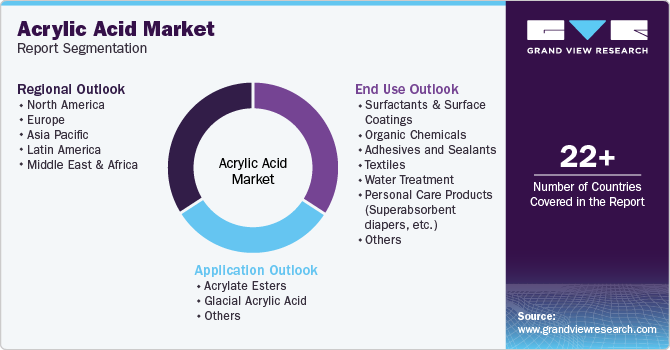

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global acrylic acid market report based on application, end use, and region.

-

Application Outlook (Revenue, USD Million, Volume in Kilo Tons, 2018 - 2030)

-

Acrylate Esters

-

Glacial Acrylic Acid

-

Others

-

End Use Outlook (Revenue, USD Million, Volume in Kilo Tons, 2018 - 2030)

-

Regional Outlook (Revenue, USD Million, Volume in Kilo Tons, 2018 - 2030)