- Home

- »

- Medical Devices

- »

-

Acute Hospital Care Market Size, Share, Trends Report, 2030GVR Report cover

![Acute Hospital Care Market Size, Share & Trends Report]()

Acute Hospital Care Market (2023 - 2030) Size, Share & Trends Analysis Report By Medical Condition (Emergency Care, Trauma Care), By Service (ICU, NICU), By Facility Type (Psychiatric, Specialized Hospitals), And Segment Forecasts

- Report ID: GVR-3-68038-544-1

- Number of Report Pages: 73

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Acute Hospital Care Market Summary

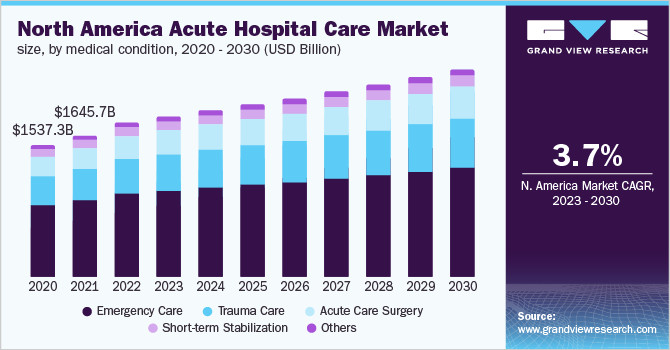

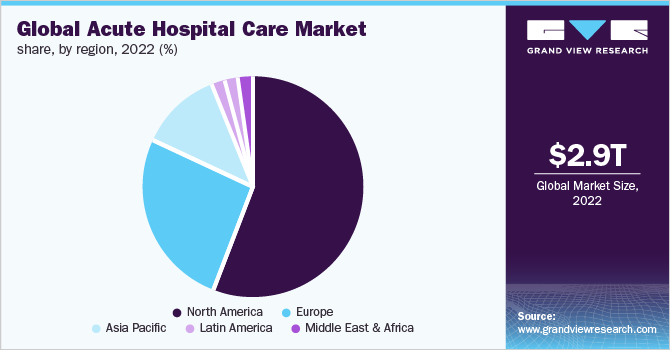

The global acute hospital care market size was valued at USD 3.2 trillion in 2022 and is projected to reach USD 4.9 trillion by 2030, growing at a CAGR of 5.62% from 2023 to 2030. The rapidly growing global geriatric population, rising prevalence of chronic diseases, and increasing disposable income are key factors propelling the industry’s growth.

Key Market Trends & Insights

- North America accounted for the largest revenue share of 56.59% in 2022.

- The Asia Pacific region is expected to register the fastest CAGR of 8.94% over the forecast period.

- In terms of medical conditions, the emergency care segment held the largest revenue share of 53.93% in 2022.

- By facility type, the general acute care hospitals segment dominated the industry and accounted for revenue share of 60.10% in 2022.

- Based on services, the Intensive Care Unit (ICU) segment dominated the industry and accounted for a market share of 58.28% in 2022

Market Size & Forecast

- 2022 Market Size: USD 3.2 Trillion

- 2030 Projected Market Size: USD 4.9 Trillion

- CAGR (2023-2030): 5.62%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

According to the United Nations estimates, in 2019, there were 703 million individuals above 65 years of age in the world. In addition, rising awareness about healthcare, advancing healthcare infrastructure & technologies, and favorable reimbursement policies are driving industry growth. It is estimated that by 2025, 49% of the population will be diagnosed with a chronic condition.

Rapid globalization, changing lifestyles, the adoption of unhealthy habits, increasing alcohol & tobacco consumption, and lack of physical activity are contributing to a rise in the prevalence of chronic diseases. These factors are expected to drive industry growth. Acute care hospitals need to maintain viability and assess new service lines to drive industry growth over the forecast period. These facilities can focus on expanding their service portfolio by providing post-acute care, which would ensure financial survival and offer multiple growth opportunities. It comprises inpatient rehabilitation facilities, LTAC facilities, home health agencies, and skilled nursing facilities.

COVID-19 acute hospital care market impact: 7.5% growth from 2020 - 2021

Pandemic Impact

Post COVID Outlook

The COVID-19 pandemic had a negative impact on the market due to a decline in the number of hospitalizations. Hospitals primarily focused on the treatment of COVID-19 patients. Doctors further shifted their focus from face-to-face to telemedicine as people were hesitant to seek medical assistance

The COVID-19 pandemic has created many opportunities for industry growth by increasing end-user reliance on these acute disease treatment services and products.In 2021, inpatient discharge orders to PAC authorities returned to pre-pandemic levels. Discharge was referred to home healthcare rather than a skilled nursing facility

Shortage of healthcare providers and uneven distribution of healthcare facilities & resources in urban & rural regions are among the factors hindering the industry growth. For instance, the majority of the healthcare systems across the globe were under significant pressure due to the COVID-19 pandemic as a result of inadequate preparedness caused by an uneven distribution of health facilities, medical professionals, and clinical resources

In the coming years, the number of inpatient admissions for non-COVID-related diseases is projected to increase, positively impacting the industry growth

This will help in boosting the profit margin and diversifying their service portfolio. Approximately, 40% of the patients arriving in these facilities require continued services, which provides these facilities with a diverse service portfolio, creating growth opportunities. Furthermore, reimbursement and insurance coverage are crucial for improving market penetration. The high cost of availing of health services, along with other high expenses, limits affordability and access to acute care. The lack of government-sponsored universal insurance policies is a major concern for healthcare access in low-income and below-poverty line populations in developing economies.

Medical Condition Insights

In terms of medical conditions, the emergency care segment held the largest revenue share of 53.93% in 2022. This can be attributed to the high incidence of accidents, burns, heart attacks, trauma, stroke, acute infections, and other such conditions. Furthermore, favorable reimbursement and coverage policies laid down by several governments support segment growth. In addition, there are over 3.0 million non-fatal injuries each year, resulting in over 5 million deaths around the world. With such a high prevalence of disability and mortality, due to trauma, the need for emergency services is expected to increase.

Short-term stabilization involves the provision of integrated medical and mental interventions in a medical setting on a short-term basis, which is tailored as per the severity of the specific emergency-mild, moderate, or severe. If an individual has consumed a toxic amount of alcohol or medications, such as opiates, prompt medical attention is critical. Moreover, short-term stabilization may be beneficial in psychiatric emergencies. Furthermore, many psychiatry patients injure themselves as a result of stress, worry, and substance addiction, among others. These factors are expected to contribute to segment growth during the forecast period.

Acute care surgery is progressively overtaking trauma care and is estimated to register the fastest CAGR of 6.44% from 2023 to 2030. It is a relatively new surgical specialty that combines training in surgical critical care, trauma surgery, and emergency general surgery to evaluate & treat patients who are experiencing general surgical problems. The majority of emergency cases requiring acute care surgery involve abdominal disorders, such as acute appendicitis, diverticulitis, cholecystitis, intestinal blockage, pancreatitis, intra-abdominal infection, intestinal ischemia, and incarcerated hernias, and ruptured internal organs.

Facility Type Insights

The general acute care hospitals segment dominated the industry and accounted for revenue share of 60.10% in 2022 owing to the growing number of admissions at these facilities. Moreover, acute stabilization may be beneficial in psychiatric emergencies. Changing lifestyle & perusal of unhealthy habits contributing to stroke prevalence and rising awareness about mental disorders are driving the segment growth. The psychiatric hospitals segment is anticipated to witness the fastest growth rate of 6.75% during the forecast period. Psychiatric hospitals, alternatively referred to as behavioral health units or mental health units, are hospitals or wards dedicated to the treatment of mental illnesses, such as bipolar disorder, schizophrenia, and major depressive disorder. The prevalence of mental health problems is increasing at a significant rate among children and adults around the globe.

The COVID-19 pandemic has led to increasing awareness regarding the importance of mental health generating significant growth opportunities for behavioral health units in the coming years. Rehabilitation services include physical therapy, occupational therapy, speech therapy, cognitive therapy, respiratory treatment, psychotherapy services, and prosthetic/orthotic services. Inpatient rehabilitation hospitals/units are regulated and certified facilities that focus on rehabilitative health rather than on general medical and surgical care. Rehabilitation is described as the process of restoring a disabled individual to self-sufficiency or the highest level of functional independence attainable. The increasing prevalence of chronic diseases and the growing geriatric population are fueling the growth of the rehabilitation hospitals segment.

Services Insights

Based on services, the Intensive Care Unit (ICU) segment dominated the industry and accounted for a market share of 58.28% in 2022 owing to the high patient population requiring intensive monitoring. Moreover, the COVID-19 pandemic boosted the demand for ICUs. According to studies, the majority of the admissions in acute care hospitals are to the ICU. Several hospitals have assigned specialty ICUs for treating different ailments, such as surgical interventions, cardiac disorders, and medical emergencies. The NICU segment is anticipated to register the fastest CAGR of 6.26% during the forecast period. An increasing number of premature births with breathing difficulties requiring intensive monitoring is contributing to the segment growth.

Rising global awareness regarding childcare, entry of health insurance firms, and the advent of the private sector in NICUs are the other factors expected to contribute to the segment growth. The increasing prevalence of cardiovascular conditions is a primary factor responsible for Cardiac Care Units (CCUs) segment growth. Individuals with these disorders are at risk of experiencing sudden, unexpected changes in their state and often require continuous monitoring, such as targeted temperature regulation (inducing mild hypothermia). According to the AHA 2021 annual survey, the U.S. has 15,160 cardiac intensive care beds. These wards provide specialized cardiology services and are staffed by cardiac-trained medical personnel.

Regional Insights

North America accounted for the largest revenue share of 56.59% in 2022 owing to the presence of adequate healthcare resources, well-established healthcare infrastructure, growing healthcare spending, and the rising prevalence of chronic disorders. Moreover, the government is introducing favorable initiatives to curb growing healthcare expenditure. According to CMS estimates in 2019, there are approximately 4,749 acute hospitals based in the U.S. Europe ranked second in terms of market value share in 2021 due to the improved funding and reimbursement framework implemented in several European countries.

The European healthcare system is challenged with short-term & long-term economic & financial restrictions, increasing the risk of chronic disorders, high demand for technological innovations, rising need for a skilled workforce, and the significant impact of the pandemic. Hospitals and healthcare facilities are transforming their business models from the hospital- & physician-centric to integrated models, wherein facilities would work in tandem with primary and community care.

The Asia Pacific region is expected to register the fastest CAGR of 8.94% over the forecast period. The rapid growth of this region can be attributed to the factors, such as advancements in healthcare technology, increasing healthcare expenditures, and the presence of a large patient population pool. Moreover, increased demand for acute care in countries, such as India, China, and South Korea, is expected to drive the expansion of the regional market in the years to come. The need for healthcare is being driven by an increase in the demand for high-quality equipment in the healthcare industry to diagnose and treat problems early.

Key Companies & Market Share Insights

The industry is highly fragmented with the presence of various multinational and local healthcare facilities. Industry players are focusing on collaborations and merger & acquisition strategies to gain a competitive edge and expand their business footprint. For instance, Mission Health, a six-hospital system in western North Carolina, was acquired by HCA Healthcare in February 2019. The purpose of this acquisition was to gain access to the consumer base of North Carolina. As a result of this arrangement, Mission Health was able to gain special protection for its rural population, resulting in the country’s largest per capita foundation. In February 2018, Universal Health Services, Inc. acquired a 109-bed psychiatric hospital in Gulfport, Mississippi. Some of the prominent players in the global acute hospital care market include:

-

TH Medical (Tenet Healthcare Corporation)

-

Fresenius Medical Care AG & Co. KGaA

-

Ramsay Health Care

-

Asklepios Kliniken GmbH& Co. KGaA

-

Universal Health Services, Inc.

-

Community Health Systems, Inc.

-

Ascension

-

IHH Healthcare Berhad

-

Mediclinic International

-

Lifepoint Health, Inc.

-

Ardent Health Services

Acute Hospital Care Market Report Scope

Report Attribute

Details

The market size value in 2023

USD 3.3 trillion

The revenue forecast in 2030

USD 4.9 trillion

Growth rate

CAGR of 5.62% from 2023 to 2030

The base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion/trillion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Medical condition, facility type, service, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Japan; China; India; Australia; Brazil; Mexico; South Africa; Saudi Arabia

Key Companies Profiled

TH Medical (Tenet Healthcare Corporation); Fresenius Medical Care AG & Co. KGaA; Ramsay Health Care; Asklepios Kliniken GmbH & Co. KGaA; Universal Health Services, Inc.; Community Health Systems, Inc.; Ascension; IHH Healthcare Berhad; Mediclinic International; Lifepoint Health, Inc.; Ardent Health Services

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

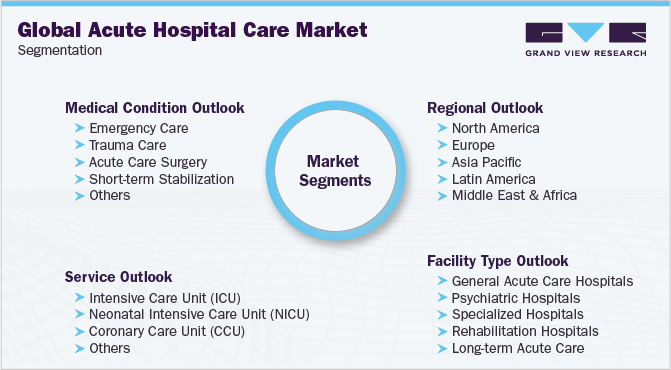

Global Acute Hospital Care Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global acute hospital care market report on basis of medical condition, facility type, service, and region:

-

Medical Condition Outlook (Revenue, USD Billion, 2017 - 2030)

-

Emergency Care

-

Trauma Care

-

Acute Care Surgery

-

Short-term Stabilization

-

Others

-

-

Facility Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

General Acute Care Hospitals

-

Psychiatric Hospitals

-

Specialized Hospitals

-

Rehabilitation Hospitals

-

Long-term Acute Care

-

-

Service Outlook (Revenue, USD Billion, 2017 - 2030)

-

Intensive Care Unit (ICU)

-

Neonatal Intensive Care Unit (NICU)

-

Coronary Care Unit (CCU)

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global acute hospital care market size was estimated at USD 3.2 trillion in 2022 and is expected to reach USD 3.3 trillion in 2023.

b. The global acute hospital care market is expected to grow at a compound annual growth rate of 5.62% from 2023 to 2030 to reach USD 4.9 trillion by 2030.

b. North America held the largest market share in 2022 with almost 56.6%, owing to well-established acute hospitals and the presence of key players in the region.

b. Some of the key players operating in the telemedicine market include Tenet Healthcare Corporation; Fresenius Medical Care; Ramsay Healthcare; Asklepios Kliniken GmbH; Universal Health Services, Inc.; HCA Healthcare, Inc.; Community Health Systems, Inc.; Ascension Health; IHH Healthcare; Mediclinic International; Legacy Lifepoint Health, Inc.; and Ardent Health Services.

b. Key factors that are driving the acute hospital care market growth include increasing incidence of trauma, growing demand for acute care hospitals, increasing geriatric patient volume, and unmet medical needs in emerging economies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.