- Home

- »

- Petrochemicals

- »

-

Adhesives and Sealants Market Size & Trends Analysis Report, 2023GVR Report cover

![Adhesives And Sealants Market Size, Share & Trends Report]()

Adhesives And Sealants Market Size, Share & Trends Analysis Report By Technology (Water-based, Solvent-based, Hot Melt), By Product, By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-081-1

- Number of Pages: 130

- Format: Electronic (PDF)

- Historical Range: 2018 - 2023

- Industry: Bulk Chemicals

Market Trends

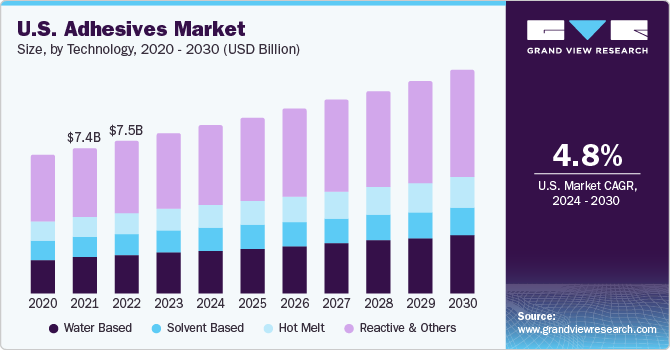

The global adhesives and sealants market size was estimated at USD 71.42 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 6.0% from 2024 to 2030. Changes in material consumption patterns, with metal, aluminum, and paper being increasingly replaced by more durable materials, are expected to drive product demand in packaging segments. A steady demand for packaging items from the food & beverage sector is poised to remain a key adhesives and sealants market growth driver in the United States. Moreover, the presence of discount retailers in the country, along with the high potential of the grocery retail sector, is expected to propel adhesive demand for packaging products.

This factor is poised to lead to long-term market growth. Moreover, the expansion is driven by demand from various industries, including automotive, construction, and packaging. With the expansion of these industries in the United States, demand for adhesives and sealants is expected to rise. The paper & packaging application segment in the adhesives market of the country is poised to emerge as the fastest-growing segment at a CAGR of 4.9% through 2030. Rising demand for bio-based products is expected to augment the demand for hot melt technology in the years to come and contribute to the expansion of the paper & packaging segment.

The COVID-19 pandemic affected the adhesive & sealant products demand in the U.S. As per a government report, the gross domestic product (GDP) of the U.S. shrunk by 3.5% in 2020 from 2019, owing to a decline in manufacturing output of end-use industries, such as building & construction, automotive & transportation, aerospace & defense, packaging, and consumer. Overall, adhesives volume registered a year-on-year (Y-O-Y) growth of 0.4% in 2020.

Market Concentration & Characteristics

The adhesives and sealants industry are highly competitive and fragmented, with many small and medium-sized businesses operating. The market comprises large and medium-sized enterprises, with companies continuously implementing strategies such as acquisitions, collaborations, and product launches.

To strengthen their position in the industry, major players are actively pursuing product innovations, partnerships, expansions, and mergers and acquisitions across the value chain to retain their market share on a global scale. For instance, In March 2022, Wacker announced the expansion of its production and cartridge filling capacities for silicone sealants at its Nünchritz site by 2024. The expansion will increase the company’s capability to supply customers, ready-to-use silicone sealants for their direct sales.

Adhesives Technology Insights

Reactive & other technologies dominated the global market with a revenue share of 49.44% in 2023. Reactive technology-based products offer several advantages and thus are key factors behind the growth of the segment. These advantages include high manufacturing speeds owing to short setting time, higher heat resistance, and strong adhesion properties to a wide range of substrates. The hot-melt segment is anticipated to grow at a lucrative pace from 2024 to 2030. Within the textiles & fabrics industry, the use of polyester hot melt adhesives started gaining prominence in the last decade. A wider use of this product has been observed in the cotton, wool, and fabrics sub-sector over the last few years.

The reason is that the product greatly improves the anti-pilling performance of cotton-woven fabrics while enhancing the elastic recovery rate of the fabric. The use of hot melt adhesive products in dashboards of automotive vehicles is increasingly becoming popular globally. These products find applications in the dashboard wherein they offer reduced vibrations coupled with greater insulation from the sound. The increased focus on offering soundproof rides is likely to push product penetration in the automotive industry during the forecast period.

Adhesives Product Insights

The acrylic product segment dominated the market with a revenue share of 33.80% in 2023. This segment is projected to grow on account of rising construction activities and investments in infrastructure space. Construction of chemical/industrial process plants, stadiums, bridges, museums, concert halls, research facilities, and medical buildings is projected to benefit the segment expansion. Polyurethane adhesive products exhibit superior properties, such as fast curing, good abrasion & chemical resistance, and excellent bond strength, on various substrates, such as metal, plastic, rubber, wood, and glass.

These products are generally based on reactive technology and contain polymers that have urethane linkages. These materials provide solidity, low viscosity, and less cure time to adhesive. Epoxy-based products adhere to a wide variety of materials and their superior properties are dependent on the nature of cross-linking polymers. They provide high resistance to chemicals and environments and high-temperature resistance along with high-strength bonding on a variety of substrates. These adhesives are generally based on reactive technology.

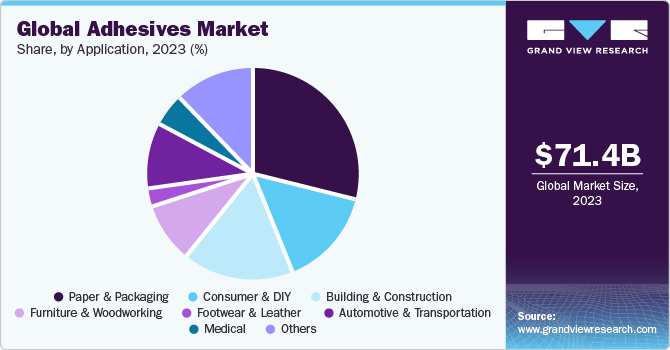

Adhesives Application Insights

Paper & packaging segment dominated the market with a revenue share of 29.38% in 2023. Flexible packaging is projected to offer new avenues for market players over the coming years. A sudden rise in healthcare spending positively affected the demand for packaging products as a result of increased demand for PPE kits, surgical masks, and other healthcare products. The building & construction segment is projected to provide numerous opportunities in the industry. This segment is witnessing rapid technological & architectural innovation.

Airports, mining facilities, transportation routes & even residential projects are undergoing an immense transformation to comply with transitioning standards & specifications. Demand for products in the assembly of electrical & electronics components is projected to benefit the global market. China is among the leading producers of various electrical and electronic components globally. Investments in emerging technologies, such as 5G and IoT, are projected to boost the Chinese electrical & electronics industry growth during the forecast period.

Sealants Product Insights

On the basis of the product, sealants have been segmented as: silicones, polyurethanes, acrylic, polyvinyl acetate, and others. Silicone sealants are highly preferred in consumer electronics. These sealants are used to create a protective barrier around sensitive electronic parts, such as circuit boards, connectors, and sensors. By sealing gaps, joints, and openings, silicon sealants prevent the ingress of moisture, dust, and other contaminants, safeguarding the electronic components from damage and ensuring their long-term reliability.

Sealants Application Insights

Construction sealants accounted for a share of 44.6% in the industry in 2023. Sealants used in construction are used for sealing joints, gaps, and connections in various building components, ensuring their longevity and structural integrity. Buildings are not static; they undergo movements due to factors like temperature changes and settling. Sealants with high flexibility can accommodate these movements without compromising their sealing properties.

Sealants play a crucial role in the automotive industry, providing a wide range of applications that contribute to the performance, durability, and safety of vehicles. These versatile substances are used in various areas of automotive manufacturing and maintenance, ensuring the integrity of the vehicle's structure and components.

Adhesives & Sealants Regional Insights

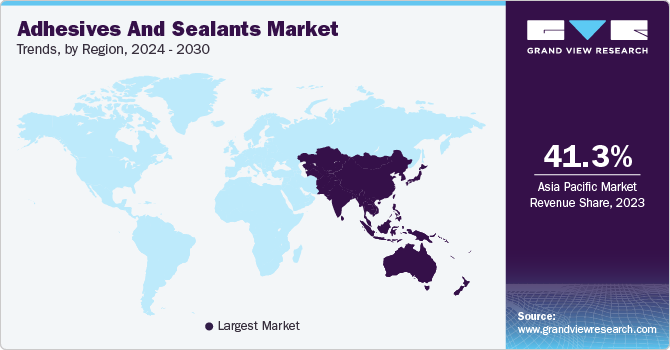

Asia Pacific dominated the industry with a revenue share of 35.95% in 2023. The COVID-19 pandemic created a sizable impact on various industries, such as textile & garments, construction, and automotive, in 2020 wherein export trade was also largely impacted. For instance, as per the government data, textile trade between China and India observed a Y-O-Y decline of 12.4% in the first 2 months of 2020 from the previous year. The market has shown a positive recovery since the third quarter of 2020 and gained momentum during 2021. GCC is one of the key growth engines for the Middle East & Africa region. Growing construction activities in the GCC region are likely to fuel product demand. In the recent past, the housing sector in GCC countries has not performed well.

This was primarily on account of declining oil prices and economic slowdown. However, in the near future, the construction sector is expected to function well due to rising investments in energy, residential construction, and transportation infrastructure. Government initiatives for economic recovery are anticipated to fuel infrastructural developments in Central & South America. The construction industry in economies such as Colombia, Argentina, and Peru are anticipated to witness steady growth during the projection period. This is expected to drive product demand in the region. For example, Peru's economic growth can be mainly attributed to an increase in construction and related activities in the country.

Key Companies & Market Share Insights

The global industry is characterized by the presence of medium- and large-scale producers, which have local as well as international presences. These producers observed a reduction in demand during 2020, owing to the COVID-19 pandemic. Value chains at different levels witnessed different obstacles, such as shortage of raw materials & labor, halting of industrial production, etc. In 2020, several players reported heavy losses owing to low demand for adhesives as manufacturing operations in end-use industries were suspended due to nationwide lockdowns and other government restrictions. In the first nine months of 2020, Henkel’s sales decreased by around 4.5%, dropping to EUR 14,485 million

Several manufacturers are developing products free of volatile organic compounds (VOCs) and other harmful chemicals. These products are considered eco-friendly and adhere to various environmental regulations. These manufacturers utilize several strategic initiatives, such as mergers & acquisitions, agreements, collaborations, partnerships, and joint ventures, to maintain their dominance.

-

In June 2023, H.B. Fuller acquired Beardow Adams, a UK-based adhesive manufacturing company offering various industrial adhesives. The acquisition will expedite H.B. Fuller’s growth in several core markets, leading to increased profitability and business synergies through production optimization, enhanced distribution capabilities, and innovative solutions.

-

In September 2022, Henkel AG & Co. KGaA announced expansion of its production plant in South Dakota. This plant manufactures thermal interface material adhesives for use in the electronics and automotive industries. The adhesives are sold under the brands Loctite and Bergquist.

Key Adhesives And Sealants Companies:

The following are the leading companies in the adhesives and sealants market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these adhesives and sealants companies are analyzed to map the supply network.

- 3M Company

- Ashland Inc.

- Avery Denison Corporation

- H B Fuller

- Henkel AG

- Sika AG

- Pidilite Industries

- Huntsman

- Wacker Chemie AG

- RPM International Inc.

Adhesives and Sealants Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 75.63 billion

Revenue forecast in 2030

USD 107.27 billion

Growth rate

CAGR of 6.0% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative Units

Volume in kilotons, revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Adhesives Market: Technology, product, application, region;

Sealants Market: Product, application, regionRegional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Russia; Italy; Spain; Turkey; China; India; Japan; South Korea; Brazil; Argentina; Colombia; Saudi Arabia; Iran; UAE

Key companies profiled

3M Company; Ashland Inc.; Avery Denison Corporation; H B Fuller; Henkel AG; Sika AG; Pidilite Industries; Huntsman; Wacker Chemie AG; RPM International Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Adhesives and Sealants Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global adhesives and sealants market report based on technology, product, application, and region:

-

Adhesives Technology Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Water Based

-

Solvent Based

-

Hot Melt

-

Reactive & Others

-

-

Adhesives Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Acrylic

-

PVA

-

Polyurethanes

-

Styrenic block

-

Epoxy

-

EVA

-

Others

-

-

Adhesives Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Paper & packaging

-

Consumer & DIY

-

Building & construction

-

Furniture & woodworking

-

Footwear & leather

-

Automotive & transportation

-

Medical

-

Others

-

-

Sealants Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Silicones

-

Polyurethanes

-

Acrylic

-

Polyvinyl acetate

-

Others

-

-

Sealants Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Construction

-

Automotive

-

Packaging

-

Assembly

-

Consumers

-

Others

-

-

Adhesives & Sealants Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

U.K.

-

Russia

-

Italy

-

Spain

-

Turkey

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

India

-

Indonesia

-

-

Central & South America

-

Brazil

-

Argentina

-

Colombia

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global adhesives and sealants market size was estimated at USD 71.42 billion in 2023 and is expected to reach USD 75.63 billion in 2024. Rising penetration of flexible packaging products and adhesive demand in households are projected to assist the market growth.

b. The global adhesives and sealants market is expected to grow at a compound annual growth rate of 6.0% from 2024 to 2030 to reach USD 107.27 billion by 2030.

b. The Asia Pacific was the key regional segment of the adhesives and sealants market with a revenue share of above 35.95% of the global market in 2023. Rising industrial production and thus product demand in assembly operations coupled with moderate growth of the construction sector in China and India are projected to drive the market growth.

b. Some of the key players operating in the adhesives & sealants market are 3M Company, Ashland Inc., Avery Denison Corporation, Bostik, H.B Fuller Company, Henkel AG and Sika AG.

b. The key factors that are driving the adhesives and sealants market are global infrastructure investments and the lucrative growth of the packaging industry.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."