- Home

- »

- Beauty & Personal Care

- »

-

Aftershave Lotions And Creams Market Size Report, 2030GVR Report cover

![Aftershave Lotions And Creams Market Size, Share & Trends Report]()

Aftershave Lotions And Creams Market Size, Share & Trends Analysis Report By Product (Balm, Lotion, Gel, Splash), By Distribution Channel (Supermarket/ Hypermarket, Online), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-3-68038-236-5

- Number of Report Pages: 70

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Market Size & Trends

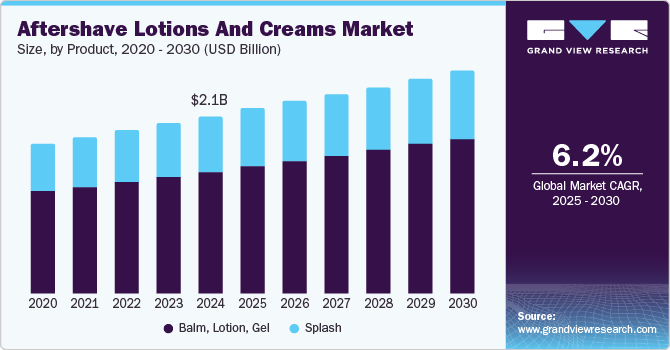

The global aftershave lotions and creams market size was valued at USD 2.13 billion in 2024 and is expected to grow at a CAGR of 6.2% from 2025 to 2030. The market growth can be attributed to increasing consumer awareness about the importance of skincare and grooming. With people becoming increasingly conscious of their appearance and personal hygiene, the demand for aftershave lotions and creams is rising. This trend is particularly popular among millennials and Gen Z, who prioritize grooming and self-care as part of their daily routines.

Furthermore, technological innovations in natural and organic ingredients have increasingly appealed to consumers who seek safer and more sustainable options. Aftershave lotions and creams that offer moisturizing, nourishing, and smooth skin benefits gained significant popularity, further boosting market demand. In addition, eco-friendly packaging solutions have attracted environmentally conscious consumers, enhancing the appeal of these products.

Moreover, the expansion of e-commerce platforms with rapid internet penetration considerably contributed to the market's growth. Online shopping provides consumers with convenient access to a wide range of aftershave products, often at competitive prices. E-commerce platforms provide detailed product information, easy comparison options, and customer reviews, which help consumers make informed purchasing decisions. This shift towards online shopping is projected to continue driving market growth in the coming years.

Product Insights

Balm, lotion, and gel dominated the market with a 68.7% share in 2024 due to men's growing emphasis on personal grooming and self-care worldwide. Consumers have highly sought aftershave products made from natural and organic ingredients, avoiding synthetic chemicals that are prone to cause skin irritation. Moreover, beyond the traditional soothing and antiseptic properties, aftershaves have been increasingly marketed for their skincare benefits, such as hydration, anti-aging, and protection. This has led to increased demand for multifunctional products such as balms and lotions, which are often more hydrating and suitable for sensitive skin.

Splash is expected to boost over the forecast period. Splash aftershaves, known for their invigorating sting and refreshing scent, continue to resonate with consumers who value classic grooming experiences. Additionally, technological advancements in product formulation have enhanced the appeal of splash products. For instance, modern formulations often include skin-soothing and moisturizing ingredients, such as aloe vera and glycerin, which counteract the drying effects traditionally associated with alcohol-based aftershaves. These improvements make splash products more suitable for a wider range of skin types.

Distribution Channel Insights

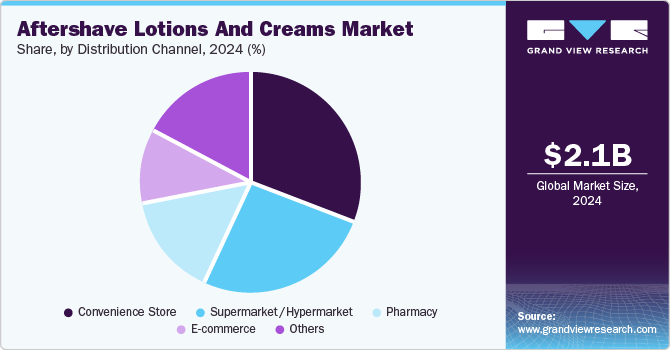

Convenience stores accounted for a dominant market share in 2024. With a high density of outlets in urban and suburban areas, convenience stores provide an easily accessible point of purchase for consumers looking for quick, on-the-go grooming solutions. Moreover, the strategic placement of convenience stores in high-traffic areas near offices, residential complexes, and transit hubs is expected to stimulate further growth. This strategic location ensures the visibility of aftershave lotions and creams, encouraging impulse purchases.

E-commerce platforms are expected to emerge at the fastest CAGR of 4.5% over the forecast period, primarily due to the wide variety of online products. These channels offer an extensive range of aftershave lotions and creams, including niche and premium brands that may not be readily available in physical stores. Such an extensive selection of products allows consumers to find products that best meet their needs and preferences. Moreover, consumers can browse, compare, and purchase aftershave products through online platforms with enhanced user experience, thereby driving market growth.

Regional Insights

The aftershave lotions and creams market in North America registered a 27.4% share in 2024, owing to the growing consciousness among men. Men have increasingly adopted daily skincare routines, and aftershave products have become a regular part of post-shave care for healthier skin, improved appearance, and solutions to common shaving issues such as irritation and dryness.

U.S. Aftershave Lotions And Creams Market Trends

The U.S. aftershave lotions and creams market in 2024 was driven by men's growing awareness of the importance of grooming and skincare. Consumers have increasingly sought aftershave products as essentials for maintaining skin health post-shave. They have focused more on preventing irritation, razor burn, and other skin issues, leading to a higher demand for soothing aftershave lotions, creams, and balms.

Europe Aftershave Lotions And Creams Market Trends

The European aftershave lotions and creams market held a dominant share of 35.4% in 2024, with men increasingly investing in grooming and skincare, particularly in countries including the UK, Germany, and France. The rising awareness of skin health and the importance of post-shave routines has led to an uptick in the demand for aftershave creams, lotions, and gels. Moreover, the region has stringent regulations regarding cosmetic ingredients, pushing companies to adopt cleaner, more eco-friendly formulations. The market witnessed a high demand for aftershave products made with organic, natural, and vegan ingredients as consumers increasingly focus on sustainability.

Asia Pacific Aftershave Lotions And Creams Market Trends

The aftershave lotions and creams market in the Asia Pacific (APAC) region held a 22.3% share in 2024. The market witnessed a growing focus on men’s grooming and personal care in countries including China, Japan, South Korea, and India. Moreover, the influence of Korean and Japanese skincare routines has significantly shaped consumer expectations in the APAC region. Men have actively sought products with moisturizing, anti-aging, and brightening properties, particularly in countries such as South Korea and Japan, where skincare is deeply integrated into grooming solutions.

Key Aftershave Lotions And Creams Company Insights

The global market is highly competitive due to the presence of top players, including Procter and Gamble, Unilever, Beiersdorf, and others. Increasing demand for natural and organic products and stringent regulations on using certain synthetic chemicals have led to tough competition from various vendors. The market is further identified by several strategic activities such as expansions, mergers and acquisitions, and product and technological innovations.

-

Procter & Gamble (P&G) is a global consumer goods company with a vast portfolio of well-known brands, including Tide, Pampers, Gillette, and Olay. The company focuses on innovation, continuously developing new products to meet consumer needs and preferences.

-

Unilever is a major player in the global consumer goods market, known for its wide range of products that promote sustainable living. The company has a diverse portfolio of brands, including Dove, Axe, Lipton, and Ben & Jerry's.

Key Aftershave Lotions And Creams Companies:

The following are the leading companies in the aftershave lotions and creams market. These companies collectively hold the largest market share and dictate industry trends.

- Procter & Gamble

- Unilever

- Godrej Consumer Products Limited

- L’Oréal

- Colgate-Palmolive Company

- Coty Inc.

- D.R. Harris & Co Ltd

- Vi-john Group

- Herbacin Cosmetic GmbH.

Aftershave Lotions And Creams Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.23 billion

Revenue forecast in 2030

USD 2.66 billion

Growth rate

CAGR of 6.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Spain, Italy, China, Japan, India, Australia, South Korea, Brazil, South Africa

Key companies profiled

Procter & Gamble; Unilever; Godrej Consumer Products Limited; L’Oréal; Colgate-Palmolive Company; Coty Inc.; D.R. Harris & Co Ltd; Vi-john Group; Herbacin Cosmetic GmbH.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aftershave Lotions And Creams Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global aftershave lotions and creams market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Balm, Lotion, Gel

-

Splash

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarket/ Hypermarket

-

Convenience Store

-

Pharmacy

-

E-commerce

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."