- Home

- »

- Advanced Interior Materials

- »

-

Aerospace And Defense MRO Market Size, Share Report, 2030GVR Report cover

![Aerospace And Defense MRO Market Size, Share & Trends Report]()

Aerospace And Defense MRO Market Size, Share & Trends Analysis Report By Product (Engine, Airframe, Line, Component), By Application, By End-use, By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68038-041-5

- Number of Report Pages: 206

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Advanced Materials

Report Overview

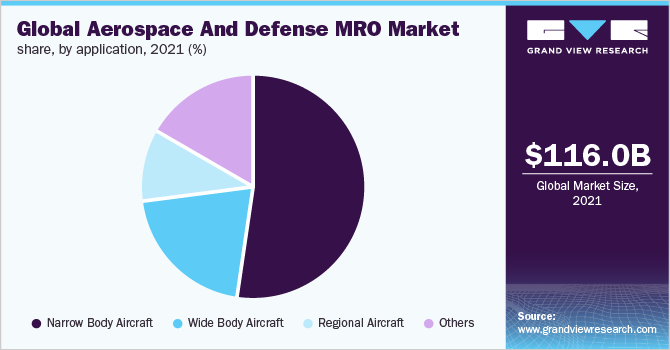

The global aerospace and defense MRO market was valued at USD 116.0 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 5.5% from 2022 to 2030. The market is anticipated to witness significant growth over the forecast period on account of a wide expansion of fleet by low-cost airlines, rising military spending, the prevalence of aging commercial and military aircraft fleets, and steady economic growth. Due to the spread of COVID-19, the demand for MRO services across the world was impacted considerably owing to the reduced utilization of aircraft. Freight operators responded to the disruption caused by COVID-19 by operating above normal utilization levels, delaying their retirements, and including new and parked airplanes into their fleets to fulfill the cargo aircraft demand.

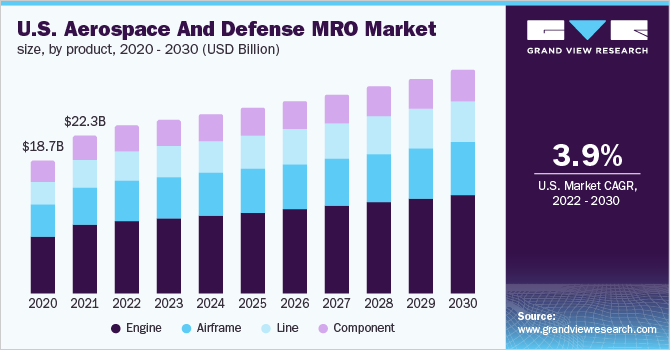

Engine MRO accounted for the largest revenue share in 2021 and is expected to maintain its lead over the forecast period. Engine OEMs continue to dominate with a variety of maintenance packages that are time-limited and life-limited, usually covering the operator’s entire fleet. In addition, the line MRO segment is expected to witness the fastest growth over the forecast period.

OEM and global third-party companies have adopted advanced predictive and preventive aircraft maintenance technologies to digitize and automate their airframe maintenance activities to enhance the overall efficiency of maintenance processes. The deployment of advanced technologies such as artificial intelligence and machine learning is expected to provide opportunities for firms to compete at the global level and reduce MRO expenses.

To maintain the high availability of aircraft and optimize the main trance cost, many large commercial airlines such as Air France KLM Group; Delta Air Lines Inc.; and Lufthansa Airlines operate their own MRO facilities to conduct basic and routine maintenance checks. MRO facilities for commercial airlines are often located in the airline's major hubs and in general, most of the facilities, do not subcontract work for other airlines.

Product Insights

The engine segment held the largest revenue share of over 40.0% in 2021. Engine MRO is inclusive of field maintenance and depot maintenance. Depot maintenance of engines consists of repair and material maintenance of engines, their complete or partial rebuilding, and part assemblies. Field maintenance involves on-equipment maintenance activities and shop works.

The airframe segment accounted for the second-largest revenue share in 2021. Several companies are entering into strategic partnerships with airlines and OEMs owing to the growing demand for the heavy maintenance of airframes from airlines.

The line segment is expected to register the highest CAGR of 6.5% over the forecast period. As the number of flights is increasing worldwide, it is expected to lead to the demand for line MRO services to carry out routine aircraft checks. The flourishing global aerospace and defense sector is one of the key factors fueling the growth of the line maintenance market across the world.

The component segment of the aerospace and defense MRO is projected to witness significant growth during the forecast period. The key factors driving this segment are rapid aircraft fleet expansions and strategic collaborations between component OEM and MRO companies for the development of new components and outsourcing of aftermarket components for aircraft activities.

End-use Insights

The commercial aviation segment accounted for the largest revenue share of over 65.0% in 2021. The demand for this segment is expected to be supported by increasing Low-cost Carrier (LCC) penetration in developing economies, growing urbanization, budding developing economy, rapidly growing international trade relations, and mandatory maintenance program for aging aircraft.

The business and general aviation MRO market is highly consolidated with few players accounting for a majority of the share and is intertwined with commercial aviation. Several companies are investing and partnering in the business aviation MRO market owing to the increased demand for high-class business and personal travel.

The military aviation segment is expected to expand at a CAGR of 4.9% from 2022 to 2030. Governments throughout the world are modernizing and maintaining their existing fleets offering contracts to OEMs that are driving collaborations among OEMs and MRO companies to develop capabilities.

The other types of aircraft include unmanned aerial vehicles (UAV) and spacecraft (manned and unmanned). These are usually termed drones. UAVs and spacecraft are expected to play an essential role in the aerospace industry owing to the increasing initiatives for outer space exploration by governments, which are expected to drive the demand for MRO services over the forecast period. These are widely used in military missions such as border surveillance.

Application Insights

Narrow-body aircraft accounted for the largest revenue share of over 50.0% in 2021. As developing countries are growing, the demand for aircraft maintenance services is also on the rise. MRO activities are essential for extending the lifespan of narrow-body aircraft and assuring their crashworthiness. These activities include routine maintenance, checks, repairs, and modifications disbursed on narrow-body aircraft and their elements.

Regional aircraft, often known as a feeder liner, is expected to expand at a CAGR of 4.3% over the forecast period. To increase the market share, regional aircraft MRO service providers are acquiring the local players and constructing new facilities at strategic locations. Several local companies are collaborating with OEMs and worldwide service providers to achieve technical skills and MRO certification to undertake on-site services on regional jets.

A wide-body aircraft has the capacity to carry a large number of passengers and is frequently used to operate long-haul and medium-haul flights. The high demand for wide-body aircraft MRO is due to the growth in long-haul routes with higher traffic, usually connecting international destinations.

Other types of aircraft including helicopters, gyrocopters, and turboprops are expected to expand at a CAGR of 4.7% in terms of revenue over the forecast period. The other aircraft MRO segment is fragmented with numerous local and international players providing various services to the existing military and civil helicopters and gyrocopters.

Regional Insights

Asia Pacific held the largest revenue share of over 30.0% in 2021 and is expected to register the fastest CAGR over the forecast period. Rapid economic growth, urbanization, the launch of new domestic airlines, low-cost labor markets such as India and China, and government support in establishing the aerospace clusters are driving the need for more aircraft and expanded aviation services in the region.

The North American market is expected to expand at a CAGR of 4.0% over the forecast period. Increasing demand for aircraft operations from the passenger and freight service sectors is expected to fuel the demand for aircraft MRO services from North America over the forecast period. MRO service providers in North America form joint ventures with each other to leverage their expertise.

Europe is one of the most liberalized regions in terms of civil aviation regulations and activities undertaken by the European Union member states. The region is one of the earliest and most affected regions in the world due to the COVID-19 pandemic. Factors such as reduction in airline fleets and lower aircraft utilization are expected to affect the growth of the aircraft engine MRO market in Europe.

The Middle East has emerged as a key player in the aerospace industry over the last two decades. The aerospace MRO market in the Middle East has witnessed a tremendous transformation over time, with a massive shift toward third-party suppliers from in-house services.

Key Companies & Market Share Insights

The presence of a limited number of certified suppliers and the increased requirement for customized and order-specific services lead to no threat of substitution in the market. The leading players are focusing on maintaining strategic relationships with aftermarket suppliers of aircraft parts to ensure uninterrupted MRO services. Moreover, declining market growth, leveling off outsourcing, and a rising number of OEMs in the aftermarket have intensified the competition. Some prominent players in the global aerospace and defense MRO market include:

-

AAR Corporation

-

SIA Engineering Company Ltd.

-

Embraer S.A.

-

Air France KLM Group

-

Raytheon Technologies Corporation

-

Delta Air Lines, Inc.

-

General Dynamics Corporation

-

MTU Aero Engines AG

-

Lufthansa Technik

-

Honeywell International Inc.

-

Spirit AeroSystems, Inc.

Aerospace And Defense MRO Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 123.2 billion

Revenue forecast in 2030

USD 187.3 billion

Growth rate

CAGR of 5.5% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East; Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; China; India; Japan; Australia; Indonesia; Malaysia; Singapore; Brazil; Argentina; UAE; Saudi Arabia

Key companies profiled

AAR Corporation; SIA Engineering Company Ltd.; Embraer S.A.; Air France KLM Group; Raytheon Technologies Corporation; Delta Air Lines, Inc.; General Dynamics Corporation; MTU Aero Engines AG; Lufthansa Technik; Honeywell International Inc.; Spirit AeroSystems, Inc.; Turkish Technic Inc.; Bombardier; Rolls-Royce plc; Hong Kong Aircraft Engineering Company Limited; GE Aviation; Boeing; Airbus; ST Engineering; Magnetic MRO

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aerospace And Defense MRO Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global aerospace and defense MRO market report based on product, application, end-use, and region:

-

Product Outlook (Revenue, USD Million; 2017 - 2030)

-

Engine

-

Airframe

-

Line

-

Component

-

-

Application Outlook (Revenue, USD Million; 2017 - 2030)

-

Narrow Body Aircraft

-

Wide Body Aircraft

-

Regional Aircraft

-

Others

-

-

End-use Outlook (Revenue, USD Million; 2017 - 2030)

-

Commercial Aviation

-

Business & General Aviation

-

Military Aviation

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

Indonesia

-

Malaysia

-

Singapore

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East

-

UAE

-

South Arabia

-

-

Africa

-

Frequently Asked Questions About This Report

b. The aerospace and defense MRO market size was estimated at USD 116.0 billion in 2021 and is expected to reach USD 123.2 billion in 2022.

b. The aerospace and defense MRO market is expected to grow at a compound annual growth rate of 5.5% from 2022 to 2030 to reach USD 187.3 billion by 2030.

b. Engine MRO led the market accounting for 40% of the revenue share on account of the critical nature of the components.

b. Some prominent players in the aerospace and defense MRO market include AAR Corporation, SIA Engineering Company Ltd., Embraer S.A., Air France KLM Group, Raytheon Technologies Corporation, Delta Air Lines, Inc., General Dynamics Corporation, MTU Aero Engines AG, Lufthansa Technik, Honeywell International Inc., and, Spirit AeroSystems, Inc.

b. The key factors that are driving the Aerospace & Defense MRO market include the launch of new domestic low-cost airlines and expansion of existing fleets, MRO outsourcing, increased focus of OEMs on aircraft MRO, growing demand from developing economies, the prevalence of aging aircraft fleet, and increased military spending.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."