- Home

- »

- Advanced Interior Materials

- »

-

Aerogel Market Size, Share, Growth & Trends Repot, 2030GVR Report cover

![Aerogel Market Size, Share & Trends Report]()

Aerogel Market Size, Share & Trends Analysis Report By Product (Silica, Polymers), By End-use (Performance Coatings, Oil & Gas), By Form (Blanket, Panel), By Technology, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-792-6

- Number of Pages: 121

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Advanced Materials

Report Overview

The global aerogel market size was estimated at USD 1.04 billion in 2022 and is expected to register a growth of 16.3% over the forecast period. In terms of properties, it offers superior thermal resistance, lightweight, very low density, fire-resistance, and excellent thermal insulation wherein it is widely used across varied applications. In accordance with the properties, aerogels are manufactured in several forms such as blankets, particles, panels, and monolith.

Aerogels can be molded into thin films or monoliths and used in thermal insulation, acoustic, thin-film coatings, vibration damping, or any place where structural foam is required in case of automotive purposes. The automotive industry is shifting from internal combustion engines (ICEs) to fully electric and automatic moving machines earlier the companies focused on one of the specified parameters in a vehicle, including efficiency, comfort, performance, or safety however, with the help of aerogels all these requirements can be clubbed together in a vehicle, thus, making them an ideal raw material for automotive use.

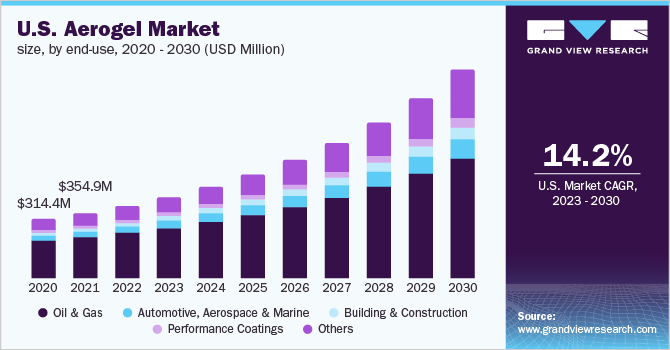

The U.S. holds a strong dominance in the market owing to the increased awareness among manufacturers regarding the benefits of aerogels as compared to other insulating materials. The key players are constantly working on research and development for improving the products with support from the government for funding the research. With the well-established aerospace, marine, automobiles, building and construction, performance coating, oil and natural gas industry in the U.S., the use of aerogels for these applications prevails in high volume.

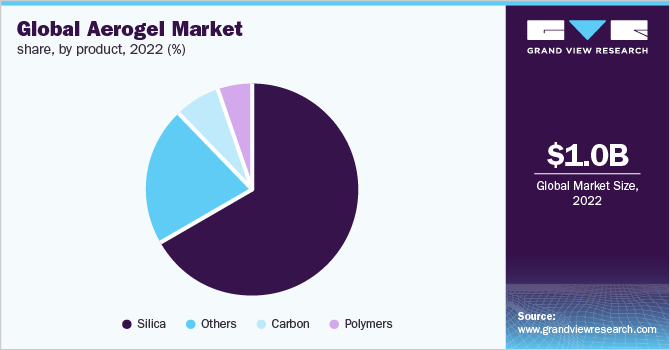

Aerogels are low-density materials that exhibit unique properties and are available in solid form. These are traditionally manufactured by using supercritical drying technology. However, advanced technologies have been developed for more efficient results. These are made by removing liquid from a gel by using a specific procedure, which results in a 3D nanoporous structure with an air range from 80 to 99%. These can be manufactured from any material but are commonly manufactured using silica and termed as silica aerogel. However, some of the other materials used in their manufacturing are silica, polymer, and carbon, among others.

The manufacturers have agreements with suppliers, distributors, exporters, or online sellers for the disbursal of the product in the end-use market. Efficient distribution is one of the major challenging factors responsible for the slow expansion of manufacturers in foreign markets. The high production cost involved in the manufacturing of aerogel as well as its fragility and delicacy associated with the transportation in distant locations involved in the final delivery is likely to restrict its growth to an extent over the forecast timeframe.

Product Insights

Silica segment led the market and accounted for more than 66% share of the global revenue in 2022. Silica aerogels have attracted increased traction worldwide owing to their efficient chemical properties and their existing and potential applications in a wide variety of technological areas. These gels are nanostructured materials, with high specific surface areas, increased porosity, low density, reduced dielectric constant, and excellent heat insulation properties.

The demand for polymer aerogels is anticipated to witness the fastest growth worldwide during the forecast period owing to their higher chemical and physical benefits compared with silica aerogels. Polymer aerogels are used in defense applications, electronic substrates, building and construction applications, vehicle interiors, and antennas. Polymer when developed in a monolithic form, are mechanically robust and thus, tend to drop a few advantages provided by silica including transparency and low thermal conductivity.

Carbon product segment is projected to register a CAGR of 19.4% in terms of value over 2022-2030. The growth of this segment of the market can be attributed to the rising use of carbon aerogels in energy storage applications. These aerogels have high mass-specific surface areas and electrical conductivity and offer excellent environmental compatibility. They have low chemical inertness, which makes them promising materials for use in catalysis, distillation, sorbent, and energy storage applications.

Some drawbacks of carbon aerogels in terms of their intended applications include their brittleness and shrinkage during fabrication. In attempts to combat these issues, the product can be reinforced with carbon fibers to decrease their shrinkage and increase their flexibility. These reinforced carbon aerogels can be made by impregnating RF solutions into carbon fibers, followed by the supercritical drying process. The aforementioned factors are expected to boost market demand.

Technology Insights

Supercritical drying segment led the market and accounted for more than 72.8% share of the global revenue in 2022 since it enables preservation of their three-dimensional pore structures. This leads to unique properties such as high porosity, low density, and large surface area of aerogels. Supercritical drying is defined as the extraction of solvents from pores of aerogels using supercritical fluids, is a popular method for drying wet gels.

The process of supercritical drying is important for scaling up laboratory drying units to pilot and industrial scales and assessing the production economics of aerogels on an industrial scale. High-temperature supercritical drying using organic solvents is also the best way to minimize shrinkage, allowing for supercritical drying to have a density lower than carbon dioxide.

The other technologies present for aerogel market include ambient pressure drying with matrix strengthening technology and freeze-drying technology. These technologies are used for the production of different types of aerogels. They are used to remove liquid and replace it with air while preserving the original structure.

Freeze-drying is another technology that can be used to dry wet gels. In this technology, solvents inside pores are frozen by lowering the temperature below the freezing point of solvents. Subsequently, the solvent pressure is reduced below the sublimation pressure at this temperature generally by pulling a vacuum on the system.

Form Insights

Blanket aerogels segment led the market and accounted for USD 696.7 million of the global revenue in 2022 as they offer thermal insulation in buildings as well as apparel owing to their well-suited properties required in insulation such as high-breathability, water repellency, low-dusting & low-powdering, and light diffusion. The presence of such characteristics is expected to boost the demand for blanket aerogel market.

Particle aerogel segment is anticipated to witness substantial growth over the forecast period owing to its efficient chemical and physical properties over blankets aerogels. These products have a variety of applications in defense, electronic substrates, building and construction, transport interiors, and antennas.

Rising necessity toward building safe, reliable, and energy-efficient system as the energy spent on heating or cooling is wasted owing to ineffective thermal envelopes is driving the market growth. Aerogel particles enable the commercialization of high-performance insulating systems owing to their low-cost and limited carbon emission which lead to better energy efficiency. These factors are anticipated to boost the growth of the particle aerogel segment over the forecast period.

Aerogel Panels segment is projected to register a CAGR of 20.7% in terms of value over the forecast period owing to the characteristics such as ultra-low thermal conductivity, hydrophobicity, and ease of handling. These panels are used in various applications, including military equipment insulation, high and low-temperature industrial furnaces, and insulation of boards in construction applications.

End-use Insights

In 2022 oil & gas end-use segment exhibited to be the largest market which accounted for more than 62% of the global revenue. Aerogel blankets are mostly used to improve the insulation of deep-sea pipes and oil & gas pipelines to reduce the production cost, improve pipeline compression resistance, and reduce the amount of steel used in construction. Moreover, hydrophobicity, mechanical strength, and exceptional thermal performance is further expected to fuel the application industry growth over the forecast period.

The building and construction industry was valued at USD 37.5 million in 2018 and is expected to reach USD 212.9 million by 2030, growing at a CAGR of 17.1% over the projected period. Aerogels can be used as blankets, boards, and renders in the construction industry and help maintain integrity, authenticity, compatibility, and reversibility in heritage buildings. Aerogel products are also useful in the preservation of heritage objects and help reduce energy consumption in the building sector.

Demand for aerogels is increasing in automotive, aerospace & marine end-use as labeling provides detailed information about ingredients used. NASA has found aerogel to be a keen and important material in various applications and has developed two different methodologies to make it more useful such as creating aerogel reinforced with polymers, resulting in thin-layer interior space, which strengthens the aerogel.

Automotive industry is growing, converting from internal combustion engines (ICEs) to fully electric and automatic moving machines. Earlier, companies focused on one of the specified parameters in a vehicle, including efficiency, comfort, performance, or safety. However, with the help of aerogels, all these categories can be met in a vehicle, thus, making aerogel an ideal raw material in automotive industry. Thus the use of aerogels in aerospace applications are anticipated to grow over the forecast period.

Regional Insights

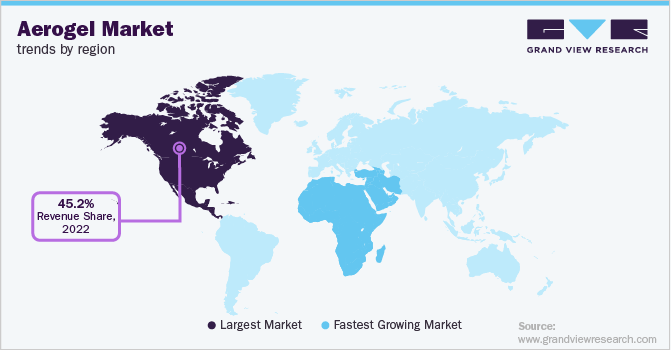

North America dominated the market and accounted for a 45.2% share of global revenue in 2022 owing to increasing demand from end-use industries including aerospace, building & construction, automotive, and oil & gas. The market in North America exhibits a huge growth potential in terms of application development, quality, and product innovation for the aerogel market, whereas the demand is driven by its superior insulation and low thermal conductivity properties.

The key factor supporting the aerogel market growth in Europe is the European Union's energy efficiency policy, which mandates all buildings across countries such as Germany, the UK, Spain, Italy, and others to reduce their energy consumption by 20%. The market growth in the region is attributed to the presence of key players such as BASF SE, Enersens, Aspen Aerogels, Inc., and Cabot Corporation.

The expansion of building & construction industry in Europe has bolstered the demand for silica aerogels as they offer low thermal conductivity, optical transparency, hydrophobicity, low bulk density, and high surface area. In countries such as Germany, Italy, the UK, and Spain, the governments have taken initiatives to develop infrastructure, boosting commercial and residential projects. This is expected to benefit the growth of silica aerogels.

Middle East & Africa is expected to witness the fastest growth with a CAGR of 19.6%, on account of widespread product application in aerospace, automotive, building & construction, and oil & natural gas industries. However, the use of alternative insulation materials such as polyurethane foam, rock wool, mineral wool, and stone wool can hamper the market growth in the region.

Key Companies & Market Share Insights

The market is moderately competitive in nature owing to the presence of a few manufacturers with strong networks across the globe. It is highly influenced by North America and the Middle East and Africa due to the presence of companies with huge investing power for continuous development. Aerogels will remain high in demand across the globe due to their chemical and physical benefits.

The high switching cost of buyers is a prominent factor contributing to the high bargaining power of the suppliers. The less number of players with their strong foothold along with their ability to provide cost-effective use of aerogels is another major factor contributing to the high supplier power. Some prominent players in the global aerogel market include:

-

Aspen Aerogels, Inc.

-

Cabot Corporation

-

Aerogel Technologies, LLC

-

Active Aerogels, LDA

-

BASF SE

-

JIOS Aerogel Corporation

-

Nano Technology Co., Ltd.

-

Dow, Inc.

-

Enersens

Aerogel Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.19 billion

Revenue forecast in 2030

USD 3.48 billion

Growth rate

CAGR of 16.3% from 2023 to 2030

Base year for estimation

2022

Actual estimates/Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, form, end-use, region

Regional Scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Germany; U.K.; China; Japan; Brazil

Key companies profiled

Aspen Aerogels, Inc.; Cabot Corporation; Aerogel Technologies, LLC; Active Aerogels; LDA; BASF SE; JIOS Aerogel Corporation; Nano Technology Co.; Ltd.; Dow, Inc.; Enersens

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aerogel Market Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global aerogel market report based on product, form, technology, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Silica

-

Polymers

-

Carbon

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Supercritical Drying

-

Others

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Blanket

-

Particle

-

Panel

-

Monolith

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Oil & Gas

-

Building & Construction

-

Automotive, Aerospace & Marine

-

Performance Coatings

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

U.K.

-

-

Asia Pacific

-

China

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global aerogel market size was estimated at USD 1.04 billion in 2022 and is expected to reach USD 1.19 billion in 2023.

b. The global aerogel market is expected to grow at a compound annual growth rate of 16.3% from 2023 to 2030 to reach USD 3.48 billion by 2030.

b. Silica dominated aerogel market with a share of 66.3% in 2022 owing to its use in thermal insulation systems in aerospace, transparent window systems, environment clean-up & protection systems applications

b. Some of the key players operating in the aerogel market include Aspen Aerogels, Inc., Cabot Corporation, Aerogel Technologies, LLC, Active Aerogels, LDA, and BASF SE

b. The key factor which is driving aerogel market is growing applications the oil & gas, construction, automotive, aerospace, marine, and performance coatings.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."