- Home

- »

- Advanced Interior Materials

- »

-

Aerospace Insulation Market Size, Industry Report, 2033GVR Report cover

![Aerospace Insulation Market Size, Share & Trends Report]()

Aerospace Insulation Market (2025 - 2033) Size, Share & Trends Analysis Report By Material (Ceramic Materials, Fiberglass), By Product (Thermal Insulation, Acoustic Insulation), By Application (Engine, Aerostructure), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-720-9

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Aerospace Insulation Market Summary

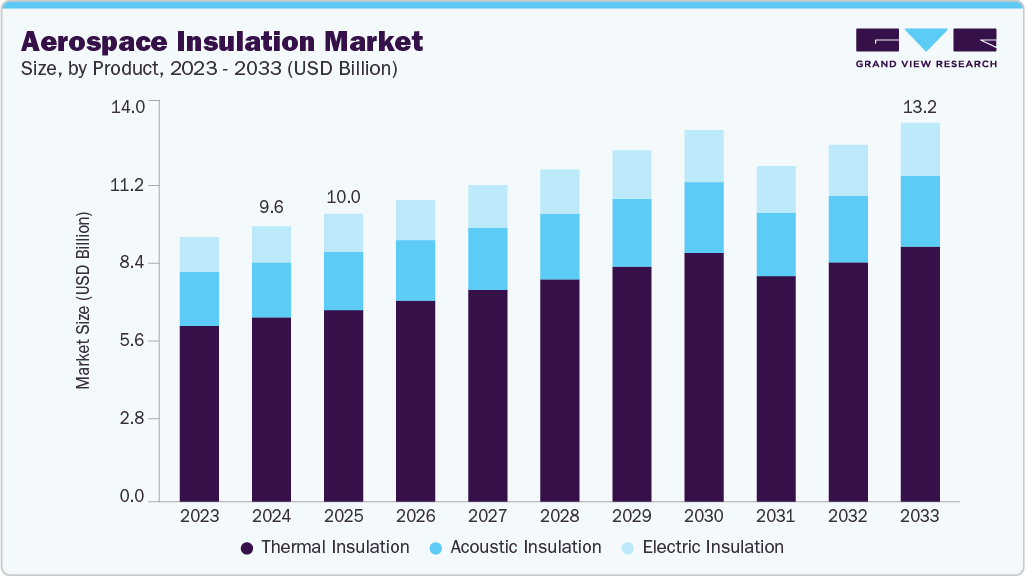

The global aerospace insulation market size was estimated at USD 9.57 billion in 2024 and is projected to reach USD 13.19 billion by 2033, growing at a CAGR of 5.2% from 2025 to 2033. The global aerospace industry is experiencing a strong push towards lightweight components to improve fuel efficiency and reduce emissions.

Key Market Trends & Insights

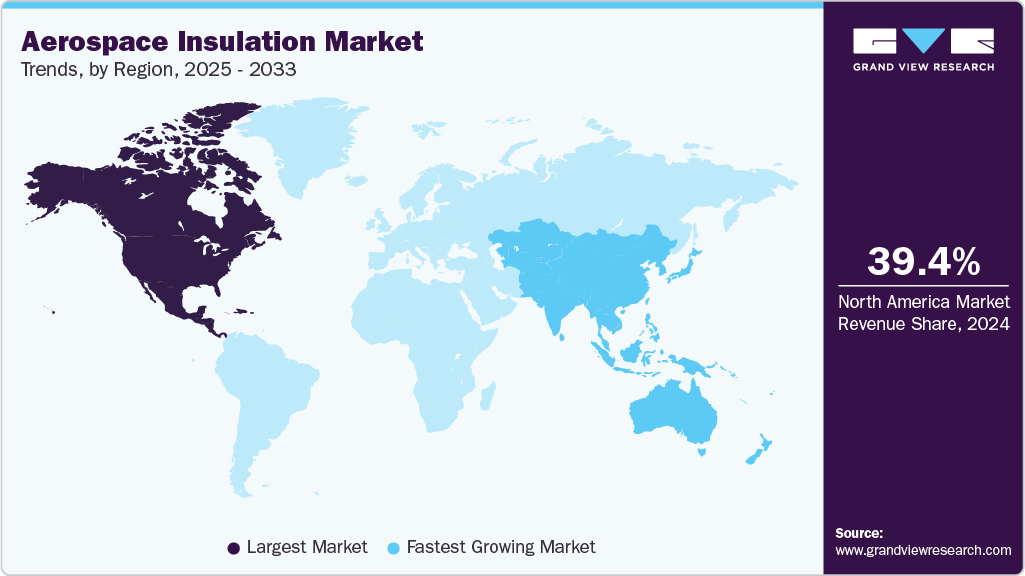

- North America dominated the aerospace insulation market with the largest revenue share of 39.39% in 2024.

- High defense spending and next-gen aircraft investments like hypersonic and unmanned vehicles drive the U.S. aerospace insulation market.

- By material, the ceramic materials segment dominated the global aerospace insulation market, accounting for a revenue share of 49.8% in 2024

- By product, electric insulation segment is expected to grow at a considerable CAGR of 6.2% from 2025 to 2033 in terms of revenue.

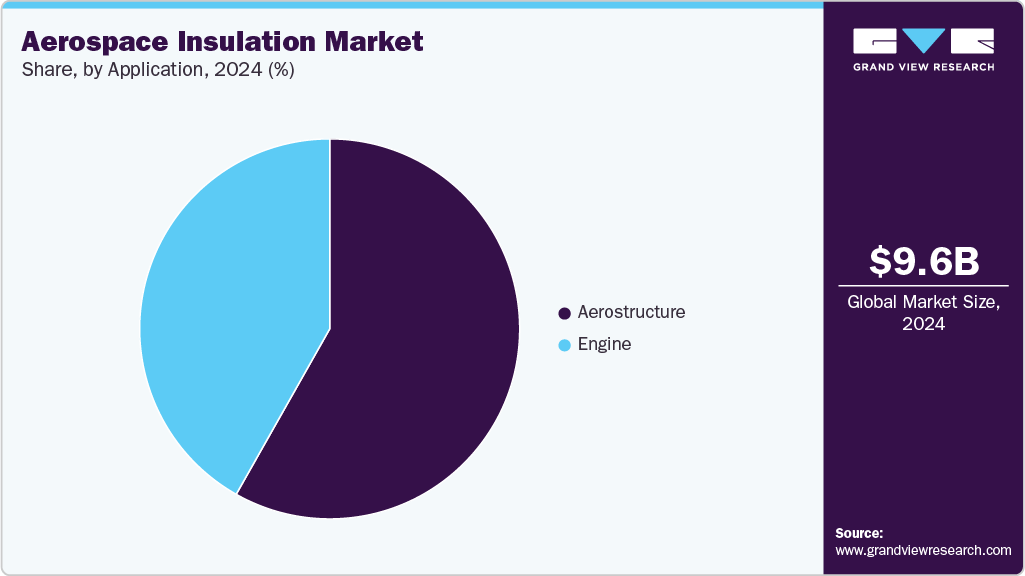

- By application, the engine segment held the largest revenue share of 41.81% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 9.57 Billion

- 2033 Projected Market Size: USD 13.19 Billion

- CAGR (2025-2033): 5.2%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Aerospace insulation materials, such as advanced composites and foams, play a critical role in achieving these goals by minimizing aircraft weight while maintaining thermal and acoustic performance. Airlines and aircraft manufacturers are increasingly adopting high-performance insulation to comply with regulatory frameworks and reduce operational costs. This shift is significantly driving the demand for innovative insulation materials across commercial, military, and business aviation sectors.Governments and international aviation authorities have imposed stringent regulations regarding cabin safety, fire resistance, and thermal management. Materials used in aerospace insulation must meet specific standards, such as FAR 25.853 for flammability and toxicity. These regulatory requirements have accelerated innovation in insulation materials that not only enhance passenger safety but also meet environmental standards. As compliance becomes more critical in aircraft design and retrofitting, the demand for certified insulation products continues to grow.

The global increase in air travel, particularly in emerging economies, is propelling the need for new aircraft and fleet modernization. As airlines expand their fleets to accommodate the rising number of passengers, the demand for aerospace insulation for both new builds and refurbishments has surged. Additionally, aircraft retrofitting projects aimed at enhancing comfort and energy efficiency are contributing to the steady demand for advanced insulation solutions, further stimulating market growth.

Ongoing research and development in aerospace insulation technologies have resulted in the introduction of next-generation materials such as aerogels, ceramic fibers, and vacuum insulation panels. These advanced materials offer superior thermal and acoustic insulation properties while reducing bulk and weight. Technological innovations are allowing manufacturers to meet the evolving requirements of modern aircraft cabins, cargo holds, engines, and fuselage components, thus playing a crucial role in expanding the market's scope and application areas.

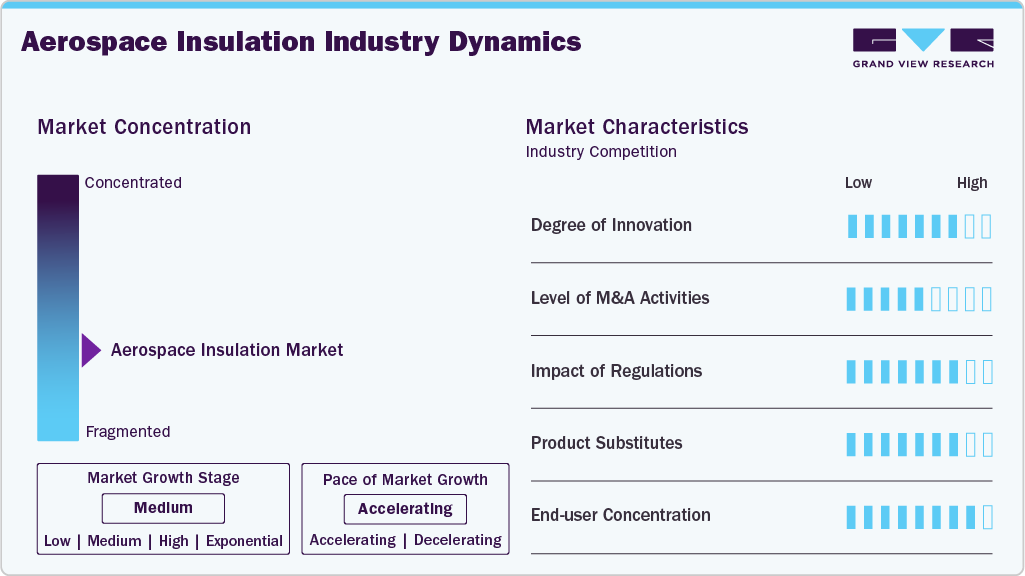

Market Concentration & Characteristics

The aerospace insulation market exhibits distinct structural characteristics shaped by innovation intensity, regulatory mandates, and end user dynamics. A high degree of innovation defines the competitive landscape, with manufacturers investing heavily in advanced materials such as aerogels, nanocomposites, and lightweight foams to meet evolving demands for energy efficiency, fire safety, and noise reduction. This innovation is crucial for compliance with strict international aviation regulations set by bodies like the FAA and EASA, which govern material flammability, toxicity, and environmental impact. As a result, market players with strong R&D capabilities and proprietary technologies are better positioned to gain a competitive advantage and secure contracts with aircraft OEMs and defense organizations.

In terms of market concentration, the aerospace insulation industry is relatively consolidated, with a few major players catering to large aircraft manufacturers and MRO (maintenance, repair, and overhaul) providers. The level of mergers and acquisitions is moderately high, driven by the need to strengthen technological portfolios and global supply chains. End user concentration is also significant, as aerospace insulation suppliers typically serve a small number of large customers such as Boeing, Airbus, and national defense agencies. The threat of substitutes remains low due to the specialized performance requirements in aviation, further reinforcing the importance of certified, application-specific insulation materials.

Material Insights

The ceramic materials segment dominated the global aerospace insulation market, accounting for a revenue share of 49.8% in 2024, driven by its exceptional thermal resistance and stability under extreme conditions. Ceramics can withstand high operating temperatures, making them ideal for applications in aircraft engines, exhaust systems, and heat shields. As aircraft designs evolve toward higher engine efficiency and compactness, the need for insulation materials that can perform reliably in elevated thermal environments is becoming increasingly critical.

The fiberglass segment is anticipated to experience significant CAGR growth during the forecast period. Fiberglass insulation materials are widely used in aircraft fuselages, cargo compartments, and cabin interiors to minimize heat transfer and dampen noise levels. The material’s high fire resistance and compliance with stringent aviation safety regulations make it a preferred choice among OEMs and MRO providers. Additionally, the affordability and ease of fabrication of fiberglass contribute to its growing adoption in both commercial and military aviation sectors. The increasing demand for fuel-efficient aircraft further promotes the use of lightweight fiberglass insulation solutions to reduce overall aircraft weight and emissions.

Product Insights

The thermal insulation segment dominated the global aerospace insulation market, accounting for a revenue share of 66.3% in 2024, driven by the critical need to maintain optimal temperature conditions within aircraft cabins and systems. In high-altitude environments, where external temperatures can drop drastically, effective thermal insulation ensures passenger comfort, crew safety, and the protection of onboard electronic and mechanical systems. Airlines and aircraft manufacturers prioritize advanced insulation materials that can withstand extreme thermal variations while minimizing heat loss or gain.

The electric insulation segment is anticipated to experience the fastest CAGR during the forecast period, driven by the increasing electrification of aircraft systems. As aerospace manufacturers shift toward more electric aircraft (MEA) to reduce emissions and improve fuel efficiency, the demand for advanced electric insulation materials has grown significantly. These materials are critical for ensuring the safety, reliability, and performance of electrical systems in both commercial and military aircraft.

End Use Insights

The commercial segment held the largest revenue share of 59.24% in 2024, driven by rising demand for enhanced passenger comfort and in-flight experience. Airlines are increasingly focusing on noise reduction, cabin temperature control, and vibration dampening to improve the quality of long-haul and short-haul flights. This has led to a surge in the adoption of advanced acoustic and thermal insulation materials that ensure quieter, safer, and more comfortable cabin environments.

The military segment is anticipated to experience significant CAGR growth during the forecast period, driven by rising defense budgets and continuous modernization of military aircraft fleets. Governments across key regions such as the United States, China, India, and NATO countries are heavily investing in upgrading fighter jets, transport aircraft, and surveillance systems. These modern aircraft demand high-performance insulation materials that offer thermal resistance, noise suppression, and protection against fire in extreme environments.

Application Insights

The engine segment held the largest revenue share of 41.81% in 2024. Modern aircraft engines generate immense heat, making insulation essential to protect surrounding components, ensure operational stability, and prevent heat-related system failures. Advanced insulation materials such as ceramic composites and high-temperature foams help maintain engine efficiency and longevity.

The aerostructure segment is anticipated to experience significant CAGR growth during the forecast period, driven by increasing emphasis on lightweight construction and fuel efficiency. As aircraft manufacturers seek to reduce overall aircraft weight to meet stricter carbon emission regulations, the demand for advanced insulation materials within aerostructures such as fuselage, wings, and empennage-has grown significantly. These insulation materials are designed to offer thermal resistance without compromising structural integrity or increasing mass.

Regional Insights

North America aerospace insulation market dominated with the largest revenue share of 39.39% in 2024. The market in North America is primarily driven by robust investments in defense and commercial aviation. The presence of key aircraft manufacturers, such as Boeing and Bombardier, supports steady demand for advanced thermal and acoustic insulation. Growing environmental regulations focused on reducing carbon emissions are prompting the use of lightweight insulation materials. Additionally, the region’s strong MRO (Maintenance, Repair, and Overhaul) network stimulates demand for retrofit insulation solutions. Increasing adoption of composite materials further complements market expansion.

U.S. Aerospace Insulation Market Trends

The U.S. aerospace insulation market is fueled by extensive defense spending and continued investment in next-generation aircraft programs, including hypersonic and unmanned aerial vehicles. NASA and the U.S. Air Force are key drivers in the use of advanced aerospace insulation for high-performance and space applications. Moreover, stringent FAA regulations for cabin comfort, safety, and energy efficiency push OEMs to innovate in thermal and acoustic insulation. The rising trend of domestic air travel post-COVID has also led to increased demand for aircraft retrofitting and refurbishing. These factors collectively reinforce market growth.

Asia Pacific Aerospace Insulation Market Trends

The Asia Pacific aerospace insulation market witnesses growth driven by rapid expansion in commercial aviation and defense modernization programs. Countries like India, South Korea, and Australia are increasingly investing in domestic aerospace manufacturing and procurement. Insulation demand is also influenced by rising passenger traffic and the need for fleet expansion by regional airlines. Furthermore, government initiatives supporting local aircraft production and partnerships with global aerospace firms are enhancing insulation technology integration. The cost-sensitive nature of the market also pushes for lightweight and affordable insulation solutions.

China aerospace insulation market benefits from the government’s push toward self-reliance in aerospace technology. Major programs such as COMAC’s C919 and ARJ21 have significantly increased demand for domestic production of insulation materials. Rapid growth in air travel and urbanization necessitates the expansion of commercial airline fleets, directly impacting insulation usage. The country’s dual focus on civilian and military aerospace sectors contributes to demand diversity. In addition, advancements in high-speed rail and space exploration further stimulate innovation in high-performance insulation.

Europe Aerospace Insulation Market Trends

Europe's aerospace insulation market is driven by its strong focus on sustainable aviation and emissions reduction. Airbus, one of the world’s largest aircraft manufacturers, leads regional adoption of advanced thermal and acoustic insulation technologies. The European Union's Green Deal and associated aviation sustainability targets are influencing insulation designs that improve fuel efficiency and reduce noise pollution. Moreover, the presence of a mature airline industry and a well-established MRO network supports ongoing demand for both OEM and retrofit insulation solutions. Continuous R&D investment enhances competitiveness.

Germany aerospace insulation market stands out as a key hub within Europe for aerospace insulation innovation, thanks to its advanced engineering capabilities and strong industrial base. The country’s collaboration between academic research institutes and aerospace OEMs fosters cutting-edge insulation material development. Demand is also driven by Germany’s involvement in major European aircraft programs, including Airbus and space missions through the European Space Agency (ESA). Additionally, domestic efforts to boost aerospace exports and improve aircraft energy efficiency contribute to steady market growth.

Central & South America Aerospace Insulation Market Trends

The Central & South America aerospace insulation market is propelled by increasing demand for regional and low-cost air travel. Brazil, home to Embraer, is a significant contributor, particularly in the regional jet segment. The need to modernize older aircraft fleets in the region encourages retrofitting, boosting demand for insulation upgrades. Although budget constraints remain, international partnerships and investments in airport infrastructure help stimulate market activity. Growing environmental awareness is also encouraging interest in sustainable insulation materials.

Middle East & Africa Aerospace Insulation Market Trends

The Middle East & Africa aerospace insulation market growth is mainly driven by the rapid expansion of airline fleets by carriers like Emirates, Qatar Airways, and Etihad. High investments in aviation infrastructure and airport modernization projects increase demand for insulated aircraft components. The region’s harsh climate necessitates effective thermal insulation for passenger comfort and equipment protection. Additionally, increasing defense budgets in the Gulf countries contribute to the demand for military aircraft insulation. Africa’s gradual aviation development, supported by foreign investment, presents long-term growth potential.

Key Aerospace Insulation Company Insights

Some key companies involved in the aerospace insulation market include Duracote Corporation, Rogers Corporation, DuPont, BASF SE, 3M, Esterline Technologies Corporation, Triumph Group Inc., Zodiac Aerospace, Evonik Industries, and Polymer Technologies Inc. Companies are expanding their business to achieve a competitive edge in the marketplace. Major companies are implementing mergers and acquisitions and establishing alliances with other leading companies to achieve this goal.

-

Duracote Corporation is a U.S.-based manufacturer specializing in advanced materials for aerospace and transportation applications. The company offers thermal, acoustic, and fire-resistant insulation materials designed to meet FAA and OEM specifications. Its Dura-THERM and Dura-Sonic product lines are widely used in aircraft interiors, cargo liners, and engine components. Duracote’s focus on lightweight, flame-retardant solutions support aircraft performance and regulatory compliance.

-

Rogers Corporation is a global materials technology company known for its high-performance foam and elastomeric products. In aerospace, it provides thermal insulation and vibration-damping solutions through its PORON and BISCO materials. These products are used in aircraft seals, gaskets, cabin insulation, and engine components. Rogers emphasizes lightweight, durable materials that enhance energy efficiency and passenger comfort.

Key Aerospace Insulation Companies:

The following are the leading companies in the aerospace insulation market. These companies collectively hold the largest market share and dictate industry trends.

- Duracote Corporation

- Rogers Corporation

- Dupont

- BASF SE

- 3M

- Esterline Technologies Corporation

- Triumph Group Inc.

- Zodiac Aerospace

- Evonik Industries

Aerospace Insulation Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 10.03 billion

Revenue forecast in 2033

USD 13.19 billion

Growth rate

CAGR of 5.2% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, product, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; Brazil

Key companies profiled

Duracote Corporation; Rogers Corporation; Dupont; BASF SE; 3M; Esterline Technologies Corporation; Triumph Group Inc.; Zodiac Aerospace; Evonik Industries

Customization scope

Free report customization (equivalent to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aerospace Insulation Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global aerospace insulation market report based on material, product, application, end use and region:

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Ceramic Materials

-

Mineral Wool

-

Foamed Plastics

-

Fiberglass

-

Others

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Thermal Insulation

-

Acoustic Insulation

-

Electric Insulation

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Engine

-

Aerostructure

-

-

End use Outlook (Revenue, USD Million, 2021 - 2033)

-

Commercial

-

Military

-

Business & General Aviation

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global aerospace insulation market size was estimated at USD 9.57 billion in 2024 and is expected to reach USD 10.03 billion in 2025.

b. The global aerospace insulation market is expected to grow at a compound annual growth rate of 5.2% from 2025 to 2033 to reach USD 13.19 billion by 2033.

b. The commercial segment held the largest revenue share of 59.24% in 2024, driven by rising demand for enhanced passenger comfort and in-flight experience.

b. Key players in the aerospace insulation market include Duracote Corporation, Rogers Corporation, DuPont, BASF SE, 3M, Esterline Technologies Corporation, Triumph Group Inc., Zodiac Aerospace, Evonik Industries, and Polymer Technologies Inc.

b. Key factors driving the aerospace insulation market include rising demand for lightweight materials, increased aircraft production, stringent safety and emission regulations, growing passenger comfort expectations, and advancements in insulation technologies

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.