- Home

- »

- Pharmaceuticals

- »

-

Africa Pharmaceutical Market Size, Industry Report, 2030GVR Report cover

![Africa Pharmaceutical Market Size, Share & Trends Report]()

Africa Pharmaceutical Market Size, Share & Trends Analysis Report By Molecule Type, By Product, By Type, By Disease, By Formulation, By Age Group, By Route Of Administration, By End Market, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-210-7

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Africa Pharmaceutical Market Size & Trends

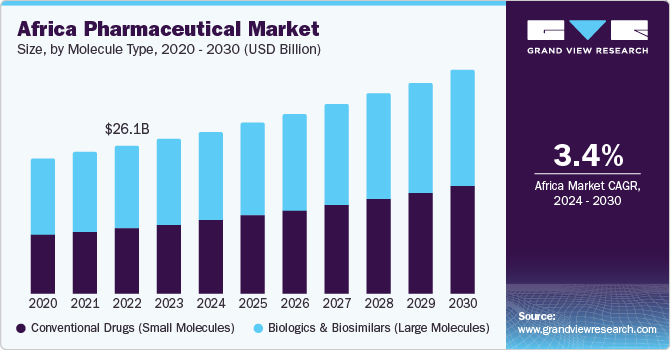

The Africa pharmaceutical market size was estimated at USD 26.85 billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 3.4% from 2024 to 2030. This growth is attributed to rising health-consciousness, increasing demand for pharmaceuticals due to chronic diseases, and affordability. According to the South African government, pharmaceutical sales and demand are likely to propel in coming years due to the high incidence of infectious & lifestyle diseases, such as obesity, hypertension, diabetes, and cancer.

The African region has witnessed gradual developments in its pharmaceutical industry. Additionally, the increasing focus by regional government authorities on the well-being of their growing populations, coupled with advancements in healthcare services, is expected to propel the market over the forecast period. Ensuring the safe and timely delivery of pharmaceuticals has emerged as a priority for regional governments, offering lucrative opportunities for local manufacturers. Africa region has witnessed gradual developments in its pharmaceutical industry. In addition, increasing focus by regional government authorities on the well-being of their growing populations, coupled with advancements in healthcare services, is expected to propel the market over the forecast period. Ensuring safe and timely delivery of pharmaceuticals has emerged as a priority for regional governments, offering lucrative opportunities for local manufacturers. In addition, the implementation of a pooled procurement mechanism in Africa is expected to create a favorable environment for leading manufacturers of generics to build plants in the country. South Africa has implemented organized cancer screening programs, which are anticipated to improve the demand for cancer treatment drugs.

High demand for prescription generic drugs, advanced healthcare infrastructure, and local pharmaceutical manufacturing are factors responsible for market growth. The country's pharma sector is witnessing considerable growth opportunities with the current development of local production capabilities. The strong local production capabilities are playing a crucial role in the distribution of drugs and COVID-19 Pharmaceuticals in the domestic market. In addition, the growing geriatric population, supportive government regulations, and high incidence of infectious diseases fuel the demand for pharmaceuticals in the country.

Market Concentration & Characteristics

The introduction of new products serves a wide variety of consumer needs and preferences thereby expanding market size and overall demand. Launching new drugs for specific diseased conditions can improve effectiveness and fulfill unmet needs, engaging patients who seek more advanced treatment. Launching cancer-specific drugs can have a significant impact on the Africa Pharmaceutical Market. For instance, in February 2022, BioNTech strategized its plan to initiate an mRNA factory in Africa. The company shipped the required raw material containers to produce the COVID-19 vaccine to Africa. WHO's mRNA technology transfer hub in South Africa is believed to complement BioNTech's plan to increase vaccine production in Africa. Similar initiatives are expected to strengthen the revenue generation capacity of South Africa over the forecast period.

Mergers and acquisitions undertaken by key leading players escalate the growth of the market. These activities help to enhance consumer bases and sales of pharmaceutical companies of the region. For instance, in December 2022, Eli Lilly and EVA Pharma announced the collaboration to deliver a sustainable supply of high-quality human and analog insulin in Africa for people with T1DM and T2DM.

The regulatory bodies play a significant role in the growth of the market. The registration of pharmaceuticals in South Africa is directed by the South African Health Products Regulatory Authority (SAHPRA) with the Medicine Control Council (MCC) under the Medicines and Related Substances Control Act 1965 (Act 101 of 1965). Moreover, the other healthcare bodies help government regulatory bodies to support the pharmaceutical market in the region. For instance, in August 2023, Africa’s CDC provided equipment worth USD 750,000 to SAHPRA to support its regulatory functions relating specifically to vaccine manufacturing.

Several key market players focus on regional expansion to accommodate a high range of customers and leverage market growth geographically. For instance, in June 2023, Chinese company, Wuhan Humanwell Hi-tech Industry Co. Ltd. announced a plan to establish a healthcare facility in Africa. The company plans to build a plant to produce psychiatric products in Africa and Morroco.

Molecule Type Insights

Based on molecule type, the market for conventional drugs (small molecules) dominated the market with a revenue share of 55.2 % in 2023. This growth can be attributed to a well-structured manufacturing facility, predictable pharmacokinetics, and oral bioavailability. Considering the emergence of cancer in the U.S., conventional drugs can be a good option for cancer treatment. In addition, proven significance, diverse applications, and patent expirations enable manufacturers to contribute to their widespread adoption. Moreover, these small molecules are preferred due to features such as the presence of good membrane penetration and better target delivery of drug.

The biologics& biosimilar segment is expected to witness growth with the fastest CAGR from 2024 to 2030. This is likely due to steady demand, its significance, and therapeutic advances of these molecules. Biologics & biosimilars can have a significant impact on immune interactions showcasing its importance in immune disorders.

Product Insights

Branded segment dominated the pharmaceutical market with a revenue share of 67.2% in 2023. The growth is attributed to the rising prevalence of chronic diseases, increasing R&D and approval of novel pharmaceuticals, and the rising demand for innovative therapies to treat various conditions. Key players perform acquisition and partnership to expand their product exposure and outcomes for patients. For instance, in September 2023, Novo Nordisk announced a partnership with Aspen Pharmacare to escalate insulin supplies in Africa.

The generic segment is expected to witness growth with the fastest CAGR from 2024 to 2030. The growth of this segment is likely due to outsourcing products at low cost, which in turn, increases the demand from the consumers. Moreover, high accessibility and affordability are likely to increase market growth. The implementation of a pooled procurement mechanism in Africa is expected to create a favorable environment for leading manufacturers of generics to build plants in the country.

Type Insights

The prescription segment held the market with a revenue share of 87.0 % in 2023. This growth is attributed to rising R&D investments by key companies and the rising prevalence of chronic disorders, increasing the demand for prescription medicines. For instance, in January 2024, Life Arc along with the Bill and Melinda Foundation together announced investments in the Grand Challenges African Drug Discovery Accelerator (GC ADDA) program to support 5 African drug discovery projects over 3 to 5 years.

The OTC segment is expected to grow with the fastest CAGR from 2024 to 2038. This growth is likely to be driven by various factors such as changing customer preferences, emerging trends, local special circumstances, and underlying macroeconomic factors. Customer preferences in the OTC Pharmaceuticals market in Africa are shifting towards self-medication and convenience. Consumers are increasingly seeking over-the-counter medications for common ailments and minor health issues, as they offer a cost-effective and easily accessible solution.

Disease Insights

Based on disease, the Cancer segment dominated the overall market with a share of 17.5 % in 2023. The country has a very high prevalence of cancer, and the government is striving to improve cancer care by providing preventive strategies, promoting diagnosis rates, and facilitating treatment access to people. For instance, the government designed a National Cancer Strategic Framework to devise strategies to reduce the cancer burden in South Africa. Moreover, cancer treatment is often very expensive as it involves the adoption of various therapies and stages. For this reason, nonprofit organizations like Cancer Alliance in the country are working to promote the adoption of biosimilars in cancer treatment. Such initiatives will help patients have access to affordable cancer medicines.

Furthermore, the infectious diseases segment is expected to witness growth with the fastest CAGR from 2024 to 2030. Infectious diseases in South Africa are a substantial burden on the government. According to WHO, South Africa is witnessing a surge in tuberculosis cases. In 2022, South Africa reported the eighth-highest incidence rate of 537 per 100,000 population. Influenza, HIV, STIs, and malaria, among others, are the most commonly diagnosed infectious diseases in South Africa. Considering the higher burden of infectious diseases, the government formulated an infectious disease subprogram under its National Strategic Plan for HIV, TB, and STIs. This program aims to formulate policies and monitor the status of infectious diseases in the country.

Route of Administration Insights

Based on the route of administration, the oral route dominated the market with a revenue share of 58.0 % in 2023. This can be attributed to several key factors such as rapid bioavailability, non-invasive nature, and higher consumer adherence rates. Pharmaceutical products such as tablets, capsules, and syrups are easy to administer through the oral route and deliver drugs at target locations, contributing to the high demand of this segment.

The parenteral route of administration is expected to expand at the fastest CAGR over the forecast period. As per the NIH report published in July 2022, the Sub-Saharan region has a high prevalence of HIV and AIDS. Due to therapeutic advancement, injectables, syringes, and fluids are highly preferred to cure these diseases. Considering the delivery of injectables, parenteral is the most convenient route among others. For instance,

Formulation Insights

Tablets dominated the market with the largest market share of 26.1 in 2023 in the pharmaceuticals market. Tablets are highly preferred due to their simplicity of administration and affordability. Furthermore, they do not need healthcare support for consumption, making it the best choice for self-administration at home. Convenience and ample availability make it a preferable choice for consumers. Moreover, regulatory bodies steadily focus on the formulation approval of key companies, thereby supporting the growth of the segment. For instance, in November 2023, Universal Corporation Limited received WHO approval to manufacture Malaria drugs. This African company was the first to receive this approval and will help to prevent malarial outbreaks worldwide.

The injectable segment is expected to grow at the fastest CAGR over the forecast period. Rising advancements and efficient delivery of medications are likely to significantly impact this segment. Injectables serve to provide immediate and complete absorption, making them a convenient choice compared to antibiotics, fluids, and other medications to treat diseases. Moreover, key companies constantly aim to develop new therapeutics with greater efficiency for chronic diseases in the region. For instance, in May 2023, South Africa announced the manufacturing of anti-HIV injections through Cipla Company in Benoni and Durban. This injectable will be more efficacious than existing HIV preventive pills and help in preventing HIV amongst the population.

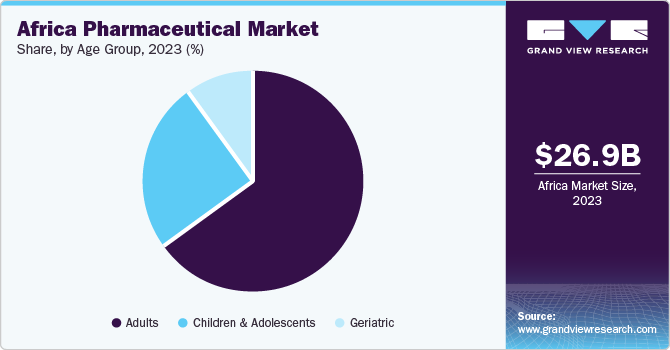

Age Group Insights

The adult segment held the largest share in the pharmaceuticals market in 2023 and is further expected to advance at the fastest growth rate over the forecast period. The higher prevalence of geriatric as well as adult population is likely to increase the demand for prescription medicines. As per the CDC, in the U.S., around 69.0%, and in Canada, around 65.5% (nearly 7 in 10 persons) aged 40-79 years used at least one prescription drug. The most commonly used drugs among the adult population include lipid-lowering drugs, ACE inhibitors, analgesics, and antidepressants.

The children & adolescent segment is expected to witness strong growth from 2024 to 2030. This growth is likely due to the rising number of medication approvals for the pediatric population. For instance, in June 2023, Pfizer Inc., in collaboration with OPKO Health Inc., received FDA approval for NGENLA, a human growth hormone medication used to treat pediatric patients. It is expected to be available for prescription in August 2023. A rising prevalence of various disorders in this population, including respiratory conditions, infectious diseases, and rare conditions, is further anticipated to fuel segment growth.

End-market Insights

Based on the end-use, the hospitals segment dominated the pharmaceuticals market, with a revenue share of 54.3% in 2023. The potential factors attributed to this growth include escalating government as well as private investment in healthcare facilities, upgrade of preexisting healthcare facilities, and growing demand for clinical services. For instance, in October 2023, the well-known Tygerberg Hospital in Parow, South Africa revealed the redevelopment program of its hospital. This mega-project of hospital renovation aims to healthcare infrastructure by transforming inefficient and traditional facilities with efficient and modern fully equipped facilities. This included a new 596-bed facility for the region serving Level 1 and Level 2 services at Belhar and another 893-bed tertiary facility on the Tygerber hospital campus to bridge the gap between higher education institutes and healthcare trainers and technologists.

Clinics are estimated to expand at the fastest CAGR from 2024 to 2030. This growth is likely due to growing health consciousness amongst the population and rising emphasis on the initiation of walk-in clinics and urgent care centers for serving timely treatment to patients. Moreover, clinics are the primary contact for addressing acute as well as chronic disorders contributing to the growth of the segment. Moreover

Country Insights

South Africa Pharmaceutical Market Trends

The pharmaceutical market in South Africa dominated the market with a share of 22.5 % in 2023. This growth can be attributed to a growing and aging population, a larger prevalence of chronic diseases, expanding private health insurance coverage, and increased patient volumes for general practitioners and specialist medical practitioners. The pharmaceutical market of the country is extensively reliant on imported products, accounting for more than two-thirds of pharmaceutical sales.

Nigeria Pharmaceutical Market Trends

Nigeria consists of a complex pharmaceutical market and is expected to grow at a faster rate over the forecast period. This growth is likely to be attributed to the implementation of government policies to motivate local production of pharmaceuticals thereby reducing the country's dependence on imported drugs. This has resulted in the emergence of local pharmaceutical companies. Another trend is the increasing use of technology in the pharmaceutical industry, with the adoption of electronic health records and telemedicine.

Botswana Pharmaceutical Market Trends

Botswana's pharmaceutical market dominated the market in 2023. This is due to the high preference for high-quality medicines. Increasing demand for pharmaceutical products, driven by the rising prevalence of chronic diseases such as HIV/AIDS and diabetes. The government's efforts to improve healthcare infrastructure and increase access to medicines have also contributed to the growth of the market. Furthermore, the country's increasing population and expanding middle class have increased the demand for pharmaceuticals.

Namibia Pharmaceutical Market Trends

The pharmaceutical market in Namibia is projected to grow with the fastest CAGR over the forecast period. Namibia’s government has been promoting local manufacturing of pharmaceutical products to reduce the country's reliance on imported drugs. This has led to the growth of local pharmaceutical companies, which have been able to produce high-quality drugs at affordable prices.

Key Africa Pharmaceutical Company Insights

The prominent companies of the country include Abbott, AbbVie, Aspen, Novartis Pfizer Laboratories, and more. These market players constantly engage in strategic initiatives, merger and acquisition activities, and regional expansion. For instance, in May 2023, the BRICS Health and Pharmaceutical Association of Africa announced an agreement to improve healthcare systems in Africa.

Key Africa Pharmaceutical Companies:

- Abbott Laboratories

- AbbVie

- Alfasigma

- Aspen

- Aurobindo Pharma

- AstraZeneca

- Bristol Myers Squibb

- BGM

- Cipla

- Sun Pharma

- BAYER

Recent Developments

-

In June 2023, Fosum Pharma partnered with IFC to improve the pharmaceutical company facility and distribution hub. This project will improve access to quality, affordable life life-saving medicines across West Africa.

-

In September 2023, Cipla, South Africa announced the agreement to acquire Actor Pharma. This acquisition will support Cipla’s strategy for OTC and wellness portfolio growth.

Africa Pharmaceutical Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 27.65 billion

Revenue Forecast in 2030

USD 33.8 billion

Growth rate

CAGR of 3.4% from 2024 to 2030

Actual data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Molecule type, product, type, disease, route of administration, formulation, age group, end-market, country

Regional Scope

Africa

Country scope

South Africa; Botswana; Nigeria; Namibia

Key companies profiled

Abbott Laboratories; AbbVie; Alfasigma; Aspen; Aurobindo Pharma; AstraZeneca; Bristol Myers Squibb; BGM; Cipla; Sun Pharma, BAYER

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Africa Pharmaceutical Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Africa pharmaceutical market report based on molecule type, product, type, disease, route of administration, formulation, age group, end-market, and country:

-

Molecule Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Biologics & Biosimilars (Large Molecules)

-

Monoclonal Antibodies

-

Vaccines

-

Cell & Gene Therapy

-

Others

-

-

Conventional Drugs (Small Molecules)

-

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Branded

-

Generics

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Prescription

-

OTC

-

-

Disease Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cardiovascular diseases

-

Cancer

-

Diabetes

-

Infectious diseases

-

Neurological disorders

-

Respiratory diseases

-

Autoimmune diseases

-

Mental health disorders

-

Gastrointestinal disorders

-

Women’s health diseases

-

Genetic and rare genetic diseases

-

Dermatological conditions

-

Obesity

-

Renal diseases

-

Liver conditions

-

Hematological disorders

-

Eye conditions

-

Infertility conditions

-

Endocrine disorders

-

Allergies

-

Others

-

-

Route of Administration Outlook (Revenue, USD Billion, 2018 - 2030)

-

Oral

-

Topical

-

Parenteral

-

Intravenous

-

Intramuscular

-

-

Inhalations

-

Other

-

-

Formulation Outlook (Revenue, USD Billion, 2018 - 2030)

-

Tablets

-

Capsules

-

Injectable

-

Sprays

-

Suspensions

-

Powders

-

Other Formulations

-

-

Age Group Outlook (Revenue, USD Billion, 2018 - 2030)

-

Children & Adolescents

-

Adults

-

Geriatric

-

-

End Market Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospitals

-

Clinics

-

Others

-

-

Country Outlook (Revenue, USD Billion, 2018 - 2030)

-

Africa

-

South Africa

-

Nigeria

-

Namibia

-

Botswana

-

-

Frequently Asked Questions About This Report

b. The Africa pharmaceutical market size was estimated at USD 26.85 billion in 2023 and is expected to reach USD 27.65 in 2024.

b. The Africa pharmaceutical market is expected to grow at a compound annual growth rate of 3.4% from 2024 to 2030 to reach USD 33.80 billion by 2030.

b. Cancer led the overall market, accounting for 17.07% in 2023. The dominance of this segment in the pharmaceutical market is aided by several key factors and trends, such as the rising global incidence of various forms of cancer, which has led to an increased demand for innovative & effective treatments, driving significant investment and research in this space.

b. Some key players operating in the Africa pharmaceutical market include Abbott ; AbbVie; Alfasigma; Aspen; Aurobindo Pharma; AstraZeneca; Bristol Myers Squibb; BGM; Cipla; Sun Pharma, BAYER

b. Key factors that are driving the market growth include rising health-consciousness, increasing demand for targeted drugs for chronic diseases, and affordability. According to the South African government, pharmaceutical sales and demand are likely to propel in coming years due to the high incidence of infectious & lifestyle diseases, such as obesity, hypertension, diabetes, and cancer.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."