- Home

- »

- Advanced Interior Materials

- »

-

Aerogel Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![Aerogel Market Size, Share & Trends Report]()

Aerogel Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Silica, Polymers, Carbon), By Form (Blanket, Particle), By End-use, By Technology (Supercritical Drying), By Region, And Segment Forecasts

- Report ID: 978-1-68038-792-6

- Number of Report Pages: 121

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Aerogel Market Summary

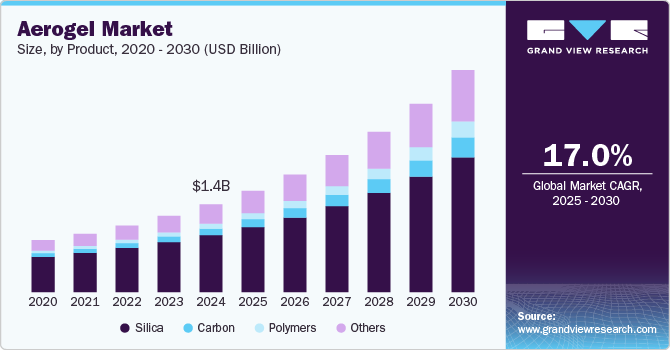

The global aerogel market size was estimated at USD 1.38 billion in 2024 and is projected to reach USD 3.49 billion by 2030, growing at a CAGR of 17.0% from 2025 to 2030. Aerogels, known for their lightweight, insulating, and highly porous nature, have found use across various industries, including construction, aerospace, automotive, and electronics.

Key Market Trends & Insights

- North America aerogel market dominated the industry and accounted for 44.4% of global revenue in 2024.

- The U.S. aerogel market is experiencing significant growth driven by material science and technology advancements.

- By product, the silica segment accounted for the largest market revenue share of 64.9% in 2024.

- By form, the blanket segment accounted for the largest market revenue share of 65.4% in 2024.

- By end use, the oil & gas segment accounted for the largest market revenue share of 61.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.38 billion

- 2030 Projected Market Size: USD 3.49 billion

- CAGR (2025-2030): 17.0%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

As global energy consumption continues to rise, there is a pressing need for solutions that reduce energy loss. Aerogels offer exceptional thermal insulation properties, making them ideal for building insulation and thermal protection in industrial processes.

Aerogels are low-density materials that exhibit unique properties and are available in solid form. These are traditionally manufactured by using supercritical drying technology. However, advanced technologies have been developed to produce more efficient results. These are made by removing liquid from a gel using a specific procedure, resulting in a 3D nanoporous structure with an air range from 80 to 99%. These can be manufactured from any material but are commonly manufactured using silica called silica aerogel. However, some other materials used in their manufacturing are silica, polymer, and carbon, among others.

The aerospace and defense sectors represent a crucial aerogel market, requiring lightweight materials that can withstand extreme temperatures and conditions. Aerogels are increasingly utilized in spacecraft, aircraft insulation, and protective gear for military applications. The emphasis on weight reduction to improve fuel efficiency and overall performance in these sectors drives demand for aerogel products, positioning them as essential materials in high-performance applications.

In addition, the growing awareness of environmental issues and the shift towards sustainable materials are pivotal in shaping the market. As industries strive to minimize their ecological footprint, aerogels provide a viable solution due to low density and high efficiency. Furthermore, ongoing research into bio-based aerogels and environmentally friendly production methods is likely to attract additional investment and interest, propelling the market forward. As sustainability becomes a priority, aerogels are well-positioned to benefit from this trend, reinforcing their role as a transformative material in various applications.

The manufacturers have agreements with suppliers, distributors, exporters, or online sellers to disburse the product in the market. Efficient distribution is one of the major challenging factors responsible for the slow expansion of manufacturers in foreign markets. The high production cost involved in aerogel manufacturing and its fragility and delicacy associated with transportation in distant locations involved in the final delivery are likely to restrict its growth to an extent over the forecast timeframe.

In addition, innovations in production techniques have led to improved scalability and reduced costs, making aerogels more accessible to a broader range of industries. For example, sol-gel processes and supercritical drying methods have been refined, resulting in higher-quality aerogels with tailored properties. This technological progress not only boosts production efficiency but also enables the customization of aerogels for specific applications, further expanding their market potential.

Product Insights

The silica segment accounted for the largest market revenue share of 64.9% in 2024. Silica aerogels have attracted increased traction worldwide due to their efficient chemical properties and their existing and potential applications in various technological areas. These gels are nanostructured materials with high specific surface areas, increased porosity, low density, reduced dielectric constant, and excellent heat insulation properties.

The demand for polymer aerogels is anticipated to witness the fastest growth with a CAGR of 22.0% worldwide during the forecast period, owing to their higher chemical and physical benefits than silica aerogels. Polymer aerogels are used in defense applications, electronic substrates, building and construction applications, vehicle interiors, and antennas. Polymers, when developed in a monolithic form, are mechanically robust and, thus, tend to drop a few advantages silica provides, including transparency and low thermal conductivity.

The carbon product segment is projected to register a CAGR of 20.2% over the forecast period. This market segment's growth can be attributed to the rising use of carbon aerogels in energy storage applications. These aerogels have high mass-specific surface areas and electrical conductivity and offer excellent environmental compatibility. They have low chemical inertness, which makes them promising materials for use in catalysis, distillation, sorbent, and energy storage applications.

Form Insights

The blanket segment accounted for the largest market revenue share of 65.4% in 2024. Aerogel blankets are composed of silica aerogel, known for its exceptional thermal resistance and low density. This combination makes them ideal for applications requiring superior insulation, such as aerospace, construction, and oil and gas industries. As energy efficiency becomes a priority globally, the need for effective insulation solutions has spurred innovation and the adoption of aerogel blankets.

The panel segment is anticipated to register the fastest CAGR of 21.5% over the forecast period. Aerogel panels are typically made from silica aerogels, which offers remarkable thermal insulation properties, making them suitable for various applications. These panels are increasingly used in construction, automotive, and aerospace sectors, where energy efficiency and weight reduction are critical factors. The growing awareness of sustainable building practices and energy conservation has further driven the demand for aerogel panels.

End-use Insights

The oil & gas segment accounted for the largest market revenue share of 61.0% in 2024. Aerogels are highly porous materials known for their low density, high thermal insulation capabilities, and excellent mechanical strength. These characteristics are precious in the oil and gas sector, where efficient thermal management is crucial for drilling, transportation, and refining operations. The ability of aerogels to withstand extreme temperatures while providing insulation helps reduce energy consumption and improve safety in oil and gas facilities.

Performance coatings are anticipated to register the fastest CAGR of 18.4% over the forecast period. The growing focus on sustainability and energy efficiency drives the adoption of aerogel-based performance coatings. As industries seek to reduce their carbon footprint, incorporating aerogels into coatings aligns with these goals by minimizing energy consumption in heating and cooling applications. In addition, advancements in aerogel production techniques are making these materials more cost-effective and accessible, encouraging their use in a broader range of applications.

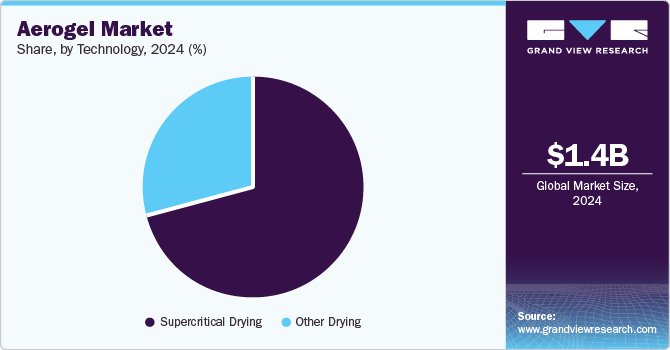

Technology Insights

The supercritical drying segment led the market and accounted for a 71.3% share of the global revenue in 2024 since it enables the preservation of their three-dimensional pore structures. This leads to unique properties such as high porosity, low density, and large surface area of aerogels. Supercritical drying, defined as the extraction of solvents from pores of aerogels using supercritical fluids, is a popular method for drying wet gels.

Supercritical drying is essential for scaling up laboratory drying units to pilot and industrial scales and assessing the production economics of aerogels on an industrial scale. High-temperature supercritical drying using organic solvents is also the best way to minimize shrinkage, allowing supercritical drying to have a lower density than carbon dioxide.

The other technologies for the market include ambient pressure drying with matrix strengthening technology and freeze-drying technology. These technologies are used to produce different types of aerogels. They remove liquid and replace it with air while preserving the original structure.

Freeze-drying is another technology that can be used to dry wet gels. In this technology, solvents inside pores are frozen by lowering the temperature below the freezing point of solvents. Subsequently, the solvent pressure is generally reduced below the sublimation pressure at this temperature by pulling a vacuum on the system.

Regional Insights

North America aerogel market dominated the industry and accounted for 44.4% of global revenue in 2024, owing to increasing demand from industries, including aerospace, building & construction, automotive, and oil & gas. The market in North America exhibits considerable growth potential in terms of application development, quality, and product innovation for the market, whereas the demand is driven by its superior insulation and low thermal conductivity properties.

U.S. Aerogel Market Trends

The U.S. aerogel market is experiencing significant growth driven by material science and technology advancements. As a highly efficient insulator, aerogel's unique properties, such as low density and high thermal resistance, make it a suitable choice for various applications, including aerospace, construction, and automotive industries. The increasing demand for energy-efficient solutions in building materials and insulation systems is propelling the adoption of aerogel products, as they provide superior thermal performance compared to traditional materials.

Middle East & Africa Aerogel Market Trends

The Middle East & Africa aerogel market is anticipated to register the fastest CAGR of 20.1% over the forecast period. Countries such as the UAE and Saudi Arabia are investing heavily in infrastructure projects, including smart cities and sustainable buildings. For instance, the construction of mega-projects such as the Neom City in Saudi Arabia emphasizes energy efficiency and advanced materials, leading to increased adoption of aerogel insulation for its superior thermal performance. This trend reflects a broader shift towards modern, eco-friendly construction practices prioritizing sustainability.

Asia Pacific Aerogel Market Trends

Asia Pacific aerogel market is anticipated to grow significantly over the forecast period. As governments and businesses prioritize sustainability, the demand for innovative materials that reduce carbon footprints escalates. In Japan, for instance, manufacturers are increasingly utilizing aerogels in thermal insulation applications for various products, including refrigerators and HVAC systems. This shift towards sustainable practices aligns with environmental regulations and meets consumer preferences for greener products, driving the adoption of aerogels.

The China aerogel market is experiencing substantial growth due to the booming aerospace and automotive sectors. As these industries prioritize lightweight materials to improve fuel efficiency and performance, aerogels are emerging as an attractive solution due to their low density and high strength-to-weight ratio. Chinese aerospace manufacturers, such as COMAC (Commercial Aircraft Corporation of China), are exploring using aerogels in various applications, from thermal protection systems to lightweight structural components. The automotive industry is also witnessing increased interest in aerogels for sound insulation and energy efficiency, further propelling market growth.

Europe Aerogel Market Trends

The aerogel market in Europe is experiencing notable growth, primarily fueled by stringent energy efficiency regulations and a strong commitment to sustainability. European nations are at the forefront of implementing policies to reduce greenhouse gas emissions, prompting industries to seek advanced materials to enhance energy performance. For instance, the European Union's Green Deal emphasizes reducing energy consumption in buildings, leading to increased adoption of aerogel insulation materials in residential and commercial construction. Projects such as refurbishing historic buildings in cities such as Amsterdam incorporate aerogels to improve energy efficiency without compromising aesthetics, highlighting their practical application in energy-conscious renovations.

Key Aerogel Company Insights

Some of the key players operating in the market include Aspen Aerogels, Inc., Cabot Corporation, Aerogel Technologies, LLC, and others:

-

Aspen Aerogels, Inc. provides advanced aerogel materials renowned for their exceptional thermal insulation properties and lightweight design. The company specializes in developing high-performance aerogel products for various industries, including oil and gas, construction, automotive, and aerospace. Aspen’s flagship product, Pyrogel, is used for industrial insulation, while Cryogel caters to cryogenic applications. These innovative materials offer significant energy savings and safety benefits, making Aspen Aerogels a key player in promoting sustainability and efficiency across multiple sectors.

-

Cabot Corporation is a global specialty chemicals and performance materials company recognized for its innovative solutions across various industries, including electronics, energy, and transportation. The company offers diverse products, including carbon blacks, fumed silica, and aerogels. Its aerogel products, particularly in aerogel-based insulation materials, are designed to provide outstanding thermal performance, lightweight characteristics, and versatility for applications in oil and gas, building and construction, and automotive sectors.

Key Aerogel Companies:

The following are the leading companies in the aerogel market. These companies collectively hold the largest market share and dictate industry trends.

- Aspen Aerogels, Inc.

- Cabot Corporation

- Aerogel Technologies, LLC

- Active Aerogels, LDA

- BASF

- JIOS Aerogel Corporation

- Nano Technology Co., Ltd.

- Dow

- Enersens

Aerogel Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.59 billion

Revenue forecast in 2030

USD 3.49 billion

Growth rate

CAGR of 17.0% from 2025 to 2030

Base year for estimation

2024

Actual estimates/Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Regional Scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Germany; UK; China; Japan; Brazil

Segments covered

Product, technology, form, end-use, region

Key companies profiled

Aspen Aerogels, Inc.; Cabot Corporation; Aerogel Technologies, LLC; Active Aerogels; LDA; BASF; JIOS Aerogel Corporation; Nano Technology Co., Ltd.; Dow; Enersens

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aerogel Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global aerogel market on the basis of product, technology, form, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Silica

-

Polymers

-

Carbon

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Supercritical Drying

-

Other Drying

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Blanket

-

Particle

-

Panel

-

Monolith

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Oil & Gas

-

Building & Construction

-

Automotive, Aerospace & Marine

-

Performance Coatings

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Belgium

-

Poland

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global aerogel market size was estimated at USD 1.38 billion in 2024 and is expected to reach USD 1.59 billion in 2025.

b. The global aerogel market is expected to grow at a compound annual growth rate of 17.0% from 2025 to 2030, reaching USD 3.49 billion by 2030.

b. Silica dominated aerogel market with a share of 64.9% in 2024, owing to its use in thermal insulation systems in aerospace, transparent window systems, environment clean-up & protection systems applications

b. Some of the key players operating in the aerogel market include Aspen Aerogels, Inc., Cabot Corporation, Aerogel Technologies, LLC, Active Aerogels, LDA, and BASF SE.

b. The key factor driving the aerogel market is the growing applications of oil & and gas, construction, automotive, aerospace, marine, and performance coatings.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.