- Home

- »

- Next Generation Technologies

- »

-

Aerospace And Defense Springs Market Size Report, 2030GVR Report cover

![Aerospace And Defense Springs Market Size, Share & Trends Report]()

Aerospace And Defense Springs Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Flat Spiral/Power Springs, Coil Springs, Torsion, Torque Coil, Clutch Springs, Others), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-838-1

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

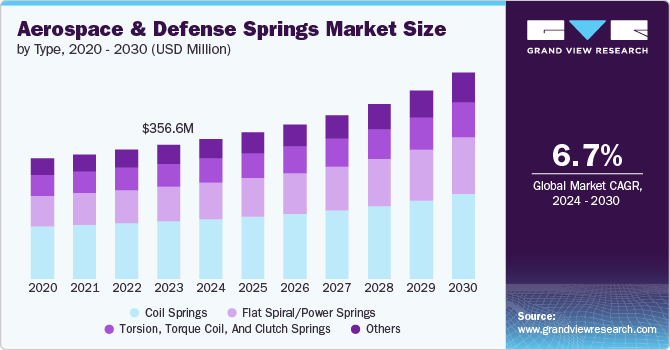

The global aerospace & defense springs market size was valued at USD 356.6 million in 2023 and is projected to register a CAGR of 6.7% from 2024 to 2030. The market is poised for significant growth over the forecast period, driven by the continued development of lightweight, high-performance aircraft while guaranteeing adequate compliance with stringent safety regulations. The growth of the market can be attributed to the vital role specialized springs can play in vibration dampening, landing gear functionality, and flight control systems. Specialized springs are emerging as a niche component of lightweight, high-performance aircraft that can help airlines save costs and improve maneuverability for military applications.

The burgeoning use of springs in aerospace and defense applications necessitates a diverse range of spring types. This demand is driving the development of corrosion-resistant, lightweight springs, and springs with extended fatigue life, all tailored to meet the specific requirements of various end-use industries and verticals. To address these evolving needs, spring manufacturers are increasingly leveraging advanced technologies to design high-precision springs.

Aircraft designs are incorporating lighter materials and demanding functionalities, creating a boom for specialized springs. Manufacturers are exploring advanced materials like high-performance alloys and composites to develop lighter springs without sacrificing performance. These lighter springs translate to significant fuel savings for airlines and enhanced maneuverability for military aircraft. Similarly, the defense sector's focus on lightweight systems like next-generation fighter jets with advanced propulsion is driving innovation in spring materials and design.

The demand for lightweight, high-performance springs is soaring in both aerospace and defense industries. For instance, the U.S. Air Force is working on the development of a new-generation fighter aircraft as part of the Next Generation Air Dominance program. This new aircraft would be powered by adaptive engine technology, which has been under development under the Next Generation Adaptive Propulsion (NGAP) program. The U.S. Air Force proposed USD 595 million to the program for NGAP in the President's Budget.

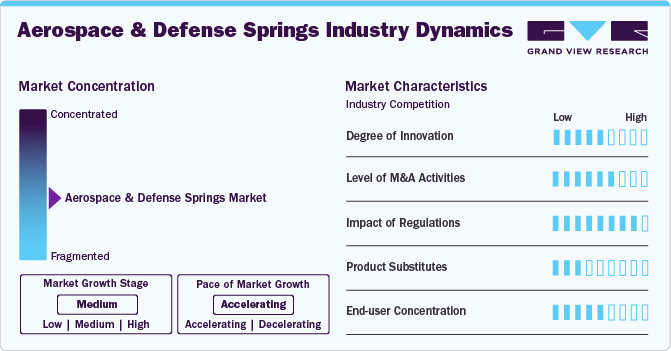

Market Concentration & Characteristics

The market is characterized by a steady stream of innovation focused on material science and manufacturing processes. Lighter, stronger, and more resilient spring designs are crucial for improving aircraft performance and fuel efficiency. Research and development efforts explore advanced materials like composites and Nickel-Titanium alloys, alongside techniques like 3D printing for complex spring geometries. These innovations not only enhance spring functionality but also enable miniaturization and integration with other components, driving the development of next-generation aerospace and defense systems.

Merger and acquisition activities in the market are moderate. Stringent quality standards and regulatory requirements create barriers to entry for new players. Existing manufacturers, however, may engage in strategic acquisitions to expand their product portfolios, access new technologies, or strengthen their presence in specific geographic regions. Consolidation can also occur as smaller players seek to compete more effectively in a cost-sensitive environment.

Strict regulations governing material quality, performance, and safety significantly impact the market. Regulatory bodies like the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA) establish rigorous testing and certification procedures that manufacturers must adhere to. These regulations ensure the reliability and safety of springs used in critical aerospace and defense applications. Stringent regulations can also hinder the adoption of new materials and technologies until they undergo thorough testing and approval processes.

While springs play a vital role in various aerospace and defense applications, there are limited direct substitutes. In specific instances, dampers or elastomeric components might offer alternative solutions, but they often lack the precise control and load-bearing capabilities of springs. The unique properties and established track record of springs make them the preferred choice for many critical functions. However, ongoing research in alternative materials and actuation technologies could potentially lead to the development of more viable substitutes in the future.

The market exhibits a relatively high degree of end-user concentration. Commercial aircraft manufacturers, contractors, and government agencies are the primary consumers of these specialized springs. The demand for springs is directly tied to the production volumes of aircraft, missiles, and other equipment. Fluctuations in government defense budgets and commercial airline investment plans can significantly impact overall market growth. Manufacturers often cultivate strong relationships with key end-users to secure long-term contracts and navigate market cycles.

Type Insights

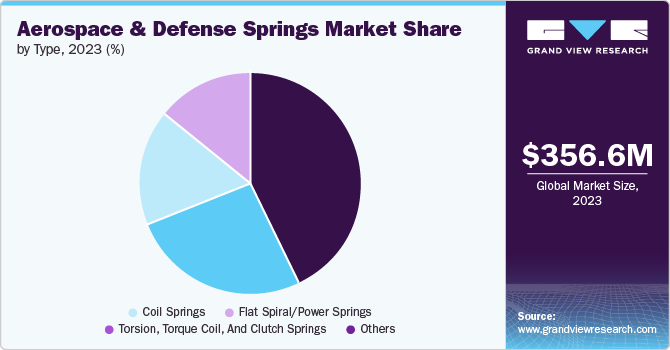

The coil springs segment dominated the market in 2023 and accounted for more than 43% share of the global revenue. Coil springs, also known as helical springs, are characterized by their distinctive helical coil design, offering unparalleled versatility and adaptability. Their distinctive helical coil design allows for various shapes, such as compression, tension, conical, and a wide range of load capacities, making them suitable for a range of critical functions within A&D systems. One of the major applications of coil springs is in an aircraft's landing gear, where coil springs act as the first line of defense, absorbing the immense impact forces generated during landing. This vital function ensures passenger and crew safety by mitigating shock that would otherwise be transmitted throughout the aircraft.

The flat spiral/power springs segment is projected to witness significant growth from 2024 to 2030. Flat spiral springs, also known as power springs or clock springs, are a distinct category within the market. Their unique construction offers a critical advantage: a consistent force output over a long deflection range. This translates into precise and unwavering control, making them ideal for applications demanding such characteristics. Within the aerospace & defense industry, flat spiral/power springs find diverse applications. They play a crucial role in aircraft control systems, particularly ailerons, elevators, and rudders. Their consistent force delivery ensures that pilot inputs translate into accurate and reliable maneuvering of the aircraft, even under demanding flight conditions. In addition, their compact design and predictable force profile make them valuable assets in missile guidance and tensioning mechanisms, where space constraints are a significant consideration.

Regional Insights

North Americaaerospace & defense springs market is expected to witness steady growth from 2024 to 2030. The region's well-established and robust A&D sector is fueling the demand for specialized springs. Consistent government investments in both commercial and military aircraft programs have resulted in an increased need for advanced weaponry and sophisticated aerospace platforms. These platforms rely heavily on high-performance springs for optimal functionality. Furthermore, North America boasts a competitive edge with its skilled workforce. The region has a long history of engineering expertise and manufacturing know-how within the A&D industry. This pool of skilled talent is critical for the design, development, and production of springs that meet the A&D industry's rigorous demands.

U.S. Aerospace & Defense Springs Market Trends

The aerospace & defense springs market in the U.S. is expected to grow at a significant CAGR from 2024 to 2030. The U.S. holds a significant position in the global market. Aerospace & defense systems operate in demanding environments, requiring exceptional spring performance. Extreme temperatures, vibrations, and pressure during flight and combat necessitate springs with superior durability and consistent functionality. Spring manufacturers are at the forefront, developing and supplying these specialized components to meet the rigorous demands of the nation's aerospace & defense industry.

Asia Pacific Aerospace & Defense Springs Market Trends

The aerospace & defense springs market Asia Pacific region dominated the global market in 2023 and accounted for a 35.6% share of the global revenue. It is expected to grow at a CAGR of 5.9% over the forecast period 2024 to 2030. The demand for lightweight, high-strength springs for applications in aviation and defense and the growing demand for springs in various integrated components, such as actuators, engines, and fuel pumps, is expected to drive the growth of the Asia Pacific market. Other factors propelling the market growth in Asia Pacific include improved spring design & simulation tools, streamlined supply chains, and enhanced collaboration between aerospace & defense companies and spring manufacturers.

Japan aerospace & defense springs market occupies a prominent position in the market due to a thriving additive manufacturing industry, the commercialization of space exploration, and a highly skilled workforce. Japanese manufacturers are employing additive manufacturing technology to create complex lighter, stronger, and highly efficient springs for aerospace & defense applications. These springs ultimately help improve fuel efficiency and platform performance for both commercial and military aircraft.

Europe Aerospace & Defense Springs Market Trends

The aerospace & defense springs market in Europe is anticipated to witness the fastest growth, recording a CAGR of 7.8% over the forecast period 2024 to 2030. The European aviation industry adheres to very strict safety and security protocols. This could lead to a higher demand for high-quality, specialized springs compared to other regions with potentially less stringent regulations. Increased defense spending due to geopolitical tensions and NATO's focus on modernization leads to a rise in military aircraft production and upgrades, which will require springs for various applications.

Germany aerospace & defense springs market is expected to grow at a CAGR of 7.1% over the forecast period, 2024 to 2030. Rising defense budgets fuel the demand for advanced weaponry and sophisticated aerospace platforms, both of which heavily rely on high-performance springs. German manufacturers, known for their expertise and quality, are well-positioned to meet this growing need. Furthermore, Germany embraces additive manufacturing (3D printing) technologies. This allows for the creation of complex spring designs with superior performance characteristics. Manufacturers are actively integrating 3D printing into production, enabling the development of lighter, stronger, and more efficient springs for aerospace & defense applications.

Key Aerospace And Defense Springs Company Insights

Some of the key companies operating in the aerospace & defense springs market include Lee Spring GmbH, Vulcan Spring & Mfg. Co., and Myers Spring Co. Inc. among others.

-

Lee Spring GmbH is a leading global manufacturer of springs, boasting a strong presence across the globe. Their extensive network of manufacturing facilities and distribution channels allows them to serve international customers effectively. Lee Spring offers a diverse product portfolio, encompassing various spring types and custom capabilities to cater to a wide range of applications. Their established reputation for high-quality products and reliable service is built on a long history in the spring industry. Furthermore, their commitment to stringent quality standards is reflected in their adherence to industry certifications like ISO 9001. The presence of strong competitors in the global market necessitates continuous innovation and strategic differentiation.

-

Vulcan Spring & Mfg. Co. is a significant player in the market. The company specializes in offering custom spring solutions that are crucial for various aerospace and defense applications. The company's focus on research and development is particularly noteworthy as it invests in developing lightweight springs with high-pressure resistant capacities. This aligns with the industry's demand for components that can reduce aircraft weight while maintaining performance. The company’s presence in the market is strengthened by its ability to meet the stringent quality and safety standards required in aerospace and defense manufacturing.

-

Myers Spring Co. Inc. is a prominent player in the market, alongside other industry leaders. Myers Spring Co. Inc. specializes in developing springs for various applications in the aerospace and defense industry. Its product range includes a variety of spring types designed to meet the specific and stringent requirements of these sectors. The company's focus on strategic alliances and long-term agreements with OEMs is a key aspect of its market strategy. This approach helps reduce risks and costs associated with developing aerospace products. The company is also noted for its investment in research and development, particularly in creating lightweight springs with high-pressure resistant capacities. This aligns with the industry trend toward weight reduction in aircraft components while maintaining high performance standards.

EBSCO Spring Co. and Rowley Spring & Stamping Corp. are some of the emerging companies in the target market.

-

EBSCO Spring Co. is a significant player in the market. The company contributes to the production of critical components for aerospace and defense applications. Its role in the market involves manufacturing springs that meet the high standards required for use in aircraft, defense equipment, and related technologies. The company offers a wide range of spring types, including compression, extension, and torsion springs, tailored to the specific needs of aerospace and defense clients. Given the competitive nature of the market, it focuses on quality control, precision manufacturing, and research and development to maintain its market presence.

-

Rowley Spring & Stamping Corp. is a strong competitor in the domestic (U.S.) market. Its expertise in metal forming and stamping processes caters to the specialized requirements of this sector. While its established presence suggests a loyal customer base, expansion into new regional markets or niche applications within the sector is expected to be potential growth areas. The company leverages its agility and responsiveness to cater to specific aerospace & defense project needs. Additionally, building strong partnerships with aerospace & defense contractors through excellent customer service and on-time delivery has propelled the growth of the company in this competitive market.

Key Aerospace And Defense Springs Companies:

The following are the leading companies in the aerospace and defense springs market. These companies collectively hold the largest market share and dictate industry trends.

- Vulcan Spring & Mfg. Co.

- Myers Spring Co. Inc.

- Argo Spring Manufacturing Co., Inc.

- John Evans' Sons Inc.

- EBSCO Spring Co.

- M. Coil Spring Manufacturing Company

- Rowley Spring & Stamping Corp.

- Nordia Springs Ltd

- Ace Wire Spring & Form Co., Inc.

- Myers Spring Co. Inc.

- Lee Springs GmbH

Recent Developments

-

In June 2022, Lesjöfors, a full-range spring component manufacturer, acquired John Evans' Sons Inc., a U.S.-based spring maker. The acquisition strengthened Lesjöfors' U.S. presence and boosted its sales in the medical industry. John Evans' Sons, known for its diverse customer base and early-stage project support, would continue operating from its Pennsylvania facility with its existing workforce workforce post-acquisition.

-

In January 2021, Lee Spring GmbH, a global manufacturer of stock and custom springs, acquired M & S Spring, a Michigan-based manufacturer of custom prototype springs. The acquisition would enable Lee Spring to leverage M & S Spring's expertise in short-run prototyping and flat springs. It would also strengthen its capabilities in prototyping custom springs that require quick turnaround times. M & S Spring would continue to operate from their then location while gaining access to Lee Spring's wider manufacturing network.

Aerospace & Defense Springs Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 372.0 million

Revenue forecast in 2030

USD 548.5 million

Growth rate

CAGR of 6.7% from 2024 to 2030

Actual Data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; China; India; Japan; Brazil; Mexico

Key companies profiled

Argo Spring Manufacturing Co., Inc.; M. Coil Spring Manufacturing Company; Myers Spring Co. Inc.; Ace Wire Spring & Form Co., Inc.; Vulcan Spring & Mfg. Co.; Myers Spring Co. Inc.; EBSCO Spring Co.; Rowley Spring & Stamping Corp.; Nordia Springs Ltd; John Evans’ Sons Inc.; Lee Springs GmbH

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aerospace & Defense Springs Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global aerospace & defense springs market report based on type and region.

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Flat Spiral/Power Springs

-

Coil Springs

-

Torsion, Torque Coil, Clutch Springs

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global aerospace and defense springs market size was estimated at USD 356.6 million in 2023 and is expected to reach USD 372.0 million in 2024.

b. The global aerospace and defense springs market is expected to grow at a compound annual growth rate of 6.7% from 2024 to 2030, reaching USD 548.5 million by 2030.

b. Asia Pacific dominated the aerospace and defense springs market, with a share of 35.6% in 2023. This is attributable to the development of aerospace & defense manufacturing facilities, availability of raw materials, and skilled labor. India is emerging as a major production hub due to its advanced aerospace & defense programs and significant R&D investments.

b. Some key players operating in the aerospace and defense springs market include Argo Spring Manufacturing Co., Inc.; Lee Spring GmbH, M. Coil Spring Manufacturing Company; Ace Wire Spring & Form Co., Inc, Vulcan Spring & Mfg. Co.; Myers Spring Co. Inc.; MW Industries Inc.; Nordia Springs Ltd; and John Evans’ Sons Inc.

b. The aerospace and defense springs market is expected to grow significantly, driven by the development of lightweight, high-performance aircraft and adherence to stringent safety regulations. Key factors driving the market growth include rising demand for commercial aircraft and the ongoing replacement of aging aircraft with lightweight and fuel-efficient variants.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.