- Home

- »

- Plastics, Polymers & Resins

- »

-

Aerospace Foam Market Size & Share Report, 2022-2030GVR Report cover

![Aerospace Foam Market Size, Share & Trends Report]()

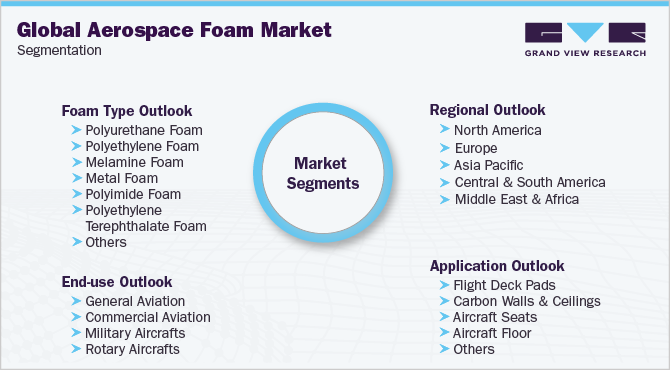

Aerospace Foam Market Size, Share & Trends Analysis Report By Foam Type (PU, PE), By End Use (Commercial, General Aviation), By Application (Carbon Walls & Ceilings, Aircraft Seats), And Segment Forecasts 2022 - 2030

- Report ID: GVR-2-68038-735-3

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2019 - 2020

- Forecast Period: 2022 - 2030

- Industry: Bulk Chemicals

Report Overview

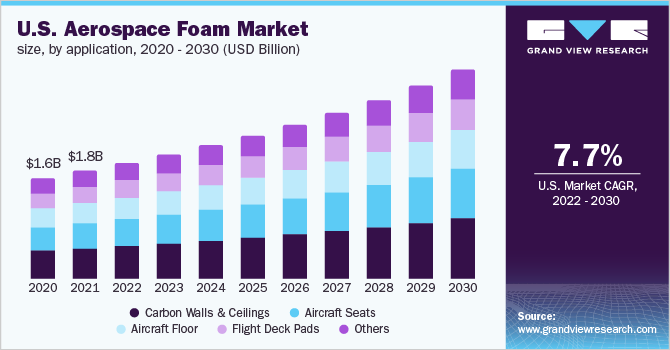

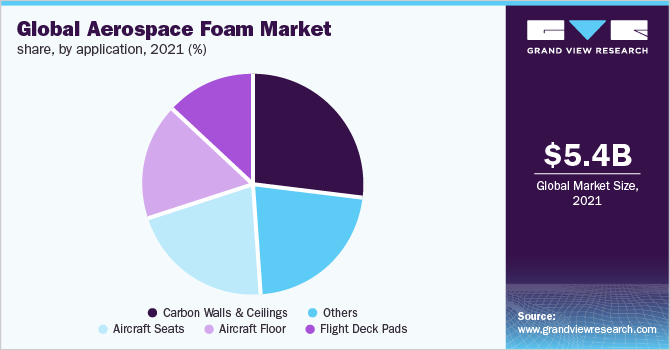

The global aerospace foam market size was valued at USD 5.4 billion in 2021 and is expected to grow at a compound annual growth rate (CAGR) of 6.5% from 2022 to 2030. Increasing fuel prices have propelled aircraft manufacturers to minimize aircraft weight and to carry more loads in a go. Hence, these manufacturers have adopted the installation of aerospace foam across various aircraft applications, such as flight deck pads, carbon walls & ceilings, aircraft seats, and aircraft floors. Furthermore, increasing commotion across air travel in recent years has propelled the demand for aircraft across all end-uses including general aviation, commercial aviation, military aircraft, and rotary aircraft.

Hence, this has positively impacted the utility of aerospace foam across aircraft manufacturing and is prominently expected to grow during the forecast period. The U.S. generated the largest demand for aerospace foam in 2021 and is anticipated to follow a similar trend over the forecast period. The high product demand across the country is primarily driven by the strong growth of the aerospace industry due to increased inter-state travel during the past decade as a result of increased disposable income. The U.S. military services have been a significant industry for the propulsion of demand for aerospace foam across military aircraft, owing to the increased use of aerospace foam across the external fuel tanks.

For instance, in August 2022, aircraft manufacturer Boeing successfully delivered four MH-139A test helicopters to the U.S. Air Force (USAF) to support four major air force commands, and protection against the intercontinental ballistic missiles, along with other operating agencies. In 2020, due to the outbreak of the COVID-19 pandemic across the globe, the global airline industry took a major jolt due to multiple flight cancellations, airport stand still, and manufacturing units coming to rest for containing the spread of the virus, which, in turn, negatively impacted the growth of the industry. However, due to the increasing rate of recovery and availability of vaccines globally, the operations of the airline industry were resumed, significantly revamping the product demand.

Foam Type Insights

The Polyurethane (PU) foam type segment dominated the global industry in 2021, in terms of both revenue & volume, and accounted for the maximum revenue share of more than 34.35%. The segment is estimated to projected to expand further at the fastest CAGR from 2022 to 2030. The high share is attributed to the product’s wide scope of application. PU foams are used for insulation of aircraft, baggage sections, ceilings and walls, and separators between the class segments and lavatories. Followed by specialty high-performance foams including special Polyethylene (PE) and Expanded Polyethylene (EPE) foams.

The EPE foam provides unparalleled dimensional stability and recovery characteristics, making it an ideal alternative to traditional foams used across the aerospace industry. These foams are used across the ceilings of an aircraft to decrease repeated impacts by providing optimal cushioning. PE foam is used across the aisle and walls & ceiling of an aircraft owing to its high insulation and dampening properties. PE foam has recently gained traction across the aerospace sector and is anticipated to grow significantly during the forecast period due to its properties of maintaining cabin temperature in a contrast to colder atmospheric temperature conditions during the flight duration, preventing temperature exchange.

Application Insights

The carbon walls & ceilings application segment dominated the global industry in 2021 and accounted for the maximum share of more than 26.45% of the overall revenue. The segment is anticipated to expand further at the fastest growth rate maintaining the dominant revenue share throughout the forecast period. This is owing to the widespread usage of aerospace foam, especially PU foam, across the chassis of the aircraft. Since the stature of the aircraft encapsulates passengers and cargo, it requires to be highly insulated to avoid any wind exchange from within the aircraft and the outside atmosphere.

Hence aerospace foams find a major application across the carbon wall & ceilings and are expected to have a high demand during the forecast period. Aircraft seats comprise a major part of air travel in terms of comfort and luxury. Since air travel can vary from a journey of about 2 hours to 20 hours & above, the seats must be highly comforting for passengers as well as the crew on board. Hence aerospace foam is majorly used for manufacturing aircraft seats as they provide high-impact absorption properties, comfort in terms of seating, and additional add-on to the manufacturer’s objective of lightweight aircraft.

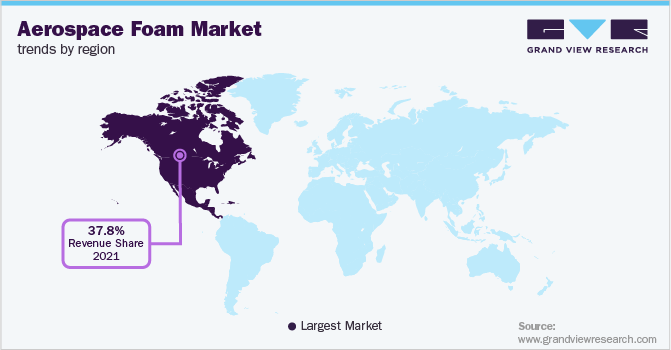

Regional Insights

North America dominated the global industry in 2021 and accounted for the maximum share of more than 37.85% of the overall revenue. The U.S. is a key contributor to the North America regional market on account of a rise in the demand for aircraft across the country in the past decade. Furthermore, the presence of major aircraft manufacturers in the U.S.intensify the existing competitive environment in the regional market. Companies, such as Lockheed Martin, Boeing, General Electric, Raytheon Technologies Corp., and Safran, mark the highly competitive environment for aircraft manufacturing across the region.

Hence, the product demand has witnessed high growth and the region is anticipated to follow similar growth trends during the forecast period. Europe has witnessed a rise in demand for aircraft due to the increased footfall of tourists across the region in recent years. According to the General Aviation Shipment Report 2021, published by General Aviation Manufacturers Association (GAMA), Europe recorded a total airplane shipment of 13.6%, accounting for an approximate shipment of 702 airplanes in contrast to 618 airplanes shipped during 2020. This has increased the product demand across the region and is expected to maintain a similar growth trend during the forecast period.

Key Companies & Market Share Insights

The global industry is characterized by the presence of several players. Key players are actively involved in adopting strategies targeted toward attaining sustainable transition, sales execution, and efficient pricing. Such players offer broad capabilities as well as capacities, which enables them to cater to diversified needs arising across multiple end-use industries. Some of the major companies operating in the global aerospace foam market include:

-

Boyd Corp.

-

Evonik Industries AG

-

ERG Aerospace Corp.

-

SABIC

-

BASF SE

-

ZOTEFOAMS PLC

-

General Plastics Manufacturing Company

-

Solvay

-

UFP Technologies, Inc.

-

Recticel NV/SA

-

NCFI Polyurethanes

-

DuPont

-

Rogers Corp.

-

ARMACELL

Aerospace Foam Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 5.74 billion

Revenue forecast in 2030

USD 9.52 billion

Growth rate

CAGR of 6.5% from 2022 to 2030

Base year for estimation

2021

Historicaldata

2019 - 2020

Forecast period

2022 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2022 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Foam type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; China; India; Japan; South Korea; Brazil; Argentina; GCC Countries; South Africa

Key companies profiled

Boyd Corp.; Evonik Industries AG; ERG Aerospace Corp.; SABIC; BASF SE; ZOTEFOAMS PLC; General Plastics Manufacturing Company; Solvay; UFP Technologies, Inc.; Recticel NV/SA; NCFI Polyurethanes; DuPont, Rogers Corp.; ARMACELL

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aerospace Foam Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2030. For the purpose of this study, Grand View Research has segmented the global aerospace foam market report on the basis of type, application, end-use, and region:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2019 - 2030)

-

Polyurethane Foam

-

Polyethylene Foam

-

Melamine Foam

-

Metal Foam

-

Polyimide Foam

-

Polyethylene Terephthalate Foam

-

Polyvinyl Chloride Foam

-

Specialty High Performance Foam

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2019 - 2030)

-

Flight Deck Pads

-

Carbon Walls & Ceilings

-

Aircraft Seats

-

Aircraft Floor

-

Others

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2019 - 2030)

-

General Aviation

-

Commercial Aviation

-

Military Aircrafts

-

Rotary Aircrafts

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2019 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

GCC Countries

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global aerospace foam market size was estimated at USD 5.4 billion in 2021 and is expected to reach USD 5.74 billion in 2022.

b. The global aerospace foam market is expected to grow at a compound annual growth rate of 6.5% from 2019 to 2030 to reach USD 9.52 billion by 2030.

b. North America dominated the aerospace foam market with a share of 38.42% in 2021. This is attributable to the strong growth in the U.S. aerospace industry and the market dominance for North America additionally pertains due to the presence of major aircraft manufacturers present across the U.S., adding up to the existing competitive environment across the country.

b. Some key players operating in the aerospace foam market include Boyd Corporation, Evonik Industries AG, ERG Aerospace Corporation, SABIC, BASF SE, ZOTEFOAMS PLC, General Plastics Manufacturing Company, Solvay, UFP Technologies, Inc., Recticel NV/SA, NCFI Polyurethanes, DuPont, Rogers Corporation, and ARMACELL.

b. Key factors that are driving the market growth include increasing demand for lightweight aircraft in lieu with increasing fuel prices, along with increased air travel in recent years.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."