- Home

- »

- Automotive & Transportation

- »

-

Aerial Work Platform Market Size And Share Report, 2030GVR Report cover

![Aerial Work Platform Market Size, Share & Trends Report]()

Aerial Work Platform Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Boom, Scissor), By Propulsion Type (ICE, Electric), By Application (Construction, Utilities), By Lifting Height, By Region And Segment Forecasts

- Report ID: GVR-4-68039-127-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Aerial Work Platform Market Summary

The global aerial work platform market size was valued at USD 17.46 billion in 2022 and is projected to reach USD 33.78 billion by 2030, growing at a CAGR of 8.9% from 2023 to 2030. The expansion of the construction industry, particularly in emerging economies, is the primary factor driving the market.

Key Market Trends & Insights

- The North America region witnessed a significant aerial work platform market share of over 38.0% in 2022.

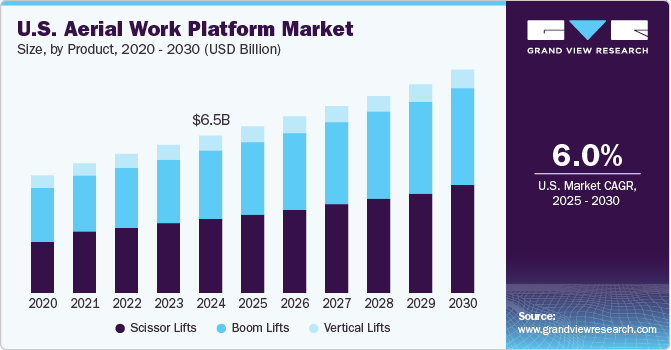

- The aerial work platform market in the U.S. is expected to grow at a significant CAGR over the forecast period.

- On the basis of product, scissor lifts segment accounted for 46.0% of the revenue share in 2022.

- On the basis of propulsion type, the ICE segment accounted for 63.0% of the revenue share in 2022.

- On the basis of lifting height, the more than 51ft segment accounted for a share of 43.0% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 17.46 Billion

- 2030 Projected Market Size: USD 33.78 Billion

- CAGR (2023-2030): 8.9%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

Rapid urbanization, infrastructure development projects, and the necessity for maintaining and repairing existing structures have fueled the demand for efficient and secure aerial lifts. These platforms enable workers to easily access elevated areas, enhancing productivity and safety standards on construction sites. Aerial Work Platforms (AWPs) serve to access remote heights, providing access for people, equipment, or a combination of both to inaccessible areas.They are predominantly utilized in construction and maintenance work across various industries, facilitating tasks, such as product placement, goods storage in warehouse units, and other applications. Technological advancements have significantly enhanced the functionality and efficiency of AWPs. Manufacturers are incorporating innovative features, such as telescopic booms, articulating arms, self-leveling capabilities, and advanced control systems. These developments have expanded the applications of AWPs and improved their overall performance, making them more attractive to end-users. For instance, automated warehouses have become increasingly popular in developed countries, necessitating the use of numerous single-scissor lifts, double-scissor lifts, and other lifting tables for product and pallet placement.

As a result, substantial funding, and investment in the construction of warehouse buildings by various e-commerce and logistics companies across the globe contribute significantly to the overall market growth.Economic conditions and geopolitical factors play a role in shaping the AWP market. Economic downturns, recessions, or fluctuations in currency exchange rates can impact construction and infrastructure development projects, leading to reduced demand for AWPs. In addition, geopolitical tensions, trade disputes, and regulatory uncertainties can affect global supply chains, making it challenging for manufacturers to procure raw materials and distribute their products efficiently.

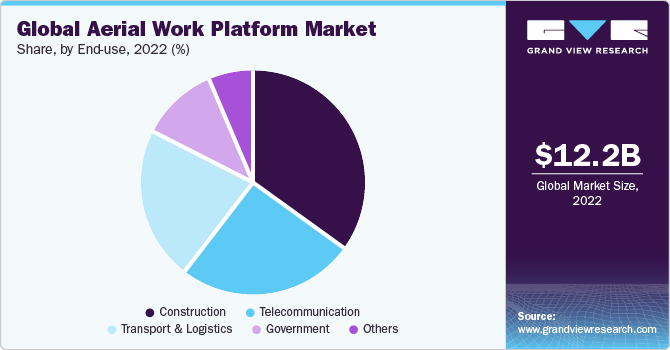

The market is projected to experience substantial growth due to extensive product usage across various industries, including transportation, logistics, retail, storage, construction, and warehousing. With their versatility, diverse applications, and maneuverability around obstacles, boom lifts are expected to be in high demand, especially for maintaining electric utilities, telecommunications, and construction projects. As a result, the growing importance of efficient and safe elevated work solutions will drive the demand for AWPs over the forecast period.

Moreover, the American National Standards Institute (ANSI) introduced new regulations in December 2018 that apply to all operators, owners, and supervisors of aerial lifts, including scissor lifts, boom lifts, as well as under-bridge inspection machines. These standards aim to improve safety measures and align North American equipment standards with international norms. By adopting these standards, companies, and equipment manufacturers can enhance their competitiveness in the global marketplace.

Product Insights

On the basis of product, scissor lifts dominated the market and accounted for over 46.0% of the global revenue share in 2022.This segment's growth can be attributed to the scissor lift's affordability and excellent operational efficiency due to its compact design and capacity to perform rapid loading tasks. Scissor lifts are widely utilized for material positioning and vertical lifting, offering ergonomic designs that enhance worker productivity and minimize the risk of workplace injuries. These favorable qualities contribute significantly to the growth of this segment.

However, the boom lifts segment is expected to register the highest CAGR over the forecast period. Industrial facilities, including manufacturing plants, warehouses, and power stations, require regular maintenance and repair work at elevated heights. Boom lifts offer a safe and efficient solution for technicians and workers to access and service equipment, machinery, and infrastructure. The growing emphasis on preventive maintenance and adherence to safety regulations is fueling the demand for boom lifts in the industrial sector. Hence, such factors are anticipated to provide growth opportunities.

Propulsion Type Insights

On the basis of propulsion type, the ICE segment dominated the market and accounted for over 63.0% of the global revenue share in 2022. The segment is primarily fuelled by the increased demand for diesel engine-operated lifts used in outdoor applications with heavy loads. These AWPs are designed to withstand demanding loading conditions, enabling them to reach greater heights and carry heavier loads. They are primarily utilized in construction settings and are more oriented toward the construction industry compared to their electric counterparts. ICE AWPs overcome a significant drawback of electric AWPs, which is their limited usability in remote locations. ICE AWPs can be effectively deployed in such settings due to their hydraulic systems that enable heavy-duty applications.

However, theelectric segment is expected to register the highest CAGR over the forecast period. The main application of electric AWPs is indoors due to their superior maneuverability with a smaller turning radius. Over the forecast period, there is expected to be a significant growth rate for electric aerial lifts due to their zero emissions and high capacity. These electric lifts are designed to be compact, making them ideal for warehouse operations that involve navigating narrow aisles and confined spaces. Electric AWPs experience less downtime than their diesel counterparts since they have fewer components, resulting in substantially reduced maintenance costs. In addition, the absence of a hydraulic system in electric AWPs prevents overheating issues, which can limit the operating time of diesel-powered lifts.

Lifting Height Insights

On the basis of lifting height, the more than 51ft segment accounted for the largest market share of over 43.0% in 2022. Aerial work platforms with lifting heights exceeding 51ft are essential for tasks, such as wind turbine installation, inspection, and maintenance, as well as solar panel installation on rooftops and large-scale solar farms. The growing renewable energy sector is fuelling the need for advanced AWPs that can reach greater heights. With a focus on worker safety, efficiency, and accessibility to elevated areas, the demand for specialized AWPs with higher lifting capacities is projected to increase, driving the segment growth.

However, the less than 20 ft segment is expected to lead the market with the highest CAGR over the forecast period. AWPs with lower lifting heights are versatile machines that can be employed in a wide range of applications. They are suitable for various industries, including construction, maintenance, electrical work, HVAC installations, and more. Their flexibility allows workers to efficiently reach elevated areas for tasks, such as repairs, installations, inspections, and maintenance. By using a single AWP for multiple purposes, productivity is enhanced, and the requirement for additional equipment is minimized.

Application Insights

On the basis of application, the construction segment dominated the market with a share of over 56.0% in 2022 and is expected to register the highest CAGR over the forecast period. Construction sites involve accessing higher heights and majorly use rough terrain aerial platforms. These sites are prone to accidents related to workers operating at high heights. AWPs offer increased safety and flexibility to workers and operators as compared to conventional solutions. Increasing construction activities in developing countries, such as China, India, and Brazil, are expected to drive the demand for AWPs. By utilizing AWPs, workers can access elevated areas without the need for ladders, scaffolding, or other risky methods.

The transportation and logistics sectors are projected to grow at significant CAGRs over the forecast period. A rising number of supermarkets and the growing e-commerce industry have increased the number of warehouses and logistic centers around the globe. Growing e-commerce businesses and rapid globalization have boosted trade activities around the globe, which are expected to drive the demand for AWPs. In addition, manufacturing facilities require timely maintenance as well as repair. These facilities need an AWP platform to carry out maintenance work of machinery and material handling equipment. AWPs facilitate improved access to difficult-to-reach areas in manufacturing plants and other commercial places.

Regional Insights

The North America region witnessed a significant market share of over 38.0% in 2022. This growth is attributed to the rapidly increasing investments in the construction of various commercial and residential complexes. In addition, the IT and telecom sectors in the U.S. & Canada are expected to support the usage of AWPs for setting up telecom towers and maintenance and repair operations at big heights; thus the development of the logistics and supply chain sector led to the establishment of distribution centers, warehouses, and retail location, augmenting the demand for AWPs. The U.S. market is expected to grow rapidly over the forecast period owing to factors, such as rapid investments in the logistics industry and rapid infrastructural development of clean energy systems.

Furthermore, the U.S. government is investing heavily in the installation of solar panels and windmills for power generation as per its various sustainable energy initiatives. Installation, fittings, and maintenance of such structures require lifting workers at great heights, wherein AWPs prove beneficial, thus driving the market growth.However, Asia Pacific is expected to register the highest CAGR over the forecast period. Asia Pacific is characterized by increasing government investments toward infrastructure development and the construction of affordable residences for the rising population, which is anticipated to contribute to the product demand for AWPs.

Rapid development in the logistics and supply chain sector, coupled with the rising e-commerce involving the construction of warehouses and large retail centers, is expected to drive product demand for the forecasted period. Rapid development in the logistics, retail, and warehousing sector in terms of automation is projected to drive product demand in China. China-based companies are installing AWPs to reduce the industrial fatalities caused due to high-rise operations, thus augmenting the market growth.

Key Companies & Market Share Insights

Key manufacturers focus majorly on offering quality-certified equipment to ensure the safety and protection of workers. In addition, companies are investing in the research & development of advanced-quality AWPs. Moreover, companies operating in the market are also involved in mergers & acquisitions to diversify their presence and gain higher market shares. For instance, in February 2023, MEC announced the launch new electric NANO10-XD. It is an electric scissor lift that includes a standard Xtra Deck for maneuvering in tight spaces, such as 2-foot by 2-foot ceiling grids. This compact lift is designed to minimize environmental impact by eliminating the risk of oil leaks through its all-electric lift, steer, and drive system.Some of the prominent players in the global aerial work platform market include:

-

AICHI CORPORATION

-

Advance Lifts, Inc.

-

Altec Industries

-

Bronto Skylift

-

DINOLIFT OY

-

EdmoLift AB

-

HAULOTTE GROUP

-

JLG Industries

-

Linamar Corporation

-

MEC

-

RUNSHARE Heavy Industry Company, Ltd.

-

Tadano Ltd.

-

Terex Corporation

-

WIESE USA

-

Zhejiang Dingli Machinery Co., Ltd. (DINGLI)

Aerial Work Platform Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 18.55 billion

Revenue forecast in 2030

USD 33.78 billion

Growth rate

CAGR of 8.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

June 2023

Quantitative units

Revenue in USD million/billion, Volume in Units, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking/share, competitive landscape, growth factors, and trends

Segments covered

Product, propulsion type, lifting height, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Mexico; Argentina; U.A.E.; Saudi Arabia; South Africa

Key companies profiled

AICHI CORPORATION; Advance Lifts, Inc.; Altec Industries; Bronto Skylift; DINOLIFT OY; EdmoLift AB; HAULOTTE GROUP; JLG Industries; Linamar Corp.; MEC; RUNSHARE Heavy Industry Company, Ltd.; Tadano Ltd.; Terex Corp.; WIESE USA; Zhejiang Dingli Machinery Co., Ltd. (DINGLI)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aerial Work Platform Market Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the aerial work platform market based on product, propulsion type, lifting height, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030) (Volume, Units)

-

Boom Lifts

-

Scissor Lifts

-

Vertical Lift

-

-

Propulsion Type Outlook (Revenue, USD Million, 2018 - 2030)

-

ICE

-

Electric

-

Air

-

-

Lifting Height Outlook (Revenue, USD Million, 2018 - 2030)

-

Less than 20 ft

-

21-50 ft

-

More than 51 ft

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Construction

-

Utilities

-

Logistics & Transportation

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030) (Volume, Units)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa (MEA)

-

U.A.E.

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global aerial work platform market size was estimated at USD 17.46 billion in 2022 and is expected to reach USD 18.55 billion in 2023.

b. The aerial work platform market is expected to grow at a compound annual growth rate of 8.9% from 2023 to 2030 to reach USD 33.78 billion by 2030.

b. North America led the market and accounted for over 38% of the global revenue in 2022 owing to rapidly rising investments in construction of various residential and commercial complexes.

b. Some of the key players operating in the aerial work platform market include Terex Corporation, MEC, JLG Industries, Galmon (Singapore), Aichi Corporation, EdmoLift AB, Wiese USA, Linamar Corporation, Advance Lifts, Inc., and Haulotte Group

b. The key factors driving the aerial work platform market include increasing constructional and infrastructural activities & increasing constructional and infrastructural activities across the globe.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.