- Home

- »

- Biotechnology

- »

-

ADME Toxicology Testing Market Size & Share Report, 2030GVR Report cover

![ADME Toxicology Testing Market Size, Share & Trends Report]()

ADME Toxicology Testing Market (2025 - 2030) Size, Share & Trends Analysis Report By Technology (Cell Culture Tech, High Throughput Tech, Molecular Imaging), By Application, By Method, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-627-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

ADME Toxicology Testing Market Trends

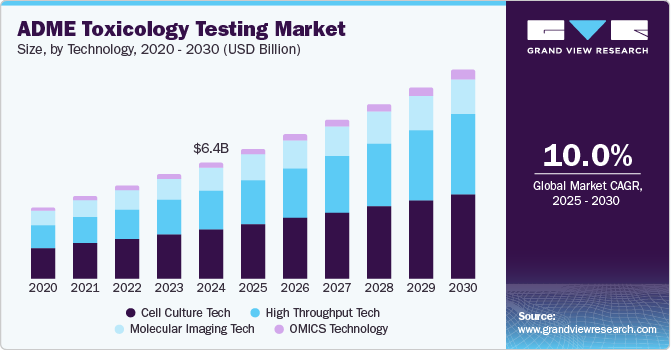

The global ADME toxicology testing market size was estimated at USD 6.38 billion in 2024 and is projected to witness a CAGR of 10.0% from 2025 to 2030. Technological innovations in ADME studies, a high rate of late-stage drug failures, and an increased need for novel drug molecules are anticipated to propel market growth over the forecast period. The high drug attrition rate has prompted pharmaceutical companies and regulatory bodies to invest significantly in ADME Tox studies alongside other pharmacological research. This is due to the critical role these studies play in determining the success of a drug candidate. The importance of ADME Tox studies has been extensively evaluated and confirmed through ongoing research.

The COVID-19 pandemic had a significant impact on the market. Initially, the pandemic caused significant disruptions in research and laboratory operations globally. Lockdowns, social distancing measures, and resource reallocations to combat COVID-19 led many laboratories to reduce their workforce or temporarily suspend ongoing studies. This resulted in a slowdown of drug development projects, delaying critical ADME testing that is essential for understanding drug safety and efficacy. Supply chain disruptions further compounded these challenges. The pandemic affected the availability of essential reagents, materials, and equipment necessary for toxicology testing. Many companies faced delays in procurement, impacting their ability to conduct timely and efficient studies. This backlogged testing schedule forced researchers to navigate a complex landscape of logistical challenges, which impeded progress across various drug development programs.

Furthermore, prioritizing the safety of drug candidates holds immense significance. ADME toxicology testing aids in detecting potential toxic effects and evaluating the risk-benefit profile of emerging drugs. It facilitates identifying and eliminating drug candidates that could potentially induce harmful effects in humans, thereby diminishing the likelihood of drug failures or safety concerns during clinical trials. ADME toxicology testing is mainly used to conduct various genetic, chemical, and pharmacological tests that aid the drug discovery process, from drug design to drug trials and other drug interactions. This process involves control software, various devices to handle liquids, and other detectors that help rapidly identify active compounds, genetic interactions, and other biomolecular interactions.

However, most of these techniques need skilled expertise and software that can handle and store multiple sets of data at a rapid pace. This could limit market growth to an extent. ADME toxicology testing is now done throughout drug design and development to prevent late-stage failure and ensure systematic evaluation to prevent the potential loss of a molecule or investment. Most companies follow good laboratory practice (GLP) and non-GLP testing procedures to meet regulatory standards. Regulatory bodies are being pushed to establish tighter quality control standards to achieve integrity and accuracy of obtained and stored data. Automation and efficient liquid handling systems are boosting market growth.

For instance, Tecan, a provider of laboratory instruments and solutions for clinical diagnostics, introduced an automated screening system to support ADME for the early stages of drug discovery. Regulatory changes from governing bodies, such as the U.S. FDA, are expected to impact the market growth and the direction of innovations carried out. For instance, according to the National Institutes of Health (NIH), clinical trials are being performed using biochemical or cell-based, in-vitro testing instead of animal testing. The use of artificial intelligence for drug discovery that predicts chemical toxicity, molecular design, and rational drug design is also expected to boost market growth. Moreover, it is expected that the availability of numerous innovative approaches, such as in-silica simulated models and databases for the analysis of extensive chemicals to comprehend and analyze their toxicity, will contribute to market growth.

Technology Insights

Cell culture held the largest market share of 42.59% in 2024. One of the key driving factors for using cell culture technology in ADME testing is its ability to provide a more physiologically relevant environment for studying drug interactions. Cell cultures, especially 3D cultures, mimic human tissues more accurately than traditional biochemical assays, allowing for better predictions of how a drug will behave in the human body. This reduces reliance on animal models, improves the accuracy of toxicity & efficacy assessments, and expedites drug development processes.

The high throughput tech segment is expected to grow at the highest CAGR from 2025 to 2030. High-throughput ADME refers to the screening of compounds for toxicology assessments. This technology employs automated microscopy to evaluate cellular responses to pharmaceuticals. It serves as an invaluable tool in the early phases of drug discovery. Consequently, high-throughput screening is widely utilized in drug development's hit-to-lead and lead optimization stages. This technique also facilitates the screening of a diverse array of compounds, thereby reducing both costs and time, hence driving market growth.

Method Insights

The cellular assay segment held the largest market share of 44.39% in 2024 and is expected to grow at the fastest CAGR from 2025 to 2030. The method’s ability to deliver real-time, high-throughput data on drug metabolism, toxicity, and cellular responses is a major factor contributing to its large share. Moreover, this method enhances the ability to screen a large number of compounds quickly, improving early-stage drug candidate selection and reducing the likelihood of late-stage failures.

The biochemical assay segment is expected to grow significantly over the forecast period. The biochemical assays play a crucial role in the ADME TOX testing landscape, providing essential insights into the pharmacokinetic properties of drug candidates. These assays assess various parameters vital for understanding how a compound behaves within biological systems. For example, CYP enzyme inhibition assays are widely used to evaluate the potential of new drugs to interact with cytochrome P450 enzymes, which are critical for drug metabolism. Companies like Thermo Fisher Scientific and Reaction Biology offer a range of biochemical assays designed to facilitate high-throughput screening and provide comprehensive data on drug interactions and metabolic profiles.

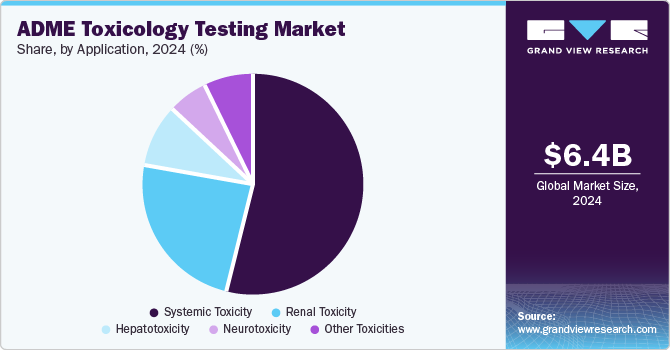

Application Insights

Systemic toxicity held the largest market share of 53.78% in 2024. Systemic toxicity tests play a vital role in assessing the impact of a drug on different organs and tissues after it has been absorbed, as it can result in adverse effects. Moreover, regulatory bodies emphasize a thorough evaluation of systemic toxicity to guarantee the safety of drugs for human use. This shift is increasing the demand for more accurate and dependable ADME testing methods to predict these risks early in the drug development process.

The renal toxicity segment is expected to grow significantly over the forecast period. The growing emphasis on renal toxicity testing has led to significant developments in the tools and methodologies employed by key market players. Companies such as Charles River Laboratories and WuXi AppTec have expanded their offerings to include advanced renal cell culture systems that facilitate high-throughput screening of nephrotoxic effects. These systems enable researchers to assess drug interactions with renal transporters and cellular responses to potential toxicants more efficiently, which drives demand and growth in this segment.

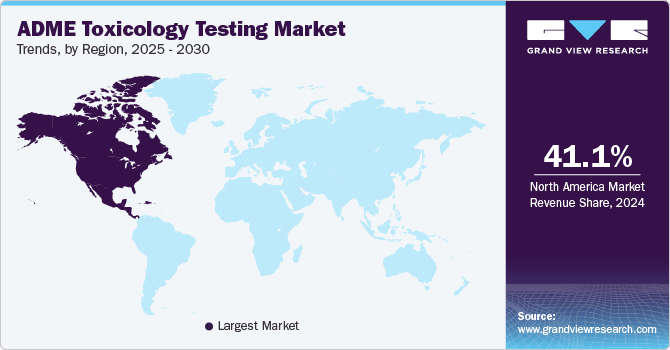

Regional Insights

North America accounted for the largest market share of 41.13% in 2024 for the ADME toxicology testing market, driven by technological advancements & increasing regulatory demands, a rise in healthcare expenditure, and the presence of adequate infrastructure for the growth & development of drug discovery technologies. The region has a robust healthcare infrastructure and a strong emphasis on drug safety, which has led to the adoption of innovative testing methodologies. Moreover, the presence of leading market players coupled with the increasing efforts to enhance the drug discovery process with research and development in the field of ADME toxicology by these market players is further expected to fuel the market growth.

U.S. ADME Toxicology Testing Market Trends

The growth of the ADME toxicology testing market in the U.S. is driven by the increasing complexity of drug development processes, coupled with a rising number of late-stage drug failures and increasing demand for drugs owing to the rising chronic disease and aging population base. As pharmaceutical companies face stringent regulatory requirements from bodies such as the FDA, the demand for comprehensive ADME testing has increased.

Europe ADME Toxicology Testing Market Trends

The ADME toxicology testing market in Europe is growing significantly as European countries hold a significant position in the market. The increasing demand for safer pharmaceuticals and stringent regulatory requirements drives the European market. European pharmaceutical companies prioritize ADME toxicology testing to examine the risks associated with late-stage drug failures. The rise in technological advancements, such as high-throughput screening and in vitro testing methods, has further enhanced the efficiency and accuracy of toxicity assessments. As a result, the companies operating in the market invest more in these technologies to streamline their drug development processes and comply with evolving regulatory standards.

The UK ADME toxicology testing market held a significant share in 2024. A combination of regulatory pressures, advancements in technology, and growing efforts by the market players in the country drive the market in the UK. As pharmaceutical companies face stringent regulatory pressure from regulatory bodies regarding the safety and efficacy of new drug candidates, the demand for comprehensive toxicological assessments has surged. Thus, the companies offering ADME toxicology testing services are significantly investing in improving their offering and test accuracy, thereby enhancing the access of these advanced services to the pharmaceutical sector.

The ADME toxicology testing market in France is growing significantly over the forecast period. The French pharmaceutical industry is increasingly adopting ADME testing to enhance the efficiency of drug discovery processes. This shift is owing to the rising need to reduce late-stage drug failures, which have become a costly burden on pharmaceutical companies. This trend accelerates the drug development processes and aligns with stringent European Union regulations requiring comprehensive safety data before clinical trials.

Germany toxicology testing market holds a robust healthcare infrastructure and a strong emphasis on research & development, encouraging innovation in toxicology testing methodologies. The integration of advanced technologies, such as high-throughput screening and in-silico modeling, has further enhanced the efficiency and accuracy of ADME testing processes, making them indispensable in drug discovery. The ongoing technological advancements and an increasing focus on personalized medicine and precision therapeutics are expected to drive further demand for ADME toxicology testing solutions.

Asia Pacific ADME Toxicology Testing Market Trends

The ADME toxicology testing market in Asia Pacific held the highest CAGR of 14.33% over the forecast period. The region has seen a rise in pharmaceutical and biotechnological R&D activities, spurred by increased investments from both domestic and international players. Growing demand for drug discovery and development has heightened the need for precise and efficient ADME toxicology testing to ensure the safety and efficacy of new drugs. Additionally, regulatory agencies across countries like China, Japan, and India have implemented stricter guidelines for drug testing, further boosting the demand for ADME services.

China ADME toxicology testing market is experiencing significant growth, driven by the country's expanding pharmaceutical industry and increasing regulatory requirements for drug safety assessments. As a major player in the global pharmaceutical landscape, China’s demand for reliable toxicology testing services is intensifying, particularly with the rise in drug development activities and investment in biopharmaceuticals.

The ADME toxicology testing market in Japan is evolving rapidly, driven by stringent regulatory frameworks, increasing demand for drug safety assessments, and technological advancements. As Japan is a key player in the pharmaceutical industry, reliable toxicology testing is critical to ensuring compliance with both domestic and international regulations.

MEA ADME Toxicology Testing Market Trends

The ADME toxicology testing market in MEA is expected to grow significantly over the forecast period. Growing healthcare infrastructure and increased investment in the pharmaceutical sector have led to a rising demand for drug discovery and development services, including ADME toxicology testing. Countries like the UAE, Saudi Arabia, and South Africa are becoming hubs for clinical research, supported by government initiatives to attract foreign investment and establish local manufacturing capabilities. Additionally, the increasing burden of chronic diseases, such as diabetes and cardiovascular conditions, is driving the need for innovative therapeutics, which in turn require thorough ADME testing to ensure drug safety and efficacy.

Saudi Arabia ADME toxicology testing market is expected to grow significantly over the forecast period as thebiomedical research sector in Saudi Arabia has gained increasing attention over the past few years. The Saudi Arabian government is also supporting the research community and enhancing its contribution to biomedical research, thereby helping transform the treatment of various diseases.

The ADME toxicology testing market in Kuwait is emerging as a vital component of the pharmaceutical and biotechnology sectors. With increasing investments in drug development and a growing emphasis on regulatory compliance, the demand for ADME testing is rising. Kuwait's strategic location in the Gulf region positions it as a pharmaceutical research and development hub, attracting local and international companies.

Key ADME Toxicology Testing Company Insights

The key players operating in the market are adopting product approval to increase the reach of their products in the market and improve their availability, along with expansion as a strategy to enhance production/research activities. In addition, several market players are acquiring smaller players to strengthen their market position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve their competencies.

Key ADME Toxicology Testing Companies:

The following are the leading companies in the ADME toxicology testing market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific, Inc.

- Danaher

- Charles River Laboratories

- Promega Corporation

- Agilent Technologies, Inc.

- Curia Global, Inc.

- Dassault Systèmes

- Catalent, Inc

- Labcorp

- Eurofins Scientific

- Miltenyi Biotec

- IQVIA Inc.

Recent Development

-

In September 2024, Scientist.com partnered with Evotec SE to enhance drug discovery and development processes through its digital marketplace. The partnership incorporates ADME-PK services via Cyprotex, an Evotec company focusing on ADME studies.

-

In August 2024, Recursion and Exscientia entered a definitive agreement to create a global leader in technology-enabled drug discovery. This collaboration will combine Recursion's biology, chemistry, and machine learning expertise with Exscientia's precision drug design capabilities. The partnership further aims to accelerate drug discovery, with a focus on end-to-end capabilities across the drug development lifecycle, enhancing both companies' abilities to develop innovative therapies efficiently.

-

In October 2023, Cyprotex, a subsidiary of Evotec, launched an e-commerce platform called the "e-Store" for online ordering of its ADME-Tox services. The platform simplifies access to Cyprotex's offerings by providing 24/7 availability, allowing users to easily place, track, and reorder services. This new system is designed to reduce administrative burden and speed up service delivery, with a range of payment options and instant access to pricing and protocols.

-

In April 2023, Evotec's Cyprotex US announced the opening of its new state-of-the-art facility in Framingham, MA, marking a significant expansion of its ADME-Tox services. The 30,000-square-foot facility features advanced liquid handling automation and mass spectrometry technology, enhancing efficiency and capacity for high-throughput testing.

ADME Toxicology Testing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.10 billion

Revenue forecast in 2030

USD 11.44 billion

Growth rate

CAGR of 10.0% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, method, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico, UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Thermo Fisher Scientific Inc.; Promega Corp.; Agilent Technologies, Inc.; Curia Global, Inc.; Dassault Systèmes; Beckman Coulter, Inc., (Danaher); Catalent, Inc.; Charles River Laboratories; Labcorp Drug Development; Eurofins Scientific; GE HealthCare; Miltenyi Biotec; IQVIA Inc.

Customization scope

Free report customization (equivalent up to 8 analyst's working days) with purchase. Addition or alteration to country, regional & segment scope.

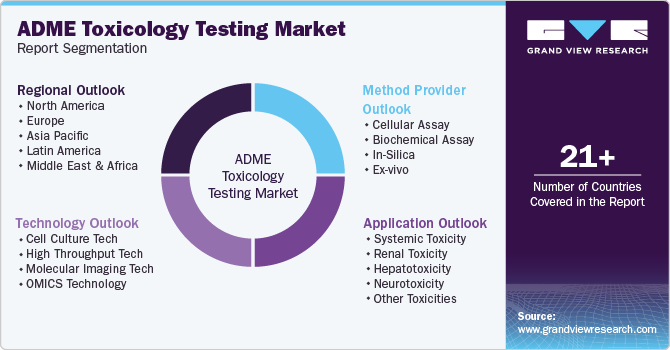

Global ADME Toxicology Testing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels, and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global ADME toxicology testing market based on technology, application, method, and region.

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Cell Culture Tech

-

High Throughput Tech

-

Molecular Imaging Tech

-

OMICS Technology

-

-

Method Provider Outlook (Revenue, USD Million, 2018 - 2030)

-

Cellular Assay

-

Biochemical Assay

-

In-Silica

-

Ex-vivo

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Systemic Toxicity

-

Renal Toxicity

-

Hepatotoxicity

-

Neurotoxicity

-

Other Toxicities

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global ADME toxicology testing market size was estimated at USD 6.38 billion in 2024 and is expected to reach USD 7.10 billion in 2025.

b. The global ADME toxicology testing market is expected to grow at a compound annual growth rate of 10% from 2025 to 2030 to reach USD 11.44 billion by 2030.

b. North America dominated the ADME toxicology testing market with a share of 41.13% in 2024. The growth in the region is mainly driven by technological advancements & increasing regulatory demands, a rise in healthcare expenditure, and the presence of adequate infrastructure for the growth & development of drug discovery technologies.

b. Some key players operating in the ADME toxicology testing market include Thermo Fisher Scientific Inc.; Promega Corp.; Agilent Technologies, Inc.; Curia Global, Inc.; Dassault Systèmes; Beckman Coulter, Inc., (Danaher); Catalent, Inc.; Charles River Laboratories; Labcorp Drug Development; Eurofins Scientific; GE HealthCare; Miltenyi Biotec; IQVIA Inc.

b. Key factors that are driving the ADME toxicology testing market growth include a high rate of late-stage drug failure, an increasing need for novel drug molecules, technological advancements in ADME studies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.