- Home

- »

- Biotechnology

- »

-

Adeno Associated Virus Vector Manufacturing Market Report, 2030GVR Report cover

![Adeno Associated Virus Vector Manufacturing Market Size, Share & Trends Report]()

Adeno Associated Virus Vector Manufacturing Market (2025 - 2030) Size, Share & Trends Analysis Report By Scale Of Operations (Clinical, Preclinical, Commercial), By Method, By Therapeutic Area, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-037-5

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Adeno Associated Virus Vector Manufacturing Market Summary

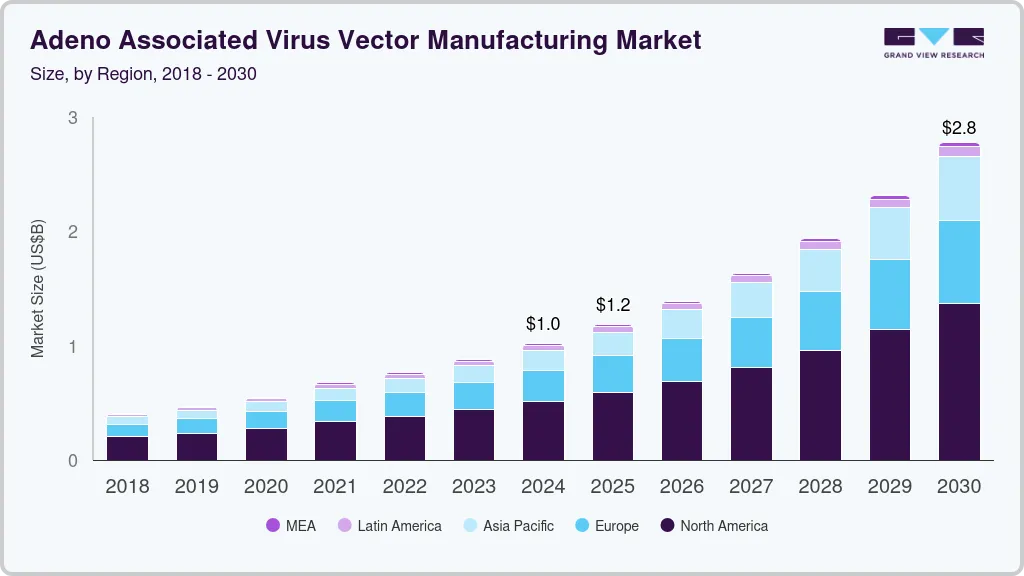

The global adeno associated virus vector manufacturing market size was estimated at USD 1,020.1 million in 2024 and is projected to reach USD 2,778.5 million by 2030, growing at a CAGR of 18.5% from 2025 to 2030. Adeno-associated virus (AAV) vectors are characterized by their unique biological properties, which include a non-pathogenic nature and the ability to induce long-lasting gene expression.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, clinical accounted for a revenue of USD 564.6 million in 2024.

- Commercial is the most lucrative scale of operations segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 1,020.1 Million

- 2030 Projected Market Size: USD 2,778.5 Million

- CAGR (2025-2030): 18.5%

- North America: Largest market in 2024

These vectors are particularly appealing in gene therapy due to their minimal immune response and ability to target a wide range of tissues effectively which boosts the market growth. In addition, the growing number of new market entrants, a strong pipeline for gene therapies and vaccines, and advancements in technology are propelling market growth.

Technological advancements by industry players are expected to enhance workflows related to AAV vector development and gene therapy operations. Key market participants, along with emerging companies, are actively focused on improving research and development for innovative, safe, and effective gene delivery methods. AAV vectors are being utilized to treat conditions such as cystic fibrosis, Duchenne muscular dystrophy (DMD), retinitis pigmentosa, and various chronic diseases, including cancer. The global AAV vector manufacturing sector has seen economic growth driven by rising demand for these vectors.

Researchers are increasingly focused on creating gene-based therapies for a variety of diseases. Although the current number of patients receiving gene therapies is relatively low, the future of this field is promising, as it has the potential to transform treatment protocols by directly targeting the genes involved in disease development. Numerous universities and research institutions have an extensive array of gene therapy products in development, which is anticipated to further stimulate the gene therapy market in the coming years. For instance, the University of Massachusetts Medical School and the University of Utah are conducting several clinical trials aimed at developing and launching new gene therapies.

Furthermore, several companies are pursuing strategic initiatives to improve their market position. For example, in June 2023, SK Pharmteco Co., the contract development and manufacturing organization (CDMO) of South Korea’s SK Group, secured a second plant in France, which doubled its production capacity for viral vectors.

The COVID-19 pandemic positively influenced the market. Market growth during the pandemic was primarily driven by the increasing demand for therapeutic manufacturing from pharmaceutical and biotech companies. Such demand has created opportunities to advance research and development for the creation of new viral vector-based vaccines and treatments. For example, in September 2021, the University of Oxford and the Ludwig Institute for Cancer Research developed a cancer vaccine inspired by the successful production of the Oxford-AstraZeneca vaccine for SARS-CoV-2. This newly formulated cancer vaccine, when combined with immunotherapy, demonstrated a reduction in tumor size and elicited an anti-tumor immune response in vivo, presenting significant opportunities for global expansion in the AAV vector CDMO sector.

Despite these developments, there is still significant demand for AAV vectors produced under GMP conditions in biomanufacturing facilities. The costs associated with manufacturing AAV vectors at the laboratory scale are relatively high, primarily due to the expensive and time-consuming downstream processes involved. This could potentially impede growth in the global AAV vector manufacturing market. However, AAV vector manufacturing is widely regarded as one of the safest and most effective approaches for emerging therapies, indicating that the market is likely to experience substantial growth in the years ahead.

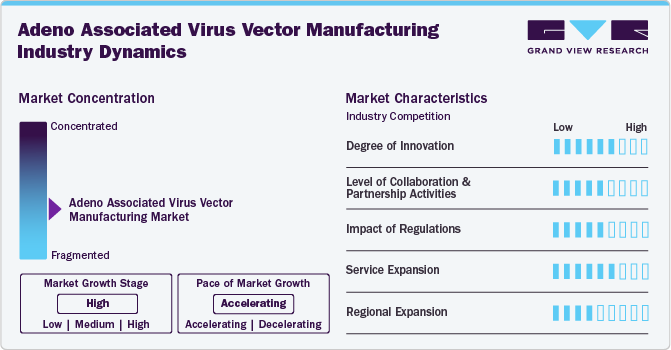

Market Concentration & Characteristics

The AAV vector manufacturing market is marked by substantial innovation, with ongoing development of new technologies and processes aimed at enhancing the efficiency and effectiveness of production methods. This progress has enabled the creation of high-quality products that cater to a variety of consumer needs. Furthermore, advancements in research and development have uncovered new applications for AAV, solidifying its value across numerous fields.

Collaboration and partnership activities are anticipated to have a significant impact on the growth of the AAV vector manufacturing industry. For instance, in September 2022, Oxford Biomedica Solutions signed a new partnership with an undisclosed U.S.-based biotechnology company to provide end-to-end AAV platform services, including preclinical gene therapy programs.

Regulations significantly impact the AAV vector manufacturing market by ensuring safety, efficacy, and quality standards for gene therapies. Compliance with stringent guidelines can streamline approval processes, fostering innovation and market growth. However, navigating complex regulatory landscapes can also pose challenges, potentially delaying product development. Ultimately, balanced regulations promote consumer trust while encouraging advancements in AAV technology and applications.

Service expansion in this industry is driven by increasing demand for tailored solutions, such as vector development, production scalability, and regulatory support. Companies are enhancing their service offerings to include comprehensive consulting and technical assistance, facilitating smoother project transitions. This growth enables clients to access specialized expertise, ultimately accelerating the development of innovative gene therapies and expanding market opportunities.

Regional expansion is fueled by the rising demand for gene therapies across various geographies. Companies are establishing manufacturing facilities in emerging markets to tap into local expertise and resources. This strategic growth allows for quicker response times, reduced costs, and enhanced access to diverse customer base, ultimately driving innovation and market reach on a global scale.

Scale Of Operations Insights

Clinical segment held the major share of 47.94% in the adeno associated virus vector manufacturing market in 2024. The clinical scale of operations segment captured the largest share in the AAV vector manufacturing market due to the increasing demand for advanced therapies, particularly in gene therapy applications. As pharmaceutical and biotech companies conduct more clinical trials, the need for scalable, high-quality AAV production has surged. This segment benefits from significant investments in research and development, as well as support from non-commercial entities sponsoring trials. Furthermore, the regulatory push for innovative treatments has led to a proliferation of clinical studies, driving the demand for reliable AAV vector manufacturing at a clinical scale to ensure effective and safe therapeutic outcomes.

The commercial segment is expected to grow at the highest CAGR from 2025 to 2030. Key market players are advancing manufacturing infrastructure for large-scale production of AAV vectors, which is fueling growth. For example, Applied Genetic Technologies Corporation has established a facility dedicated to producing AAV vector-based gene therapies, which includes preclinical research capabilities for Phase 1 and Phase 2 studies. Significant advancements in research and development for clinical applications are contributing to the rapid expansion of this segment.

Method Insights

The in vivo segment dominated the global market in 2024. This is primarily due to its direct application in therapeutic interventions. In vivo studies enable the delivery of AAV vectors directly into living organisms, allowing for real-time assessment of efficacy and safety in targeted tissues. This approach is crucial for advancing gene therapies, as it closely mimics clinical scenarios. The increasing prevalence of genetic disorders and the demand for effective treatments drive investment in in vivo applications. Furthermore, successful clinical trials utilizing in vivo AAV vectors have improved confidence in their effectiveness, solidifying their market leadership.

The in vitro segment is anticipated to grow at a significant CAGR from 2025 to 2030 due to its critical role in the early stages of gene therapy development. As researchers seek to optimize AAV vectors for various applications, in vitro methodologies allow for efficient testing, rapid iterations, and precise evaluations in controlled environments. In addition, advancements in biotechnological tools and increased focus on personalized medicine are driving demand for innovative AAV applications. The growing number of research initiatives and collaborations targeting genetic disorders further enhance the potential for in vitro techniques, making them integral to future AAV vector manufacturing advancements.

Therapeutic Area Insights

The neurological disorders segment held the largest market share of 29.35% in 2024. In recent years, AAV has become an important vector for Central Nervous System (CNS) therapies. This vector has shown promising results for CNS diseases that cannot be treated with drugs, including neuromuscular diseases, neurodegenerative diseases, and lysosomal storage disorders. AAV vector has been shown to have a wide range of applications in clinical research for neurological disorders such as Parkinson’s disease, Alzheimer’s disease, spinal muscular atrophy, amyotrophic lateral sclerosis, and temporal lobe epilepsy.

The genetic disorders segment is anticipated to grow at the highest CAGR of 21.17% from 2025 to 2030. This growth is attributed to the increasing prevalence of genetic disorders caused by unhealthy lifestyles, environmental factors, dietary habits, hereditary issues, and compromised immunity. AAV vector-based therapies are being developed to address these conditions, with numerous research institutes focusing on new treatment options. AAV-based gene therapies have advanced to target a range of tissues and cells for treating various genetic diseases. It has become the primary vector for gene therapy delivery compared to lentivirus and adenovirus. AAV has a favorable safety profile and can provide long-term gene expression. It is capable of infecting both dividing and nondividing cells, which has led to significant attention from companies to produce AAV-based therapies.

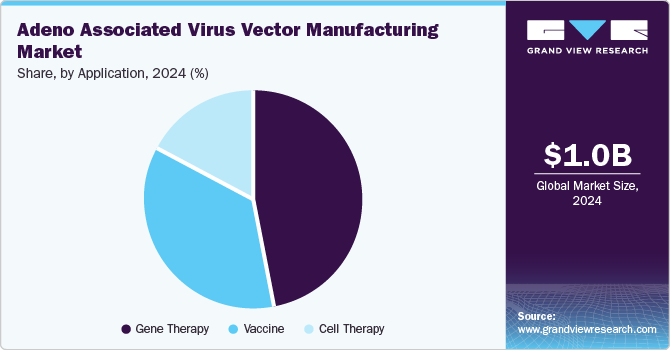

Application Insights

The gene therapy segment held the largest market share of 47.23% in 2024 due to its transformative potential in treating genetic disorders. AAV vectors are favored for their ability to deliver therapeutic genes safely and effectively, minimizing immune responses. As the prevalence of genetic conditions rises, the demand for innovative treatments intensifies, positioning gene therapy as a leading application. For instance, in June 2024, REGENXBIO Inc. mentioned the enrollment initiation in a new cohort of patients (1 to 3 age group of boys) in its Phase I/II Affinity Duchenne trial evaluating RGX-202 safety & efficacy with Duchenne muscular dystrophy. Successful clinical trials and advancements in AAV technology have further validated their efficacy, attracting significant investment. This combination of therapeutic promise and growing research interest solidifies the gene therapy segment's dominance in the AAV vector manufacturing landscape.

The cell therapy segment is expected to grow at a significant CAGR in the AAV vector manufacturing market due to the increasing demand for advanced treatment options for various diseases, including cancer and genetic disorders. AAV vectors are crucial for enhancing the effectiveness of cell therapies by facilitating the delivery of therapeutic genes into target cells. As research progresses in regenerative medicine and immunotherapy, the integration of AAV technology into cell therapies is becoming more prevalent. In addition, the rise in clinical trials and collaborations focused on developing innovative cell-based treatments further propels this segment's growth, reflecting its promising future.

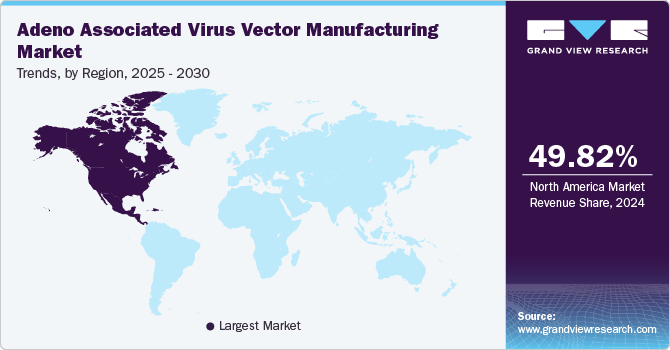

Regional Insights

North America adeno associated virus vector manufacturing market is accounted for the largest market share of 49.82% in 2024 driven by the growing demand for AAV vectors in genetic and molecular biology research and development. The U.S. leads this market, supported by a strong presence of major pharmaceutical and biotechnology firms, research institutions, and academic centers. Increased investments in drug discovery and technological advancements in advanced therapy medical products are propelling regional growth.

U.S. Adeno Associated Virus Vector Manufacturing Market Trends

The U.S AAV vector manufacturing market is expected to grow in the coming years due to presence of several key market players in this country. These players are undergoing various strategic initiatives such as collaborations and new product launches. For instance, in November 2023, Genezen, a top cell and gene therapy CDMO, secured an additional USD 18.5 million in growth funding led by Ampersand Capital Partners. This investment will help speed up Genezen's expansion in retroviral, lentiviral, and AAV vector manufacturing while supporting the delivery of a strong pipeline of customer projects focused on developing innovative cell & gene therapies.

Europe Adeno Associated Virus Vector Manufacturing Market Trends

The Europe AAV vector manufacturing market is experiencing significant growth, fueled by rising investments in gene therapy research and development. Key factors include increasing government support for innovative medical treatments and a robust network of pharmaceutical and biotechnology companies. Europe’s emphasis on personalized medicine and advanced therapies is driving demand for AAV vectors. In addition, collaborations among research institutions and industry players enhance technological advancements, further expanding the market. As regulatory frameworks evolve, Europe is poised to become a leading hub for AAV vector production.

The AAV vector manufacturing market in the UK held a significant share in 2024. Prominent biotechnology firms are undertaking several strategic expansion initiatives in this country which are expected to offer lucrative growth opportunities over the forecast period. For instance, in November 2023, ViroCell Biologics received approval from the UK's healthcare regulator to start manufacturing and exporting viral vector products from a leading children's hospital.

France AAV vector manufacturing market is expected to grow remarkably over the forecast period. The French government promotes life sciences research and innovation by offering funding programs, tax incentives, and infrastructure development. This support stimulates investment in biotechnology, genomics, and personalized medicine, thereby increasing the demand for AAV vectors within these fields.

The AAV vector manufacturing market in Germany is anticipated to grow significantly over the forecast period. The country has strong investments in biotechnology and a robust research infrastructure. The country's focus on innovative therapies, along with high public and private funding availability is driving the demand for AAV vectors for various biomedical applications.

Asia Pacific Adeno Associated Virus Vector Manufacturing Market Trends

The Asia Pacific AAV vector manufacturing market is projected to grow at the highest CAGR of 22.02% over the forecast period. Countries in the Asia Pacific region, such as China, India, Japan, and South Korea, are experiencing significant industrialization and economic growth, which is driving demand in various sectors, including pharmaceuticals and biotechnology-both of which rely heavily on AAV vectors. Substantial investments from governments and private companies in healthcare infrastructure, pharmaceutical research, and life sciences are enhancing the need for AAV vector manufacturing. In addition, the region's rapidly growing population and increasing urbanization are elevating demand for healthcare services, leading to greater pharmaceutical production and research activities, further propelling the AAV vector market.

The AAV vector manufacturing market in China is expected to grow over the forecast period. The Chinese government is actively supporting the growth of its domestic pharmaceutical industry, including AAV vector development. These initiatives lead to increased funding for research and development, benefiting the AAV vector manufacturing market. In addition, China’s aging population drives higher demand for treatments for chronic diseases, where AAV vectors are increasingly utilized. This growing need for effective therapies is anticipated to significantly boost the AAV vector market.

Japan AAV vector manufacturing market is witnessing significant growth over the forecast period. The AAV vector manufacturing market in Japan is rapidly expanding, driven by increasing demand for gene therapies and innovative treatments. Key players are investing in advanced technologies and facilities, enhancing production efficiency and scalability. These developments are positioning Japan as a significant hub for AAV vector advancements and biopharmaceutical innovation.

MEA Adeno Associated Virus Vector Manufacturing Market Trends

The MEA AAV vector manufacturing market is expected to grow at a significant pace over the forecast period. The region is experiencing significant growth, spurred by advancements in gene therapy and a rising focus on rare diseases. Increased funding from both public and private sectors, alongside collaborative research initiatives, is fostering a robust ecosystem. As regulatory frameworks evolve, the region is expected to witness a rise in the number of companies offering innovative biomanufacturing solutions.

Saudi Arabia AAV vector manufacturing market is expected to grow over the forecast period. The growth in market is expected to be fuelled by Vision 2030, which emphasizes biotechnology as a key sector. Significant investments in research facilities and partnerships with international firms enhance local capabilities. In addition, the country's strategic location facilitates access to emerging markets in the region, boosting manufacturing potential.

The AAV vector manufacturing market in Kuwait is anticipated to grow due to the increasing investments in biotechnology and gene therapy research. Government initiatives to promote advanced medical technologies and collaborations with international research institutions are enhancing local capabilities, positioning Kuwait as an emerging player in the regional AAV manufacturing landscape.

Key Adeno Associated Virus Vector Manufacturing Company Insights

Companies in the AAV vector manufacturingmarket are focusing on expansion to enhance production and research efforts. In addition, many players are acquiring smaller firms to strengthen their market presence, diversify service offerings, and improve overall capabilities.

Key Adeno Associated Virus Vector Manufacturing Companies:

The following are the leading companies in the adeno associated virus vector manufacturing market. These companies collectively hold the largest market share and dictate industry trends.

- F. Hoffmann-La Roche Ltd

- Charles River Laboratories

- Oxford Biomedica PLC

- WuXi AppTec

- Yposkesi, Inc.

- Sarepta Therapeutics, Inc.

- Pfizer Inc.

- Genezen

- Creative Biogene

- GenScript (ProBio)

Recent Developments

-

In July 2024, Form Bio announced the launch of an AAV data dictionary and open-source tools, driven by a newly formed AAV Working Group created in collaboration with PacBio, which included prominent AAV experts from both industry and academia.

-

In March 2023, AGC Biologics announced the launch of its BravoAAV viral vector platform. The platform provides rapid, efficient, and reproducible GMP production of AAV for clinical and commercial use

-

In March 2023, Catalent announced the expansion of its UpTempo platform for CGMP manufacturing of adeno-associated viral (AAV) vectors. The update introduced an in-house, clonal HEK293 cell line and off-the-shelf plasmids, streamlining the supply chain for gene therapies and reducing timelines for first-in-human clinical evaluations.

Adeno Associated Virus Vector Manufacturing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.19 billion

Revenue forecast in 2030

USD 2.78 billion

Growth rate

CAGR of 18.55% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

October 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Scale of operations, method, therapeutic area, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil, Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

F. Hoffmann-La Roche Ltd; Charles River Laboratories; Oxford Biomedica PLC; WuXi AppTec; Yposkesi, Inc.; Sarepta Therapeutics, Inc.; Pfizer Inc.; Genezen; Creative Biogene; GenScript (ProBio)

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Adeno Associated Virus Vector Manufacturing Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented global adeno associated virus vector manufacturing market on the basis of scale of operations, method, therapeutic area, application, and region:

-

Scale of Operations Scope Outlook (Revenue, USD Million, 2018 - 2030)

-

Clinical

-

Preclinical

-

Commercial

-

-

Method Scope Outlook (Revenue, USD Million, 2018 - 2030)

-

In Vitro

-

In Vivo

-

-

Therapeutic Area Scope Outlook (Revenue, USD Million, 2018 - 2030)

-

Hematological Diseases

-

Infectious Diseases

-

Genetic Disorders

-

Neurological Disorders

-

Ophthalmic Disorders

-

Others

-

-

Application Scope Outlook (Revenue, USD Million, 2018 - 2030)

-

Cell Therapy

-

Gene Therapy

-

Vaccine

-

-

Regional Scope Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global adeno associated virus vector manufacturing market size was estimated at USD 1.02 billion in 2024 and is expected to reach USD 1.19 billion in 2025.

b. The global adeno associated virus vector manufacturing market is expected to grow at a compound annual growth rate of 18.55% from 2025 to 2030 to reach USD 2.78 billion by 2030.

b. North America dominated the AAV vector manufacturing market with a share of 49.82% in 2024. This can be attributed to the growing research and product development activities undertaken by companies in gene & cell therapy, coupled with a substantial number of CDMOs, in the region

b. Some key players operating in the AAV vector manufacturing market include F. Hoffmann-La Roche Ltd; Charles River Laboratories; Oxford Biomedica PLC; WuXi AppTec; Yposkesi, Inc.; Sarepta Therapeutics, Inc.; Pfizer Inc.; Genezen; Creative Biogene; GenScript (ProBio)

b. Key factors that are driving the market growth include increasing number of clinical trials using viral vectors for treating various chronic diseases along with a robust gene therapy pipeline

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.