- Home

- »

- Next Generation Technologies

- »

-

Aerial Imaging Market Size & Share, Industry Report, 2030GVR Report cover

![Aerial Imaging Market Size, Share & Trends Report]()

Aerial Imaging Market (2025 - 2030) Size, Share & Trends Analysis Report By Platform, By Application (Geospatial Mapping, Disaster Management, Energy and Resource Management, Surveillance and Monitoring, Urban Planning), By End Use And Segment Forecasts

- Report ID: 978-1-68038-340-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Aerial Imaging Market Summary

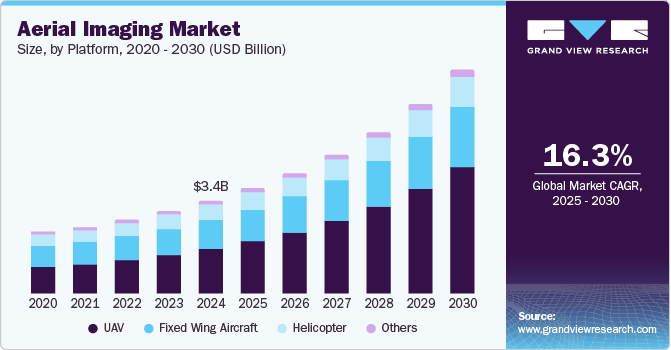

The global aerial imaging market size was estimated at USD 3.41 billion in 2024 and is projected to reach USD 8.24 billion by 2030, growing at a CAGR of 16.3% from 2025 to 2030. This growth can be attributed to the advancements in drone and UAV technologies, including high-resolution cameras and advanced data processing tools that improve the quality and accessibility of aerial imagery.

Key Market Trends & Insights

- Asia Pacific dominated the global market with a 35.9% revenue share in 2024.

- The U.S. aerial imaging market dominated the regional market in 2024.

- By platform, the UAV segment dominated the market in 2024, accounting for a 48.3% revenue share.

- By end use, the media and entertainment segment is anticipated to witness the fastest CAGR during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 3.41 Billion

- 2030 Projected Market Size: USD 8.24 Billion

- CAGR (2025-2030): 16.3%

- Asia Pacific: Largest market in 2024

These innovations enable industries such as agriculture, construction, and environmental monitoring to collect precise visual data, enhancing decision-making and operational efficiency across sectors.

Urban expansion has heightened the demand for location-based services, creating a growing need for accurate mapping and surveying tools. Aerial imaging provides critical insights into land use, urban planning, and environmental assessments, making it indispensable for public agencies and private enterprises. By offering detailed visual data, aerial imaging supports strategic planning and sustainable development initiatives, addressing key challenges in rapidly evolving urban landscapes.

Moreover, the aerial imaging industry is witnessing rapid commercial adoption, with sectors such as real estate, media, and agriculture leveraging this technology to meet diverse needs. For instance, aerial imagery in the real estate and agriculture sectors enhances property listings with unique perspectives that attract potential buyers and supports precision farming by enabling farmers to monitor crop health and optimize yields. This adaptability underscores the industry’s broad applicability, driving its growing market potential across various sectors.

Furthermore, increased investment in infrastructure development is a significant factor propelling the aerial imaging market. Organizations increasingly recognize the importance of spatial data for planning and monitoring projects, fueling demand for aerial imaging solutions. Advanced imaging technologies provide vital data for efficient project execution and management, streamlining operations across multiple industries.

Platform Insights

The UAV segment dominated the market in 2024, accounting for a revenue share of 48.3%. This dominance is attributable to advancements in UAV technology, including enhanced flight capabilities and high-resolution imaging systems. Its widespread adoption across agriculture, construction, and defense industries is driven by efficiency and cost-effectiveness. Furthermore, UAVs excel in collecting precise data from hard-to-reach areas, enhancing their utility and market demand. These factors highlight the key role of UAVs in driving innovation and growth in the aerial imaging industry.

The fixed-wing aircraft segment is anticipated to experience a significant CAGR during the forecast period. This growth can be attributed to its ability to cover larger areas in less time than other aerial imaging solutions. Fixed wing aircraft are widely used for mapping, surveillance, and environmental monitoring applications due totheir efficiency and extended flight range. In addition, advancements in imaging technology and the increasing demand for high-resolution data are further driving their adoption.

Application Insights

The geospatial mapping segment held the largest revenue share of the market in 2024. This growth is driven by the increasing demand for accurate mapping solutions across various industries. Geospatial mapping is crucial for urban planning, agriculture, and environmental monitoring applications. Furthermore, advancements in satellite and UAV technologies have enhanced the precision and efficiency of these mapping solutions. As a result, this segment is expected to maintain its leading position and drive growth in the aerial imaging industry.

The surveillance and monitoring segment is expected to grow at the highest CAGR during the forecast period. This growth can be attributed to the increasing need for real-time data collection and advanced monitoring solutions across industries. Integrating Artificial Intelligence (AI) and Machine Learning (ML) in surveillance systems has improved threat detection and response accuracy and efficiency. In addition, the increasing adoption of drone technology for border control, wildlife monitoring, and disaster response is contributing to the segment's expansion.

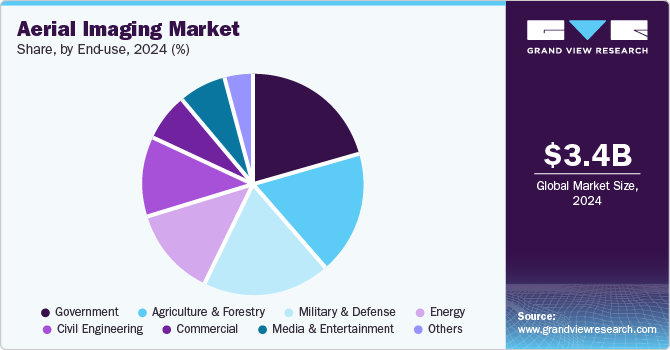

End Use Insights

The government segment held the largest revenue share of the market in 2024. This dominance can be attributed to the growing demand for advanced aerial imaging solutions in defense, law enforcement, and disaster management. Governments rely on aerial imaging for surveillance, border control, and critical infrastructure monitoring. Moreover, its use in environmental protection and urban planning significantly contributes to the growth of the aerial imaging industry. Consequently, the government segment is expected to maintain its leading position and drive market expansion in the coming years.

The media and entertainment segment is anticipated to witness the highest CAGR during the forecast period. This growth can be attributed to the increasing demand for high-quality aerial footage in film production, advertising, and virtual events. Advances in drone and UAV technology enable the capture of dynamic and visually stunning content, attracting more media companies to incorporate aerial imagery. Furthermore, the growing trend of immersive experiences, such as virtual reality and 360-degree videos, is fueling the demand for aerial imaging in the media and entertainment industry.

Regional Insights

The North America aerial imaging market held a significant revenue share of the global market in 2024. This growth is attributable to the presence of major industry players and the increasing use of aerial imaging technology in sectors such as agriculture and construction. The region is experiencing widespread adoption of advanced platforms such as drones and UAVs for high-resolution data collection. In addition, the U.S. military and civil government are expanding their use of UAVs for surveillance and reconnaissance. Furthermore, initiatives by the Federal Aviation Administration (FAA) to develop UAS test sites and foster industry partnerships are expected to accelerate growth across the region.

U.S. Aerial Imaging Market Trends

The U.S. aerial imaging market dominated the regional market in 2024. This growth is driven by the increasing use of aerial imaging technologies in the agriculture, construction, and defense sectors. Moreover, government agencies, particularly the military, increasingly utilize aerial imaging for surveillance and monitoring. With strategic investments in research and development and strong regulatory support, the U.S. is well-positioned to sustain its dominance and drive innovation in the aerial imaging industry in the coming years.

Asia Pacific Aerial Imaging Market Trends

The Asia Pacific aerial imaging market dominated the global market with a revenue share of 35.9% in 2024. This significant share is attributable to rapid urbanization and infrastructure development across key regional countries such as China and India. The increasing adoption of drones and advanced imaging technologies for agriculture, construction, and environmental monitoring applications has further fueled market growth. Furthermore, supportive government policies and investments in geospatial projects have created a favorable environment for aerial imaging solutions. As a result, the Asia Pacific region is expected to continue leading the market, driven by its expanding commercial opportunities and technological advancements.

The China aerial imaging market held the largest revenue share in the regional market in 2024. The country is home to major drone manufacturers, such as DJI, which dominate the consumer drone market. Rapid urban development and large-scale infrastructure projects fuel the demand for aerial imaging technologies across various industries. Moreover, supportive government policies and investments in advanced technologies have fostered an environment conducive to innovation and adoption. Consequently, China is expected to continue driving growth in applications such as agriculture, environmental monitoring, and urban planning within the aerial imaging market.

Middle East and Africa Aerial Imaging Market Trends

The Middle East and Africa aerial imaging market is expected to exhibit the highest CAGR during the forecast period. This growth can be attributed to rapid urbanization and significant investments in infrastructure development across the region. Countries such as the UAE and Saudi Arabia are increasingly adopting aerial imaging technologies for construction, energy, and environmental monitoring applications. Moreover, the focus on smart city initiatives further propels the demand for aerial surveys and mapping solutions to enhance urban living. As awareness of the benefits of aerial imaging grows, the market is set for substantial expansion in both commercial and government sectors.

The Kingdom of Saudi Arabia aerial imaging market held the largest revenue share in the regional market in 2024. This dominance is driven by the Vision 2030 initiative, which promotes technological advancement and infrastructure development. Major projects such as NEOM and the Red Sea Project have fueled demand for aerial imaging in planning and monitoring. In addition, integrating aerial imaging in sectors such as agriculture and strategic partnerships with global technology firms have strengthened Saudi Arabia's position as a leading player in the Middle East and Africa market.

Key Aerial Imaging Company Insights

Some key players in the aerial imaging market include Google Inc., Fugro Ltd, Nearmap Ltd, and EagleView Technologies Inc and Pictometry International Corp. These companies utilize advanced drone technology and high-resolution imaging systems to enhance their product offerings. They focus on delivering innovative solutions for construction, agriculture, and environmental monitoring applications. The growing demand for location-based services and precision agriculture drives their market growth. Overall, these firms are committed to advancing aerial imaging capabilities to meet the diverse needs of various industries.

-

Google Inc. is a key player in the aerial imaging market, utilizing its advanced mapping technologies to provide high-quality aerial imagery solutions. The company integrates AI to enhance its offerings, enabling detailed and photorealistic images for urban planning and environmental monitoring applications. Google’s Aerial View API allows users to access comprehensive aerial data.

-

Fugro Ltd is a leading provider of aerial imaging services specializing in geospatial data collection and analysis. The company employs advanced drone technology to deliver high-resolution imagery for infrastructure monitoring and environmental assessments. Combining aerial imaging with geospatial analysis helps clients make informed decisions based on accurate data.

Key Aerial Imaging Companies:

The following are the leading companies in the aerial imaging market. These companies collectively hold the largest market share and dictate industry trends:

- Google Inc.

- Cooper Aerial Surveys Co.

- Digital Aerial Solutions (DAS), LLC

- EagleView Technologies, Inc. and Pictometry International Corp.

- Fugro

- Global UAV Technologies Ltd

- Kucera International

- Nearmap

- Landiscor

- Greenman-Pedersen, Inc.

Recent Developments

-

In September 2024, Google announced updates to Google Earth and Maps, introducing historical imagery that allows users to view satellite and aerial photographs dating back as far as 80 years. This feature aims to help users explore changes in geography and urban development over time, enhancing their understanding of environmental impacts. In addition, Google expanded its Street View capabilities to nearly 80 countries, providing new imagery for many locations. The updates included improvements in image quality through advanced AI models, resulting in clearer and more vibrant visuals across the platforms.

-

In February 2024, Fugro was selected to map Italy's coastal habitats for the Marine Ecosystem Restoration (MER) Project. This initiative aims to restore marine habitats and enhance conservation efforts as part of the Italian government's National Recovery and Resilience Plan. Fugro partnered with Compagnia Generale Ripreseaeree to utilize advanced technology, including aerial imaging and remote sensing, to map seagrass meadows comprehensively.

Aerial Imaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.88 billion

Revenue forecast in 2030

USD 8.24 billion

Growth rate

CAGR of 16.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Platform, application, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, Australia, South Korea, Brazil, South Africa, Saudi Arabia, UAE

Key companies profiled

Google Inc.; Cooper Aerial Surveys Co.; Digital Aerial Solutions (DAS), LLC; EagleView Technologies, Inc. and Pictometry International Corp.; Fugro; Global UAV Technologies Ltd; Kucera International; Nearmap; Landiscor; Greenman-Pedersen, Inc (GPI)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aerial Imaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global aerial imaging market report based on platform, application, end use, and region:

-

Platform Outlook (Revenue, USD Billion, 2018 - 2030)

-

Fixed Wing Aircraft

-

Helicopter

-

UAV

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Geospatial Mapping

-

Disaster Management

-

Energy and Resource Management

-

Surveillance and Monitoring

-

Urban Planning

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Government

-

Military and Defense

-

Energy

-

Agriculture and Forestry

-

Civil Engineering

-

Media and Entertainment

-

Commercial

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.